Document processing

20 min read

—

Jun 10, 2025

Casimir Rajnerowicz

Content Creator

A commercial loan officer at a mid-sized regional bank has a problem.

For the third time this week, she's staring at a loan application from a promising business that requires extensive manual review—financial statements with inconsistent formatting, historical credit reports needing cross-referencing, legal documents requiring careful examination, and industry-specific risk factors demanding specialized analysis.

Approval will take days, perhaps weeks. The applicant has already hinted they're talking to a competitor who promises faster decisions. Meanwhile, her department is under pressure to increase loan volume while reducing risk exposure. She knows her team is missing key insights buried in the mountain of unstructured data in each application.

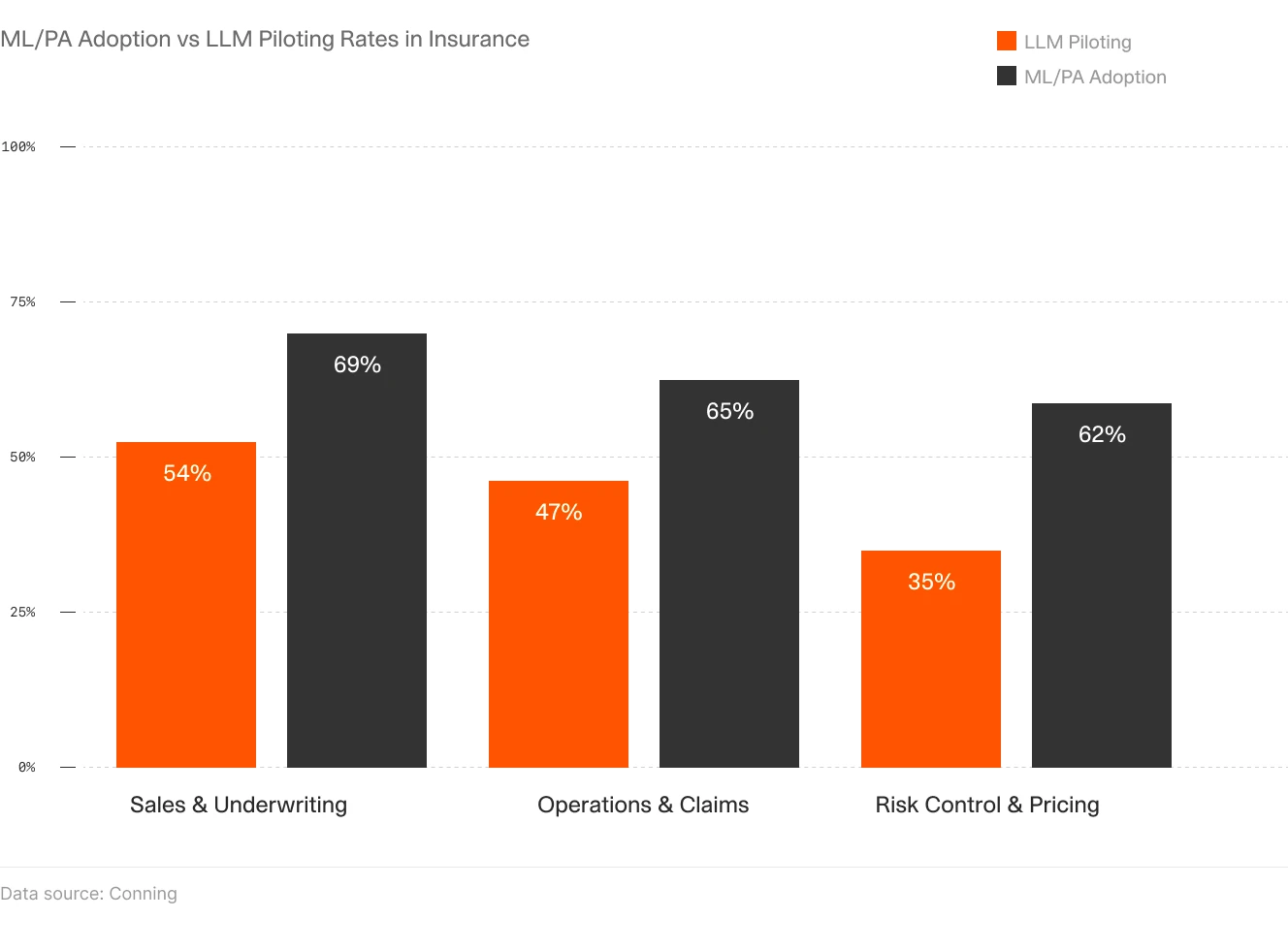

This scenario is playing out daily across the financial industry, where commercial lending decisions increasingly hinge on the ability to quickly and accurately process complex financial information. A report on AI in lending estimates that AI implementation can lead to productivity gains of 20% to 60%. However, the majority of mid-market financial institutions still haven't deployed any AI solutions for commercial lending operations.

Why?

Many institutions remain trapped between legacy systems and the promise of AI, uncertain how to bridge the gap without disrupting crucial processes or introducing new risks.

