Knowledge work automation

31 min read

—

Jan 8, 2026

A practitioner's comparison of the top AI platforms for lease abstraction, property management, and valuation—separating marketing hype from measurable ROI.

Casimir Rajnerowicz

Content Creator

In 2026, real estate asset managers are still spending an average of 4-8 hours manually abstracting a single commercial lease. Multiplied across a portfolio of thousands of properties, this means teams are drowning in document review instead of focusing on strategic analysis and deal execution. The manual extraction of key dates, financial terms, and complex clauses from PDFs consumes thousands of hours annually and introduces error rates that can reach 10% or higher.

This operational bottleneck is why AI tools for real estate have exploded in adoption. Recent industry data shows that while 92% of commercial real estate firms have started or plan to pilot AI initiatives, only 5% have achieved all their program goals. The gap between aspiration and execution is massive, but the opportunity is equally significant. McKinsey estimates AI could generate $110-180 billion in annual value for the U.S. real estate market alone.

The real estate AI market is projected to reach $1.3 trillion by 2034, with a 36% compound annual growth rate. Tools now address every aspect of real estate operations: from AI-powered lease abstraction that processes documents in minutes instead of hours, to property management platforms that save 10+ hours per week, to valuation systems achieving sub-3% error rates. Real estate professionals using these tools report time reductions of 70-90%, accuracy improvements to over 95%, and an ROI ranging from several hundred percent to millions in recovered revenue.

This comprehensive guide examines the best AI tools for real estate across all major categories. We evaluate platforms based on actual capabilities, pricing transparency, measurable results, and real-world implementation examples—not just marketing claims.

Lease abstraction and document processing platforms that reduce review time.

Property management AI systems delivering 10+ hour weekly savings.

Investment analysis tools with valuation error rates below 3%.

Market analytics platforms processing millions of property records.

CRM and brokerage systems that increase conversions.

Specialized tools for tenant screening, maintenance, portfolio management, and marketing.

Implementation recommendations tiered by portfolio size and budget.

The State of AI Adoption in Real Estate

Before examining specific tools, it is critical to understand the current adoption landscape. While 92% of commercial real estate occupiers and 88% of investors have started or plan to start AI pilots, the execution gap remains stark. A recent study found that despite high adoption rates, a mere 5% of firms have achieved all their AI program goals.

This disconnect originates from several factors. Many real estate professionals lack the technical infrastructure needed for a successful AI implementation. Legacy systems built over decades do not easily integrate with modern AI platforms. Data quality issues plague organizations that have not established consistent taxonomy and validation processes. Change management becomes a major challenge when teams resist new workflows that fundamentally alter how they have operated for years.

Yet the economic drivers for AI adoption continue to intensify. Labor shortages across the industry make operational efficiency a top priority. Compliance requirements like ASC 842 and IFRS 16 mandate that all leases longer than 12 months appear on balance sheets, which has accelerated the demand for automated lease abstraction. ESG and sustainability mandates require detailed data on energy consumption and building performance. Competitive pressure mounts as early adopters begin to demonstrate dramatic efficiency gains.

The tools examined in this guide are solutions that have moved beyond the pilot stage to production deployment at scale. They show measurable results, transparent pricing models, and integration capabilities that address real operational needs rather than theoretical possibilities.

Best AI Tools for Real estate: Lease Abstraction and Document Processing

Lease abstraction is the single highest-impact use case for AI in real estate operations. The process of reviewing commercial leases, extracting critical data points, and maintaining accurate records consumes enormous resources and introduces material error risk. Modern AI platforms can reduce abstraction time from 4-8 hours per lease to 15-30 minutes and achieve accuracy rates between 95-99%.

V7 Go

V7 Go is the first generative AI platform purpose-built for finance and real estate document intelligence.

