Knowledge work automation

16 min read

—

Dec 8, 2025

A comprehensive guide to the best Portfolio Management Systems (PMS) for Private Equity, Venture Capital, and Asset Management. We evaluate eFront, Addepar, Allvue, and how AI agents are finally solving the data ingestion gap.

Casimir Rajnerowicz

Content Creator

If you ask a General Partner at a mid-sized private equity firm where their data lives, they might point to an expensive logo on a slide deck—something like eFront, Investran, or Allvue. But if you ask the Vice President of Finance where the actual, workable data lives (the data used to answer an urgent Limited Partner question at 8:00 PM on a Tuesday) they will almost invariably point to Microsoft Excel.

This is the dirty secret of the asset management industry: despite spending billions of dollars annually on sophisticated Portfolio Management Systems (PMS), the industry’s backbone remains a fragile mesh of spreadsheet workbooks. This fragility exists not because the software is bad, but because the data is messy.

While public market data feeds neatly into systems via Bloomberg or custodian APIs, private market data remains stubbornly analog. It arrives in the form of unstructured PDF capital calls, quarterly reports (PCAPs), K-1 tax forms, and ad-hoc email updates from portfolio companies. This creates a massive "ingestion gap." Highly paid analysts, trained to value assets and structure deals, spend an estimated 40-60% of their time acting as data entry clerks, re-keying numbers from PDFs into the PMS.

The best portfolio management software is no longer defined just by how well it calculates waterfalls or tracks general ledgers (though those are table stakes). The new competitive frontier is interoperability and automation. The winning firms are those that decouple their "System of Record" (the accounting ledger) from their "System of Intelligence" (the AI layer that reads, standardizes, and ingests the data).

In this comprehensive guide, we dissect the current landscape of portfolio management technology. We evaluate tools based on the operational reality of implementing and living with them, not just their sales demos.

In this article:

The Architecture of Modern Portfolio Tech: Understanding the critical split between the ledger and the ingestion layer.

Software Reviews: Deep dives into Addepar, eFront, Allvue, Juniper Square, and more.

Solving the Data Gap: How AI agents are finally automating the processing of capital calls and quarterly reports.

Implementation Guides: What to expect when migrating from legacy systems to a modern stack.

Why Portfolio Management Software Fails

To select the right software, you must first understand why so many implementations fail. The core issue is a fundamental misunderstanding of what a Portfolio Management System (PMS) is designed to do versus what the day-to-day workflow of an investment firm actually requires.

The "System of Record" vs. "System of Engagement"

Most traditional PMS platforms (like eFront, Investran, or Allvue) are designed as Systems of Record. They are glorified general ledgers. Their primary job is to be an immutable database of transactions, positions, and tax lots. They are rigid by design because accounting requires rigidity. You do not want a system where it is easy to accidentally change a cost basis or delete a transaction log.

However, the daily workflow of an investment team is fluid. They are dealing with messy, incoming data streams—a portfolio company restating its EBITDA from Q2, a capital call that splits commitment between two different legal entities, or a complex K-1 that needs to be reconciled against internal records. When you try to force this messy, unstructured workflow directly into a rigid System of Record, you get friction.

This friction manifests in three specific bottlenecks that every Operations leader will recognize:

The Ingestion Bottleneck: The PMS expects clean, structured data rows. The real world provides messy PDFs, scanned images, and emails. Humans have to bridge this gap manually, leading to fatigue and error.

The Look-Through Limit: Most PMS tools are good at tracking your investments (e.g., "We own 5% of Fund IV"). They are historically terrible at tracking the underlying assets (e.g., "Fund IV owns SpaceX, Stripe, and Databricks"). LPs increasingly demand "look-through" transparency to see their exposure to specific companies or sectors across their entire portfolio.

The Reporting Lag: Because ingestion is manual, the data in the PMS is often 30-45 days old by the time it is reconciled. Investment committees are forced to make real-time decisions based on last quarter's numbers.

