Document processing

11 min read

—

Dec 15, 2025

How are the most forward-thinking M&A and investment firms speeding up deal closures and reducing risk? This is your complete guide to the most powerful due diligence platforms.

Imogen Jones

Content Writer

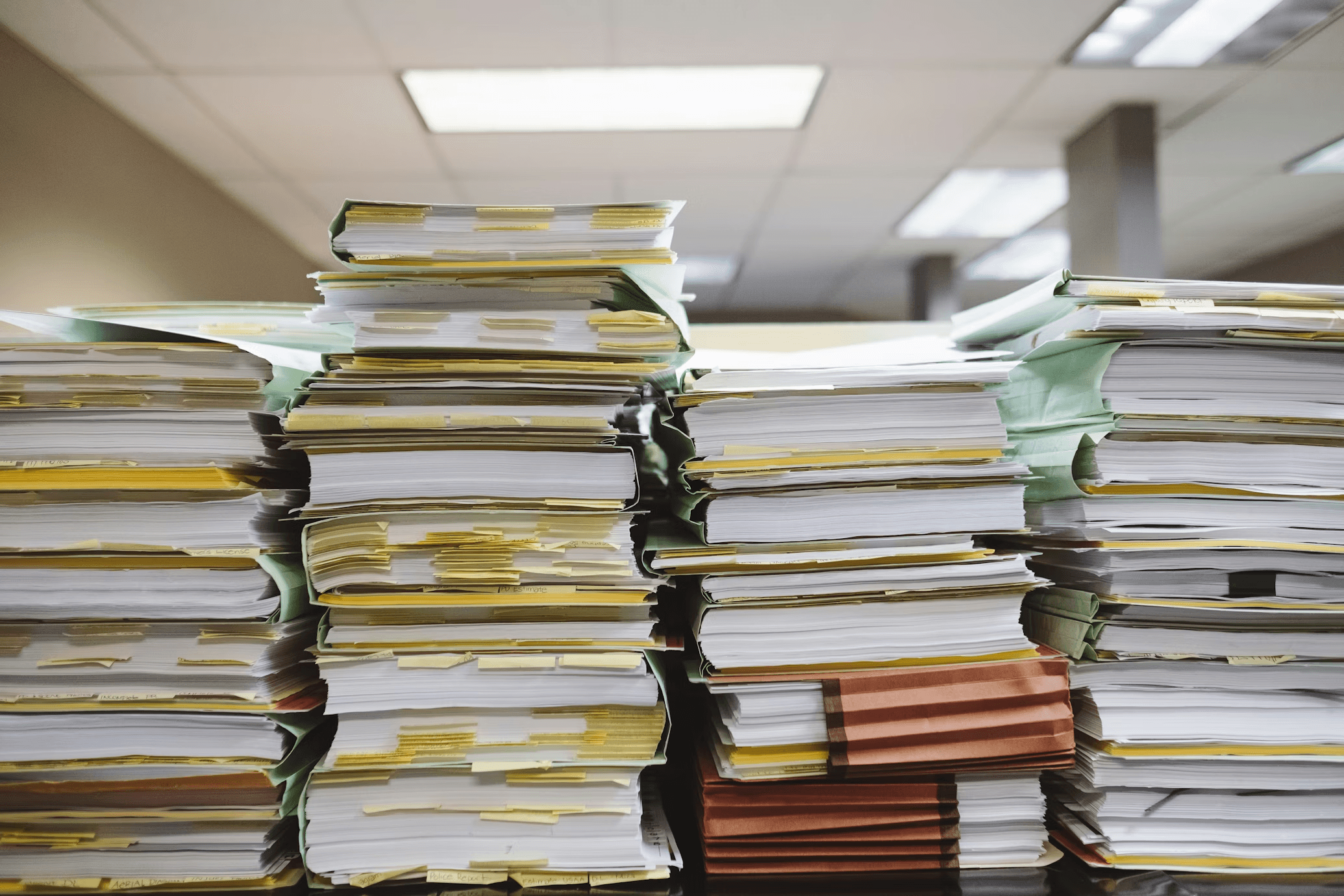

It’s 5:30 PM on a Friday. You have dinner plans. Your Associate has a life. Then, the notification hits your inbox: [External] Access Granted: Project Pluto Data Room.

Suddenly, you're staring at a folder structure containing 400 disorganized PDFs, three years of unformatted financial audits, and a capitalization table that looks like it was built by a madman.

For the last twenty years, the industry’s response to this scenario has been brute force. We throw bodies at the problem. We burn out our best junior talent by forcing them to spend their weekend manually keying numbers from PDFs into Excel, praying they don't transpose a digit in the EBITDA bridge due to sleep deprivation.

It is inefficient, expensive, and creates avoidable risk.

In this article, we’ll cover:

The difference between traditional VDRs and AI due diligence tools

Top software for due diligence

How to implement automated workflows to speed up deal cycles

From Banker Boxes to AI Agents: The Evolution of Due Diligence Software

Due diligence has always been the bottleneck of capital allocation. It is the friction between "I want to buy this company" and "I know what I’m buying." Over the last 70 years, the technology we use to remove that friction has evolved in three distinct waves.

We are now entering the fourth, and most significant, wave. Here is how the toolset has evolved from physical logistics to intelligent agents.

Physical Copies and the "War Room"

If you ask an investment partner who started their career in the 1980s about due diligence, they will likely tell you stories about "The War Room." In this case, they mean a literal, physical room, filled with stacks of banker boxes and a distinctive whiff of coffee and toner.