In this comprehensive guide, we'll examine:

How AI is fundamentally changing commercial loan and credit underwriting

The tangible business benefits driving AI adoption in lending institutions

Key technologies behind modern credit underwriting software

Implementation frameworks for integrating AI with existing lending processes

Practical considerations for compliance, security, and change management

The Evolution of Loan Underwriting: Manual to Automated to Intelligent

Commercial loan underwriting has traditionally been a time-intensive, manual process. Loan officers and underwriters spend hours analyzing financial statements, tax returns, bank statements, market analyses, and industry reports to assess a borrower's creditworthiness. This painstaking approach, while thorough, introduces several critical pain points in an increasingly competitive financial marketplace.

Extended decision timelines leave borrowers in limbo and create openings for competitors. Inconsistent risk assessments emerge as different underwriters emphasize different factors. Limited capacity forces institutions to focus only on larger loans or simplistic decision metrics. Important risk factors remain buried within unstructured data or complex document relationships. And compliance vulnerabilities multiply through manual processes and documentation gaps.

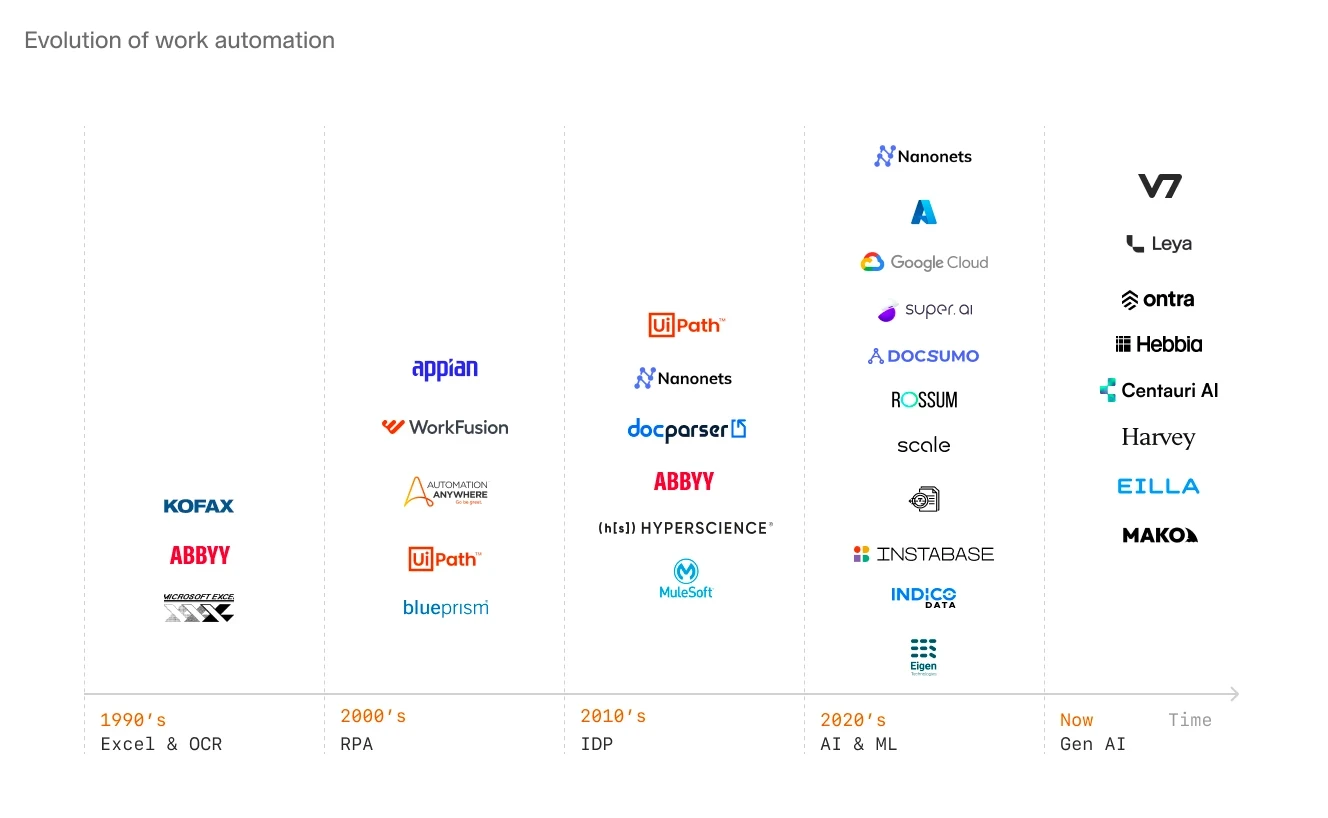

The journey toward automated underwriting began with simple rule-based systems in the 1990s, which used predetermined criteria to make straightforward accept/reject decisions. These early systems helped streamline consumer lending but proved too rigid for complex commercial loans. By the early 2000s, more sophisticated statistical models emerged, using regression analysis and credit scoring to predict default risks.

However, even these advanced statistical approaches had limitations when dealing with commercial lending's inherent complexity. They performed well on structured, numerical data but struggled with the unstructured information crucial to commercial credit evaluation—vendor contracts, market analyses, business plans, and qualitative assessment of management teams.

Enter Artificial Intelligence: The Third Wave of Credit Underwriting

AI represents a fundamental paradigm shift in commercial loan underwriting, not merely an incremental improvement over traditional automation. While previous technologies could follow rules or identify patterns in structured data, modern AI—particularly when powered by Large Language Models (LLMs) and computer vision—can process, comprehend, and derive insights from virtually any information format.

