Knowledge work automation

15 min read

—

Dec 18, 2025

We evaluate 10 platforms across modern AI challengers and legacy incumbents. From PitchBook and FactSet to Hebbia and DiligentIQ—plus how AI agents are finally solving the data extraction gap that expensive platforms ignore.

Imogen Jones

Content Writer

Back in the ’80s, when private equity was still a niche corner of finance and shoulder pads reigned supreme, Excel quietly became the industry’s unofficial operating system.

Deals were modeled, portfolios tracked, and fortunes made (or occasionally misplaced) one cell at a time. Decades and countless software purchases later, most firms still keep Excel open on monitor #2 like a trusted old friend who knows all their secrets. And honestly, there’s no shame in that: Excel earned its place. It’s powerful and endlessly adaptable.

But the broader context of private equity has shifted. Deals move faster. Data arrives in more formats than anyone asked for. And the expectations placed on investment teams have grown far beyond what even the most adept spreadsheet super-user can comfortably support.

New platforms, and increasingly AI, are stepping in to automate sourcing workflows, analyze documents, flag risks, and provide the kind of real-time insights that used to take days of manual effort.

This guide will walk you through the history of these tools, the platforms reshaping private equity today, and how you can choose the right mix for your team.

In this article:

From Excel-only workflows to modern AI agent platforms.

Strengths, use cases, and pricing for modern AI challengers (V7 Go, Hebbia, DiligentIQ, Metal AI, Dili, Grata) and legacy incumbents (PitchBook, FactSet, Capital IQ, Power BI, Tableau).

Why expensive platforms still leave teams drowning in manual work.

What to expect, how to pilot, and what success looks like.

The Evolution of Private Equity Analysis Tools

Private equity analysis is the art, and the science, of turning messy evidence (CIM claims, management narratives, contracts, cohort tables, KPIs, board decks, bank statements, customer lists, vendor diligence) into a coherent view of risk, quality, and underwriting conviction.

The tools PE teams use have evolved in waves. Each wave made teams faster, but also changed what analysts spent their time doing, what could be checked, and what could be missed.

1990s: Excel, Early OCR, and the Manual Era

From the 80s onwards, Excel became the analysis operating system for PE. The core workflow was manual: read documents, type numbers into models, reconcile inconsistencies, build a story. The “tooling stack” was spreadsheets, email, and a shared drive.

Early OCR (think Kofax/ABBYY-era) could reduce some rekeying, but it didn’t change the underlying job: accuracy still came from humans. Models were bespoke and brittle, passed down like heirlooms, with institutional knowledge embedded in tabs, macros, and hard-to-explain assumptions.

Analysis quality depended heavily on the associate’s ability to spot issues across scattered materials: a revenue definition in the CIM that doesn’t match the bank covenant definition, or a customer concentration table that conflicts with the top-customer schedule.

With that being said, Excel is still a hugely dominant player today.

2000s: RPA and Workflow Automation

In the 2000s, PE firms professionalized their pipelines. CRMs and deal-tracking systems became more common, and workflow tools/RPA started showing up in finance teams to reduce repetitive admin work: moving data between systems, assembling reports, updating pipeline stages.

This helped with the process around analysis—sourcing workflows, meeting notes, data entry into systems of record—but it didn’t crack the hardest part of PE analysis: interpreting unstructured diligence material. You still couldn’t “automate” a CIM, a credit agreement, or a vendor report using rules.

The work that mattered, understanding the business and the deal’s failure modes, remained manual.

2010s: Intelligent Document Processing (IDP)

The 2010s brought Intelligent Document Processing (IDP): better OCR, improved document classification, and table extraction for semi-structured documents. This was meaningful for PE analysis because a large slice of diligence is simply: “get the numbers out of PDFs and into something analyzable.”

They helped deal teams pull financials out of PDFs more cleanly and reduced time spent transcribing data rooms.

You can learn more about IDP in our blog here: Intelligent Document Processing with GenAI: Key Use Cases

2020s: AI & Machine Learning for Document Understanding

In the early 2020s, ML-driven approaches improved robustness: systems could learn patterns rather than rely entirely on brittle rules. This raised accuracy for classification, entity recognition, and table parsing when layouts changed.

For PE analysis, that meant higher recall across messy inputs, more tables extracted correctly, fewer failures on weird scan quality, and better automation for repeatable tasks like spreading financials or pulling KPIs from board decks.

This is profoundly transformative. To learn more about the opportunities AI is creating in finance and private equity, read our blog: 5 Applications of AI in Venture Capital and Private Equity.

But the systems still tended to answer narrow prompts (“extract X”) rather than support the core analytical workflow: compare, reconcile, explain, and escalate what matters.