A Modular Portfolio Management Stack

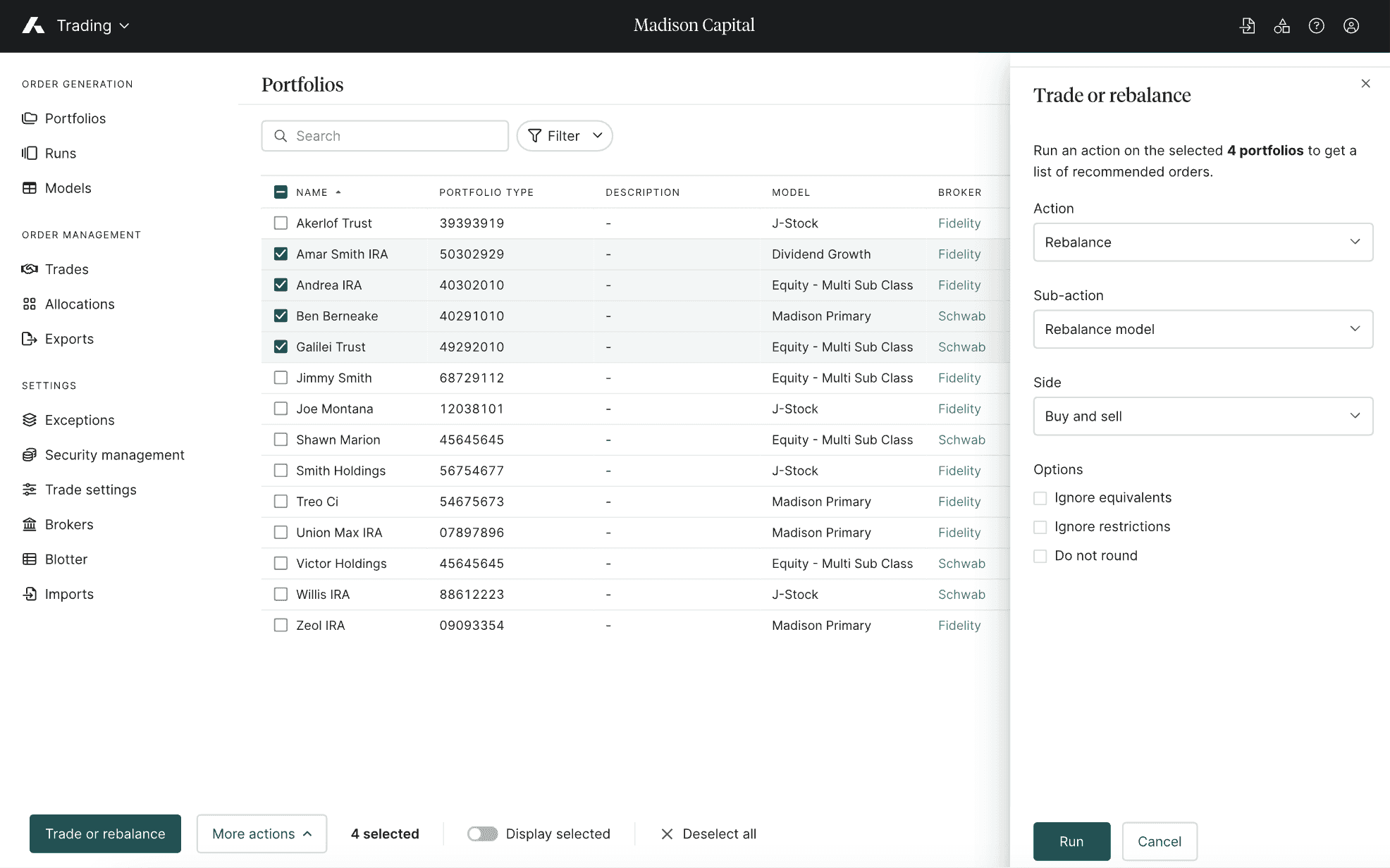

Leading firms in 2025 are moving away from the "all-in-one" monoliths that promise to do everything but excel at nothing. Instead, they are building composable tech stacks that separate concerns:

The Intelligence Layer (Ingestion): Tools like V7 Go that reside at the top of the funnel. They read emails and PDFs, extract data using AI, visually verify it, and structure it into a clean format.

The Accounting Layer (Ledger): Robust PMS platforms like eFront or Addepar that receive the clean data and handle the heavy accounting logic (waterfalls, multi-currency adjustments, IRRs).