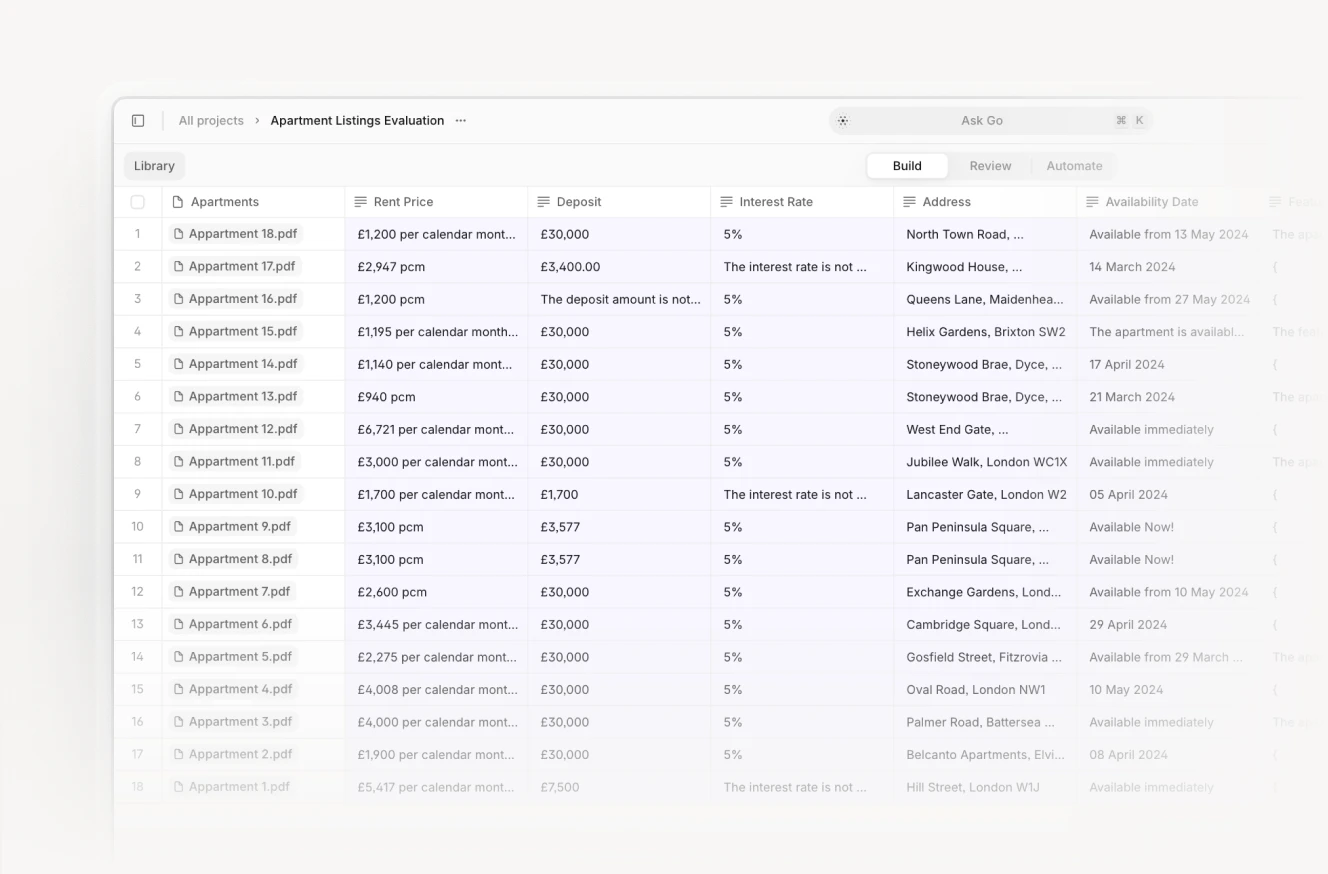

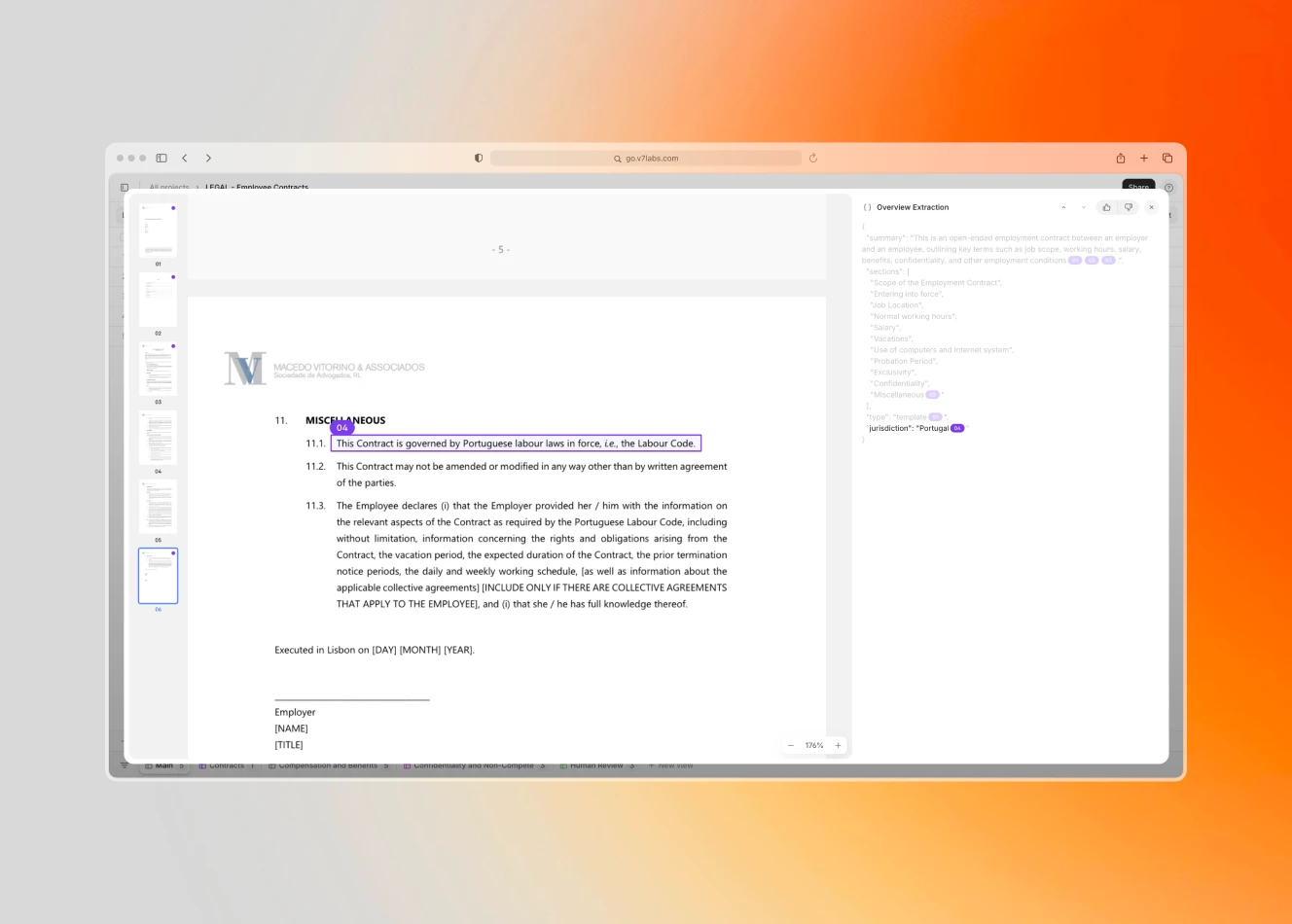

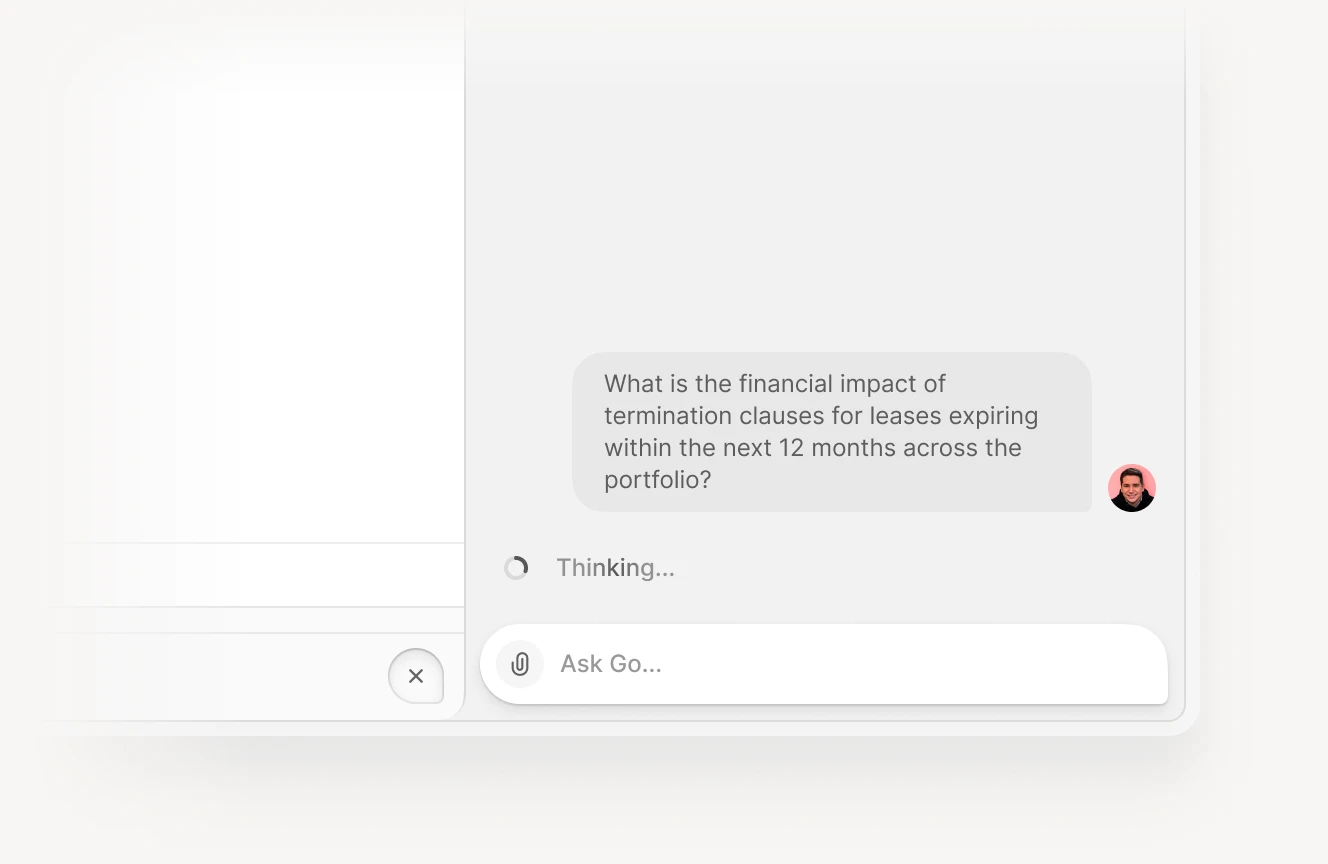

The system processes the entire document ecosystem that real estate professionals encounter, from standard commercial leases to amendments, exhibits, and related correspondence. V7 Go's key distinction is its combination of multimodal AI capabilities and complete audit trail transparency.

The platform combines OCR, RAG, and large language models like GPT-4, Claude, and Gemini in a proprietary architecture. V7 Go's Chain of Thought Reasoning capability reduces errors compared to standard LLM approaches because it breaks complex extraction tasks into explicit reasoning steps. The Index Knowledge system delivers better accuracy than standard retrieval-augmented generation by maintaining comprehensive context across multi-document cases.

V7 Go extracts all data points from any lease format and handles non-standard agreements, scanned PDFs, and even handwritten annotations. Processing takes 15-20 minutes per lease compared to the 4-8 hours required for manual review, a time reduction of 95%. Customer-reported accuracy reaches 99.5% for standard commercial lease clauses.

The platform's AI Citations feature creates an unparalleled level of transparency. Every extracted data point links directly to its source location in the original document. Users can click through to see the exact clause or paragraph that supports each piece of information. This visual grounding with a complete audit trail proves critical for legal review and compliance verification. No competing platform offers equivalent source attribution functionality.

Real-world results show the platform's operational impact. Relos, a San Francisco-based proptech company, used V7 Go to process over $100 million in real estate transaction volume. The platform saved 45-60 minutes per contract and maintained 99.5% accuracy across more than 120 transactions completed in just four months. As a result, contract processing costs dropped from $300-1,000 per transaction with traditional methods to approximately $100 with V7 Go.

A commercial real estate leader began processing documents 12 times faster than its previous systems after replacing legacy infrastructure in just two weeks. Centerline, a financial services firm, achieved a 35% productivity increase in the first month of implementation. These are not theoretical improvements but measured results from production deployments.

V7 Go offers eight specialized AI agents for real estate workflows:

The Commercial Lease Analysis Agent handles standard abstraction tasks.

The Real Estate Market Analysis Agent processes market research and competitive intelligence.

The Risk Evaluation Agent identifies and quantifies lease-related risks.

Additional agents address property valuation, investment analysis, cash flow modeling, deal sourcing, and due diligence.

The platform integrates with major property management systems including Yardi, MRI Software, AppFolio, Buildium, and ProLease. CRM integrations include Salesforce and HubSpot. Real estate data platforms like CoStar connect directly, while Zapier enables connections to hundreds of additional tools. Comprehensive APIs support custom integrations for enterprise clients.

Security and compliance certifications include SOC 2 Type II, ISO 27001, GDPR, and HIPAA compliance. Enterprise clients can deploy V7 Go in private VPC environments for maximum data control. Pricing follows a custom usage-based model that combines platform fees, user licenses, and data processing volumes. V7 Labs typically delivers proof-of-concept implementations in under a week, with full production deployment in days rather than months.

Prophia

Prophia uses a hybrid approach that combines AI automation with human expert oversight. The platform maintains what it describes as the largest private commercial real estate dataset, which trains its AI on billions of lease provisions and property records accumulated over years of operation.

