Document processing

21 min read

—

Aug 12, 2025

An in-depth review of the top AI VDRs for M&A, comparing leaders like Datasite and Intralinks with AI platforms like V7 Go that are reshaping due diligence.

Casimir Rajnerowicz

Content Creator

In the high-pressure world of mergers and acquisitions, due diligence can feel like drinking from a firehose. Deal teams face data rooms overflowing with thousands of confidential documents—financial statements, contracts, compliance certificates, customer data, and more. Traditionally, virtual data rooms (VDRs) solved the security and access problem of sharing these files. But they created a new challenge: information overload. A VDR often becomes a passive digital filing cabinet. Analysts and lawyers still pour countless hours into reading and summarizing documents manually. The result? Deals bog down in tedious work, and critical issues can be missed.

The time and expense of manual due diligence are staggering. Reviews commonly stretch over months, consuming extensive specialist hours. One survey found the average external cost of due diligence services to be around $50,000 per deal, with some transactions exceeding $150k. More importantly, internal teams often spend 6 weeks or more on the document review process for a single investment. In an environment where speed matters, these delays and costs can make the difference between a successful acquisition and a lost opportunity.

Today, the data room is evolving. AI data rooms bring intelligent analysis into the due diligence process. It's a fundamental change in how deal information is managed and utilized. Instead of a static vault, an AI-enabled data room becomes an active, queryable knowledge hub.

AI agents can interact with users via conversational interfaces and provide detailed summaries of large document repositories

It can automatically read and categorize documents, flag potential risks, and even answer complex questions by searching the content within seconds. In short, AI turns static documents into interactive, queryable assets, delivering deeper insights and accelerating deal velocity. For a broader look at this technology, you can explore our general AI virtual data room guide.

Not all VDRs are keeping pace with this evolution. Many legacy providers are rushing to bolt on AI features, while a new class of AI-native platforms (like V7 Go) is purpose-built to handle due diligence intelligence. In this guide, we review 10 of the best AI virtual data rooms for due diligence available in 2025, with a focus on how they leverage AI for M&A and private equity needs. We'll compare their core functionalities, highlight standout AI capabilities, and help you determine which platform fits your deal's needs.

What You'll Learn: Below is a roadmap of what this article covers:

Modern VDR Essentials: The baseline features every data room must have in 2025, and the new AI-driven differentiators that set cutting-edge platforms apart.

Top 10 AI Data Rooms: A review of ten leading VDR providers – from enterprise titans like Datasite and Intralinks to innovative newcomers – with a spotlight on their AI features. We'll especially examine V7 Go as an AI-native solution redefining due diligence analysis.

Choosing the Right Platform: A practical checklist for evaluating which AI data room aligns with your deal complexity, security requirements, and budget considerations.

Future Outlook: Why the next phase of due diligence is intelligent and how embracing an AI data room can become a strategic advantage in dealmaking.

The Modern VDR: Table Stakes and AI Differentiators

Any modern virtual data room, AI or not, must cover certain non-negotiable basics. Before diving into AI capabilities, ensure a prospective VDR checks these standard boxes:

Robust Security: Enterprise-grade encryption (in transit and at rest), two-factor authentication, granular user permissions, and single sign-on (SSO) are must-haves. Data rooms deal with highly sensitive data, so look for certifications like SOC 2 Type II and ISO 27001 to verify security compliance.

Access Control & Audit Trails: Every user action (viewing, downloading, printing a document) should be tracked. Detailed audit logs and reporting keep everyone accountable and are crucial for compliance and post-deal audits. Features like dynamic watermarking and remote document wipe add extra control over file sharing.

Document Organization & Search: Indexing of all text (including OCR for scanned PDFs) and a robust search function. Users should be able to quickly find keywords across the entire data room. Folder structures, tagging, and metadata help keep thousands of files organized logically.

Integrated Q&A Module: Large deals involve Q&A between buyers and sellers. Modern VDRs include a built-in Q&A or FAQ module so that bidders can submit questions within the platform and get tracked responses. This keeps deal communication auditable and centralized.

User-Friendly Interface: Finally, table stakes include an intuitive UI. Drag-and-drop upload, bulk file management, and a short learning curve for new users (especially external parties like bidders or legal counsel) are important. The interface should reduce friction, not add to it.