This was the original Data Room. Sellers compiled material documents (audits, contracts, permits, litigation files) into physical binders. Buyers sent teams to a conference room to review everything on-site. You couldn't remove documents, and you took notes by hand or by word processor, hoping not to miss critical details buried in complex exhibits.

The process was slow, expensive, and geographically constrained. A New York-based PE firm looking at a target in Munich had to fly a team to Germany for a week.

Digitization and Early Software

As the internet matured in the early 2000s, the industry digitized this process with the Virtual Data Room. Companies like Intralinks and Datasite replaced the basement with the cloud, solving the problem of access.

Now, instead of traveling, you could log in from your desk at 2:00 AM and review the same documents. VDR providers added features like granular permissions to control access, Q&A modules for buyer questions, and audit logs to track engagement.

This improved logistics significantly. However, it did not solve the core problem: someone still had to read every page. The VDR served as a digital filing cabinet, but it remained a passive storage solution.

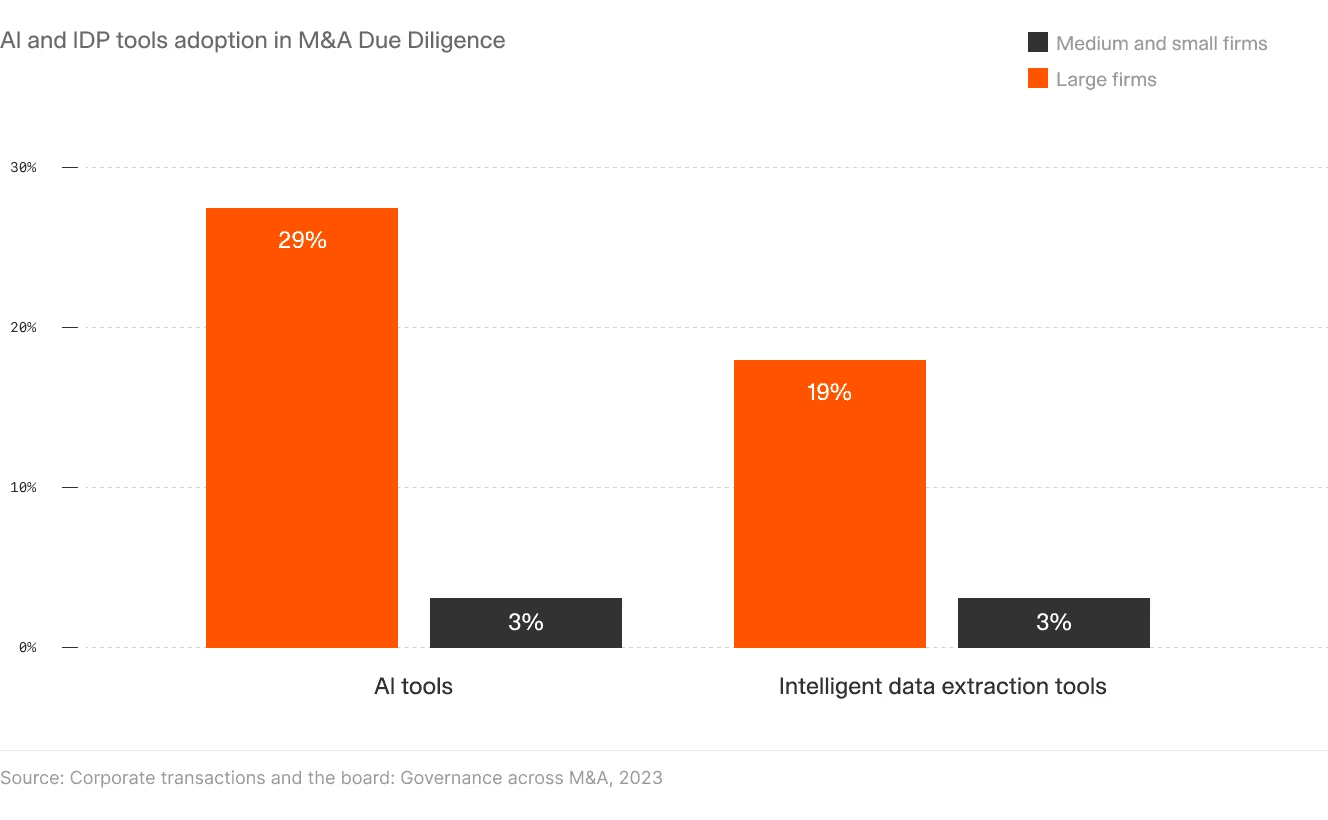

AI for Due Diligence

Traditional VDRs are passive; they host files. Modern due diligence software is active; it interrogates files.

For a private equity firm reviewing 100 deals a year, the competitive advantage lies in quickly discarding the 95 bad deals to focus on the 5 good ones. AI due diligence tools facilitate this by providing instant summaries and risk assessments, allowing senior dealmakers to make faster "go/no-go" decisions without waiting for a junior team to manually review every page.

When Generative AI arrived in 2023, deal teams saw a glimmer of hope. The promise of Large Language Models suggested a world where software could finally read. But the "General AI" era proved to be a false dawn for diligence, and investors quickly realized that copy-pasting text from a Confidential Information Memorandum into a chatbot was fraught with danger.

General models suffered from context collapse. They couldn’t reason across hundreds of disconnected files, and they had a tendency to "hallucinate" facts, a fatal flaw in an industry where accuracy is the only currency that matters.

A chatbot is great for writing emails, but makes for a terrible junior analyst.

AI Agents for Financial Due Diligence

We are now entering the fourth and most significant wave of this evolution, the Agentic Era.