Prophia offers two primary service tiers. Prophia Abstract provides self-service AI extraction of over 35 key lease terms with free viewing and charges of $20-25 for Excel or Word exports. This entry-level option suits users who need quick access to basic lease data without an enterprise commitment. Prophia Essentials delivers over 215 CRE data terms with 99% accuracy backed by human review. This tier includes unlimited user licenses, three-day turnaround times, and white-glove service including interactive stacking plans and Smart Search functionality.

The platform handles documents up to 30+ years old and can process smudges, poor-quality scans, and handwritten annotations that defeat purely automated systems. RXR, a major New York real estate firm, onboarded its entire retail and office portfolio of over 73 assets using Prophia. The platform has processed over 100,000 documents that represent more than 1 billion square feet of commercial space.

Prophia maintains SOC 2 certification and offers what it calls "living abstracts" that update automatically as lease terms change or amendments are executed. The human-in-the-loop approach ensures 99% accuracy and maintains fast turnaround times suitable for due diligence timelines. Pricing scales based on portfolio size and service level, with custom quotes for enterprise deployments.

MRI’s Lease Abstraction

MRI’s Lease Abstraction solution provides enterprise-grade AI document processing as part of its broader real estate software ecosystem. The platform combines OCR, machine learning, and configurable workflows to extract key financial, operational, and compliance-related data from commercial leases. MRI captures hundreds of critical fields, normalizes contract terms into a consistent data model, and connects abstracted data directly into MRI’s lease management and accounting modules for downstream reporting and ASC 842/IFRS 16 compliance.

Unlike lightweight pay-per-file tools, MRI is delivered as part of a full software suite rather than as a standalone abstraction utility. Pricing is based on enterprise licensing and implementation scope, making it best suited for organizations with larger portfolios, established processes, and the need for system-wide integration. The platform’s tight connection to MRI’s financial reporting, analytics, and property management tools allows teams to operationalize the abstracted data immediately.

MRI’s abstraction offering is typically used by landlords, operators, and investment firms managing hundreds to thousands of locations who require audit trails, centralized document control, and portfolio-wide visibility. Its technology reduces manual review time, lowers compliance risk, and improves data consistency across disparate lease formats. Limitations include higher onboarding effort, licensing costs that scale with organizational size, and less suitability for small teams looking for a simple, transactional abstraction tool. For enterprises seeking integrated workflows, automated accounting alignment, and standardized lease data across large portfolios, MRI provides a robust, end-to-end solution.

DocSumo

DocSumo provides intelligent document processing that extends beyond lease abstraction to comprehensive document automation. The platform offers over 30 pre-built models for common document types and supports custom model training for specialized use cases. DocSumo achieves over 99% accuracy on data extraction from PDFs, images, Excel files, and scanned documents.

Westland Real Estate Group, which manages over 14,000 units, reduced processing time by more than 50% using DocSumo to handle over 2,000 utility bills monthly. The platform's NLP-based classification automatically routes documents to appropriate workflows, while line-item extraction from tables captures complex financial data. DocSumo also functions as lease accounting software that supports ASC 842 compliance requirements.