In summary, a VDR must first and foremost be secure, organized, and easy to use. These are the qualities that established providers like Intralinks, Datasite, and iDeals have honed over years. However, as deal teams grapple with ever-growing data volume, these baseline features aren't enough. This is where the new layer of AI capabilities comes into play.

The AI Layer: From Passive Storage to Proactive Insight

Artificial intelligence is supercharging what VDRs can do. Instead of merely storing documents, the platform can actively assist in analyzing them. Here are the key AI-driven features that are redefining data rooms:

Automated Document Analysis: AI can read and understand documents at scale. This includes auto-summarization of lengthy texts (e.g. summarizing a 300-page financial report into key bullet points), clause extraction from contracts (finding specific legal provisions across hundreds of files), and intelligent metadata tagging. For example, an AI data room might automatically tag all documents that are NDAs, all that pertain to "Intellectual Property," or all that mention a certain company - without manual input. This saves due diligence teams countless hours and ensures nothing slips through unnoticed.

Intelligent Risk Flagging: Advanced platforms use AI algorithms to detect red flags or anomalies across the document set. This could mean identifying non-standard clauses in a contract (e.g. an unusual indemnity clause that deviates from market norms), spotting inconsistent financial figures between documents, or flagging compliance risks (such as missing regulatory certificates). The AI essentially functions as an extra pair of diligence eyes, continuously scanning for what humans might miss.

Natural Language Search & Q&A: Perhaps the most game-changing feature is the ability to ask questions to your data room and get answers. Instead of manually hunting through folders, deal professionals can pose queries like, “Which documents mention pending litigation?" or "What was the EBITDA for 2022?". The AI will search the full text of documents and respond with a direct answer, often with a citation showing the source. The most advanced solutions use a technique known as Retrieval-Augmented Generation (RAG) - the system fetches relevant text from your documents and uses a large language model (LLM) to formulate an answer, with references. This natural language Q&A can shave days off the process of gathering specific information.

AI-Powered Workflow Automation: Beyond analysis, AI can take over routine tasks. A prime example is automated redaction – identifying and blacking out personally identifiable information or other sensitive data across all documents in one go. Some data rooms also integrate AI for document classification, automatically sorting incoming files into the correct folders or categories (e.g. financial statements vs. HR documents) as they are uploaded. This kind of AI workflow automation ensures the data room stays organized and secure without manual effort.

From Passive to Proactive

Taken together, these AI features shift a data room from a passive repository to an active advisor. Instead of simply hosting documents for humans to read, the platform itself surfaces insights: it points out risks, answers questions, and performs laborious tasks instantly. In the traditional model, if you wanted to know “Which contracts in this data room lack a change-of-control clause?", you'd have to open each contract and read it. In an AI-enabled data room, you can query that directly and get an immediate answer, sourced from the text. This transition is profound – it means due diligence can move faster without sacrificing thoroughness. Teams can spend more time on deal strategy and negotiation, and less on page-by-page document review.

With an understanding of these capabilities, let's turn our attention to the marketplace. While we provide a detailed look at top platforms here, you can find a broader overview in our list of the best virtual data room providers. Dozens of VDR providers exist, but which are keeping up on the AI front? The next section highlights ten of the best AI data rooms in 2025 and how they compare.

Top 10 Virtual Data Rooms for Due Diligence

In this section, we review ten leading virtual data room providers and their AI capabilities. We've organized them by category and strengths. First is V7 Go, an AI-native platform setting the bar for intelligent due diligence. We then cover established enterprise players, mid-market favorites, and specialized innovators.