Consider the workflow of financial statement spreading. In the VDR era, this meant an associate staring at a PDF audit on one screen and manually typing numbers into an Excel template on the other, often until 2:00 AM. Today, a Financial Spreading Agent connects directly to the data room, identifies the income statements and balance sheets across years of unstructured files, extracts the data, and maps it to the firm’s standardized taxonomy. It handles the rote transcription instantly, allowing the human team to move straight to analysis.

This agentic approach extends to risk management as well. Instead of hoping a human reviewer stumbles upon a problematic clause, the software proactively scans the data room for "red flags" defined by the firm’s playbook. It can identify customer concentration risks, flag margin erosion trends by cross-referencing audits with board decks, and parse complex capitalization tables to validate ownership percentages.

Crucially, these modern tools must solve the "black box" trust issue through visual grounding. For example, when V7 Go flags a risk or extracts a revenue figure, it provides a clickable citation that opens the source document and highlights the exact paragraph where the evidence lives.

The history of due diligence has been a slow march toward removing friction. The firms that succeed in this new era will be those that successfully delegate the "first pass" of diligence to AI. This allows investment professionals to reclaim time for judgment, strategy, and negotiation.

To learn more, read our blog: AI in Due Diligence: What It Means for M&A and Beyond.

Key Due Diligence Workflows AI Agents Can Automate

Before evaluating specific platforms, it is useful to understand the workflows where AI agents deliver the most value. These tasks consume the most time and carry the highest error risk in traditional due diligence.

1. Automated Financial Spreading (The PDF-to-Excel Bridge)

The most soul-crushing task in PE is "spreading comps," taking a PDF audit and typing the numbers into your firm’s Excel template.

An AI agent can connect to the data room, identifies the Income Statements, Balance Sheets, and Cash Flow statements (even if they are scanned images), and extracts the line items. It normalizes the data (mapping "Revenue" and "Gross Sales" to your standardized taxonomy) and populates your financial model.

This can enable your Associate spends zero hours typing and 100% of their time analyzing the trends in the model.

Learn more in our blog Best AI for Excel in 2025 (Full Comparison + Use Cases).

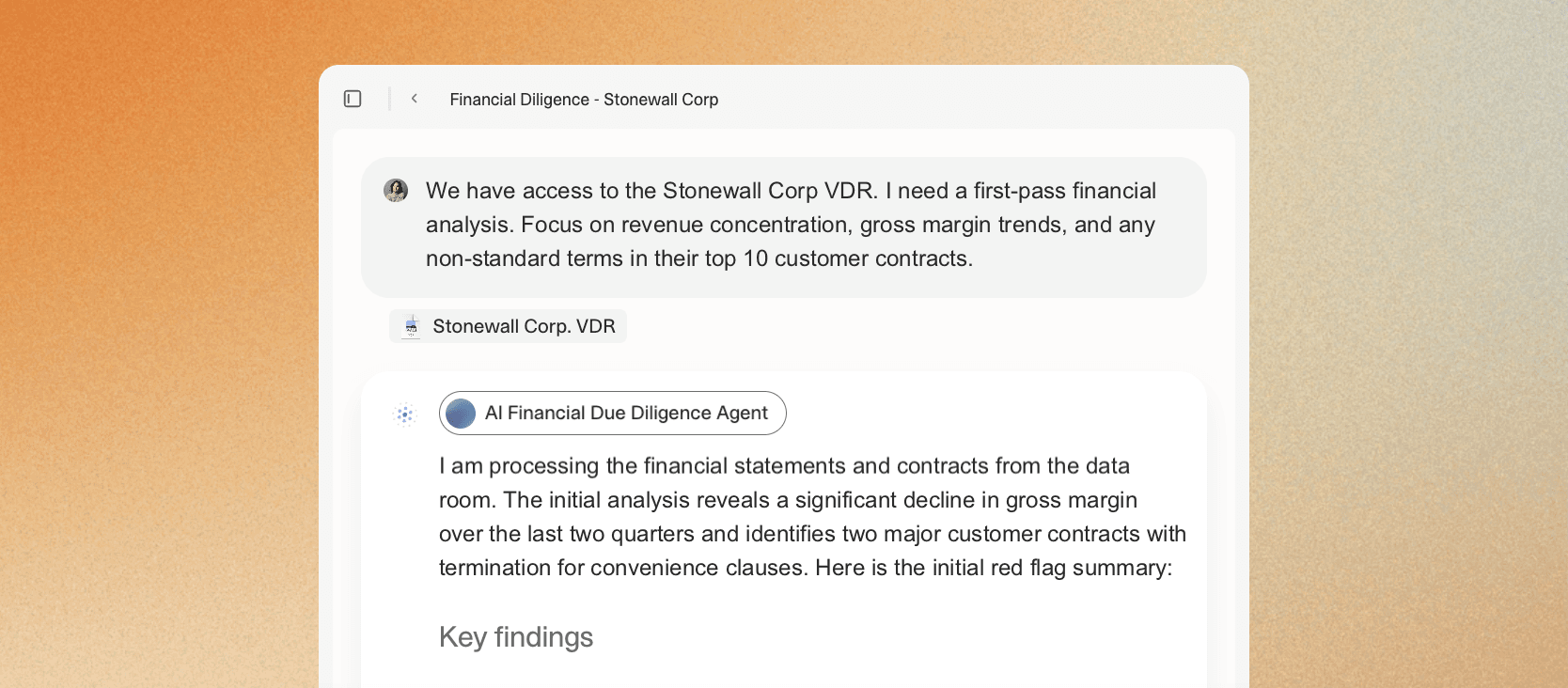

2. Red Flag Identification (Risk Radar)

When you have limited time to review a deal, you have to triage.