This capability significantly changes commercial lending, where crucial information often resides in complex, unstructured documents rather than neatly organized databases. Instead of being limited to standardized financial ratios, AI underwriting systems can analyze factors that previously required human judgment.

They identify inconsistencies between written descriptions and financial projections in business plans. They assess industry-specific risk factors mentioned in footnotes of financial statements. They flag potential regulatory issues in borrower contracts and agreements. And they recognize management changes or litigation risks buried in lengthy company reports.

The result is smarter, more comprehensive credit analysis that captures nuances previously accessible only through extensive human review. While traditional automation might provide a decision in minutes instead of days, AI underwriting provides a decision that incorporates more factors and insights than even the most experienced human underwriter could realistically consider.

The Building Blocks of AI Commercial Lending

Modern AI loan underwriting platforms integrate several technological components to create end-to-end document processing and decision-making systems. Understanding these building blocks helps clarify what distinguishes truly advanced solutions from simple automation tools:

1. Intelligent Document Processing (IDP)

At the foundation of AI underwriting lies the ability to process and understand documents in their native format—whether they're scanned loan applications, digital financial statements, or email attachments. Intelligent Document Processing combines OCR technology with advanced AI to extract, categorize, and analyze both structured and unstructured information from loan documents.

Modern IDP systems go far beyond traditional OCR by understanding document context and relationships. When processing a commercial loan application, for example, the system can automatically classify documents as financial statements, tax returns, business plans, etc. It extracts key data points like revenue figures, debt obligations, and cash flow information. It recognizes and interprets industry-specific terminology and formatting. And it flags inconsistencies across documents (e.g., different revenue projections in business plan vs. financial statements).

The best systems incorporate data extraction technology that can handle complex financial tables, handwritten notations, and even images of properties or assets included in loan collateral documentation.

2. Large Language Models & Generative AI

The recent explosion of Large Language Models (LLMs) has completely changed how AI systems understand and analyze text-heavy content—a critical capability in commercial lending where narrative descriptions, contractual terms, and footnotes often contain critical information.

In commercial loan underwriting, LLMs interpret complex financial statements and identify implications beyond simple numbers. They analyze business plans and market assessments for plausibility and internal consistency. They evaluate management team structures and experience through narrative descriptions. And they generate comprehensive risk assessments that include qualitative factors.