V7 Go: The AI-Native Powerhouse for Intelligent Due Diligence

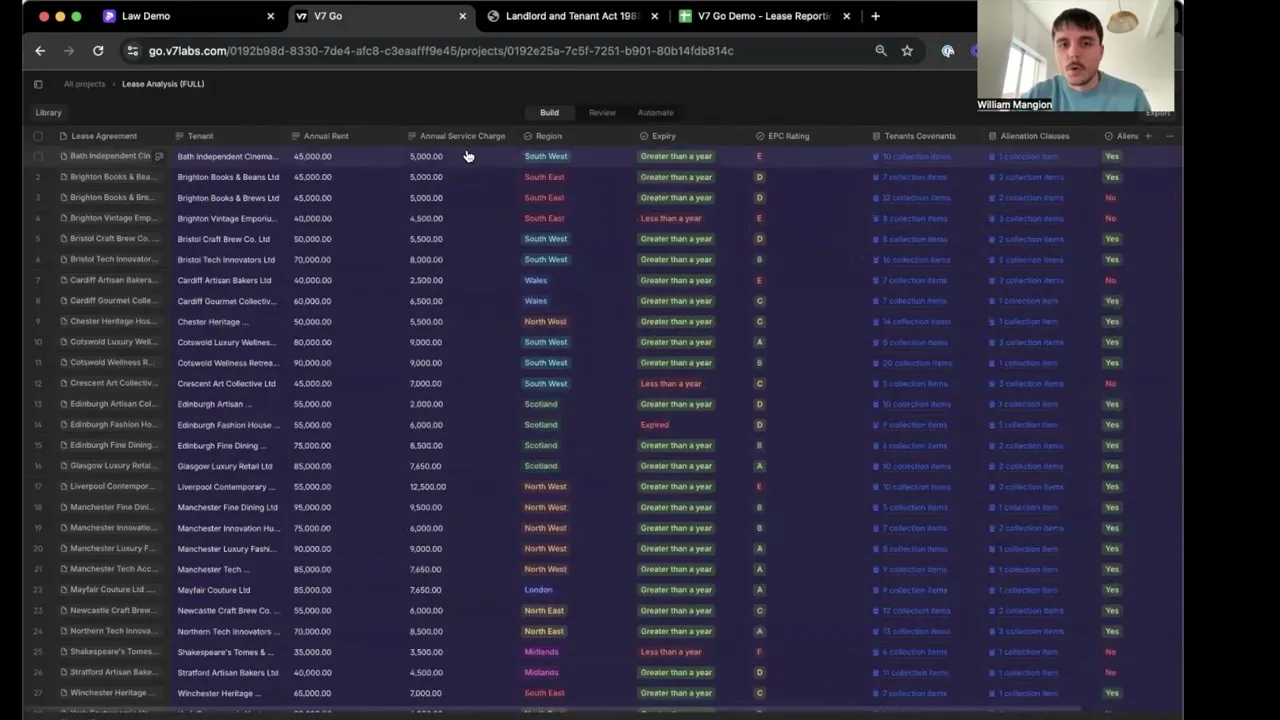

When it comes to AI in the data room, V7 Go stands out as a next-generation platform built from the ground up with artificial intelligence at its core. Unlike traditional VDRs that are adding AI as an afterthought, V7 Go's approach to data rooms is centered on its V7 Knowledge Hub—an intelligent memory bank where you can store, organize, and, most importantly, query any collection of documents.

The V7 Knowledge Hub turns a passive data room into an interactive, queryable asset for due diligence, powered by a more advanced retrieval system called Index Knowledge.

What Makes V7 Go Different:

V7 Go doesn't look or act like a typical data room. Yes, it provides secure document storage and sharing, but its real strength is in understanding the content of those documents:

AI-First Architecture & Index Knowledge: While many modern VDRs use Retrieval-Augmented Generation (RAG) for Q&A, V7 Go employs a more advanced system called Index Knowledge. Instead of just embedding and retrieving text chunks, Index Knowledge creates a multi-layered index of your documents, understanding entities, clauses, and financial metrics in context. This results in more accurate, thorough answers because the AI has a deeper map of your data to navigate. If the answer exists in your documents, Index Knowledge is designed to find it.

Deep Document Understanding: The platform doesn't just index keywords; it actually reads documents. A financial report isn't just a file name to V7 – it's a data source with facts that the AI can interpret. V7 Go can run cross-document analyses, like identifying trends or inconsistencies across an entire folder of reports.

AI Concierge (Natural Language Q&A): One of V7 Go's flagship features is an AI Concierge - a chat interface where users can ask questions across all their due diligence materials. You might ask, "Summarize any environmental liabilities mentioned in these documents" or "List all contracts that have a change of control clause and show me the clause text." The AI will query the Knowledge Hub and return an answer within seconds, complete with AI citations that show the exact source document and snippet.

Custom AI Workflows: V7 Go enables users to build custom multi-step workflows using a visual interface. You can chain together AI agents – for instance, automatically classify documents on upload, then extract key fields (like contract parties and dates), then get a summary of each file. These workflows can be tailored to specific due diligence checklists and can even interact with your Knowledge Hubs for context.

Verifiable Insights: V7 Go's emphasis on trustworthy AI is notable. The platform provides traceability for every AI-generated output. If the system flags a clause as risky or answers a question about a company's EBITDA, it always links back to the source document passage. This gives deal teams confidence in the AI's results - a critical factor when millions are on the line.