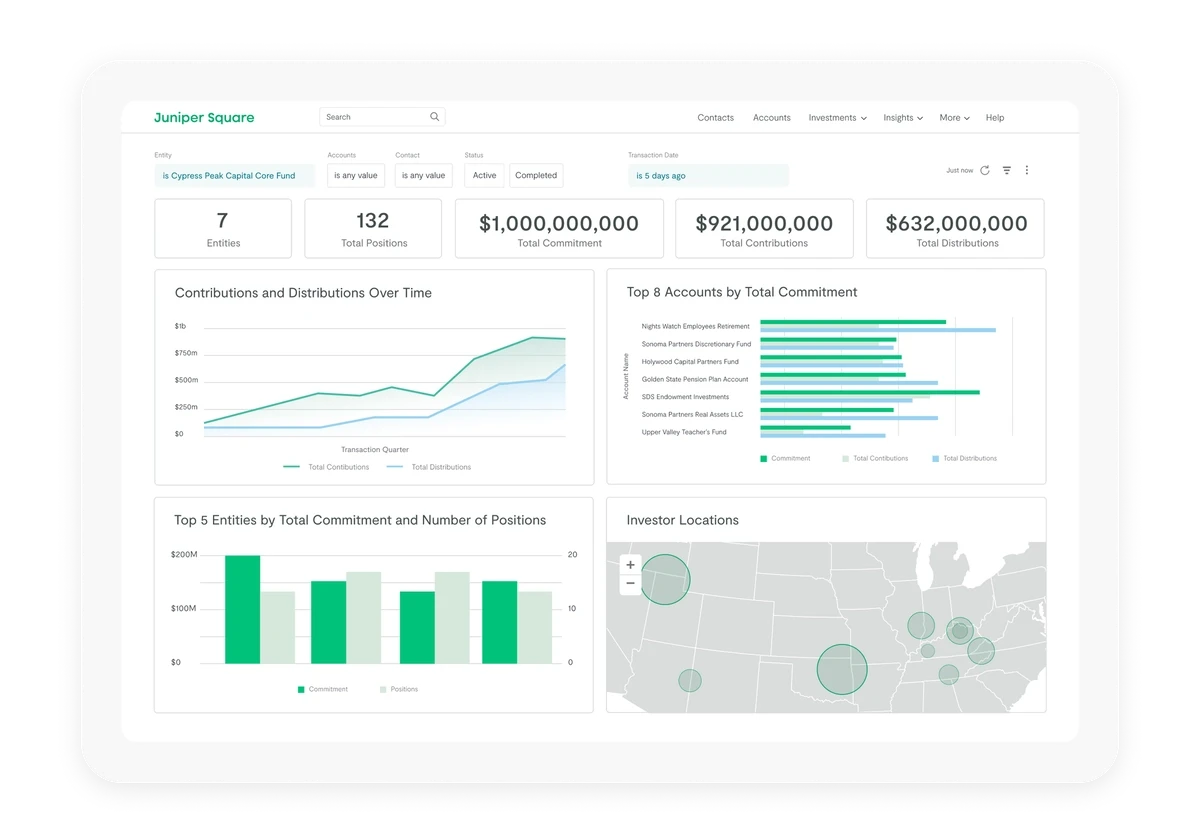

The Visualization Layer (BI): Tools like Tableau, PowerBI, or specialized portals like Juniper Square that present the final data to stakeholders and LPs.

With this framework in mind, let’s analyze the market leaders, categorizing them by their primary user base: Wealth Management vs. Private Equity/VC.

Best for Wealth Management & Family Offices

Registered Investment Advisors (RIAs) and Family Offices deal primarily with liquid assets (stocks, bonds) mixed with some alternative investments. Their primary pain point is aggregation: they need to pull data from 50 different custodians (Schwab, Fidelity, UBS, Pershing) into one consolidated view for a high-net-worth individual.

