Knowledge work automation

14 min read

—

Nov 28, 2025

A practitioner's guide to how AI agents are automating document-heavy workflows in wealth management—from client onboarding to compliance monitoring.

Imogen Jones

Content Writer

Wealth management firms can spend a fortune on platforms promising a 'single source of truth' and slick, modern workflows. Yet, whenever a complex client request actually comes in, nobody looks at the dashboard. Instead, the real work happens in the 'shadow' system: a chaotic graveyard of saved email attachments, sticky notes, and local files named 'Client_Update_v3_FINAL_REAL.xlsx'.

This is the operational reality of wealth management. The industry's backbone remains manual data entry and disconnected processes. Advisors spend much of their time not advising clients, but acting as data clerks, including re-keying numbers from tax returns, trust deeds, and custodian statements into their systems.

AI adoption in wealth management is accelerating, with firms moving beyond basic chatbots to deploy specialized AI agents. These agents are configured to handle specific, repeatable document workflows, helping firms close the ingestion gap, automate their processes and reclaim thousands of hours per year.

In this article:

The administrative burden limiting advisor capacity

Key AI technologies: OCR, IDP, LLMs, and RAG

High-ROI use cases in wealth management operations

Implementation best practices for security and compliance

Painful Manual Processes In Wealth Management

The wealth management industry has a dirty secret: the true bottleneck to growth is data ingestion and manual processes. Advisors and their support staff spend hours each week performing tasks that feel like they should have been automated a decade ago:

Re-keying account numbers, cost basis, and transaction history from custodian PDFs into portfolio management software.

Extracting key dates, beneficiaries, and distribution clauses from trust documents and estate plans.

Cross-referencing tax returns against portfolio statements to identify unreported income or carryforward losses.

Manually checking client communications for compliance red flags like promissory language.

This "stare-and-compare" workflow is tedious. It's also error-prone. A single missed digit in a cost basis entry can trigger a tax reporting error. A misread beneficiary designation can create legal liability. And because the work is manual, it does not scale.

Many firms have attempted modernization, but the reality is that wealth management technology stacks remain deeply fragmented. Systems coexist rather than consolidate. Legacy tools linger, expensive to maintain yet too risky to decommission, while new platforms create more data silos rather than fewer.

Many asset managers also rely on outdated and fragmented technology stacks, which drive up operational complexity and costs, while modernization efforts are often prolonged and expensive. And even after modernization, firms frequently fail to fully decommission legacy systems, resulting in bloated application portfolios and limited efficiency gains.

— McKinsey, How AI could reshape the economics of the asset management industry

The Solution: Modern AI and Document Understanding

For decades, wealth management firms have chased the promise of operational efficiency through technology. Every few years, a new wave of automation arrived:

Flawed OCR that could only turn scans into text

Workflow tools that pushed tasks from one human to another

RPA bots that followed rigid, brittle “if X then Y” rules

Each one offered incremental relief but never fundamentally solved the problem. These systems worked only when documents were clean and predictable. Wealth management is neither. It runs on PDFs, statements, trust documents, K-1s, and client forms that are messy, inconsistent, and constantly changing.

Then came generative AI, LLMs capable of reading, summarizing, and reasoning about text in ways previously impossible. For the first time, it felt as if software could actually understand a trust agreement, interpret a K-1, or explain the difference between two distribution clauses.