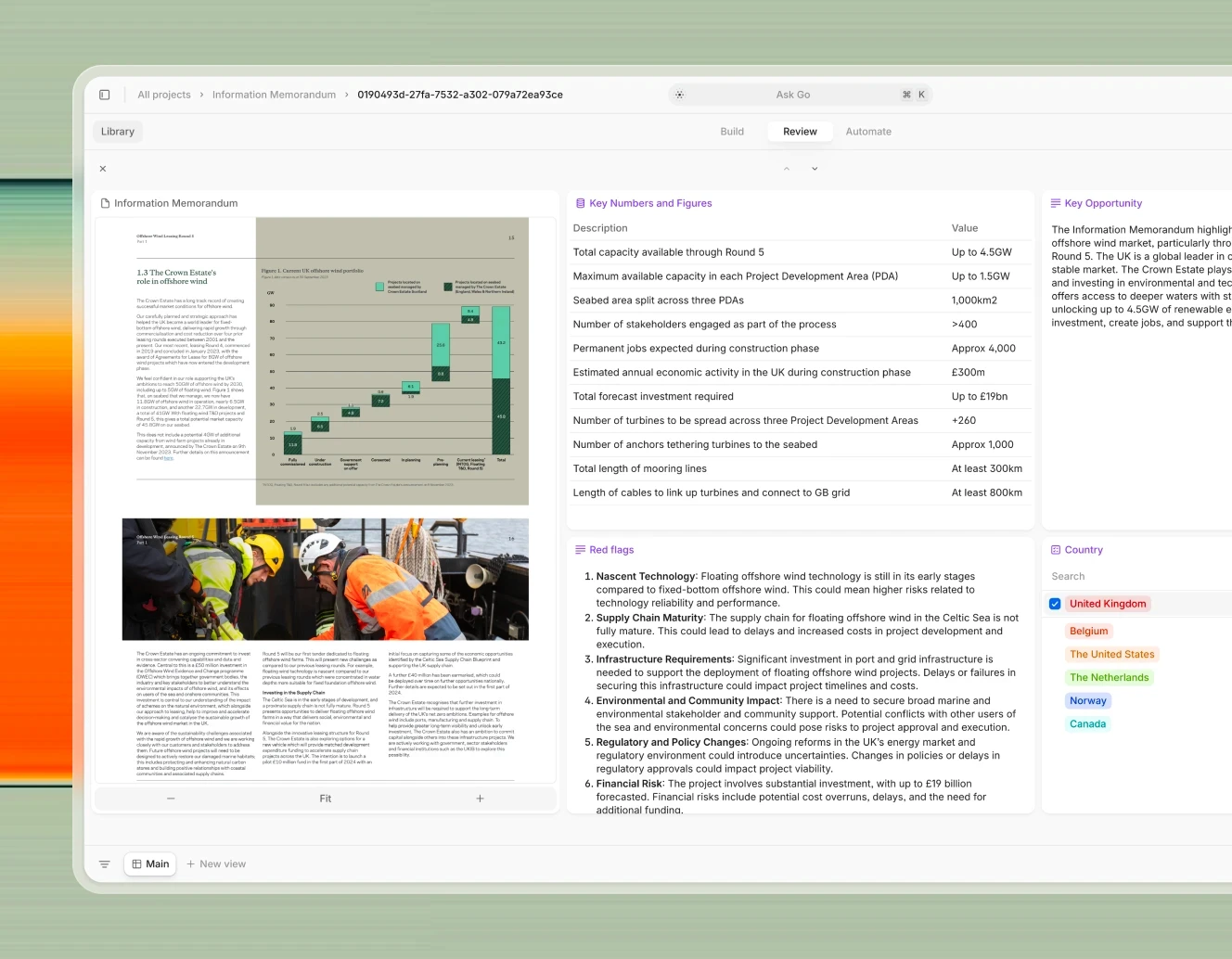

Leading solutions like V7 Go utilize multiple state-of-the-art LLMs in combination with specialized financial analysis tools, creating an ensemble approach that leverages each model's strengths for specific aspects of underwriting analysis.

3. Computer Vision & Multi-Modal AI

While text and numbers form the backbone of loan applications, commercial lending increasingly involves visual components—property photos, site plans, equipment inventories, and handwritten notes. Computer vision AI can analyze these elements, extracting valuable information that would otherwise require manual review.

For example, when evaluating a commercial real estate loan, computer vision analyzes property photos to verify condition and compare against appraised value. It extracts data from floor plans and site maps to confirm property specifications. It processes handwritten adjustments on financial statements or applications. And it reads graphs and charts in business plans or market analyses.

The most advanced systems combine these visual capabilities with text understanding in a multi-modal approach, creating a more comprehensive analysis that mirrors how human underwriters consider all available information.

4. AI Workflow Orchestration

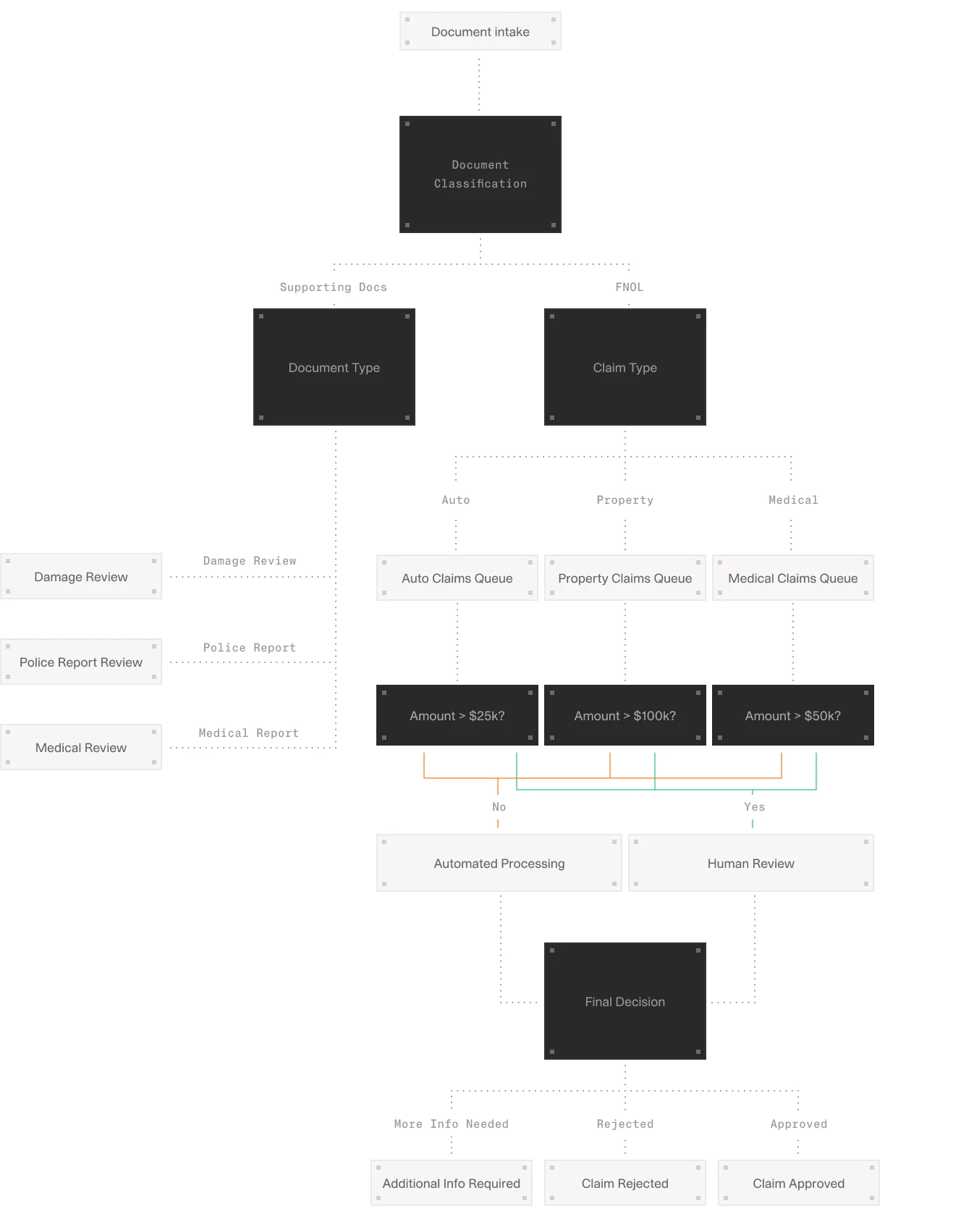

The complexity of commercial lending requires more than individual AI technologies working in isolation—it demands sophisticated workflow automation that coordinates how different components interact. Modern AI underwriting platforms employ orchestration layers that manage the entire process, from document intake to final decision output.