The platform integrates with major property management systems including MRI Software, Yardi, and JD Edwards. Pricing tiers include Growth, Business, and Enterprise plans with custom quotes based on document volume and feature requirements. DocSumo's capacity of 2,000+ documents per month suits mid-to-large portfolios, though the platform's broader document processing focus means it is less specialized for real estate compared to purpose-built solutions.

Property Management AI Platforms

AI also delivers immediate, measurable value in property management. Modern platforms automate routine tasks, enhance resident communication, optimize maintenance operations, and provide predictive insights that improve property performance. Leading solutions report time savings that exceed 10 hours per week per property manager while also improving resident satisfaction and operational metrics.

AppFolio Realm-X

AppFolio introduced Realm-X as the first generative AI conversational interface for property management. The platform embeds AI capabilities throughout the property management workflow instead of offering AI as a separate add-on feature. The Realm-X Assistant functions as an AI copilot that helps managers generate reports, manage vendors, and draft email and text communications. Realm-X Messages generates AI-powered inbox responses, saving an average of 26 seconds per message. Over 500,000 Realm-X messages were sent in the first 30 days after its October 2024 launch.

Realm-X Flows provides 24/7 workflow automation, while Realm-X Performers deploys agentic AI that acts autonomously on data signals without human intervention. Lisa, AppFolio's AI Leasing Assistant, handles prospect inquiries, schedules showings, and manages follow-ups around the clock. Smart Maintenance uses AI to triage work orders and assign them to appropriate vendors. Smart Bill Entry automates accounts payable processing.

Measured results include savings of 10+ hours per week per property manager, which adds up to three full work weeks saved annually per user. A JLL UK implementation achieved a 708% ROI through energy optimization features. Over 93% of AppFolio customers actively use its AI tools, which indicates strong adoption beyond pilot programs. The platform serves over 20,000 customers across the multifamily, student housing, and affordable housing sectors.

Realm-X Assistant and Messages are available to all AppFolio customers. Realm-X Flows requires Property Manager Plus or Max subscriptions. Pricing requires custom quotes based on portfolio size and feature requirements. AppFolio's thorough integration of AI across all platform functions distinguishes it from competitors that offer AI as separate modules.

Yardi Virtuoso

Yardi Systems deployed Virtuoso as its enterprise AI platform spanning property, asset, and investment management functions. The Virtuoso Assistant provides an AI chatbot interface that supports both text and voice interactions. Virtuoso Agents are customizable AI workers that handle specific operations like maintenance coordination, financial reconciliation, and compliance monitoring. Virtuoso Central serves as the hub where organizations manage and deploy AI agents across their operations.

The platform's predictive maintenance capabilities use NLP and image recognition to diagnose issues in an average of three minutes, reducing maintenance costs by 20-30%. RENTCafé Chat IQ, Marketing IQ, Forecast IQ, and Revenue IQ provide specialized AI capabilities for resident engagement, marketing optimization, financial forecasting, and revenue management. Fraud prevention features use anomaly detection to identify unusual patterns in financial transactions.

Yardi's scale is substantial. The company has operated for over 40 years and maintains comprehensive lifecycle platform coverage across multifamily, commercial, affordable, senior, student, public, and military housing, plus self-storage. Voyager serves enterprise clients with custom pricing, while Breeze targets smaller operators starting around $1 per unit per month. Yardi positions Virtuoso as the first AI agent marketplace in real estate, allowing users to deploy role-specific agents for asset managers, property managers, accountants, and leasing staff.

Buildium

Buildium, a RealPage company, integrates AI features throughout its property management platform rather than requiring separate AI subscriptions. AI accounting automation handles bill entry and financial reconciliation. AI chatbots, including STAN AI integration, provide 24/7 resident support. Predictive maintenance algorithms identify equipment likely to fail before breakdowns occur. Smart Bill Entry automates accounts payable similar to competing platforms.

The platform's extensive marketplace connects to hundreds of third-party services and tools. Virtual tour integration, lease management automation, and community association management for HOAs and condos extend beyond traditional rental property management. Buildium's user-friendly interface makes it accessible for property managers without technical backgrounds, which lowers the barrier to AI adoption.

Pricing follows a tiered structure with Essential, Growth, and Premium plans. Custom pricing depends on unit count, and a 14-day free trial allows for evaluation before commitment. Buildium serves residential property managers, community associations, and affordable and student housing operators that manage from 1 to 20,000+ units. While AI features are built into the platform, some advanced integrations carry separate pricing.

Investment Analysis and Due Diligence Tools

Real estate investment decisions depend on accurate data analysis and market intelligence. AI platforms now provide institutional-grade analytics, automated underwriting, and predictive insights previously available only to the largest firms. These tools democratize access to sophisticated analysis and accelerate decision cycles.

HouseCanary with CanaryAI

HouseCanary introduced CanaryAI as the first generative AI assistant specifically for real estate valuation and forecasting. The platform's automated valuation models achieve error rates below 3%, significantly better than industry standards. CanaryAI allows users to query 136 million properties using plain English questions rather than learning complex database interfaces or data science tools.

The platform maintains 40 years of historical data, which provides deep time-series analysis for market trends and property performance. Risk assessment features quantify exposure across portfolios. Market intelligence tools identify emerging opportunities and potential challenges. HouseCanary's institutional-grade AVMs serve investment firms, portfolio managers, lenders, mortgage companies, and valuation professionals.

Pricing follows enterprise models with custom quotes based on data access levels and usage volumes. The Property Explorer CMA product offers $10 per report pricing for individual comparative market analyses. API access enables integration with existing investment platforms and workflows. HouseCanary's combination of sub-3% accuracy, a plain English AI assistant, and a comprehensive property database makes it a leading choice for institutional investors.

IntellCRE

IntellCRE provides AI-powered underwriting with instant property data aggregation. The platform's proprietary AI generates automated rent and sales comps, which eliminates hours of manual research. Market analysis automation provides insights in seconds rather than days. Marketing automation features generate broker opinion of values, property brochures, marketing websites, and flipbooks automatically. DealFinder auto-searches on-market and off-market deals that match specified criteria. Dealbox captures leads with guided submission workflows.

IntellCRE maintains records on over 150 million properties nationwide. Users report saving $27,000+ annually while eliminating hours per deal in manual research and document preparation. The platform enables unprecedented speed to market for listings and proposals. Lightning-fast property evaluation takes seconds, allowing brokers and investors to quickly assess opportunities and discard unsuitable prospects.

Pricing starts at just $69 per month, which is an exceptional value compared to enterprise platforms that cost hundreds or thousands monthly. A free trial allows testing before commitment. IntellCRE targets commercial real estate brokers, multifamily investors, agents, wholesalers, developers, and analysts from novice to institutional levels. The integrated platform combines underwriting, marketing, prospecting, and deal management in one intuitive interface that requires no training. Twenty-four-hour support and comprehensive tutorial resources further lower adoption barriers.

Cherre

Cherre built a Universal Data Model that standardizes disparate real estate data sources into a coherent knowledge graph. The platform connects over 3.3 billion addresses, creating what Cherre describes as the largest real estate data knowledge graph in the industry. The semantic data layer connects and transforms data from hundreds of sources into consistent formats.