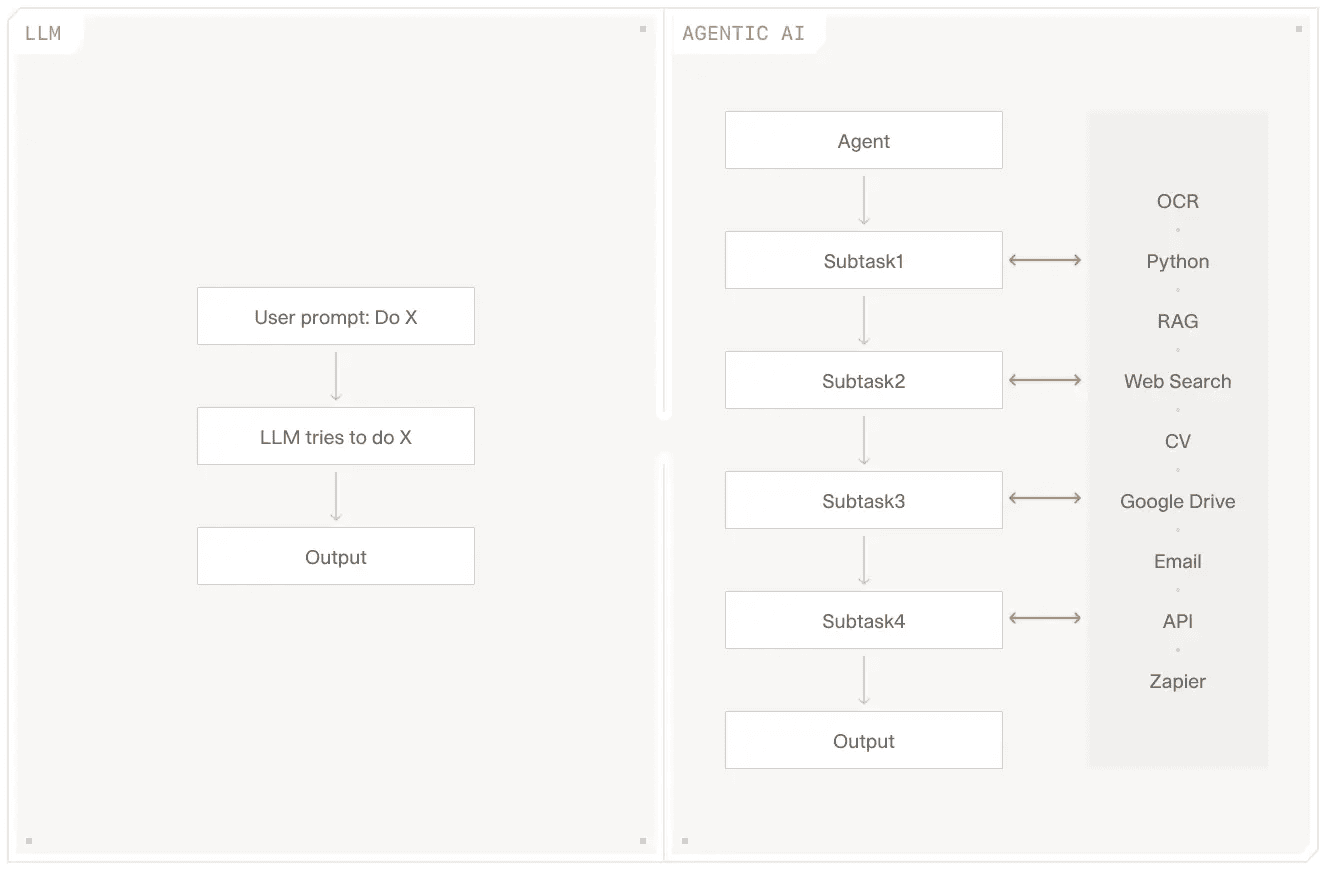

Yet, as transformative as generative AI is, it does not solve the operational bottleneck at the heart of wealth management: the need to turn documents into structured, verified, consistently updated data that flows into downstream systems without human intervention. Generative AI, on its own, cannot automate workflows. It can understand information and describe it beautifully, but it cannot execute a multi-step business process reliably without the ability to act across tools or take responsibility for an entire workflow.

This is where AI agents enter the picture, and why they represent a fundamental break with everything that came before.

An AI agent is not:

A chatbot

A fancier RPA bot

A slightly upgraded automation script

An AI agent is:

A system that constantly ingests new information

Able to understand context across many documents, accounts, and data sources

Capable of reasoning about what needs to happen next

Connected to your systems through integrations and APIs

Able to take actions and use tools, not just answer questions

This makes agents operationally useful in a way LLMs alone are not.