Agentic AI for Private Equity Analysis

The next step in the evolution of private equity analysis is not better extraction alone. It’s agentic systems that can execute multi-step analytical workflows the way a junior analyst would, but faster and more consistently.

Agentic AI systems don’t just answer isolated prompts like “extract EBITDA” or “summarize this document.” They can plan, execute, and verify a sequence of actions across many documents, formats, and data sources. This matters because PE analysis is rarely a single task. It’s a chain of dependent steps:

Extract financials from multiple sources

Normalize definitions across time periods

Identify inconsistencies between CIMs, QoE reports, and audited financials

Reconcile conflicts and surface the differences that actually matter

Produce structured outputs that feed models, IC decks, and diligence memos

In traditional tools, each of these steps required separate human effort. Agentic AI collapses them into a single, auditable workflow.

With that being said, agentic AI doesn't eliminate modeling, judgment, or debate. What it eliminates is manual reconciliation and shallow coverage caused by time constraints.

The analyst’s role shifts:

From transcribing → interpreting

From hunting for numbers → understanding why they differ

From reactive diligence → proactive risk identification

The result is higher-quality analysis per analyst, with more evidence checked, more inconsistencies surfaced, and fewer surprises after close.

Learn more about agentic AI here: How to Create an AI Agent Without Code: A Practical Guide.

Private Equity Analysis Tools: Modern AI Challengers

The emergence of generative AI has spawned a new category of private equity analysis tools. These platforms are built from the ground up to handle unstructured data, automate extraction workflows, and integrate with existing tech stacks. Here is an honest assessment of five leading contenders.