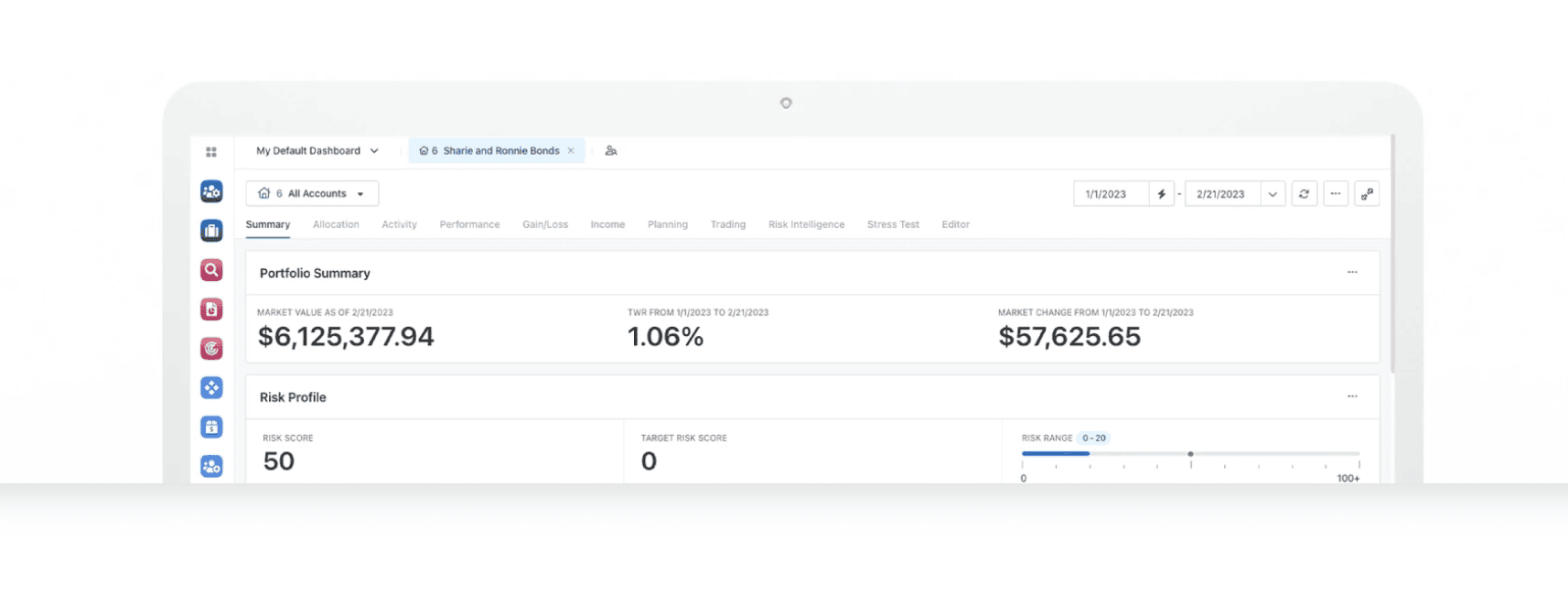

1. Addepar

Addepar is widely considered the gold standard for Ultra-High-Net-Worth (UHNW) advisory and family offices. Founded by Joe Lonsdale, it was built specifically to handle the complexity of multi-generational wealth that other systems choked on.

The Deep Dive:

Addepar’s superpower is its object-oriented data model. It can map complex ownership structures without flattening them. For example, if a family patriarch creates a trust, which owns an LLC, which owns 12% of a private jet and a portfolio of municipal bonds, Addepar preserves that hierarchy. You can report on performance at the LLC level, the Trust level, or the Patriarch level.

Pros:

Data Aggregation: It has excellent direct feeds from hundreds of custodian banks ensuring public market positions are reconciled daily.

Visual Reporting: The reporting engine allows advisors to build custom, white-labeled client portals. For advisors justifying high fees, the ability to produce beautiful, easy-to-read reports is a critical selling point.

Cons:

Private Assets: While better than most, entering detailed alternative assets (PE, Hedge Funds) still often requires manual processing or relying on Addepar's managed services team (Acervus) to key it in for you.

Cost: Premium pricing makes it less accessible for smaller RIAs. It typically targets firms with $100M+ AUM.

2. Black Diamond (SS&C)

Owned by SS&C Advent, Black Diamond is the primary competitor to Addepar in the RIA space. It typically targets the "mass affluent" to "high net worth" segments rather than the ultra-complex family office.

The Deep Dive:

Black Diamond offers a more streamlined experience. It is deeply integrated into the RIA ecosystem (Rebalancing, Billing, Trading). Its strength is its service model; each firm is assigned a dedicated service team, which acts as an outsourced operations department.

Pros:

Usability: The interface is cleaner and more intuitive than Addepar’s, requiring less training for new advisors.

Rebalancing: It includes strong native rebalancing tools, allowing advisors to execute trades across hundreds of accounts to maintain target allocations.

Cons:

Flexibility: Power users often find the reporting customization less flexible than Addepar. It handles public markets beautifully but can struggle with the nuance of complex private assets without manual workarounds.