It's no wonder McKinsey posits that "end-to-end workflow reimagination" with agentic AI could capture 25 to 40 percent of total cost base in efficiencies for a mid-sized asset manager with $500 billion in AUM.

For RIAs, private wealth firms, and multifamily offices and organizations where a single operations professional might be juggling hundreds of PDFs a week, the impact is profound. It means fewer late nights formatting quarterly reports, faster onboarding without endless back-and-forth requests for missing information, and more time meeting clients instead of tabbing between Adobe Reader and their portfolio system.

You can learn more about the distinction in our blog: What Are AI Agents and How to Use Them in 2025?

4 Key AI Technologies Wealth Managers Should Understand

To evaluate AI solutions intelligently, you need to understand the underlying technologies. Here is a breakdown of the four core capabilities that matter in wealth management workflows.

OCR is the oldest technology in this entire ecosystem, yet it remains the critical bridge between the industry's paper-heavy past and its digital future.

It began decades ago as a tool to convert simple printed pages into searchable digital text. Early OCR was brittle: it struggled with handwriting, low-quality scans, and anything outside clean, printed text. But advances in neural networks, computer vision, and later NLP dramatically improved accuracy.

Modern OCR technology can handle cursive handwriting, low-quality scans, and multi-column layouts effectively.

Wealth management use case: Digitizing client intake forms, beneficiary designations, and legacy account statements that only exist as paper or faxed copies.

Intelligent Document Processing (IDP) combines OCR with machine learning to extract structured data from unstructured documents. It can recognize that:

a number labeled “Total Contributions” is a value

“Account Number” refers to a field, even if the layout changes

a corresponding table row describes cost basis or unrealized gains

In other words, IDP bridges the gap between unstructured documents and the structured fields required downstream.

Wealth management use case: Extracting holdings, transactions, and performance data from custodial statements that arrive in different formats.

LLMs are the engines behind tools like ChatGPT and Claude. They excel at reading long, complex documents and producing summaries, answering questions, or drafting new content based on that reading.

But while LLMs are exceptional at understanding and generating language, they are still fundamentally reactive. They respond to the input you give them, nothing more. AI agents represent the next step. Rather than functioning as sophisticated text responders, agents are software systems designed to perceive their environment, make decisions, and take actions to accomplish a goal without needing constant human instruction.

This shift from language prediction to autonomous reasoning is what enables platforms like V7 Go to perform complex, document-driven financial tasks reliably.

Wealth management use case: Summarizing a 60-page trust deed into a one-page memo highlighting key provisions or drafting personalized market commentary for clients based on their individual portfolios.

Retrieval-Augmented Generation (RAG) grounds an LLM’s responses in real documents instead of relying solely on what the model learned during pre-training. In a classic RAG system, the AI retrieves a handful of relevant text passages and uses them as context when generating an answer.

It’s a powerful idea, but in practice, conventional RAG strains under the weight of real corporate data. Custom GPTs can only reference a limited number of files. Even models with huge context windows slow down or lose accuracy when fed a single dense document, let alone hundreds. The result is answers that are adjacent to the truth, yet lack the specificity required for compliance, client management, or financial decision-making.

This is where V7’s Knowledge Hubs represent a major step forward. Powered by V7’s proprietary Index Knowledge technology, Knowledge Hubs build a centralized, entity-centric, continuously updated memory layer from an organization’s entire document ecosystem.

Any time new information enters the system (whether from a PDF, a tax return, a SharePoint folder, or a Gong call transcript) the Hub automatically updates every relevant entity profile.

This allows V7 Go to answer complex, multi-document questions with precision without running into the bottlenecks typical RAG systems encounter, albeit with higher token consumption.

Wealth management use case: Asking, "What are the distribution clauses in the Smith Family Trust?" and getting an answer with direct quotes and page references. Or querying, "Which clients have unrealized losses greater than $50,000?" and getting a list pulled from tax returns and portfolio statements.