AI-powered data ingestion automates collection, routing, and validation processes that previously required substantial manual effort. Agent.STUDIO, Cherre's AI-powered platform launching in 2025, will provide next-generation analytics and automation capabilities. Over 100 pre-built connectors integrate with major data providers and internal systems. Cherre powers more than $3.3 trillion in assets under management globally for institutional investors, REITs, asset managers, property managers, and lenders.

Clients include Nuveen Real Estate, RXR, and TA Realty principals among other major institutional players. Organizations report saving millions in manual data collection costs, accelerating decision-making timelines, and dramatically improving data quality and accuracy. Cherre provides a single source of truth for entire organizations and eliminates the multiple competing databases that plague many real estate enterprises.

Pricing follows enterprise models based on data sets accessed and platform features required. Annual contracts typically span 2-3 years. Implementation requires significant data infrastructure investment and typically takes months. Cherre targets large organizations with complex data challenges rather than small operators. A $30 million Series C funding round in 2024 signals continued investment in platform capabilities and market expansion.

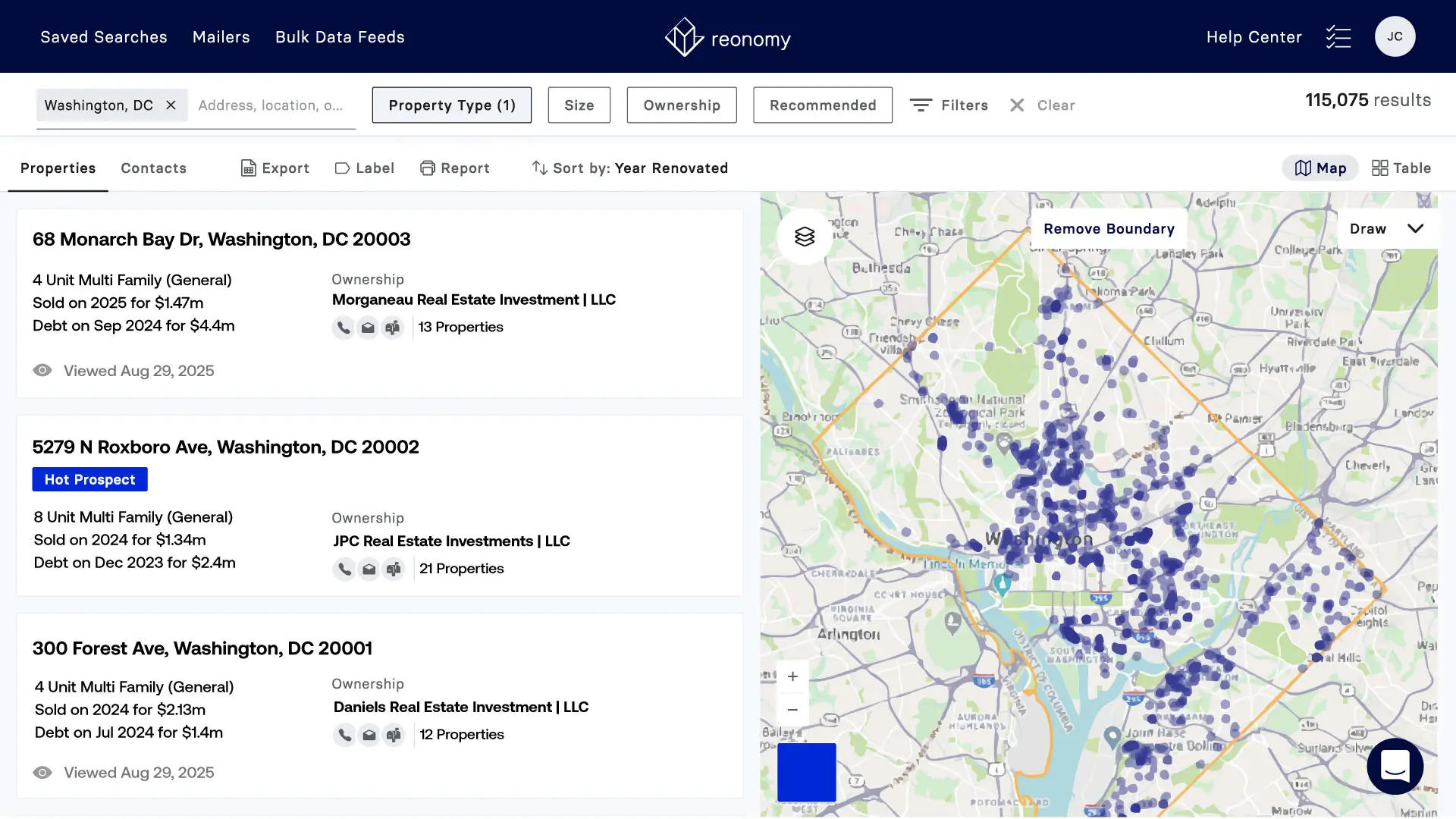

Reonomy

Reonomy, acquired by Altus Group in 2021, provides property intelligence powered by machine learning. The platform covers over 54 million commercial parcels across the entire United States, spanning over 3,100 counties and 385 metropolitan statistical areas. Reonomy ID, the platform's proprietary universal language developed with machine learning, enables consistent property identification across disparate data sources.

The Likelihood to Sell predictive indicator uses ML algorithms trained on billions of data points to identify properties most likely to transact in the near future. Ownership unmasking identifies anonymous owners by analyzing corporate structures, trusts, and LLCs. Over 200 filters enable precise targeting of investment opportunities. ML-powered comparable sales analysis accelerates underwriting and valuation work.

Web application pricing starts at $49 per month, with API access also beginning at $49 monthly. Premium tiers reach $249 per month, while Enterprise subscriptions cost $4,800 annually or $400 monthly. A seven-day free trial allows for testing before purchase. Reonomy targets commercial real estate investors, brokers, agents, developers, lenders, and property services companies. Major clients include Lee & Associates, Citi Habitats, Avison Young, SVN, Compass Commercial, JLL, Brookfield, CBRE, and Cushman & Wakefield.

The platform's proprietary Reonomy ID trained on billions of data points, exclusive data partnerships, and focus on larger cities and metro areas distinguish it from residential-focused competitors. The acquisition by Altus Group provided additional resources and market reach while maintaining Reonomy's technology and team.

HelloData.ai

HelloData.ai provides AI-driven revenue intelligence specifically for multifamily properties. It was founded by Marc Rutzen, who previously founded Enodo, which was acquired by Walker & Dunlop. The platform focuses on automated rent comps and revenue management. HelloData.ai achieves a 9/10 match rate with appraiser selections for comparable properties, an industry-leading accuracy rate.

The platform's LiquidRent Revenue Management system provides daily rent pricing recommendations based on comprehensive market data. Expense benchmarking covers over 25,000 multifamily properties, which allows operators to identify cost optimization opportunities. Unit-level data provides a complete breakdown of every unit in competitive properties. Market surveys are generated automatically daily, saving over 5 hours per week previously spent on manual research. Computer vision technology analyzes property photos and detects over 200 amenities automatically.