This orchestration capability handles critical functions like routing different document types to appropriate AI models (e.g., financial statements to quantitative analysis tools). It implements conditional logic for different loan types or borrower categories. It manages human-in-the-loop touchpoints for verification and exception handling. And it integrates with existing loan origination systems and core banking platforms.

V7 Go's workflow designer, for example, allows financial institutions to create custom automated processes that align with their specific underwriting criteria and business rules, ensuring AI augments rather than disrupts established lending practices.

5. Explainable AI & Decision Documentation

In the heavily regulated financial industry, the ability to explain and document underwriting decisions is non-negotiable. Advanced AI loan underwriting solutions incorporate explainability features that document exactly how the system reached its conclusions.

This explainability manifests through AI Citation technology that links every extracted data point back to its source document. It includes confidence scores indicating the reliability of different components of the analysis. It provides natural language explanations of how key factors influenced the overall risk assessment. And it creates complete audit trails documenting every step of the process for regulatory compliance.

These features not only satisfy regulatory requirements but also build trust with loan officers and credit committees who need to understand AI recommendations before acting on them.

Structural Comparisons: Traditional vs. AI Loan Underwriting

To understand how AI fundamentally changes commercial loan underwriting, let's compare the structural differences between traditional and AI approaches across key stages of the lending process:

Document Collection & Processing

Traditional Approach: Borrowers submit documents in various formats (paper, email attachments, uploaded files). Lending staff manually review each document, often requesting clarification or additional information when documents are incomplete or unclear. This process typically takes 3-5 business days for initial processing alone.

AI Approach: Documents are ingested through digital channels and immediately processed by AI systems that can understand, categorize, and extract information from different formats. The system identifies missing or incomplete information and can automatically generate targeted requests to borrowers. Initial processing is reduced to minutes or hours.

Financial Analysis

Traditional Approach: Financial analysts manually enter data from financial statements into standardized templates or spreadsheets. They calculate key ratios and compare performance against benchmarks, typically focusing on a limited set of metrics due to time constraints. The process is vulnerable to data entry errors and may miss important footnotes or qualifications.

AI Approach: AI extracts financial data automatically while preserving context from footnotes and explanatory text. The system calculates hundreds of financial metrics and compares performance against industry benchmarks, historical trends, and peer groups. Anomalies and inconsistencies are automatically flagged for deeper investigation.

Risk Assessment

Traditional Approach: Underwriters apply standardized risk frameworks based on financial ratios, credit scores, and subjective assessments of business plans and management. The depth of analysis is often limited by time constraints, potentially overlooking subtle risk factors or market trends. Different underwriters may evaluate similar loans differently based on experience and perspective.

AI Approach: AI systems evaluate hundreds of risk factors simultaneously, including traditional metrics plus alternative data sources like market trends, online reviews, and industry-specific risk indicators. AI agents can identify correlations and patterns across documents that might escape human notice. Risk assessments are consistent and comprehensive, with machine learning models continually improving based on outcomes.

Decision Making

Traditional Approach: Credit committees review analyst recommendations, often requiring multiple meetings for complex loans. Decisions may be influenced by subjective factors, institutional politics, or recency bias (overweighting recent experiences). Documentation of decision rationales may be inconsistent or incomplete.

AI Approach: AI provides structured recommendations with clear explanations of key factors influencing the risk assessment. Human decision-makers receive comprehensive decision support packages that highlight areas requiring judgment while automating routine evaluations. The system documents all factors considered, creating consistent audit trails for regulatory compliance.

Monitoring & Portfolio Management

Traditional Approach: Loan monitoring relies on periodic reviews triggered by payment behavior or scheduled dates. Portfolio-level insights are limited by the ability to manually aggregate and analyze data across the loan book. Early warning signs may be missed until they manifest in concrete performance issues.

AI Approach: Continuous monitoring integrates both traditional financial metrics and alternative data sources to identify emerging risks before they impact performance. Portfolio-level analytics identify patterns and correlations across the loan book, enabling proactive management. The system can automatically track covenant compliance and generate alerts for potential issues.

The Business Case for AI in Commercial Loan Underwriting

The adoption of AI for commercial loan underwriting delivers tangible benefits that extend far beyond simple operational efficiency. Leading financial institutions implementing these solutions report significant improvements across multiple dimensions:

1. Accelerated Decision Velocity

The most immediately visible benefit is dramatically faster loan processing. Banks using AI underwriting report 50-75% reductions in time-to-decision for commercial loans. This acceleration creates several competitive advantages.