Use Cases of AI in Wealth Management Operations

The question is not "Can AI help?" but "Where should we deploy it first?" The highest-ROI use cases are those that involve high-volume, repeatable document workflows where manual processing is the bottleneck.

To see these use cases in action, check out the V7 AI Wealth Management Agent.

For asset managers, the AI revolution is a timely opportunity to break out of entrenched cost structures by increasing efficiency across business functions. More recently, with the advent of agentic AI, there is a once-in-a-generation opportunity for asset managers to recover and leapfrog profitability levels.

— McKinsey, How AI could reshape the economics of the asset management industry

Multi-Source Data Consolidation

Traditionally, advisors must manually download PDFs, extract holdings and balances, normalize ticker symbols, and reconcile asset categories across completely different reporting formats.

V7 Go agents can eliminate this bottleneck. The system ingests statements from any custodian or asset manager (scanned, digital, structured, or unstructured) and uses multimodal document intelligence to extract positions, quantities, valuations, cost basis, and classifications. It then harmonizes this data across providers, resolving naming inconsistencies, mapping proprietary formats into a unified schema, and generating a complete household portfolio view instantly.

Instead of spending hours assembling a baseline dataset, advisors begin analysis with a clean, consolidated, and fully normalized source of truth.

See an example in action here: AI Data Reconciliation Agent.