AI agents can ingest the entire data room and proactively search for specific diligence risks defined by your firm’s playbook, such as:

Customer concentration: "Flag any customer accounting for >10% of revenue."

Margin erosion: "Highlight quarters where COGS increased faster than Revenue."

Accounting irregularities: "Identify sudden changes in revenue recognition policies."

The agent serves up a "Red Flag Report" cited directly from the source documents. You start your review knowing exactly where the bodies are buried.

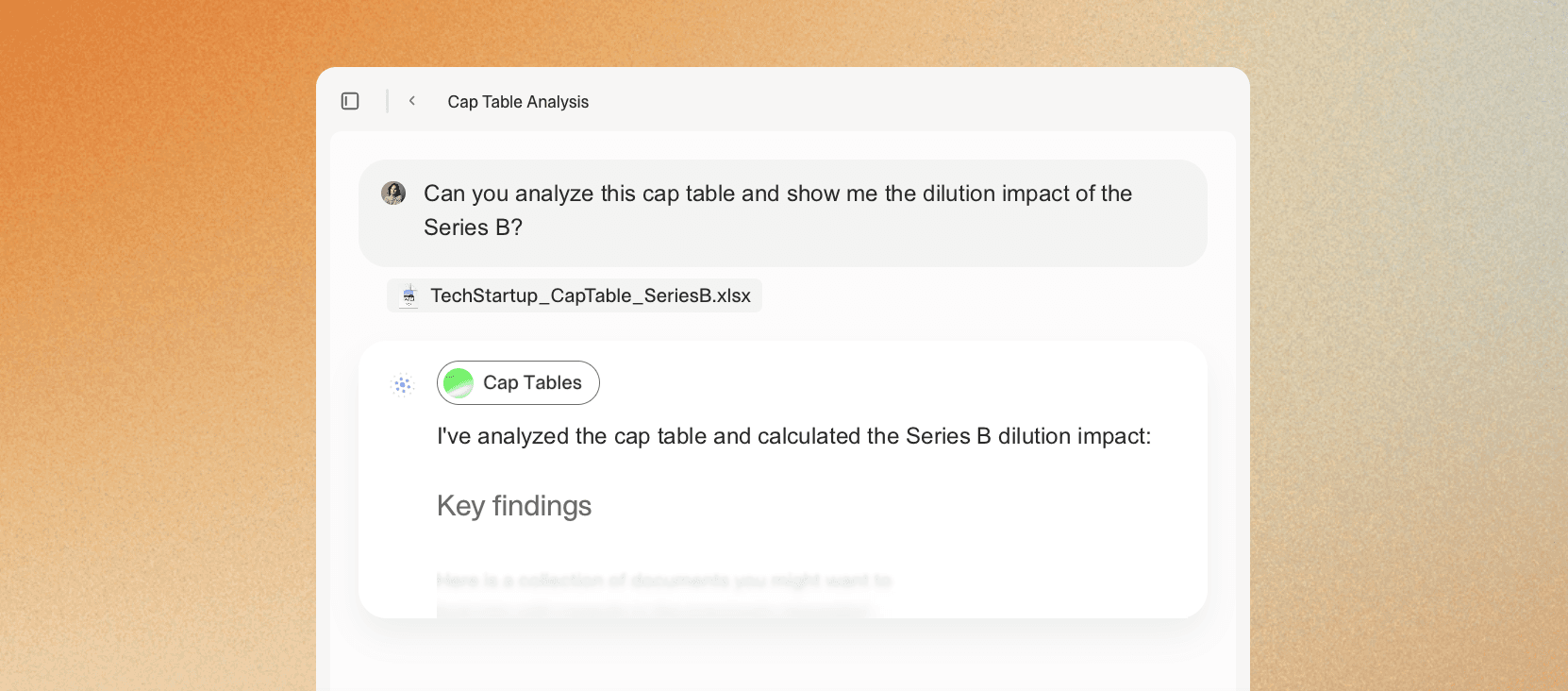

3. Cap Table Analysis & Cleanup

Startups are notorious for messy cap tables. Convertible notes, SAFE agreements, and non-standard equity classes often result in ownership structures that don't sum to 100%.

Instead of manually tracing the waterfall, an AI agent parses the cap table and the underlying subscription agreements. It validates ownership percentages, identifies liquidation preferences that might hurt your returns, and flags non-standard equity classes. It does the math before you do the deal.

Learn more here: AI Cap Table Analysis.

4. Commercial Contract Review

In a typical buyout, the target might have 500+ customer contracts. Reviewing them all for "Change of Control" or "Assignment" clauses is usually outsourced to expensive external counsel or skipped entirely in the early stages.

AI agents can read all 500 contracts simultaneously. They extract key commercial terms (Term, Termination, Liability Caps) and highlight revenue risks. If 20% of the customer base can walk away when you buy the company, you need to know that before you submit the LOI.

See this in action in the V7 AI Contract Review Agent.

Best Due Diligence Software in 2025

The market is divided between established VDR providers adding AI features and AI-native platforms building specifically for analysis. Here are the top contenders.