It improves customer experience as borrowers receive faster responses (particularly valuable for time-sensitive commercial opportunities). It leads to higher win rates in competitive lending markets where speed is often a differentiating factor. It increases loan officer productivity, allowing them to handle more opportunities with the same resources. And it reduces cost-to-originate through elimination of manual processes and shorter decision cycles.

One team reported that their AI implementation reduced average approval cycles for commercial loans from 12–15 days to 6–8 days—a change that directly increased their market share in a competitive metropolitan market.

2. Enhanced Risk Assessment Accuracy

While speed is valuable, accuracy in risk assessment remains the foundational requirement for sustainable lending. AI risk assessment solutions have demonstrated superior performance in predicting loan defaults and losses compared to traditional methods, with improvements in predictive accuracy.

This enhanced accuracy stems from several AI capabilities. AI provides comprehensive analysis of thousands of variables compared to the dozens typically considered in manual underwriting. It excels at pattern recognition that identifies subtle correlations between risk factors that might escape human notice. It removes human biases that might unconsciously influence credit decisions. And it continuously learns from outcomes to improve future predictions.

For a $10 billion commercial loan portfolio, a 15% improvement in default prediction accuracy can translate to tens of millions in avoided losses annually.

3. Scalability Without Proportional Cost Increase

Traditional lending operations face a direct correlation between loan volume and staffing needs. AI fundamentally breaks this relationship by automating the most time-intensive aspects of underwriting while maintaining or improving quality standards.

Financial institutions implementing AI underwriting software for report handling 3-4x more loan applications with the same staff, creating significant economies of scale. This scalability allows banks to expand into new markets without proportional headcount increases. They can process seasonal lending surges without temporary staffing. They maintain consistent service levels regardless of application volume. And they redirect skilled underwriters to more complex transactions that truly require human judgment.

A business lender can now double their SME loan portfolio over 18 months without adding underwriting staff—a growth trajectory that would have been impossible with traditional processes.

4. Consistency and Compliance Improvements

Regulatory scrutiny of lending practices continues to intensify, with particular focus on documentation, fairness, and consistency in underwriting. AI systems provide built-in capabilities that address these challenges.

They create comprehensive audit trails documenting every factor considered in credit decisions. They ensure consistent application of credit policies across all applications, eliminating human variability. They incorporate automated compliance checks that verify regulatory requirements are satisfied. And they enable early detection of potential fair lending issues through systematic analysis.

Banks using AI underwriting report significant reductions in regulatory findings related to inconsistent application of credit standards, with fewer documentation-related exceptions during examinations.

5. Enhanced Employee Experience and Retention

While often overlooked in purely financial analyses, AI's impact on employee experience represents a significant value driver. Commercial loan officers and underwriters are highly skilled professionals who often spend majority of their time on routine, low-value tasks rather than applying their expertise.

AI automation shifts this balance by eliminating manual data entry and document processing. It provides pre-analyzed information that highlights key issues requiring judgment. It frees time for deeper client relationships and complex deal structuring. And it reduces tedious overtime during high-volume periods.

Financial institutions that implement AI underwriting report improved job satisfaction and retention among lending teams, with one commercial bank observing a 45% reduction in turnover among credit analysts following their AI deployment.

Key Features of Modern AI Credit Underwriting Software

As the market for AI lending solutions matures, certain capabilities have emerged as essential differentiators between basic automation tools and truly effective platforms. When evaluating AI underwriting software, these features represent the current state of the art:

1. Multi-Format Document Processing

Commercial loan applications typically involve dozens of document types in various formats—from structured application forms to unstructured business plans, spreadsheet financials, and image-based property assessments. Leading AI underwriting platforms can seamlessly process all these formats.

They automatically extract and categorize line items from income statements, balance sheets, and cash flow documents in PDFs, spreadsheets, or scanned images. They process both business and personal tax returns, reconciling information across multiple schedules and forms. They analyze account activity in bank statements, categorize transactions, and verify cash flow patterns. They extract key information from business plans on market strategy, management team, and growth projections. And they process property appraisals, equipment valuations, and other asset documentation for collateral.

This multi-format capability eliminates the need for document standardization before processing, dramatically reducing preparation time and allowing the system to work with documents in their native formats.

2. Financial Spreading and Analysis

Financial spreading—the process of standardizing financial data for analysis—has traditionally been one of the most time-consuming aspects of commercial underwriting. Advanced AI solutions automate this process end-to-end.

They perform automated data extraction from financial statements across multiple periods. They standardize accounting formats to enable consistent comparison. They calculate key ratios and performance metrics (liquidity, leverage, profitability, etc.). They conduct trend analysis and projection based on historical performance. And they provide industry benchmarking against relevant peer groups.

The most sophisticated systems can even reconcile discrepancies between different financial documents, flagging inconsistencies that might indicate reporting errors or potential red flags.

3. Cash Flow Analysis and Debt Service Coverage

For commercial loans, cash flow analysis and debt service coverage represent critical components of risk assessment. Advanced AI systems can perform sophisticated cash flow modeling.

They analyze historical cash flow patterns across multiple document sources and identify seasonal fluctuations and recurring patterns. They calculate standardized debt service coverage ratios using consistent methodologies. They project future debt service capability under various scenarios. And they stress-test cash flow assumptions against economic scenarios.