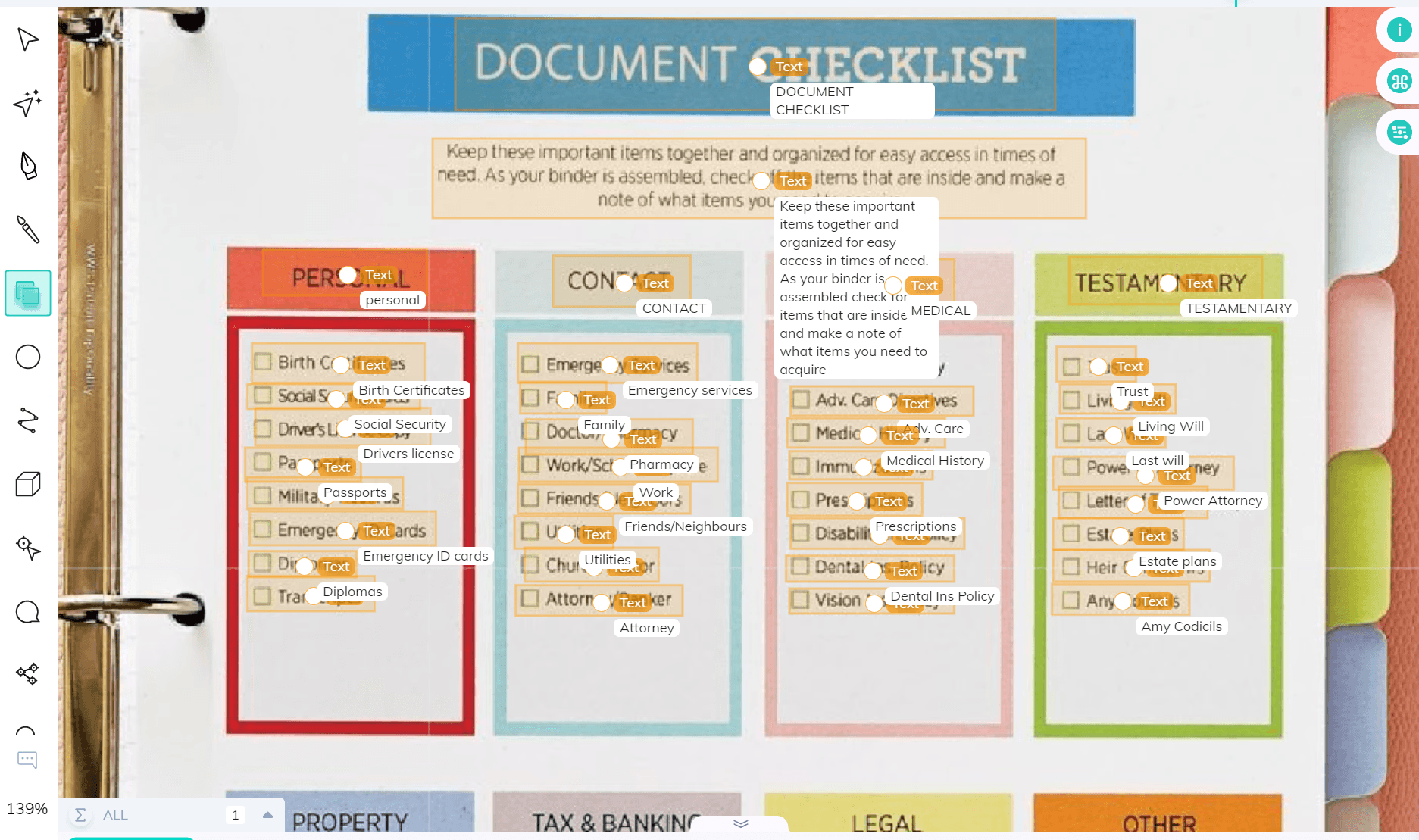

V7 Go is an AI work automation platform built for complex, document-heavy workflows like those found in private equity analysis. At its core is a flexible, agent-based architecture combined with powerful multimodal ingestion.

The V7 Knowledge Hub turns a passive data room into an interactive, queryable asset for due diligence, powered by a more advanced retrieval system called Index Knowledge.

Each agent can function like a specialized analyst: executing multi-step workflows, using tools, and producing outputs that remain fully traceable back to source material with strong human-in-the-loop review. This makes V7 Go particularly well suited for flexible, high-precision private equity analysis.

For example:

Deal Sourcing Workflow:

An analyst uploads 50 pitch decks from a recent conference. V7 Go's Deal Screening Agent extracts company name, revenue, EBITDA, sector, and growth rate from each deck. It flags the 12 companies that meet your investment criteria and generates a summary table with links to source pages.

Due Diligence Workflow:

Post-LOI, the team uploads a 300-page data room to V7 Go. The Due Diligence Agent extracts financial statements, identifies material contracts, flags covenant terms, and generates a preliminary diligence checklist. The agent flags inconsistencies, like EBITDA definitions that change between the CIM and audited financials.

Portfolio Monitoring Workflow:

Each month, portfolio companies submit financial reports in different formats—some in Excel, some in PDF, some scanned. V7 Go's Financial Reporting Agent extracts revenue, EBITDA, cash, and debt from each report, normalizes the data, and populates a master tracking spreadsheet.

Browse the complete list of agents for finance and private equity analysis here. You can also build your own, to map to your most complex workflows.

Tradeoffs:

V7 Go is optimized for analysis, automation, and execution across document-heavy workflows. It is not a traditional CRM, fund accounting system, or portfolio management platform, and teams will typically integrate it alongside those systems rather than replace them.