3. Orion Advisor Tech

Orion has grown from a reporting tool into a massive all-in-one platform that includes CRM (Redtail), trading, compliance, and billing. It is the "Microsoft Office" of the RIA world—comprehensive and ubiquitous.

Pros:

Integration: Because it owns so many parts of the stack, data flows seamlessly from CRM to planning to portfolio management.

Billing: Extremely robust billing capabilities that can handle complex fee structures across thousands of accounts.

Cons:

"Jack of All Trades": Because it does everything, some specific features can feel shallow compared to best-of-breed point solutions.

Best for Private Equity & Venture Capital (GPs)

The requirements for General Partners (GPs) in private markets are fundamentally different from Wealth Management. They don't need daily price feeds from the stock market. They need to track committed capital, called capital, distributions, and complex waterfall calculations (how profits are split between LPs and GPs).

4. eFront (BlackRock)

If you run a massive buyout fund or a sovereign wealth fund, you probably use eFront. Acquired by BlackRock in 2019 to integrate with their Aladdin platform, it is the enterprise heavyweight of the industry.

The Deep Dive:

eFront is built for complexity. It natively handles the most esoteric deal structures imaginable—hurdle rates, catch-ups, clawbacks, and cross-collateralized pools. It also includes "Front Invest," a deal pipeline module that links the front office (deal teams) with the back office (accounting).

Pros:

Functional Depth: Unrivaled capability for complex fund structures. If you have a fund-of-funds with multiple currency hedged sleeves, eFront handles it.

End-to-End: Covers the entire lifecycle from deal origination to fund administration and investor reporting.

Cons:

The Implementation Pain: eFront is notorious for long, expensive implementation cycles. A full deployment can take 6 to 12 months and cost hundreds of thousands of dollars in professional services. Users often describe it as "the SAP of private equity"—essential for the biggest players, but painful to set up.

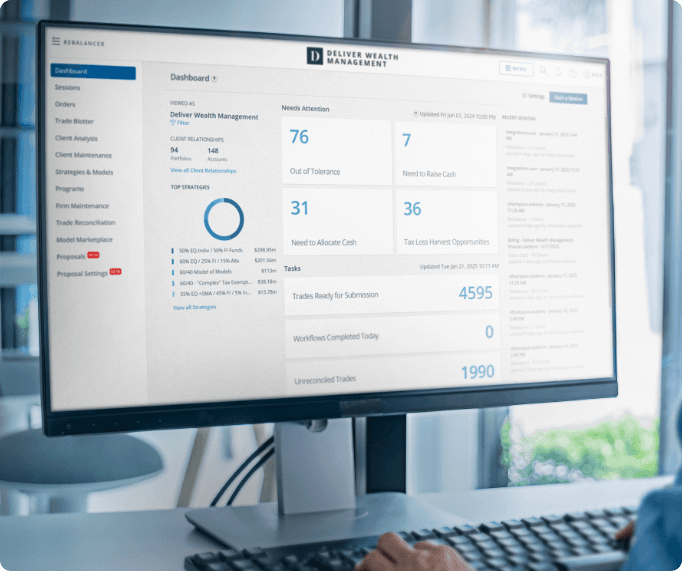

5. Allvue Systems

Formed from the merger of AltaReturn and Black Mountain, Allvue is a dominant player in the mid-market private equity and, crucially, private credit space.

The Deep Dive:

Allvue is built on the Microsoft stack (Azure, Dynamics), which means it integrates exceptionally well with Excel and Outlook—tools finance teams already live in. It is particularly strong in private credit, where it can track loan covenants, interest payments, and amortization schedules better than most equity-focused competitors.

Pros:

Credit Focus: Best-in-class for firms managing debt strategies (CLOs, direct lending).

Accounting Core: Strong general ledger capabilities integrated directly with the front office.

6. Juniper Square

Juniper Square started by revolutionizing the Real Estate syndication market but has successfully expanded into Private Equity. They flipped the traditional model: instead of focusing on the back-office accounting first, they focused on the Investor (LP) experience.

The Deep Dive:

For many GPs, Juniper Square acts as the "Face of the Firm" to their investors. Its investor portal is modern, mobile-responsive, and intuitive. LPs love it because they can find their K-1s, distribution notices, and performance charts without emailing the GP.