These capabilities provide a level of cash flow analysis consistency and thoroughness that would be difficult to achieve manually, especially across a large loan portfolio.

4. Collateral Valuation and Monitoring

Collateral assessment represents another area where AI brings significant improvements. AI systems can perform automated extraction of property details from appraisals and assessments. They validate collateral values against market data and comparable sales. They conduct automated title analysis to identify encumbrances or priority issues. They provide ongoing monitoring of collateral value through integration with market data sources. And they create visualization of collateral location and characteristics through mapping and imagery.

These capabilities allow more consistent evaluation of collateral values and more timely identification of potential collateral deterioration during the loan term.

5. Credit Policy Implementation and Compliance

AI underwriting platforms can codify and consistently apply institution-specific credit policies. They implement rule-based policy checks that verify all criteria are satisfied. They automate exception identification and escalation for policy deviations. They generate compliant documentation that meets regulatory requirements. They ensure consistent treatment across similar applicants and scenarios. And they create comprehensive audit trails for regulatory examinations.

This systematic approach to policy implementation reduces compliance risks while ensuring that credit standards are applied consistently across the organization.

6. Integration with Core Banking and Origination Systems

Even the most advanced AI underwriting solution must integrate seamlessly with existing banking infrastructure. Leading platforms offer API-based integration with loan origination systems and core platforms. They enable bidirectional data flow that ensures consistency across systems. They provide customizable data mapping to accommodate legacy system requirements. They incorporate workflow triggers that initiate next steps in the lending process. And they include document management integration for seamless file handling.

This integration capability ensures that AI underwriting enhances rather than disrupts existing processes, allowing for phased implementation and gradual transition.

Real-World Applications

The theoretical benefits of AI in commercial lending are compelling, but the practical implementation can vary significantly by institution type and lending focus. Here's how different financial institutions are applying AI underwriting in practice:

Regional and Community Banks

Mid-sized regional banks face particular challenges in commercial lending—they lack the massive technology budgets of global institutions but face the same competitive pressures and regulatory requirements. For these banks, AI is enabling capabilities previously available only to much larger competitors.

A typical implementation at a $5-10 billion regional bank might focus on streamlining commercial real estate lending, where property documentation and financial analysis are particularly time-consuming. It might automate routine small business loans to free underwriters for more complex middle-market relationships. And it could enhance portfolio monitoring to identify emerging risks across the loan book.