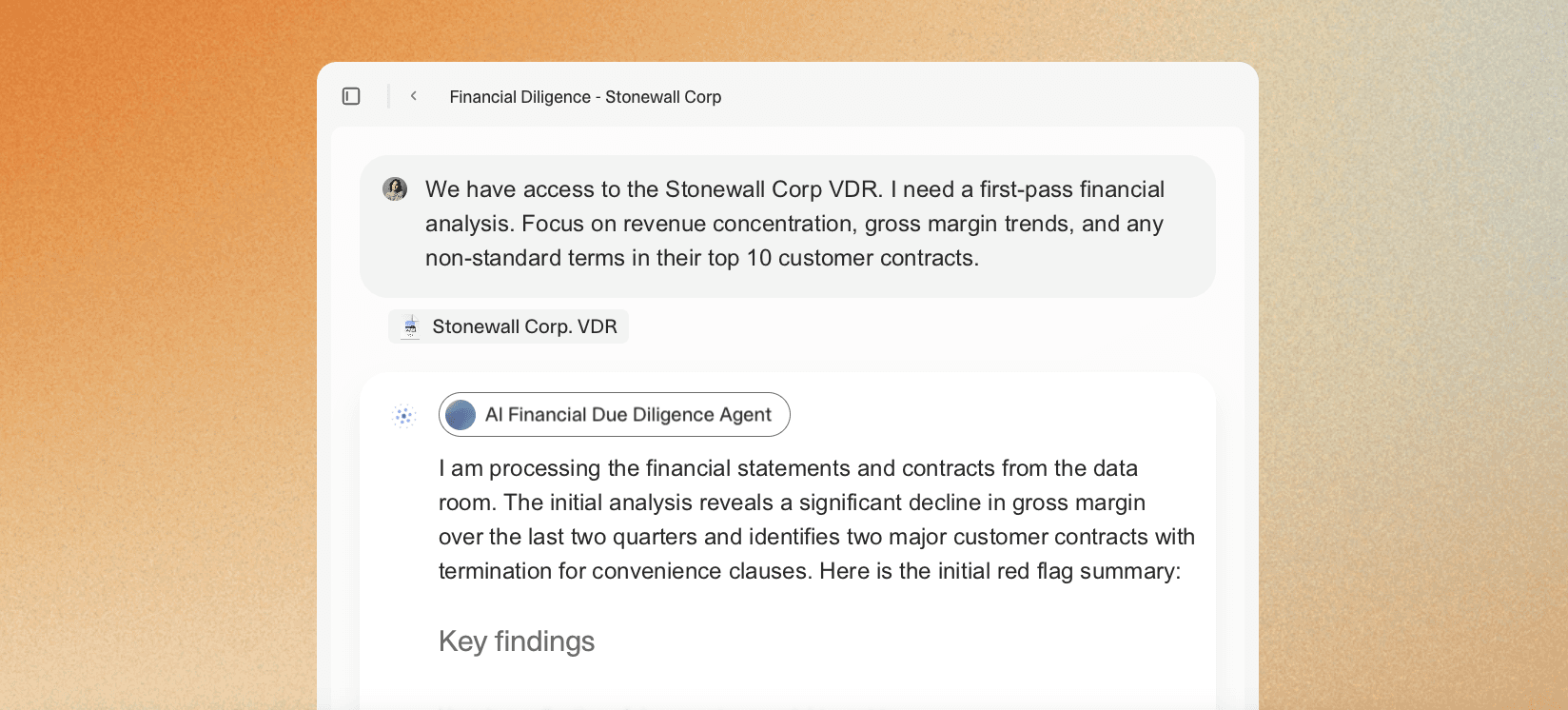

Website: hebbia.com

Hebbia is a knowledge work automation platform built for financial services teams. Its core promise is compelling: upload a data room, ask complex questions in natural language, and receive precise, citation-backed answers grounded in the original source documents.

Multi-document Q&A allows users to ask questions across hundreds of documents simultaneously. The system returns answers with direct page references and marked source text. For a PE analyst reviewing a 1,500-document data room, this means asking "What are the customer concentration figures across all quarterly reports?" and getting a consolidated answer in minutes.

Hebbia also offers pre-built extraction templates for common PE workflows such as CIM analysis, contract review, and financial statement extraction. These templates are configurable, allowing firms to tailor fields to their specific investment criteria and diligence frameworks.

Tradeoffs:

It excels at deep research and document analysis rather than operational workflows in CRMs, fund accounting, or portfolio monitoring systems. Teams looking to “close the loop” across systems may need additional tooling alongside Hebbia.

Website: ToltIQ

ToltIQ (previously DiligentIQ) is a generative AI platform built specifically for private markets due diligence. Founded by former KKR CIO Ed Brandman, the platform ingests virtual data room (VDR) contents, including credit agreements, financials, contracts, PPMs, operational reports, and surfaces structured insights, risks, and themes for GPs, LPs, and advisory firms.

Native CRM integrations with Salesforce, Affinity, and other PE-focused CRMs mean deal data flows automatically from sourcing through close. This eliminates the double-entry problem where analysts key the same company data into multiple systems.

Automated report generation produces IC memos, management presentations, and LP reports that auto-populate from extracted data. A template-driven approach means the output format matches your firm's existing deliverables.

Real-time portfolio analysis dashboards aggregate portfolio company data and flag covenant breaches or performance anomalies. The system can monitor financial covenants across a portfolio and alert the deal team when ratios approach trigger levels.

Website: dili.ai

Dili is an AI-powered “analyst” for due diligence that sits on top of company data rooms, internal knowledge bases, and external data sources. Deal teams can connect email, cloud storage, and third-party data providers (e.g., PitchBook, Capital IQ) and then ask natural-language questions or run pre-defined workflows for screening, benchmarking, risk identification, and memo drafting.

Dili emphasizes reliability in extraction, confidence scores on outputs, and the ability to flag potential risks or anomalies across documents and spreadsheets, which is particularly attractive for PE and VC teams under time pressure

Tradeoffs:

It focuses more on analysis and memo generation than on heavy-duty operational automation, so you’ll likely still rely on other tools for portfolio reporting, covenant tracking, or back-office workflows.

Website: metalai.com

Metal AI is positioning itself as “institutional intelligence” for private equity, a platform that aggregates deal history, fund knowledge, and real-time team inputs into a unified data layer, then uses AI to power diligence and internal workflows. At its core, Metal centralizes data about companies, deals, and relationships and lets firms deploy custom AI workflows over that knowledge graph for tasks like deal screening, memo drafting, and comparative analysis.

Recent launches such as Metal Workflows extend this into more complex, multi-step processes across the investment lifecycle, not just one-off Q&A over documents.