Ideal Use Case:

V7 Go is best suited for tech-savvy deal teams and organizations that handle especially large or complex due diligence projects. Private equity firms and venture capital analysts will appreciate features like the AI Investment Analysis Agent and the ability to rapidly analyze portfolio company data. Legal departments can use a pre-built AI due diligence agent to do heavy lifting on contract review. If your goal is to automate the grind of due diligence and supercharge your team's analytical capabilities, V7 Go is a compelling choice.

Summary: V7 Go is less of a traditional data room and more of an AI-driven due diligence command center. It marries the basic necessities of a VDR (security, sharing, audit logs) with cutting-edge AI analysis, allowing you to interrogate and process deal documents in ways not possible on any other platform.

Datasite & Intralinks: The Enterprise Titans

When dealing with multi-billion dollar deals and global transactions, Datasite and SS&C Intralinks have long been the go-to VDR providers. These two are often considered the “enterprise titans" of the virtual data room space—known for rock-solid security, large-scale capacity, and white-glove support services. In recent years, both have also infused AI and analytics features into their offerings to keep up with market demands.

Datasite (formerly Merrill Datasite):

Datasite is a highly sophisticated VDR tailored for complex, high-volume M&A deals (often on the sell-side). It excels in security and project management features. Notably, Datasite has developed AI tools like automated redaction and document categorization. For example, Datasite Diligence can ingest a mass of files and automatically categorize them into a pre-defined due diligence index using AI, speeding up deal preparation. Its Redaction AI can scan documents to suggest and apply redactions (like hiding personal names or sensitive terms) in bulk—a task that could otherwise take humans many hours. Datasite also provides advanced analytics on buyer engagement (e.g., reports on which documents are being heavily viewed) to help deal teams focus on what matters. In short, Datasite brings enterprise-grade power and has begun layering in AI to improve efficiency, though its AI features may feel incremental rather than transformational.

Intralinks:

Intralinks pioneered the online data room in the 2000s and remains a dominant player for big-ticket deals. Its platform, now often referred to as Intralinks VDRPro, boasts extremely granular user permissions and rigorous compliance features – banks and governments regularly trust Intralinks for this reason. On the AI front, Intralinks has introduced an AI-powered Deal Centre suite. This includes automated document scanning and AI redaction similar to Datasite's (you can simply upload documents and let the system find all instances of, say, a company name to redact). Intralinks also offers process insights like AI-driven indicators of bidder interest. While details are proprietary, it likely tracks user behavior in the data room to help the sell-side gauge which buyers are most engaged. Overall, Intralinks positions its AI as tools that accelerate workflows and improve accuracy, embedded in an already robust VDR solution.

Best For:

Large enterprises, investment banks, or private equity firms handling high-stakes, complex M&A will gravitate to Datasite or Intralinks. These providers offer the comfort of experience (decades in the business), global 24/7 support teams, and every bell-and-whistle feature for managing a deal. Their AI capabilities, while useful (particularly the time saved on redaction), are add-ons to an otherwise traditional VDR experience. Expect premium pricing commensurate with their reputation and feature depth.

iDeals, FirmRoom & DealRoom: User-Friendly Workhorses for Mid-Market Deals

Not every deal requires an enterprise heavyweight. For many mid-market M&A transactions and startup fundraises, simplicity, speed, and cost-effectiveness are top priorities. iDeals, FirmRoom, and DealRoom are three popular VDR providers that excel in these areas. They offer a strong balance of features and usability, and each has been incorporating some level of AI or smart assistance into their platforms.

iDeals:

iDeals is often praised for being a feature-rich yet user-friendly data room that caters to a wide range of industries (from legal and banking to real estate). Security is solid (two-factor auth, watermarking, etc.), and the interface is clean and modern. iDeals has added AI touches like a smart search that can auto-suggest search terms and find synonyms in documents. It also offers an intelligent Q&A module to streamline the due diligence Q&A process by organizing questions, assigning them to subject matter experts, and suggesting answers from a knowledge base. While not as deeply AI-driven as some others, iDeals covers the bases by simplifying project management – for example, it can automatically number and index your uploaded documents in a structured way, and provide analytics on which files or sections are drawing the most attention from buyers.