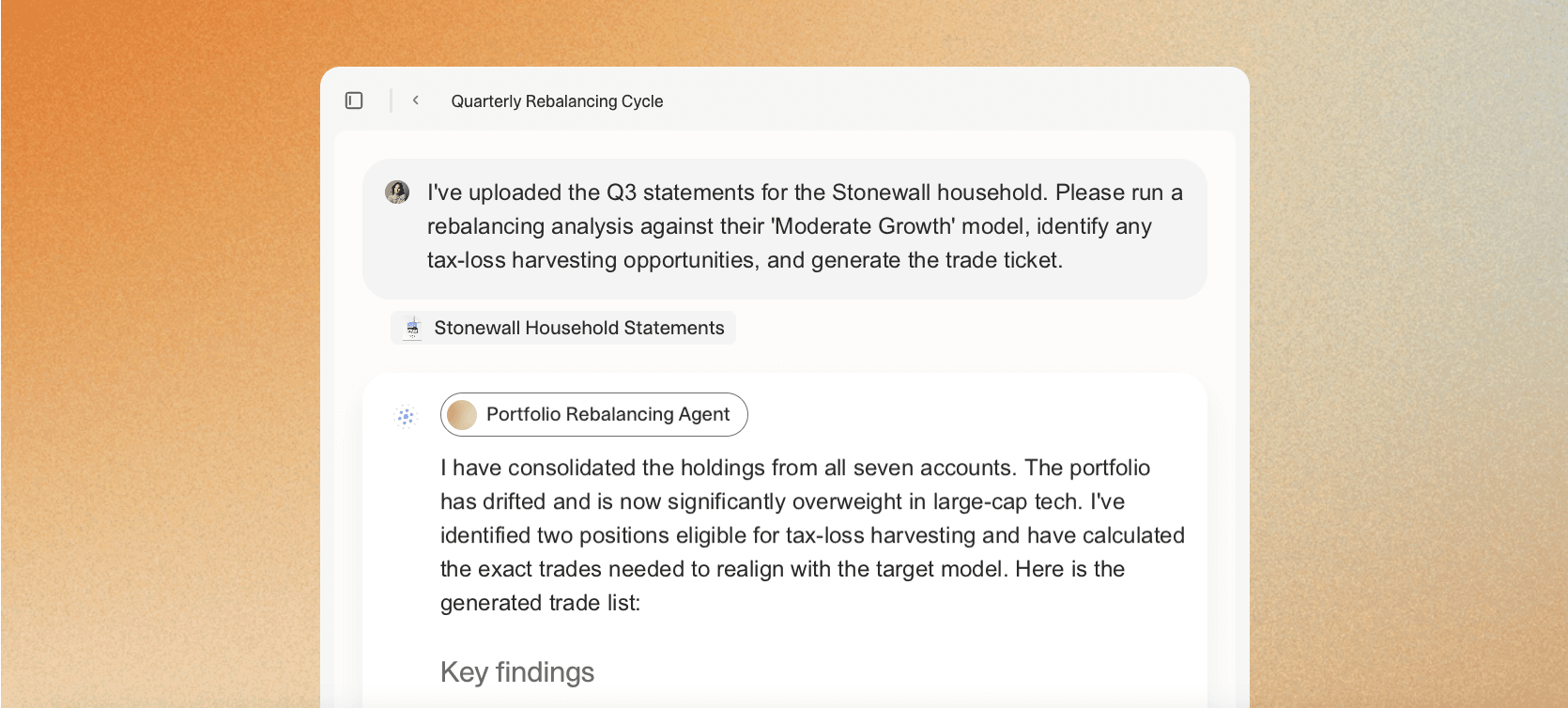

Portfolio Optimization & Rebalancing

By analyzing vast amounts of data, from market trends and company financials to economic indicators, AI agents can identify the optimal asset mix in real-time, ensuring portfolios remain strictly aligned with client goals without the manual drag of constant monitoring.

For example, rebalancing is traditionally a manual, high-friction process. Advisors spend 2 to 4 hours per household aggregating disparate account statements, manually calculating drift against investment models, and determining which trades will bring the portfolio back into alignment without triggering unnecessary tax events.

The V7 Portfolio Rebalancing Agent:

Automatically ingests and consolidates data from multiple statements to create a unified household view, then compares that reality against your firm’s target models to instantly spot overweight or underweight positions.

Unlike a simple calculator, the agent acts as a strategic partner: it scans for tax-loss harvesting opportunities, monitors cash liquidity, and applies your specific custom constraints (such as avoiding sales in legacy holdings).

Finally, it calculates the exact buy and sell orders needed, delivering a precise, trade-ready execution list.

Hyper-Personalization at Scale

Advisors know that personalized communication drives client retention. However, writing 100 unique emails explaining how the latest Fed rate decision impacts each client's specific portfolio is impossible manually. The result is often generic "Quarterly Market Updates" that clients may delete without reading.

An LLM-based agent can analyze each client's portfolio, including holdings, sector exposure, tax situation, against current market news and generate a personalized email draft. For example, it might say: "The recent drop in Tech stocks has reduced your portfolio value by 3.2%, concentrated in your NVIDIA and Microsoft positions. Based on your tax-loss harvesting strategy, we recommend..."

This allows advisors to send personalized emails efficiently, boosting engagement. The advisor reviews and approves each batch before sending; the AI drafts, the human decides.