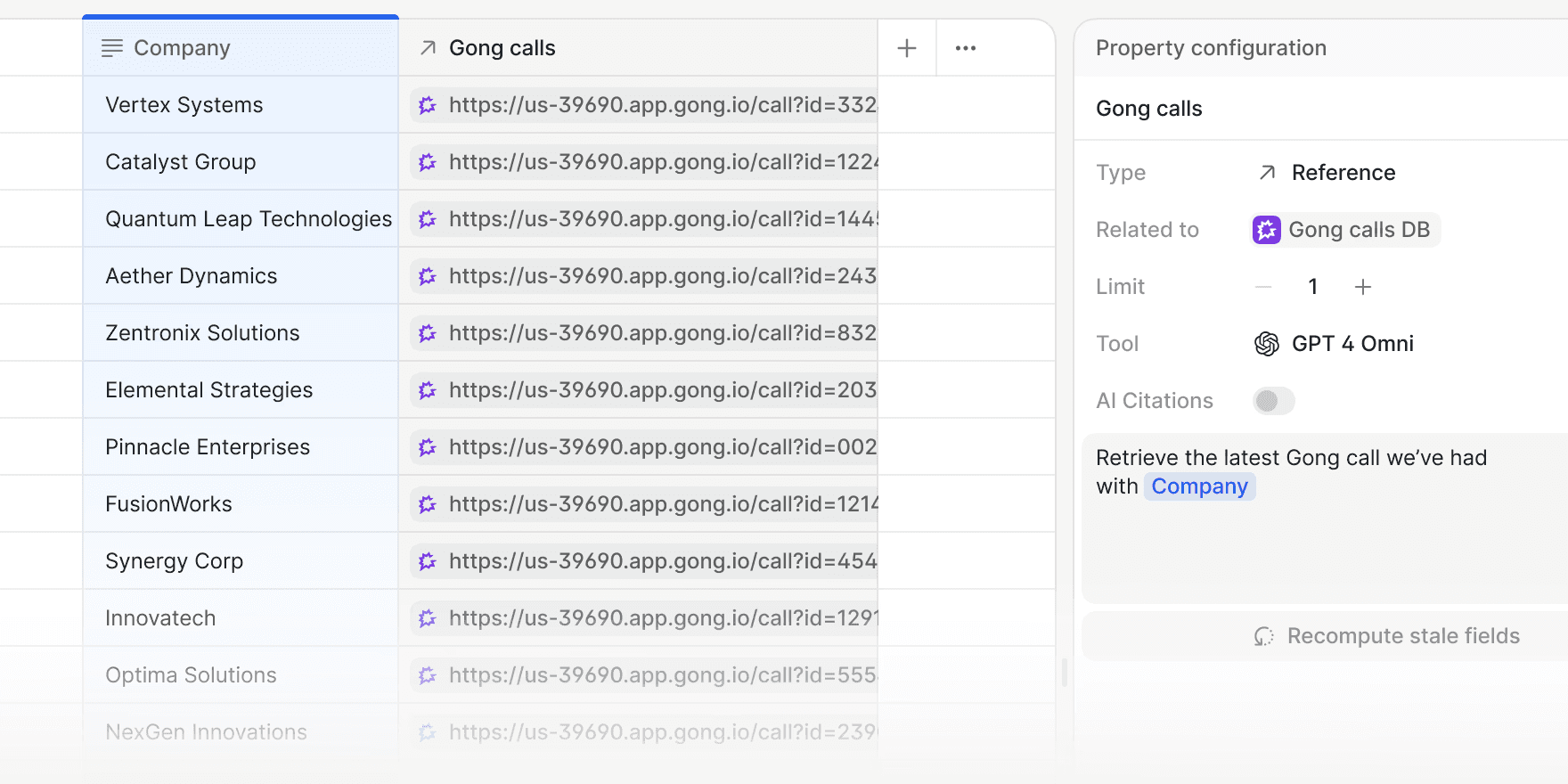

1. V7 Go: Best for AI Document Analysis & Automation

Website: V7 Go

V7 Go represents the new wave of AI-native due diligence tools, built not just to store or analyze documents, but to organize, synthesize, and reason across an entire body of knowledge.

Traditional VDRs and diligence platforms are now table stakes. And while GenAI has opened the door to more intelligent review, even the most advanced LLMs with huge context windows start to falter when confronted with long, dense, or interconnected documents.

The result is familiar: responses that sound correct but miss the specifics that actually matter in an investment decision.

V7 solves this by introducing Knowledge Hubs a step-change evolution of the virtual data room, CRM, and knowledge management system. Instead of acting as static repositories, Knowledge Hubs become living, entity-centric wikis. AI agents continuously populate and update them: when new information about a company, person, asset, or product appears, the system automatically syncs and updates every relevant entity record.

This transforms due diligence. A team can spin up a Knowledge Hub from a sprawling VDR containing hundreds of heterogeneous files, then ask precise, analyst-level questions. V7's AI Concierge searches the entire Hub, synthesizes the answer, and provides clickable citations that open the exact passage in the original source document

V7 can automate and accelerate your due diligence workflows with specialized agents, including an an AI Financial Due Diligence Agent, a Data Room Analysis Agent, and an AI Contract Review Agent. Each is designed to handle the heavy analytical and manual lift that typically consumes most of a diligence process.

Bespoke agents can also be created that map to even the most complex workflows and processes.