Tradeoffs:

Metal is primarily focused on the GP’s internal knowledge and deal process, not on heavy operational or ERP-level integration at portfolio companies.

Some users report performance lags when processing large document batches (500+ files).

The main friction point is integration with older ERP systems;despite the pre-built connectors, configuration can be complex.

Private Equity Analysis Tools: Legacy Incumbents and BI

Despite the emergence of AI-native challengers, the legacy platforms still dominate the market. Here is why—and where they are vulnerable.

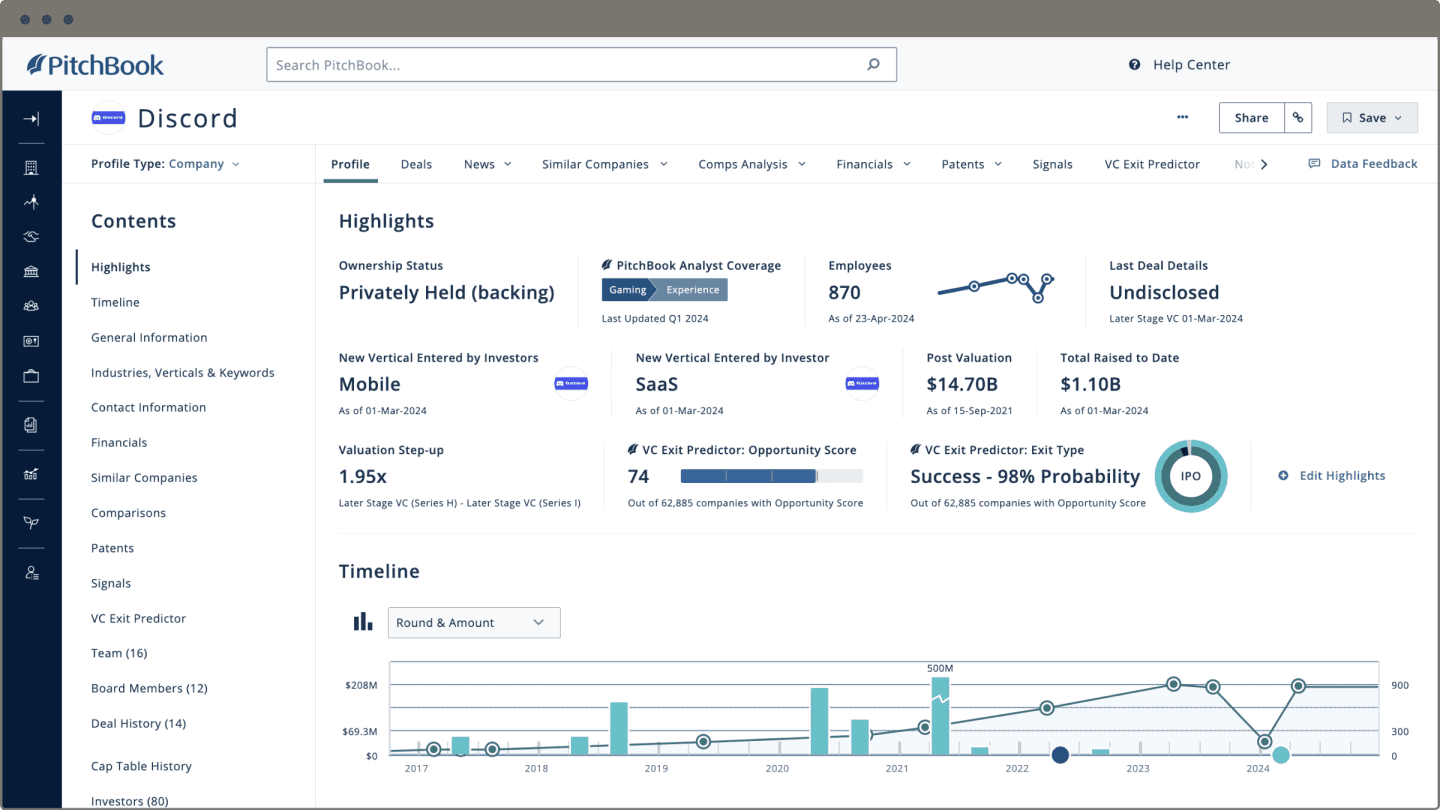

6. PitchBook

Website: pitchbook.com

PitchBook is the dominant data platform for private and growth markets, covering millions of companies, investors, funds, and deals across private and public markets. Analysts use it to answer questions like “Who owns this company?”, “What were the terms of the last round?”, and “Which funds are active in this niche?”, with deep profiles, transaction details, and LP/GP data.

PitchBook has expanded into workflows, Excel and PowerPoint plugins, an API, mobile apps, and AI-assisted data extraction and tracking, but its core value remains a curated, deeply structured database of private-market activity.