Pros:

The Portal: Best-in-class investor experience. It looks and feels like modern consumer software.

Fundraising CRM: Includes a built-in CRM optimized for capital raising, tracking soft commitments and managing digital subscription documents.

Cons:

Accounting Depth: Historically, its fund accounting capabilities were lighter than Allvue or eFront, leading firms to use it primarily as a "front end"/CRM while doing heavy accounting in a separate ledger. However, their new fund admin services are closing this gap.

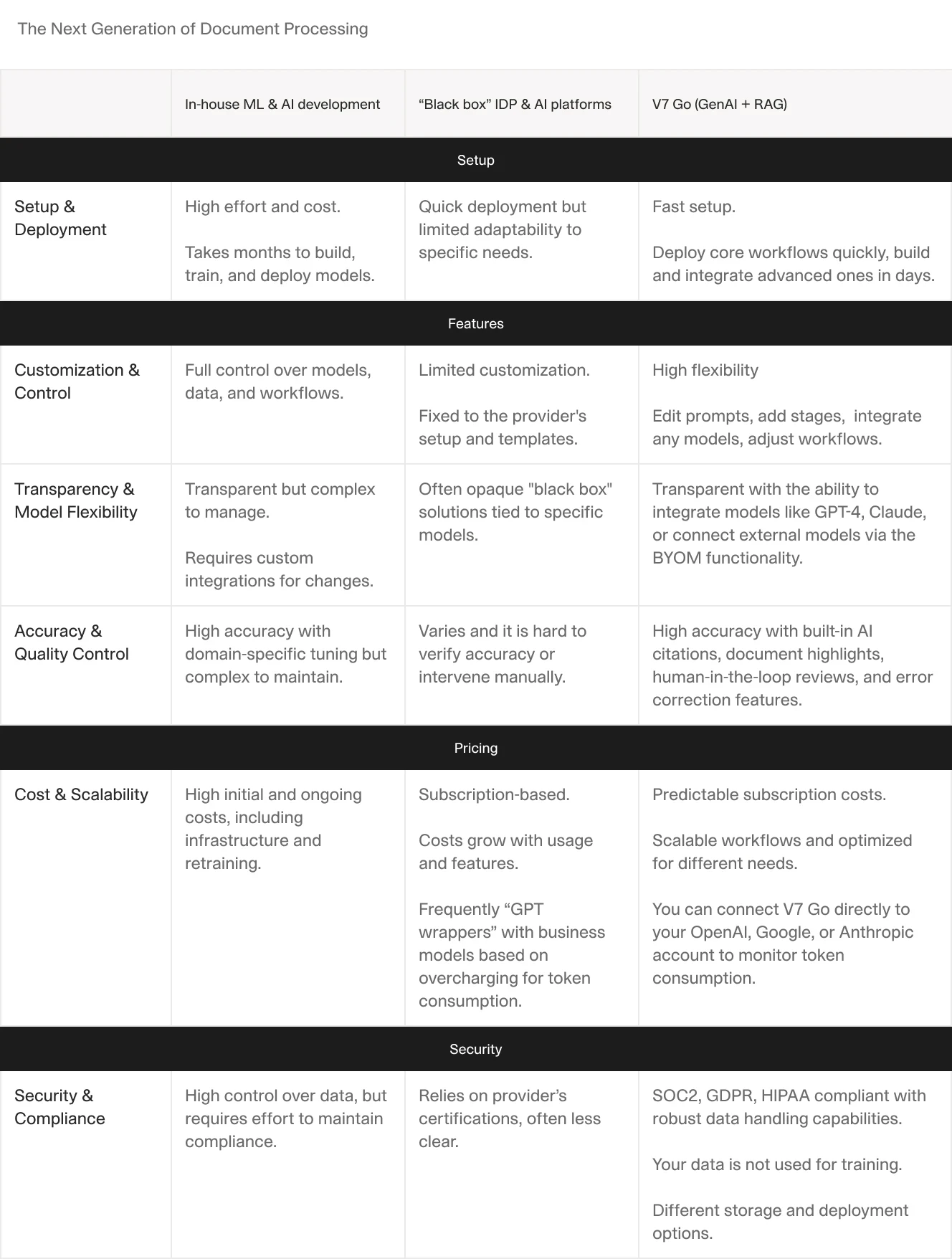

7. V7 Go: The Missing Ingestion Layer

While the platforms above act as the Ledger or the Portal, they all share a common weakness: getting data in. V7 Go represents a new category: the AI-Powered Ingestion Layer.