FirmRoom:

FirmRoom markets itself as a cost-effective, easy-to-use VDR ideal for mid-sized deals. It's actually built by the same team behind DealRoom, but offered as a more straightforward, stand-alone data room service (without the extra M&A lifecycle tools). FirmRoom's strengths are its transparent pricing (often a flat monthly fee far lower than enterprise VDRs) and a streamlined feature set that avoids overwhelming the user. It has all the standard security and document control features, but emphasizes speed: quick setup, drag-and-drop uploads, and responsive customer support to get new rooms live in hours, not days. In terms of intelligence, FirmRoom has introduced an "Auto-Indexing" feature where AI helps create a structured index of folders from unorganized uploads – a small but handy time-saver. It's a no-frills platform that covers due diligence needs without the hefty price tag or steep learning curve.

DealRoom:

DealRoom (not to be confused with a generic deal room) is a more specialized M&A project management platform that includes a VDR. Think of DealRoom as VDR meets project management software. In one interface, you manage the due diligence checklist, assign tasks, communicate with the other side, and store documents. Its claim to fame is enabling a "buyer-led" due diligence process that is more agile. On the AI side, DealRoom has rolled out an AI engine for document analysis: it can extract key information from documents and even generate summaries. For example, DealRoom can take a stack of lease agreements and automatically pull out lease durations or renewal terms, compiling a summary report for you. This is a significant value-add for teams dealing with repetitive documents. Additionally, DealRoom's integrated nature means your AI findings (like extracted data or flagged issues) can tie directly into your diligence tracker. It's worth noting that DealRoom's interface and approach are a bit different from a classic VDR – it's collaborative and works best if you fully commit to using its project management features.

Best For:

These three platforms are excellent for mid-market M&A, private company sales, and early-stage investment due diligence. They prioritize ease-of-use and speed, which means less training and fewer headaches for your team and external users. Their AI capabilities tend to focus on convenience (search, indexing, basic data extraction) rather than the more advanced analysis of an AI-native platform like V7. If you have a limited budget or a lean team, iDeals, FirmRoom, or DealRoom can provide a smooth due diligence experience without excess complexity. And for those deals where some automation is welcome but you don't need a full AI powerhouse, they strike a practical balance.

SecureDocs & CapLinked: Simplicity and Integration Specialists

Sometimes the priority is to get a secure data room up fast and ensure it plays nicely with your existing tools. SecureDocs and CapLinked are two providers known for their simplicity and integration friendliness, respectively. They may not have all the flashiest AI features, but they offer reliable platforms tailored to specific needs.

SecureDocs:

SecureDocs is often lauded for its no-nonsense approach and flat-rate pricing model. It offers a very straightforward VDR that can be deployed in minutes. For a single annual fee (often cited around $2,500/year for unlimited data and users), organizations get unlimited data rooms—which is great for serial acquirers or firms that run many projects. The interface is clean and focused: upload documents, set permissions, and go. While SecureDocs doesn't push AI features heavily, it does incorporate some useful automations. For example, it has a drag-and-drop AI indexing that will suggest folder placements for your files based on their names/content. It also provides instant full-text search across all documents (a baseline expectation now). The strength of SecureDocs is predictability - you know what you're paying, and you know it will cover the essential job of document security and organization without fuss. Companies with limited IT support or those needing a data room on short notice (e.g., a surprise due diligence request) appreciate SecureDocs' simplicity and speed.

CapLinked:

CapLinked differentiates itself with integration capabilities and collaboration features. It's sometimes described as the "Dropbox for deals" - emphasizing an easy file-sharing experience but with enterprise-grade control. CapLinked offers robust APIs and pre-built integrations, making it popular for teams that want to embed data room functionality into their workflows or connect with CRM systems like Salesforce. For instance, a deal team could sync CapLinked with Salesforce to automatically create deal rooms for new opportunities and pull participant info from the CRM. In terms of intelligent features, CapLinked has collaborative document editing and commenting (which can reduce the back-and-forth over email). It also provides customizable security controls; admins can script certain workflows or triggers thanks to its API (for example, automatically revoking access to a data room after a certain date). On AI, CapLinked isn't a frontrunner – its focus is more on being an extensible platform. That said, the company has hinted at adding AI analytics for document engagement (similar to how others show which pages users spend time on) and possibly leveraging AI for content classification down the line.