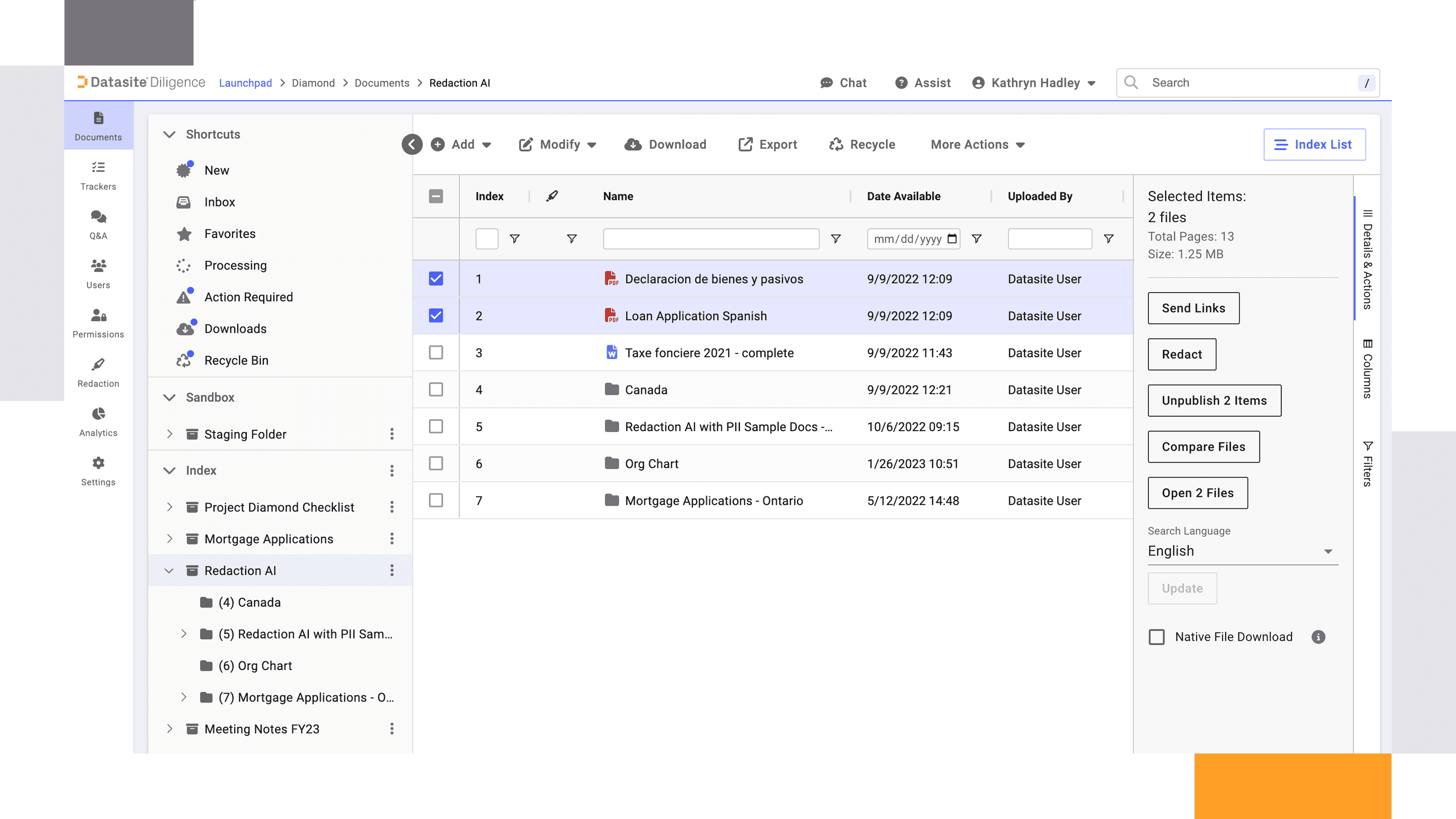

2. Datasite: Best for Large-Cap M&A Transactions

Website: Datasite

Datasite (formerly Merrill Corporation) is one of the default choices for high-end M&A, particularly on complex, global, large-cap deals. It started as a classic virtual data room provider, but has evolved into a broader deal management platform that supports everything from early preparation and restructuring through to sell-side auctions, IPOs, and distressed transactions.

Its customer base skews towards top-tier investment banks, large corporates, and global law firms that need industrial-strength infrastructure for high-volume, high-stakes deals.