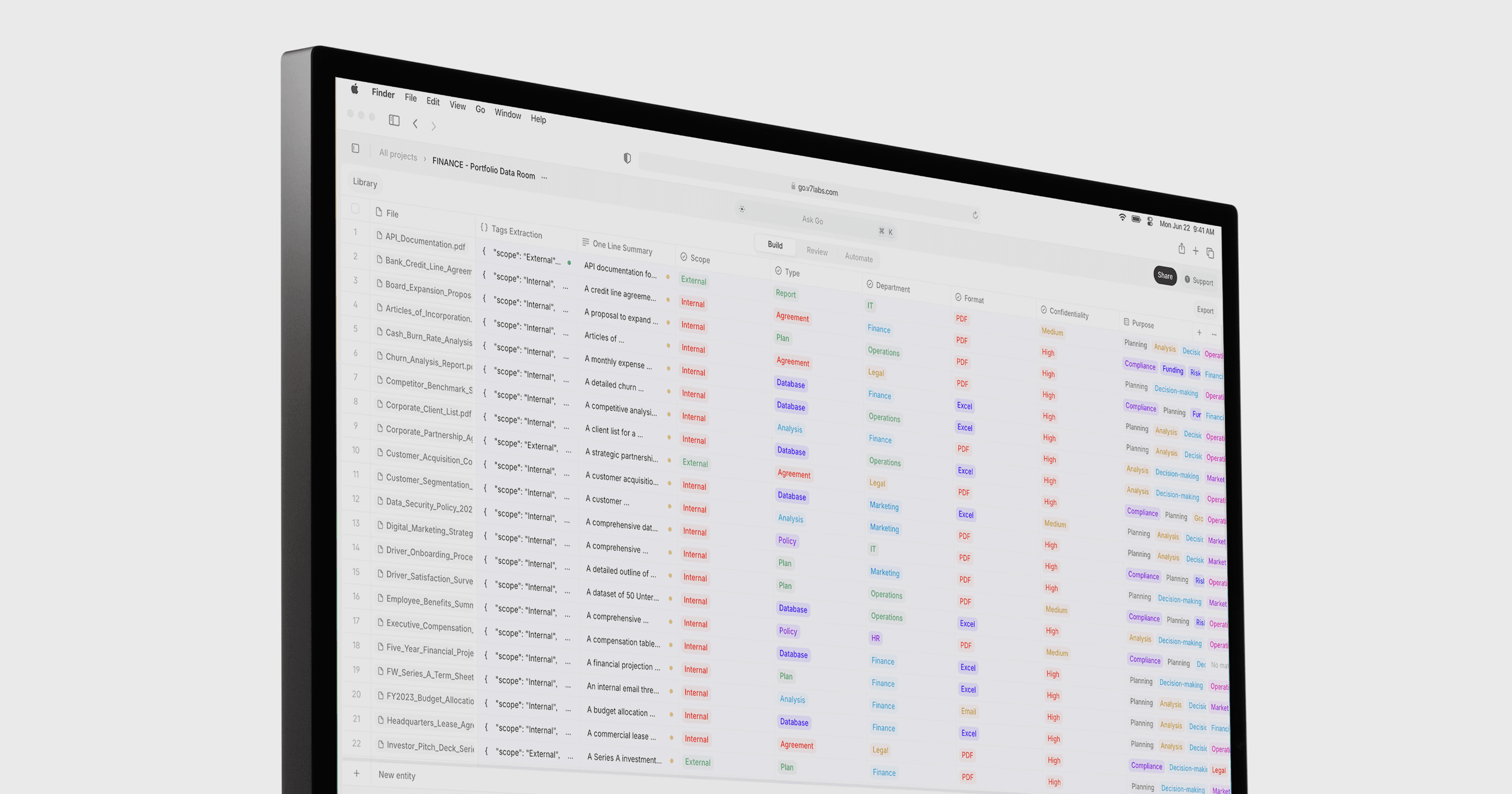

Financial Document Analysis (Estate & Tax Planning)

Reviewing a 100-page trust deed or a complex tax return to identify planning opportunities is time-consuming and requires deep expertise. Junior advisors may lack the experience, while senior advisors lack the time.

Using V7's Concierge interface, advisors can ask specific questions like: "What are the distribution clauses?" or "Who are the successor trustees?" The AI returns answers with citations to specific pages and paragraphs. Similarly, for tax returns, one might ask: "Identify all carryforward losses" or "What is the client's effective tax rate on qualified dividends?"

A task that took 90 minutes of manual review can be reduced to 10 minutes of AI-assisted review. Senior advisors can delegate initial document analysis to AI, then spend their time on high-value interpretation.

Compliance and Regulatory Monitoring

Client reporting is one of the most resource-intensive operational tasks in wealth management. Advisors must compile holdings summaries, performance charts, contribution analyses, fee breakdowns, risk metrics, and market commentary, often pulling data from disparate systems and manually verifying accuracy. The variability across clients and reporting periods makes automation difficult with traditional tools.