Best For:

Choose SecureDocs if you need a reliable, quick-start data room with essential security and you value a flat, low cost over advanced features - often ideal for small businesses, startup fundraising, or as an internal document repository for boards and audits. Choose CapLinked if your team is technically savvy and wants to integrate the data room into other software, or if real-time collaboration on documents is a priority. CapLinked is a fit for those who treat the data room as part of a larger software ecosystem (for example, portfolio management or sales pipelines) and want that flexibility.

ShareVault & Ansarada: Analytics-Driven Innovators

Rounding out our list are two providers pushing the envelope in using data and intelligence to guide deals: ShareVault and Ansarada. These could be considered the "analytics-driven innovators" among VDRs, each coming at the problem from unique angles.

ShareVault:

ShareVault is a VDR that emphasizes in-depth analytics and control. It provides an array of dashboards and reports that give deal administrators keen insight into user behavior. For example, you can see which documents or even specific pages are most viewed, which sections of the index are being ignored, and who your most active users are. This helps sellers gauge interest and identify bottlenecks in real time. ShareVault also offers fine-grained document control – you can disable downloading on certain files, set dynamic watermarks displaying user info, and even remotely "shred" (revoke access to) documents if a deal falls through. On the AI side, ShareVault has been adding machine learning-driven search and analysis features. One such feature is Smart Search, which not only finds exact keyword matches but understands related terms and concepts (a search for “GDPR compliance" might surface documents mentioning "data protection regulation" even if not worded identically). ShareVault's analytics might also leverage AI to spot when a particular user's activity spikes or deviates from the norm (potentially indicating heightened interest or concern on some issue). These kinds of insights make it a very proactive tool for deal managers who want to stay a step ahead.

Ansarada:

Ansarada often brands itself as more than a data room—a "deal readiness" or "deal management" platform. Hailing from Australia, Ansarada has made a name by infusing AI to create what they call AI deal intelligence. The flagship here is the AI Bidder Engagement Score. Ansarada's system tracks over 50 behaviors of bidders in the data room (such as documents viewed, frequency of logins, questions asked, etc.) and compares these patterns to thousands of past deals. Using this, it generates an engagement score that predicts which bidders are genuinely interested or likely to drop out. Impressively, by the first week of data room activity, Ansarada claims up to 97% accuracy in predicting bidder outcomes. This gives sellers an unprecedented ability to focus their energies on the right parties (or intervene early if a key bidder seems to be disengaging). Aside from that, Ansarada provides AI tools for document organization and preparatory checklists to get a company ready for due diligence (they originally started with a checklist product). Their data room includes a robust Q&A module and has strong security, but it's the deal guidance AI that really sets it apart. Ansarada essentially tries to guide you through the deal: it will highlight if your data room is missing documents commonly needed for, say, a biotech deal, or if a bidder's behavior suggests they're falling behind in diligence.

Best For:

ShareVault is great for those who want to squeeze insights from user data and maintain strict document control – for instance, in industries like life sciences or tech where knowing which pages investors focus on can help tailor your approach. Ansarada is ideal for sell-side teams (investment bankers or company executives) who want a more guided due diligence experience and to leverage AI to manage bidder relationships. For example, in a competitive auction, Ansarada's engagement scoring can be a strategic asset. Both ShareVault and Ansarada tend to be used in scenarios where every detail matters - they help you not just host documents, but understand the story the data is telling about your deal's progress.

How to Choose the Right AI Data Room for Your Deal

With so many options on the table, how do you determine which data room is the best fit for your needs? Here's a practical checklist of considerations for selecting an AI-enabled VDR:

Deal Complexity & Scale: Start by assessing the size and complexity of your transaction. A straightforward single-asset sale or small fundraise might only need basic VDR functions, whereas a multi-jurisdictional, multi-billion dollar merger will involve tens of thousands of documents and rigorous compliance checks. For the latter, you'll benefit from advanced AI features (like cross-document search, automated analysis) to manage the load. Complex deals may also demand multilingual support (AI translation of documents) and sophisticated permission structures. Match the VDR's capabilities to the complexity at hand.

AI Feature Needs: Identify what AI due diligence features are must-haves vs nice-to-haves. Do you simply need help with one task like automated redaction or indexing? If so, a traditional provider with one or two AI utilities (e.g., Intralinks or Datasite) might suffice. But if you want deeper insights—such as asking natural language questions, performing clause-by-clause contract analysis, or generating on-the-fly summaries—you'll want a platform oriented around AI analysis (like V7 Go or Ansarada). Make sure the provider's AI is not just buzzwords; ask for demos of exactly how their AI functions on real deal documents.