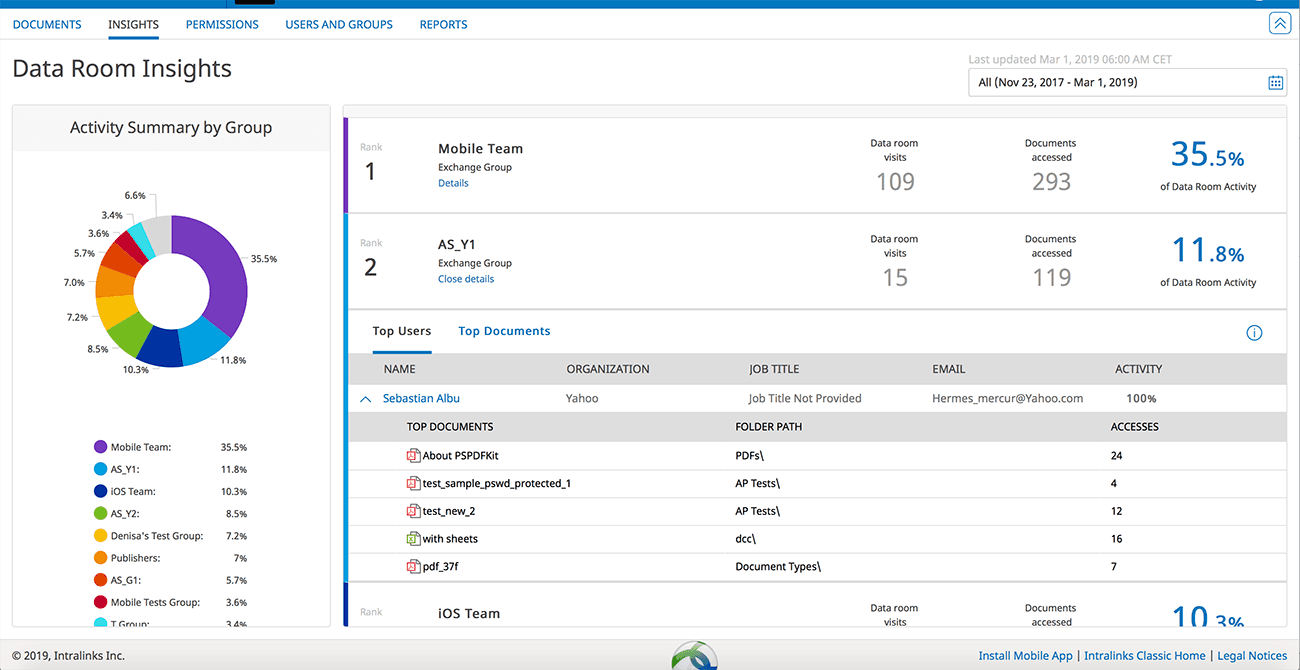

3. Intralinks: Best for Banking & Debt Capital Markets

Website: Intralinks

SS&C Intralinks is one of the original virtual data room providers and still has particularly deep roots in banking, leveraged finance, and debt capital markets. It launched one of the first widely used VDRs in the early 2000s and remains heavily embedded with global banks for syndicated loans, structured finance, and high-grade and high-yield issuance. For many DCM and loan market participants, “send it via Intralinks” is still shorthand for how information gets distributed.

More recently, SS&C has layered in AI-assisted capabilities to help organize uploads, categorize documents, and accelerate basic preparation tasks, but its primary value proposition remains: a highly secure, globally recognized environment where sensitive financing documentation can be shared with confidence.

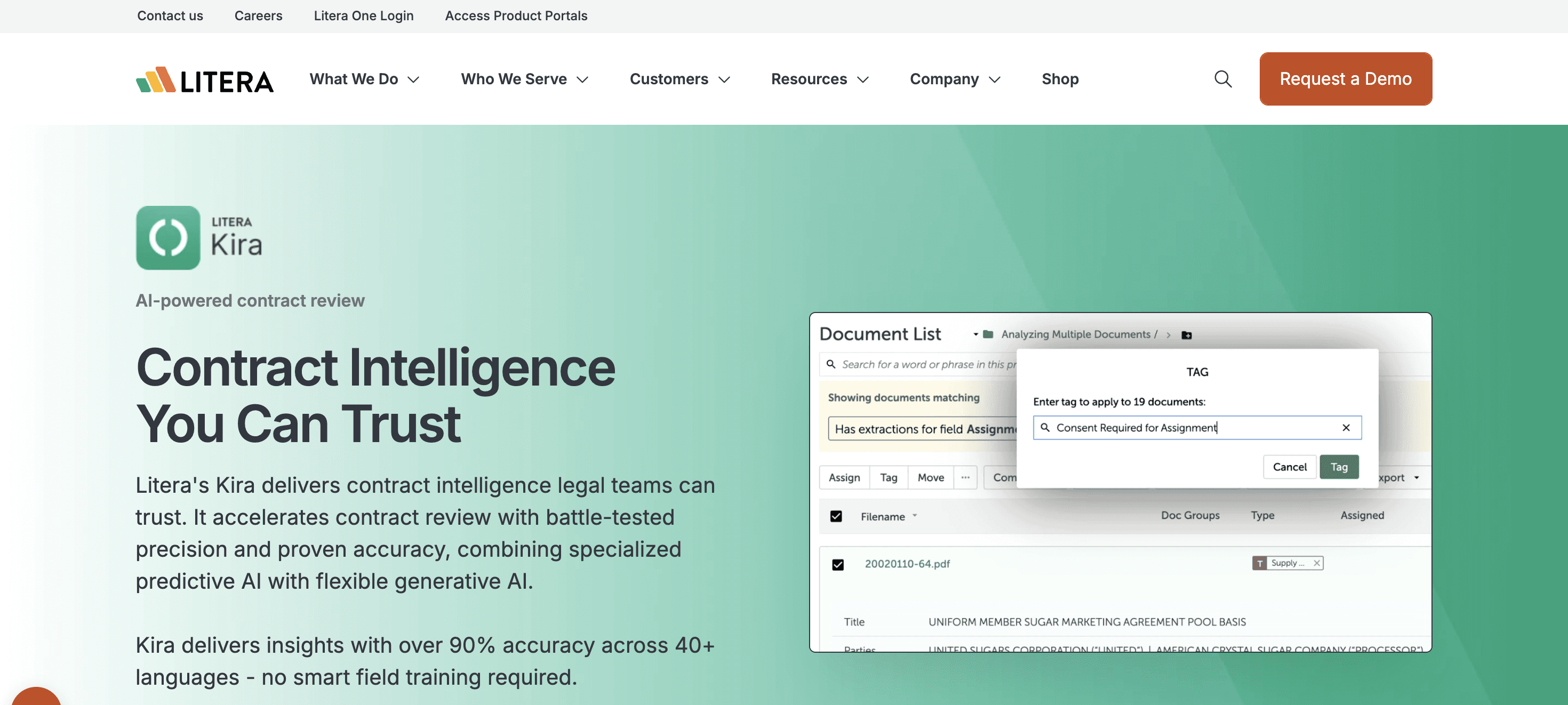

4. Kira Systems (Litera): Best for Legal Contract Review

Website: Litera's Kira

Kira, now part of Litera, is a specialized AI platform for contract review and analysis. Rather than acting as a data room itself, it plugs into whatever repository you’re using and focuses on reading and understanding the contents of legal documents.