Tradeoffs:

PitchBook is expensive and unapologetically enterprise-oriented; pricing is custom but generally sits at a premium to most AI-native tools, which can make it hard for small funds or solo GPs to justify.

The interface is powerful but can feel dated and complex compared to modern SaaS products.

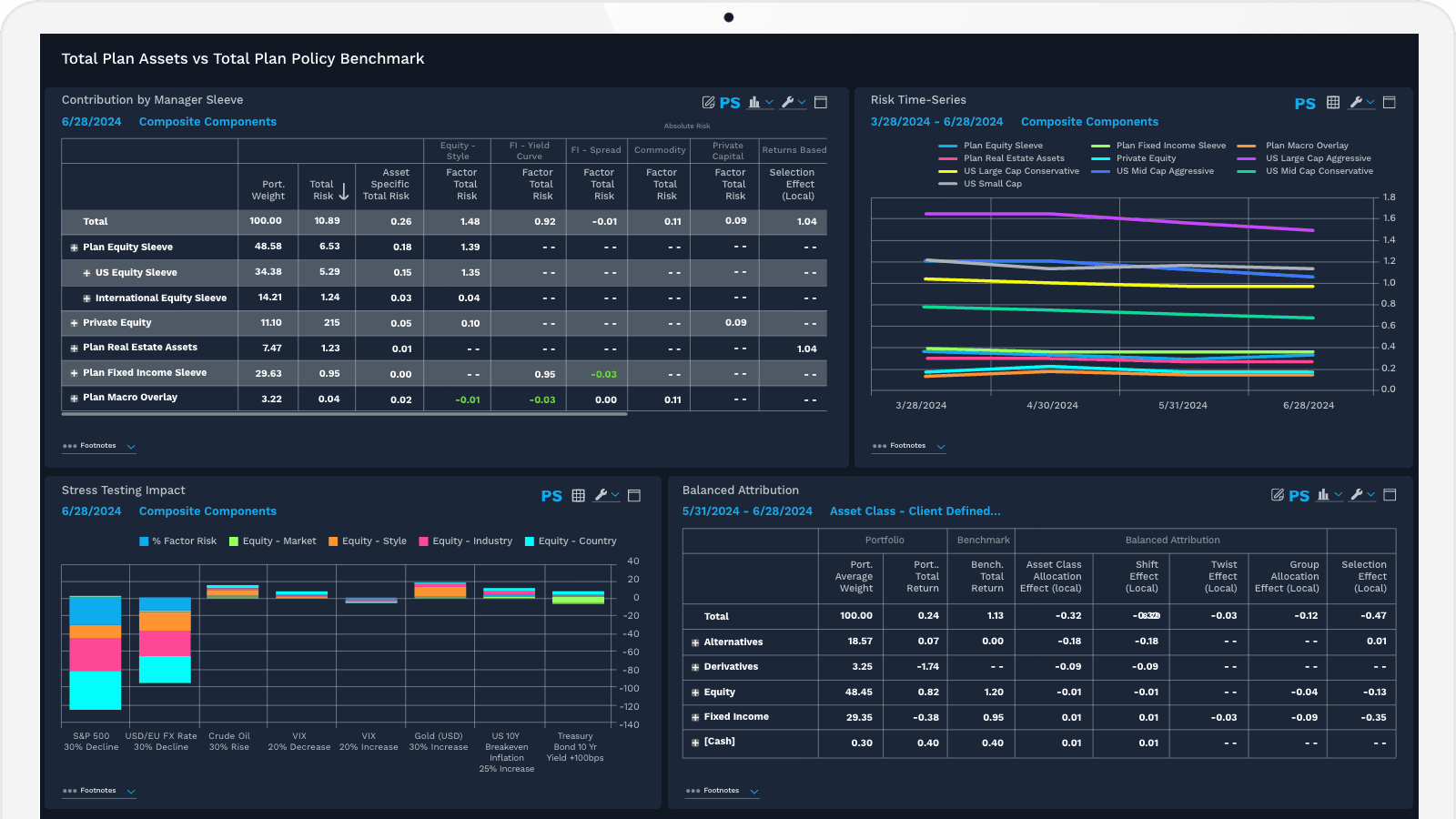

7. FactSet

Website: factset.com

FactSet is a broad, enterprise-grade financial data and analytics platform widely used by large asset managers, hedge funds, PE firms, and banks. Its workstation combines real-time market data, fundamental financials, estimates, ownership, and risk analytics in one environment, and its Office/Excel add-ins let analysts pull live, scrubbed data directly into models and presentations.