Security & Compliance: Never compromise on security. Verify that the VDR is compliant with industry standards like SOC 2, ISO 27001, GDPR, etc. If your deal involves particularly sensitive data (e.g., personal health information in a healthcare deal or state secrets in a government contract), ensure the data room offers features like data residency (hosting servers in specific jurisdictions), custom encryption keys, and strict access protocols. Investigate how the provider's AI features handle your data – for example, if using large language models, do they retain any information? The best AI data rooms will explicitly state that your document data is not used to train outside models and remains private.

User Experience for All Parties: The platform needs to be intuitive not only for your internal team but also for external users like investors, buyers, or attorneys who will access the data room. Consider the least tech-savvy stakeholder who will use the system. Does the interface make it simple for them to find what they need? Features like an AI Q&A can be a double-edged sword here: while powerful, if it's too complex to use, some participants might avoid it. Look for solutions that integrate AI in a user-friendly way (for example, a clear "Ask a question" box or one-click auto-summaries) rather than requiring a lot of configuration. Many providers offer free trials - take advantage of these to pilot the UX with a small group before committing.

Integration & Workflow Fit: Think about how the data room will fit into your broader deal workflow. Do you need it to sync with other software (e.g., your CRM, project management tools, or analysis spreadsheets)? If you have in-house developers or specific processes, an open API and integration options (like those offered by CapLinked or via Zapier connectors) can save time. Also, consider the workflow around due diligence: some platforms like DealRoom include project management, which could replace separate tools you're using. Others, like V7 Go, might output data that you want to feed into analytics tools or databases. Ensure the VDR you choose plays nicely with how your team works.

Pricing Transparency: Data room pricing can range from all-inclusive flat rates to complex per-page or per-user billing that spikes costs unexpectedly. At the outset, clarify the pricing model. If your deal is likely to involve a very large number of pages or an extended timeline, a provider with unlimited usage (SecureDocs, FirmRoom, etc.) might be cost-effective. Be wary of overage fees for adding more users or uploading more data than initially planned. It's often wise to negotiate a flat project fee if possible, so that cost does not become a deterrent to fully utilizing the data room. Many providers will offer custom quotes for large deals - don't hesitate to compare a few. And remember, the most expensive option is not automatically the best; it should align with real value delivered (especially via AI features that save you manual work hours).

Using this checklist, you can map your requirements against what each provider offers. In some cases, you might even use more than one tool: for instance, a traditional VDR for document hosting and a specialized AI tool for analysis. However, the platforms we've discussed are increasingly one-stop solutions.

Ultimately, choosing the right AI data room is about aligning technology to your deal's specific needs. Consider the human element (who will use it and how), the technical element (what it can do and connect with), and the financial element (does the ROI in time saved justify the cost).

Conclusion: The Future of Due Diligence is Intelligent

The evolution of the data room reflects a broader shift in M&A and investment due diligence: from labor-intensive and reactive, to technology-assisted and proactive. The stakes in deals aren't getting any lower—if anything, regulatory scrutiny is increasing and the volume of data is growing—so the tools we use to manage due diligence must rise to the challenge. AI-enhanced data rooms are no longer a nice-to-have novelty; they are fast becoming a strategic imperative.

By leveraging AI, a modern data room can surface key insights in minutes that might take a human team days or weeks to discover. It can tirelessly cross-check every document, ensure nothing critical is overlooked, and adapt as new information comes in. In practical terms, this means faster deal cycles, lower risk of nasty surprises, and more confident decision-making. But it's not a one-size-fits-all scenario. As we've seen, the "best" AI data room for a given situation depends on the nature of the deal and the users involved. A venture capital diligence for a startup might prioritize ease and speed (making a platform like iDeals or FirmRoom attractive), while a large-scale corporate merger might demand the heavy analytics firepower of a V7 Go or the bidder behavior insights of Ansarada.

In closing, remember that the goal remains the same: a successful, well-informed deal. The data room is a means to that end. Whichever provider you choose, ensure it lets your team to focus on high-level analysis and strategy rather than getting lost in paperwork.

In an era where the speed and depth of insight can determine deal success, investing in the right data room isn't just an IT decision – it's a strategic one. If you're ready to move beyond the digital filing cabinet to an intelligent platform, consider exploring how an AI-native solution like V7 Go can improve your due diligence process. Kick-start your next deal with a smarter data room. Book a Demo and see the difference that intelligent automation can make in your transaction.