Rent data accuracy typically falls within 3-4% of actual leased rents. Daily updates cover over 35 million units nationwide. The platform reduces rent survey time by over 80% and generates rent comps in under one minute. Market analysis time drops by 98%. Onboarding takes just five minutes, which eliminates lengthy implementation cycles. The platform covers over 2.2 million properties.

HelloData.ai targets multifamily property managers, investors, developers, asset managers, acquisition teams, appraisers, and lenders. The explainable AI provides insights in plain English rather than technical jargon, which makes the platform accessible to users without data science backgrounds. The fact that it was founded by the Enodo creator provides credibility and industry expertise. Pricing requires contact for custom quotes based on portfolio size and feature requirements. A seven-day free trial enables evaluation before commitment.

Property Valuation and Appraisal AI

Automated valuation models use AI and machine learning to estimate property values with increasing accuracy. The best platforms now achieve error rates below 5%, approaching or exceeding human appraiser accuracy for many property types. These tools accelerate lending decisions, portfolio valuations, and investment analysis, and they reduce costs compared to traditional appraisals.

ATTOM AVM

ATTOM Data Solutions deployed a multi-model AVM that selects the best valuation method for each specific geographic area. The platform maintains over 155 million property assessments, 430 million transaction records, and coverage across 3,140 counties. Its accuracy reaches 70% of valuations within 10% of actual sale prices, and 85% within 20%. The median error is 6%, with 99% coverage of the U.S. population.

ATTOM is positioned between expensive lender-grade AVMs and free consumer tools like Zillow's Zestimate. Custom enterprise pricing, bulk licensing options, and ATTOM Cloud delivery provide flexible deployment models. The multi-model approach provides hyperlocal precision by selecting the optimal algorithm for each market's characteristics. Transparent confidence scoring helps users understand valuation reliability.

ATTOM targets mid-market real estate firms, brokers, agents, lenders, investors, and portfolio managers who need better accuracy than consumer tools but cannot justify premium lender-grade pricing. The platform requires bulk licensing for the best value, so it is more suitable for organizations processing significant volumes rather than one-off valuations.

CoreLogic Total Home ValueX

CoreLogic (as of 2025 officially rebranded as Cotality) has over 50 years of real estate data experience, which it uses in Total Home ValueX, a single-model AVM with advanced AI and network graph technology. The platform achieves 99% accuracy across various scenarios with 3.9% year-over-year tracking accuracy. Coverage extends to 99.9% of U.S. properties and draws on over 3 billion historical records.

The single consistent methodology reduces surprises compared to multi-model approaches that might produce varying results as different models are activated in different geographies. Specialized risk analysis for natural disasters including hurricanes, wildfires, and floods supports insurance and investment decisions. CoreLogic targets large financial institutions, lenders, mortgage servicers, commercial real estate companies, portfolio managers, and insurance companies.

Subscription-based enterprise pricing requires custom quotes. The premium positioning, enterprise focus, and implementation requirements make CoreLogic less suitable for small firms or individual investors. The platform's consistency, massive data coverage, and specialized risk analysis justify the investment for large organizations that process substantial volumes.

Quantarium QVM

Quantarium, acquired by Xome in 2015, operates a self-learning AI engine that analyzes over 900 factors to generate more than 1 billion property values monthly. TeraLook visual technology incorporates image analysis of properties and neighborhoods. The platform is widely considered among the best AVM models for accuracy and timeliness.

Quantarium is integrated into Realtor.com and provides valuations to millions of home shoppers and real estate professionals. The self-learning AI continuously improves as new data becomes available, and it adapts to market changes faster than static models. Proprietary data sources provide information unavailable to competitors. Enterprise and API pricing require custom quotes. Quantarium targets lenders, mortgage banks, brokers, originators, insurance agencies, appraisers, and servicers.

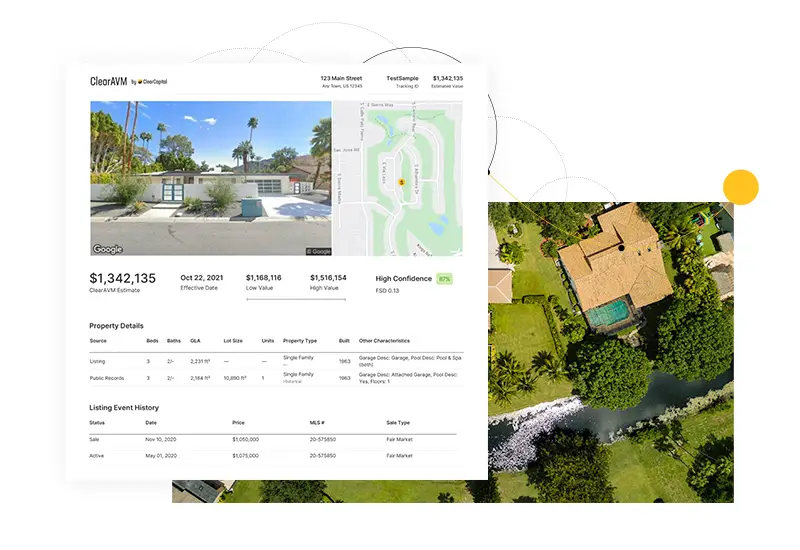

Clear Capital ClearAVM

Clear Capital provides a lending-grade AVM with hourly updates rather than daily refreshes. The platform covers over 139 million U.S. properties, 95% of the market, and draws on over 3 billion historical records. Predicted accuracy measurement enables users to set risk tolerance thresholds appropriate for their use cases.

A Hitch case study showed a 30% increase in loan approvals using ClearAVM compared to previous valuation methods. The platform processes valuations 50% faster than traditional appraisals and maintains lending-grade accuracy standards. Interactive assessment tools allow users to adjust assumptions and see the resulting impacts on value. Clear Capital offers pay-per-use options alongside enterprise subscriptions, which provides flexibility for various volume levels. The platform targets single-family rental managers and investors, lenders, portfolio managers, appraisers, and commercial real estate professionals.

Market Analysis and Predictive Analytics

Understanding market trends, identifying emerging opportunities, and predicting future performance are what separate successful real estate investors from average performers. AI-powered market analysis platforms process millions of data points to surface insights that would take human analysts weeks or months to uncover.

PropStream

PropStream combines ML-powered automated valuation with predictive AI for foreclosure risk assessment. Its hedonic machine learning methodology analyzes property characteristics, location factors, and market conditions to generate valuations. The Foreclosure Factor uses AI propensity scoring to rank properties from Very Low to Very High likelihood of foreclosure. Wholesale Value calculations at 70% of estimated value help investors quickly identify potential deals.

Daily data updates with MLS information refreshed multiple times a day ensure current market intelligence. MLS photo processing uses AI to assess property condition from images. PropStream focuses on motivated sellers and distressed properties, so it is particularly valuable for investors, wholesalers, and landlords rather than traditional transactions. Pricing includes a seven-day free trial with 50 free leads, then subscription-based plans with custom quotes.