It sits in front of your PMS or Excel models, automating the extraction of data from the messy documents that traditional systems cannot read.

The Workflow:

Ingestion: You forward emails with Capital Call Notices, PCAPs (Portfolio Company Periodic Reports), or Financial Statements to a V7 Go hub.

AI Agents Extract & Verify: Specialized AI agents identify the document type. If it’s a Capital Call, it extracts the call amount, due date, and entity. If it’s a Quarterly Report, it extracts the Net Asset Value (NAV), underlying portfolio company metrics, and commentary.

Visual Grounding: V7 Go provides AI Citations. It highlights exactly where in the PDF the number came from. This is critical for audit—you don’t just get a number in a database; you get the evidence.

Push to Ledger: It maps these formats into a unified structure (JSON/CSV) and pushes it directly into Allvue, eFront, or your data warehouse.

For Funds of Funds or LPs receiving thousands of notices a year, V7 Go turns a manual data entry crisis into a manageable review process.

Deep Dive: Comparing Data Ingestion Capabilities

To truly understand which software fits your firm, you have to look at how they solve the data ingestion problem. This is where the most operational friction occurs.

The Services Approach (Addepar, eFront): Many legacy providers solve the data gap by throwing people at it. They offer "Managed Data Services" where you email them your PDFs, and their offshore teams manually key in the data. This works, but it is slow (24-48 hour turnaround) and expensive. It also creates a "black box" risk—if they key in a wrong number, you might not catch it until a client report goes out.

The Native AI Approach (Allvue): Some platforms are building AI assistants directly into their UI (like Allvue's "Andi"). These are great for querying data already in the system (e.g., "Show me exposure to Tech"), but they often struggle with the raw ingestion of messy, non-standard documents.

The Specialized AI Layer (V7 Go): This approach treats ingestion as a separate, specialized problem. By using a dedicated tool like V7 Go, firms get AI data extraction that is faster than human services and more transparent than black-box AI. The "Visual Grounding" feature means every data point is audit-ready immediately.

Advanced Use Cases: Beyond Basic Accounting

Once you have solved the data ingestion problem, modern portfolio management software opens up high-value capabilities that go beyond simple accounting.

1. Look-Through Exposure Analysis

One of the most pressing demands from Limited Partners today is detailed exposure analysis. If a global event impacts the semiconductor supply chain, LPs want to know immediately: "What is our total exposure to semiconductor manufacturers across all our private equity holdings?"

In a traditional workflow, answering this is a nightmare. The GP has to open the quarterly reports of every fund they invested in, look at the underlying portfolio companies, and manually aggregate the data.

With an AI-enabled stack, this becomes a simple query. V7 Go can ingest the quarterly reports from underlying funds, extract the portfolio company descriptions and sector tags using LLMs, and feed a unified data lake. The GP can then run a report in minutes showing exposure by sector, geography, or even currency across the entire fund-of-funds structure.

2. Covenant Monitoring in Private Credit

For private credit funds, risk lives in the loan covenants. Monitoring these requires checking quarterly borrowing base certificates and compliance certificates against the credit agreement.

This is a prime use case for intelligent document processing. An AI workflow can:

Ingest the quarterly compliance certificate from the borrower.

Extract the reported ratios (e.g., Leverage Ratio, Fixed Charge Coverage Ratio).

Compare them against the limits defined in the original loan agreement.

Flag any potential breaches or "tight" covenants for the portfolio manager.

This turns risk management from a passive, lagging process into a proactive one.

Above: V7 Go agent processing 10-Q reports and financial statements to categorize and extract metadata automatically.

3. Automating the Valuation Policy

Valuations for illiquid assets are often based on comparable company analysis (comps) or precedent transactions. Gathering the data for these comps is tedious.

Modern systems allow for automated valuation workflows. By integrating live market data feeds (from providers like CapIQ or FactSet) with internal portfolio data, firms can automate the draft valuation models. AI agents can assist by scraping news and earnings reports for comparable companies to update the qualitative section of the valuation memo. This doesn't replace the valuation committee, but it gives them a fully prepped starting point.