The core feature is clause and field extraction. Kira can quickly surface provisions like change-of-control, assignment, non-compete, indemnity, and limitation of liability across a large set of documents, pulling the relevant language into a structured interface so lawyers can compare terms side by side.

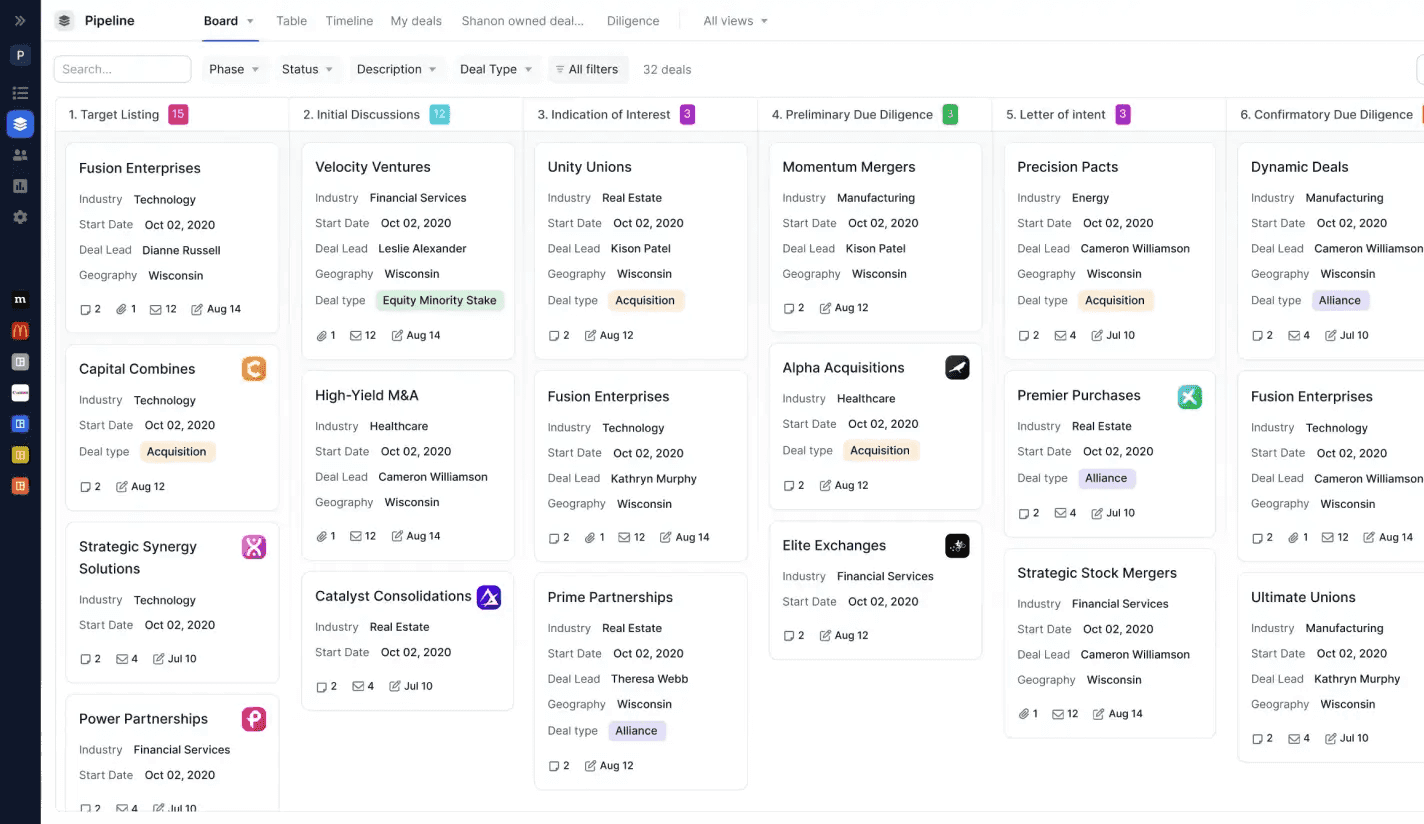

5. DealRoom: Best for Agile Deal Project Management

Website: DealRoom

DealRoom positions itself as more than a virtual data room; it’s an M&A lifecycle platform that merges document sharing with project management and Agile principles. Instead of treating due diligence as “just” a folder tree and a Q&A log, DealRoom organizes work into requests, tasks, and workflows that map directly onto how a modern deal team actually operates.

For corporate development teams and mid-market PE funds, that means one environment where documents, diligence checklists, and communications live together.

How AI is Changing the Due Diligence Workflow

The integration of AI into due diligence software is shifting the role of the analyst. The software performs the "first pass," extracting data and flagging anomalies, while the human professional verifies the findings and focuses on strategic interpretation.

For example, in CIM review, software can now ingest a 50-page memorandum and output a structured investment summary in seconds. This doesn't mean the analyst stops reading the CIM; it means they read it with a prepared cheat sheet of key facts, risks, and questions already generated, ensuring nothing is missed.

Similarly, in financial statement analysis, AI can automatically spread historical financials into a standardized template. This eliminates the hours spent keying numbers into Excel, allowing the investment team to spend that time building sensitivity scenarios and stress-testing the model.

You can read more about the changing role of technology and the continued importance of human knowledge and oversight in our blog, Will AI Replace Financial Analysts?

By automating the routine aspects of data extraction and review, investment professionals can focus on what truly matters. At the end of the day, that's making the right investment decision.

Ready to accelerate your deal flow? Book a demo to see how V7 Go can automate your due diligence document analysis.