FactSet is particularly strong when you need multi-asset coverage (equities, fixed income, currencies, derivatives) plus portfolio analytics and reporting in a single stack.

Tradeoffs:

FactSet’s breadth comes with a steep learning curve and enterprise-grade pricing: official pricing is custom, but it’s generally comparable to other full terminals, meaning significant per-user spend for power seats.

It’s not designed to ingest and understand your VDRs or private documents. Like PitchBook, it’s a research and analytics environment, not an automation engine, so you’ll still need separate tools for document extraction and workflow orchestration.

8. S&P Capital IQ

Website: spglobal.com/marketintelligence

S&P Capital IQ (now often branded as Capital IQ Pro) is S&P Global Market Intelligence’s flagship platform for company, market, and transaction data. It combines deep coverage of public and private companies, sectors, M&A and capital markets activity with robust screening, charting, and research tools, plus a widely used Excel add-in that feeds live financials and market data into models. Capital IQ is a staple in M&A, equity research, and corporate finance, particularly for building DCFs, LBOs, and detailed comparable sets from standardized financials.

Tradeoffs:

Capital IQ is a powerful data and modeling platform, not a document understanding tool; it won’t read your CIMs or credit agreements for you.

The interface is mature rather than modern, and new users often need training to get full value from screening and Excel formula capabilities.