Buying Guide: How to Evaluate Vendors in 2025

If you are in the market for new portfolio management software, the sales demo will always look perfect. The data will be clean, the dashboards will be green, and the reports will generate instantly. To assess the reality, you need to ask harder questions.

1. The "Messy Data" Test

Do not let the vendor demo with their pre-loaded sample data. Bring your own. Bring a scanned PDF of a capital call from a difficult GP. Bring a quarterly report with a non-standard table structure. Ask them to ingest it live.

If the system requires a human on their back-end to "map" the document template before it works, you know that you will have a bottleneck every time a document format changes. You want a system powered by agents that can understand document context, not just memorize template coordinates.

2. Data Portability and API Access

Your data is your most valuable asset. Many legacy providers try to lock you in by making it difficult to export your historical data in a usable format. Demand to see the API documentation. Can you programmatically query your entire transaction history? Can you pull the underlying portfolio company metrics into a separate data warehouse like Snowflake? If the data is trapped in their UI, walk away.

3. The Security Audit

When dealing with sensitive financial data, "secure" is not a binary yes/no. Ask specific questions:

Model Training: "Do you use my private data to train public AI models?" The answer must be a hard NO. Enterprise-grade platforms like V7 Go offer strict isolation where your documents are used as context (RAG) but never used to update the model weights.

Data Residency: "Can I choose where my data is hosted?" This is critical for GDPR compliance if you have European investors.

Certifications: SOC 2 Type II is the minimum ante. ISO 27001 is preferred.

Read more: De-risking Asset Management with AI

Pricing Models: What to Expect

Understanding the pricing structure is crucial for building your business case. The industry is split between three models:

AUM-Based: Common in Wealth Management (Addepar, Orion). You pay a percentage (basis points, e.g., 1-2 bps) of the assets on the platform. This aligns incentives but means your software costs scale linearly with your success. If you double your assets, you double your bill, even if your workload didn't double.

Tiered / Platform Fees: Common in Private Equity (eFront, Allvue). You pay a hefty annual license fee ($50k - $250k+) regardless of usage, often determined by the number of funds or entities. Implementation fees are often charged separately and can equal the first year's license fee.

Usage / Volume Based: Common in modern AI tools (V7 Go). You pay based on the volume of work done—pages processed, agents run, or entities managed. This is often the most ROI-positive model for firms starting their automation journey, as you only pay for value received. It allows for a "land and expand" strategy where you automate one specific workflow (e.g., Capital Calls) before rolling out others.

AI Portfolio Management Software Implementation

Buying the software is the easy part. Implementing it is where careers are made or broken.

Phase 1: Data Cleansing (Weeks 1-4)

Before migrating to a new system, you must clean your existing data. Inconsistent entity names (e.g., "Fund IV LP" vs "Fund IV, L.P.") will break automated systems. Use this opportunity to standardize your taxonomy across your organization.

Phase 2: The "Feeder" Setup (Weeks 5-8)

Set up your ingestion layer first. Configure your AI agents to process incoming documents. Do not try to automate everything at once. Start with the highest volume, most standardized documents (usually Capital Calls or Broker Statements).

Phase 3: Parallel Run (Weeks 9-12)

Run the new system alongside your old Excel models for at least one quarter. This "parallel run" is essential to catch calculation differences and build trust in the new system. If the AI extracts a number, verify it. Use the human-in-the-loop interface to correct errors, which allows you to refine the system's logic for future accuracy.

The Future Architecture: Modular and Connected

The era of the "all-in-one" monolithic portfolio management system is fading. The future belongs to modular, interconnected ecosystems where the best-in-class ledger (like Addepar or eFront) connects seamlessly with the best-in-class intelligence layer (like V7 Go) and the best visualization layer (like PowerBI).

This approach reduces vendor lock-in and allows you to swap out components as technology improves. The critical glue holding this stack together is clean, structured data. By automating the ingestion layer, you ensure that every downstream system, from your risk dashboard to your investor portal, is fed with accurate, timely information.

For asset managers, the competitive advantage won't come from having the same software as everyone else. It will come from information advantage—the ability to ingest, synthesize, and act on unstructured market data faster and more accurately than the competition. While your competitors are waiting for their back office to finish typing data from PDFs, your team could be analyzing the trends that data reveals.

To see how you can automate the ingestion of your portfolio data book a demo with V7 Go. We can help you build a custom extraction workflow that feeds accurate, auditable data directly into your management systems.