SmartZip

SmartZip delivers AI-driven predictive analytics that identify homeowners likely to sell within 12 months. The platform evaluates homeowner data and consumer behavior patterns to generate seller lead predictions. Built-in CRM and automated marketing tools enable agents to nurture leads efficiently. Lead nurturing sequences are activated automatically as prospects move through the sales cycle.

SmartZip targets real estate agents of all experience levels, teams, and brokerages. The user-friendly interface makes sophisticated predictive analytics accessible without data science expertise. The integration of CRM and predictive capabilities in one platform eliminates the need to manage multiple systems. Automated lead nurturing reduces manual follow-up work and improves conversion rates. Pricing requires custom quotes based on geographic territory and lead volume. Geographic exclusivity commitments ensure agents do not compete with others using the same tool in their market.

CRM and Brokerage AI Tools

Customer relationship management is foundational for real estate professionals, but modern AI capabilities extend far beyond contact management. Today's CRM platforms provide predictive analytics, automated communication, lead scoring, and workflow automation that dramatically improve agent productivity and conversion rates.

Follow Up Boss

Follow Up Boss (by Zillow) integrates AI throughout its lead management and follow-up CRM platform. AI-generated personalized email and text responses use an agent's own historical data to craft authentic communications. Automated call summaries extract key points from conversations without manual note-taking. Task suggestions based on lead activity ensure timely follow-up without requiring agents to remember every interaction. Lead history recaps provide at-a-glance context before conversations.

The platform automatically captures leads from over 250 sources including websites, portals, and social media. There are no separate AI fees—AI capabilities are included with the calling feature rather than requiring additional subscriptions. The AI learns from each agent's specific communication patterns, previous emails, texts, and call notes to generate responses that match their voice and style.

Pricing starts at $58-69 per month for one user on the Grow Plan, with the Dialer add-on costing $33 per user monthly. The Pro Plan is $416 monthly for 10 users, while the Platform Plan is $833 monthly for 30 users. A 14-day free trial enables evaluation before commitment. Follow Up Boss targets individual agents, real estate teams of 10+ agents, large brokerages, and team leads. Pricing scales up quickly for larger teams, and AI features require the calling add-on.

Structurely

Structurely provides an AI-powered chatbot named Aisa Holmes (AI Inside Sales Agent) that engages prospects via SMS, web chat, and Facebook Messenger with natural language processing. The system automatically qualifies leads, nurtures them through campaigns of 12+ months, and hands them off to agents when they are ready to act. Aisa Holmes creates human-like conversations that include deliberate typos and response delays, which makes interactions feel natural rather than robotic.

Measured results show a substantial impact. A RE/MAX team increased its appointment conversion from 5% to 15%, effectively tripling their conversion rate. Another client experienced a 400% increase in lead volume and achieved a 233% lift in conversions. Edric Williams, a Structurely client, noted the platform enabled him to hire three new agents to handle the increased opportunity flow. Purpose-built for real estate with over 60 integrations, Structurely automatically follows up with leads for over 12 months without manual intervention.

Pricing starts at $179 monthly for the Starter plan with 1 seat and 50 leads per month. The Growth plan is $299 monthly for 10 seats and 125 leads. The Build plan is $499 monthly for 30 seats and 225 leads. An alternative $3 per lead pricing model suits varying volume needs. Structurely targets individual agents, real estate teams, brokers, and multi-agent operations that handle 600-700 leads monthly. The additional cost beyond existing CRM subscriptions and required integration setup are considerations, though the conversational AI with emotional intelligence and 12+ month nurturing justify the investment for teams with sufficient lead volume.

REsimpli

REsimpli is the number one AI CRM specifically for real estate investors rather than traditional agents. VoiceFollow AI handles automatic phone follow-ups and appointment scheduling. CallAnswer AI automatically answers incoming calls and gathers property details from sellers. CallGrade AI analyzes call recordings and scores agent performance. Conversational AI enables two-way SMS conversations with prospects. MeetGrade AI evaluates in-person meetings. SpeedToLead AI provides an instant response to new leads, which is critical in investor markets where speed determines success.

Additional features include skip tracing, drip campaigns, and dedicated buyer and seller websites. Users report closing 2.3x more deals with REsimpli compared to previous systems. The platform ensures investors never miss calls from motivated sellers, who often do not leave voicemails and will not call back.

Basic pricing starts around $97 monthly and includes 250 minutes and SMS, one cash buyer search, 20,000 list stacking records, and 10,000 free skip tracing credits, a value of $1,500. Higher tiers provide over 1,000 minutes and expanded features. Annual billing saves 29%, and a 30-day free trial allows for testing. REsimpli targets real estate investors, wholesalers, fix-and-flip professionals, and property flippers. The investor focus means less suitability for traditional agents, though the multiple AI agents addressing different workflow tasks and included skip tracing provide exceptional value for the target market.

Specialized Real Estate AI Applications

Beyond the major categories of lease abstraction, property management, investment analysis, and CRM, several specialized AI applications address specific operational needs. These tools often deliver outsized returns because they target high-pain, high-cost processes.

Snappt: Fraud Detection and Tenant Screening

Snappt uses data-driven fraud detection to analyze thousands of metadata elements in financial documents. The platform detects falsified bank statements, pay stubs, and other financial documents used in rental applications. Its machine learning algorithms are tuned specifically for document manipulation and achieve 99.8% accuracy in identifying fraudulent documents. Biometric identity verification performs over 30 ID checks, while real-time income verification connects directly to payroll systems. OCR and data analysis deliver results in 10 minutes or less.

Snappt integration with RentGrow and Yardi ScreeningWorks Pro enables seamless adoption within existing workflows. The platform protects over 2.2 million units nationally and prevents fraud that could cost property managers over $7,500 per eviction. The NoHo 14 property eliminated application fraud entirely and saved over $500,000 in fraud-related losses. A 51% reduction in potential bad debt and evictions shows a clear ROI. Screening time drops from 4-10 hours to minutes and accuracy improves dramatically. Property managers report that 97% have experienced application fraud in the past year, which highlights the scope of the problem Snappt addresses. Subscription-based pricing requires custom quotes, but the savings of $7,500+ per prevented eviction provides a rapid payback.

BrainBox AI: HVAC Optimization

BrainBox AI deploys autonomous HVAC optimization using physics-informed artificial intelligence. Its deep learning neural networks include LSTM and time series analysis combined with Neural Ordinary Differential Equations. The physics-informed approach blends physics models with deep learning and achieves 99.6% accuracy in predictive analytics while requiring 10x less training data than traditional deep learning approaches. The system automatically adjusts HVAC equipment every five minutes, makes over 280 control strategy assessments daily per HVAC component, and sends 2 million unique commands per day across client installations.

Results include a 25% reduction in HVAC energy consumption, 99.6% accuracy in predicting building energy use six hours ahead, a 40% reduction in carbon emissions, and 96% predictive accuracy per HVAC zone. The platform has impacted over 14,900 buildings across more than 20 countries and was displacing 850,000 tons of CO2 annually by the end of 2021. Neural ODEs reduced model training time by 90% and dramatically decreased data requirements.