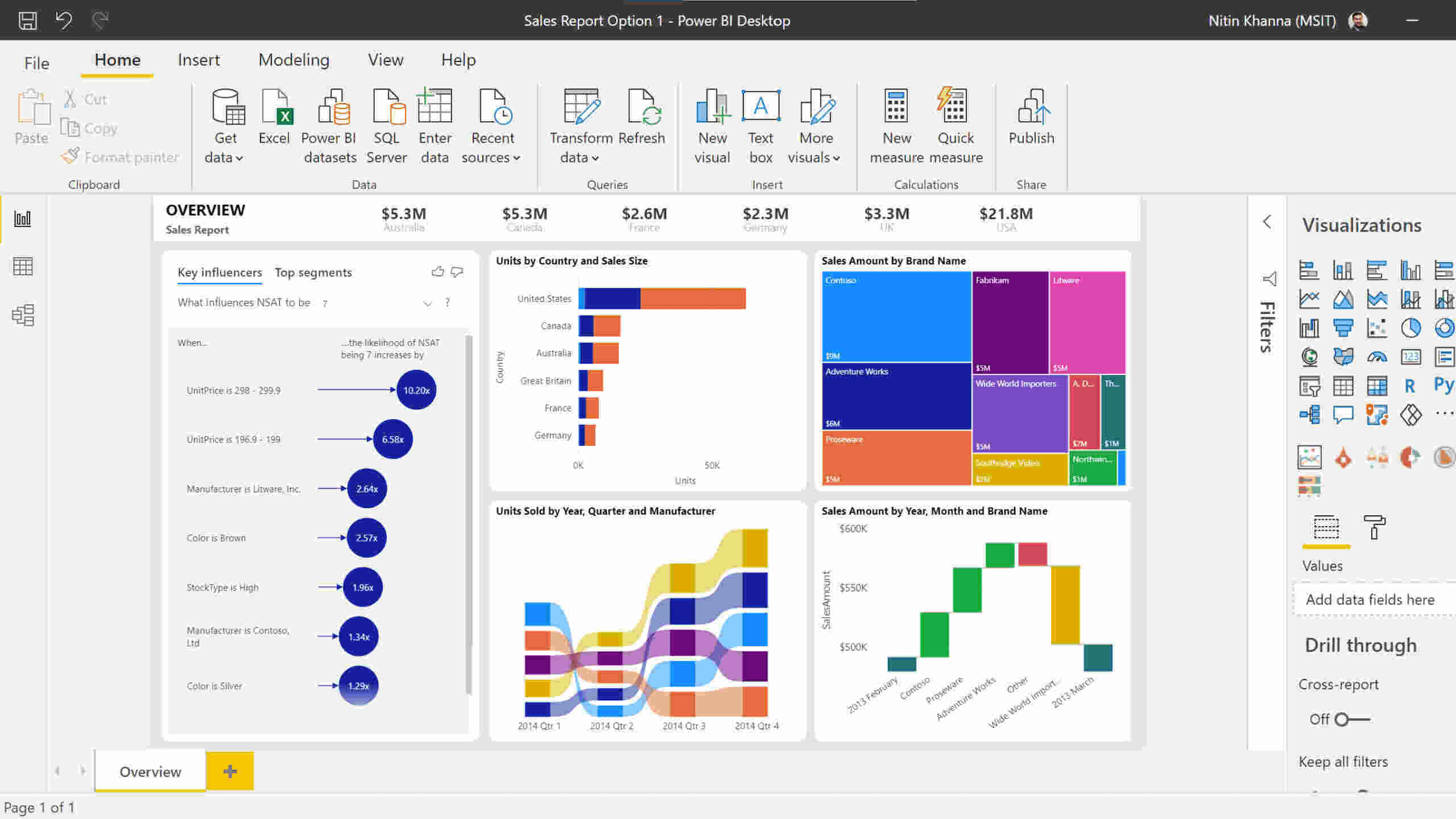

9. Power BI

Website: powerbi.microsoft.com

Power BI is Microsoft’s flagship business intelligence and data visualization platform, widely used for building internal and LP-facing dashboards from a mix of SQL databases, Excel models, data warehouses, and SaaS tools. For PE firms, the typical usage pattern is to feed it portfolio company KPIs, fund performance metrics, and finance data, then let stakeholders drill through from high-level dashboards down to deal, company, or even ledger-level detail.

Tight integration with Microsoft 365 and Azure Active Directory enables row-level security, embedding in Teams/SharePoint, and centralized access control.

Tradeoffs:

Total cost of ownership can grow when you factor in Premium capacity, data engineering, and governance.

It’s also purely a visualization/analytics layer: if your underlying data is messy, inconsistent, or still trapped in PDFs, Power BI will simply surface that mess more beautifully.

10. Tableau: Visual Analytics

Website: tableau.com

Tableau, now part of Salesforce, is a leading visual analytics platform known for its drag-and-drop interface and polished, highly interactive dashboards. PE firms often use Tableau to build executive-level and LP-facing views over portfolio performance, value creation plans, and operational KPIs, with connectors into warehouses, portfolio management systems, and CRMs.

Tradeoffs:

Tableau’s strengths are visual quality and analyst-friendly exploration, but that comes with higher per-user costs than Power BI and a separate ecosystem from Microsoft, an extra consideration for firms standardized on Azure and M365.

Like Power BI, Tableau assumes you’ve already solved data ingestion and transformation; it won’t extract numbers from CIMs or PDFs on its own, so pairing it with an AI document layer is increasingly the norm in modern PE data stacks.

Implementation Guide for Private Equity Analysis Tools

Selecting a private equity analysis platform is only the starting point. Implementation is where most PE technology initiatives fail. The failure modes are predictable: pilots that don’t map to real diligence work, unclear accuracy thresholds, and tools that never earn analyst trust.

In practice, PE firms that succeed follow a three-phase approach.

Phase 1: Pilot

Start with a narrow, high-value workflow. Do not try to automate everything at once. Good pilot candidates include:

CIM Extraction: Upload 20 recent CIMs, extract key metrics (revenue, EBITDA, growth rate, customer concentration, management team), compare against manual extraction for accuracy. Define acceptance criteria upfront, such as ±2% on financial figures, 95% accuracy on categorical fields.

Contract Review: Upload NDAs or vendor contracts, extract key terms (governing law, term, renewal, assignment rights), compare against legal team's manual review.

Financial Statement Spreading: Upload sets of financial statements from portfolio companies, extract income statement and balance sheet data into a standard template, compare against analyst-built models.

The goal is to prove accuracy and time savings on a small sample before scaling. Set clear success metrics. You should also be implementing quality control from the beginning, with:

Workflow-specific accuracy thresholds

Human review gates for edge cases

Monthly accuracy tracking and tuning

Phase 2: Scaling

Once the core workflows are automated, expand to adjacent use cases. Common expansion paths include:

From CIM extraction to full data room analysis.

From contract review to covenant monitoring.

From financial statement spreading to full portfolio analytics.

The key is to maintain quality as you scale. Set clear acceptance criteria for each workflow. Implement human review checkpoints for edge cases. Monitor accuracy metrics monthly and adjust configurations as needed.

Phase 3: Full Implementation

This is the phase most firms miss, and where the real leverage appears.

Once workflows are proven, the focus shifts from speed to consistency and institutional memory.

Standardized diligence outputs

Every deal produces comparable metrics, tables, and checklists—regardless of who ran the analysis.Knowledge continuity across deals

Definitions, assumptions, and extraction logic persist across funds and vintages instead of living in individual Excel files.Faster onboarding of new analysts

New hires spend less time learning “how we do things” and more time evaluating risk.Higher deal coverage without headcount growth

Teams screen more opportunities, run deeper diligence, and monitor portfolios more frequently, without burning out associates.

At this point, the platform is no longer a tool. It becomes a fundamental part of your analytical infrastructure.

To see how V7 Go can automate your data extraction workflows, from CIM analysis to portfolio monitoring, book a demo.