Specialized Commercial Lenders

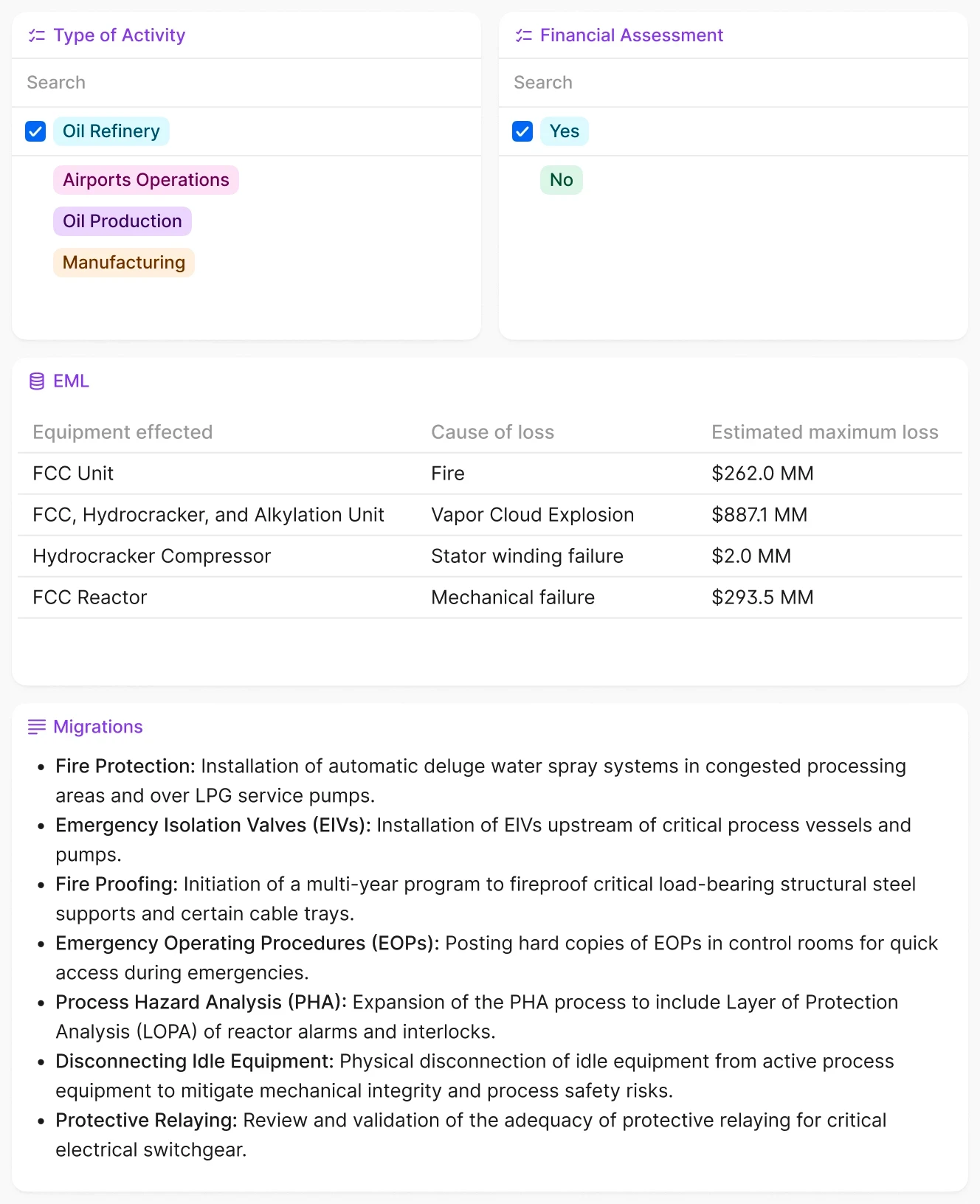

Lenders focusing on specific commercial segments—equipment financing, inventory lending, factoring, or SBA loans—often deal with highly specialized documentation and industry-specific risk factors. For these institutions, AI offers the ability to encode deep domain expertise into underwriting systems.

For example, an equipment finance company can implement AI underwriting that incorporates automated analysis of equipment specifications and valuations, industry-specific financial ratio analysis tailored to equipment usage patterns, and vendor-specific risk assessment based on historical performance. This implementation would allow them to reduce decision time for transactions under $250,000 from 5 days to same-day approval in 80% of cases, creating a significant competitive advantage in time-sensitive equipment purchases.

Fintech and Digital-First Lenders

While traditional banks often implement AI to enhance existing processes, digital-first lenders are building entire lending operations around AI capabilities. These institutions leverage artificial intelligence throughout the customer journey, often achieving dramatically faster processing times and lower operational costs.

Digital SME lenders can build a lending platform that uses AI to analyze applicants' accounting software data via API integration, process bank transaction data to verify cash flow patterns, and incorporate alternative data sources like online reviews and social media sentiment.

Enterprise Banking

Global banks and enterprise financial institutions are implementing AI underwriting at massive scale, often processing thousands of commercial loan applications daily across multiple countries and regulatory jurisdictions. These implementations typically involve complex integration with multiple legacy systems and regional processes, sophisticated governance frameworks ensuring consistent global standards, and multi-language and multi-jurisdiction capabilities.

Implementation Strategy and Best Practices

Successfully implementing AI for commercial loan underwriting requires more than just selecting the right technology—it demands a strategic approach that addresses organizational, process, and change management dimensions.

Based on successful implementations across various financial institutions, these best practices have emerged:

1. Start With a Focused Use Case

Rather than attempting an enterprise-wide transformation immediately, successful AI implementations typically begin with specific, high-impact use cases. Examples of effective starting points include automating financial spreading for a specific loan type or size range, enhancing document processing for collateral evaluation, or implementing portfolio monitoring for early warning indicators.

This focused approach allows organizations to demonstrate concrete value quickly, build internal expertise, and refine their implementation approach before expanding to more complex applications.

2. Involve Business Users Early and Often

AI implementations that fail often do so because of insufficient involvement from the business users who will ultimately work with the system. Successful projects typically include joint design sessions with credit officers, analysts, and technology teams. They incorporate early prototype testing with real loan scenarios and documents. And they enable iterative refinement based on user feedback throughout development.

This collaborative approach ensures that the implemented solution addresses real business needs and integrates effectively with existing workflows rather than creating parallel processes.

3. Balance Automation with Human Expertise

The most successful AI underwriting implementations recognize that certain aspects of commercial lending still benefit from human judgment. Effective implementations typically automate routine, high-volume tasks while preserving human review for complex decisions. They implement confidence scoring that routes borderline cases for additional review. And they provide explanation capabilities that allow underwriters to understand AI recommendations.

This balanced approach leverages AI for efficiency while maintaining the risk management benefits of experienced human judgment where it adds the most value.

4. Maintain Strong Data Governance

AI underwriting models are only as good as the data that trains and informs them. Strong data governance is essential for maintaining system accuracy and compliance over time.

This includes establishing clear data standards for document intake and processing. It requires implementing robust validation processes for extracted information. It means monitoring system performance against expected outcomes. And it involves regularly updating training data to reflect changing conditions.

Organizations that implement these governance practices typically see sustained or improving performance over time, while those that neglect governance often experience degrading accuracy and increasing exceptions.

5. Plan for Integration and Scaling

While starting with focused use cases is advisable, successful implementations plan for eventual scaling and integration across the lending lifecycle from the beginning.

This involves implementing modular architectures that can be expanded incrementally, designing APIs and integration points with existing systems, building reusable components that can be applied across loan types, and developing consistent data models that support enterprise-wide analysis.

This forward-looking design approach prevents creating isolated solutions that later become integration challenges as AI adoption expands throughout the organization.

Success in commercial lending won’t come from just using AI. It will come from using it wisely. The real edge goes to lenders who apply AI to sharpen human judgment, not sideline it. The choices you make now will shape your edge in the market tomorrow.

Curious what that looks like in practice?

Explore how tools like V7 Go help commercial loan underwriters spend less time on paperwork—and more time making better credit decisions.