Royal London Asset Management achieved a 708% ROI with 59% energy savings in its 11,600 square meter office building, which reduced carbon emissions by 500 metric tons annually. The platform typically pays for itself in under one year, with monthly SaaS fees that are lower than the energy savings generated. ARIA, BrainBox AI's generative AI virtual assistant built on AWS Bedrock and the Claude LLM, provides a conversational interface for building operators. The platform targets commercial real estate owners, office buildings, retail, hotels, airports, and data centers with existing HVAC and building management systems.

Virtual Staging and Marketing AI

AI virtual staging has matured to production quality and dramatically reduced costs compared to physical staging. Properties that use virtual staging sell 73% faster on average, with offer prices 1-5% higher than non-staged comparable properties. Several platforms now deliver high-quality results.

BoxBrownie.com pioneered a hybrid AI plus human designer approach to virtual staging. The platform offers residential staging, commercial staging, 360-degree staging, day-to-dusk conversion, sky replacement, image enhancement, floor plan redraws, and virtual renovations. It has multiple design styles, including Modern, Contemporary, Farmhouse, Traditional, Urban/Industrial, Mid-Century Modern, Hamptons, Commercial, and Scandinavian. Pricing is $24 USD per room for residential or commercial with an 8-48 hour turnaround, dramatically less than the $2,800+ for traditional physical staging.

Documented results include properties on the market for six months selling in one day after virtual staging. NAR data shows a 1-5% increase in offer prices versus non-staged homes, 81% of buyers believing staging helps them visualize living in the home, and 72% of listing agents considering virtual staging important for selling. Images are returned within three hours in many cases. The hybrid approach that combines AI with human designers ensures quality control while maintaining a fast turnaround and affordable pricing.

Collov AI provides fully automated virtual staging with real-time rendering. Style transformation spans modern, traditional, minimalist, and luxury aesthetics. Twilight conversion, photo enhancement, pool water clarity improvement, lawn renovation, and sky replacement augment standard staging. Users can add or remove furniture with one click. Virtual renovations can modify walls, floors, and materials. Results include a 72% spike in listing views after virtual staging, a 44% increase in qualified leads, and multiple success stories of properties receiving offers within one week after staging following months with no interest. Virtually staged properties sell 73% faster and command 20% higher offers on average.

Virtual Staging AI delivers one-click automated staging with a 15-second rendering time. Automated furniture removal and addition works across multiple views, showing the same furniture from different angles. Pricing starts at $16 monthly for 6 images, which equates to $2.67 per image, the cheapest option available. The simple one-click process requires no design expertise. Limitations include minimal customization options, pure AI without human review, and subscription requirements. For maximum speed and minimum cost, Virtual Staging AI excels, though quality may vary compared to hybrid or professionally reviewed options.

Real Estate AI Implementation Strategy

A successful AI tool implementation requires matching capabilities to actual operational needs, not chasing the latest technology trends. The most successful deployments start with a clear problem definition, a realistic scope, and measurable success metrics. Organizations should identify the highest-pain processes that consume the most time, generate the most errors, or create the greatest bottlenecks. Lease abstraction, for example, represents an obvious target because the pain is acute, the process is well-defined, and the benefits are immediately measurable.

Strategic investments in platforms like V7 Go for real estate document intelligence, comprehensive property management systems, or portfolio analytics infrastructure deliver compounding value over time. These implementations require a more significant upfront investment in time, money, and organizational change. However, they fundamentally improve operational capacity, not just optimize specific tasks. A 95% reduction in lease abstraction time does not just save hours—it enables one analyst to handle five times the portfolio size, which fundamentally changes what the organization can accomplish.

Small property managers that operate 1-50 properties should prioritize affordability and ease of implementation. LeaseLens at $25 per export, Prophia Abstract with free viewing, Virtual Staging AI at $16 monthly, and LionDesk CRM at $33 monthly provide enterprise-grade capabilities at accessible price points. These tools require minimal training, work independently without complex integrations, and deliver immediate value without multi-month implementation cycles.

Mid-size portfolio managers that handle 50-500 properties need more sophisticated capabilities with batch processing, integrations, and workflow automation. Prophia Essentials with 99% accuracy and human review, DocSumo for comprehensive document processing, HelloData.ai for multifamily market intelligence, Follow Up Boss for CRM and lead management, and Buildium for property management operations address this market. These platforms balance capability with accessibility and provide enterprise features without enterprise complexity.

Large enterprises and REITs that manage over 500 properties require platforms that can handle massive scale, complex workflows, regulatory compliance, and enterprise integrations. V7 Go for document intelligence with AI Citations and audit trails, Leverton/MRI for lease abstraction at an institutional scale, Cherre for comprehensive data infrastructure, Yardi Virtuoso for enterprise property management, Juniper Square for portfolio management, and AppFolio Realm-X for property operations deliver the capabilities, security, compliance certifications, and support infrastructure that large organizations require. Custom pricing reflects substantial functionality, though implementation cycles extend to months rather than weeks.

Real estate investors prioritize deal flow, analysis speed, and decision support. IntellCRE at $69 monthly for comprehensive underwriting with over 150 million property records, Reonomy starting at $49 monthly for property intelligence, PropStream for motivated seller identification, REsimpli for investor-focused CRM, and HouseCanary for institutional-grade valuations serve this market well. These tools help investors evaluate more opportunities faster, identify better deals earlier, and make decisions with greater confidence.

Brokers and agents need lead generation, client communication, marketing automation, and transaction management. Follow Up Boss for AI-enhanced CRM, Structurely for conversational AI lead nurturing, Lofty for an all-in-one brokerage platform, BoxBrownie for professional marketing materials, and SmartZip for predictive seller identification provide comprehensive coverage. The 233% conversion lift from Structurely, 50-100% sales increases with Cloze, and 2.3x more deals closed with REsimpli show a measurable impact on agent productivity and income.

The 92% adoption rate with only 5% goal achievement highlights a critical gap between experimentation and execution.

Successful implementations share common characteristics. They start with executive sponsorship and clear objectives, not bottom-up pilot projects that struggle for resources. They invest in data infrastructure and quality before deploying AI, because they recognize that algorithms trained on bad data produce bad outcomes. They provide comprehensive training and change management support and treat AI adoption as an organizational transformation, not just a technology upgrade. They establish clear metrics and accountability and measure outcomes, not just implementation milestones. They iterate based on actual usage and results and do not assume the initial implementation is final.

The real estate AI market will reach $1.3 trillion by 2034 because the operational improvements are real, measurable, and sustainable. The tools examined in this guide deliver 70-95% time reductions, 95-99%+ accuracy improvements, and an ROI from several hundred percent to millions in recovered revenue. Early adopters gain competitive advantages that compound over time as they reinvest efficiency gains into growth, innovation, and market expansion. The 5% achievement rate means that 95% of firms are still figuring out how to make AI work, which creates a massive opportunity for organizations that execute well.

End-to-end due diligence workflow showing AI-powered data room analysis and specialized agent delegation