V7 Go can handle reporting end-to-end. Agents assemble performance results, benchmark comparisons, allocation charts, fee calculations, and custom narrative sections directly from the underlying source data. They format reports according to the firm’s preferred template (PDF, Excel, PowerPoint, or portal-ready) and support custom disclosures and compliance language.

Because every data point originates from documented, traceable sources, advisors can confidently deliver reports without manual validation loops. What once required days of preparation becomes a near-instant process.

Wealth Management Daily Task Quick Wins

Beyond the big workflows, AI delivers immediate value on small, repetitive tasks that add up to hours per week. These include summarizing the last three client meetings into a one-page brief, cleaning up messy notes in the CRM, or summarizing earnings calls for portfolio holdings.

Warning: Be wary of the "Shadow AI" risk. Junior advisors using free, public tools like ChatGPT to process client data can create a major compliance violation. Client information uploaded to public AI tools can potentially be used to train those models, creating data privacy and regulatory risks. Always use enterprise-grade, SOC 2-compliant platforms with strict data isolation policies.

AI Implementation Best Practices

Deploying AI in a regulated, client-facing environment is different from deploying it in a tech startup. Wealth management firms must balance innovation with fiduciary duty, data privacy, and regulatory compliance.

High-net-worth clients demand confidentiality. A data breach involving client tax returns or estate plans is a business-ending event. Firms should use AI platforms that can demonstrate compliance with leading industry certifications. This ensures that client data is isolated from other customers and that the vendor has undergone rigorous third-party security audits.

Crucially, ensure the AI vendor does not use your data to train public models.

AI in wealth management should be assistive, not autonomous. The AI can draft a rebalancing trade, but the advisor must approve it. The AI can flag a compliance risk, but the compliance officer decides whether to escalate.

This is also a regulatory requirement. Regulation Best Interest (Reg BI) holds advisors personally accountable for recommendations. You can't outsource fiduciary duty to an algorithm. Workflows should be designed where the AI does the heavy lifting (reading documents, extracting data, drafting outputs) but always presents its work to a human for review and approval as needed.

For example, when an AI agent extracts beneficiary information from a trust deed, it should highlight the exact sentences it used and allow the reviewer to confirm or correct the extraction before it flows into the CRM.

Wealth management firms run on a complex web of interconnected systems: CRM, portfolio management, financial planning, and custodian platforms. Your AI solution must integrate with these systems.

Click here to learn more about integrations in V7 Go.

Real-World ROI: Time Savings and Revenue Growth

The business case for AI in wealth management generally comes down to two metrics: time savings and revenue growth.

By automating client onboarding and document analysis, firms can reallocate time to higher-value tasks like client communication. For instance, reducing onboarding document review from 8 hours to 2 hours per client saves hundreds of hours per year for a mid-sized firm.

The more valuable ROI is often indirect: when senior advisors spend less time on administrative tasks, they can spend more time on client acquisition and relationship management. An advisor managing 80 households who is freed from administrative overload might scale to 120 households without sacrificing service quality, directly impacting the firm's revenue.

The Future: The AI-Augmented Firm

In the AI-augmented firm of the near future, a typical Monday morning looks different. New client documents arrive via email, and an AI agent extracts the data, pre-fills the CRM, and flags items for human review, like a missing signature or a beneficiary conflict. The advisor reviews these flagged items in minutes rather than hours. Meanwhile, another agent has drafted personalized market commentary for clients based on overnight news, waiting for advisor approval.

This allows the advisor to handle tasks by 10:00 AM that used to take until 2:00 PM. The rest of the day is spent on what actually matters: client meetings, strategic planning, and business development. Firms are building this today using platforms like V7 Go, which provide the infrastructure (AI agents, Knowledge Hubs, secure document processing) to make it real.

62% of wealth management firms believe AI will "significantly" transform their operations. To see how AI agents can automate your firm's document-heavy workflows, from contract review to compliance monitoring, book a demo with V7 Go.