Knowledge work automation

14 min read

—

Dec 3, 2025

A comprehensive guide to the essential software categories for modern real estate investors. We evaluate deal analysis platforms, market research tools, and how AI agents are finally solving the document ingestion gap.

Imogen Jones

Content Writer

For all the money real estate firms pour into underwriting platforms, data rooms, and portfolio systems, it can feel like the operational backbone of the industry is still a fragile network of Excel workbooks held together by manual data entry.

Public market data flows cleanly through APIs, but private real estate data remains stubbornly analog. It shows up as unstructured rent rolls, scanned lease amendments, handwritten inspection notes, and chaotic email threads from property managers.

The consequences ripple through the organization. Investment committees rely on data that is days or weeks out of date. Promising opportunities stall because underwriting teams can’t process the deal flow fast enough. And expensive enterprise software sits underused, not because people don’t value it, but because feeding it clean, structured data is too time-consuming.

This guide explores the real estate technology landscape through that operational lens, including what actually works in practice, and how firms can modernize their workflows without getting distracted by marketing hype.

In this article:

Understanding the critical split between deal analysis, market research, document intelligence, operations, and reporting.

Deep dives into RealData, ARGUS, CoStar, Reonomy, and more.

How AI agents are finally automating the processing of leases and rent rolls.

What to expect when building a modern real estate tech stack.

The Real Estate Investor's Software Ecosystem

Real estate technology ranges from enormous, enterprise-grade platforms that power institutional portfolios to highly specialized niche tools designed for a single strategy or asset type. For investors, this diversity can be both an advantage and a challenge: the right tools can streamline operations and sharpen decision-making, while the wrong mix can create data silos, redundant workflows, and unnecessary complexity.

Understanding where each category fits (and what problems it actually solves) is essential to building an efficient, scalable investment stack.

In this section, we will explore:

AI solutions

Deal analysis and financial modeling platforms

Market research and sourcing tools

Property operations and management software

Analytical and reporting tools

Let’s begin with the most transformative layer of them all: artificial intelligence.

AI For Real Estate Investors

Before diving into specific software providers, it’s important to understand why AI is rapidly becoming the connective tissue across the real estate tech stack.

Artificial intelligence has already transformed the way many industries operate, but few stand to gain as much, as quickly, as real estate investing. Over the last few years, generative AI has taken the spotlight, dazzling the world with its ability to create images, draft content, and summarize complex data in seconds.

Industry analysts agree on the scale of the opportunity. Morgan Stanley estimates that AI can automate 37% of tasks in real estate, which would represent a significant $34 billion in operating efficiencies.

But generative AI is only phase one of this transformation.

From Generative to Agentic: The Next Leap Forward For Real Estate

The future lies in agentic AI, with systems that don’t just follow instructions, but think, reason, and act across multiple steps to achieve a goal. While generative AI answers your questions, agentic AI takes action on your behalf, automating entire workflows that previously demanded hours of human oversight.

Where generative AI might summarize a rent roll or draft an LOI, agentic AI executes entire processes, such as:

Pulling comps from multiple data providers

Building a financial model

Running sensitivity analyses

Drafting investor memos

Updating your CRM, pipeline, or deal room

Notifying you when assumptions deviate from thresholds

McKinsey’s experience working with early adopters indicates that AI agents can unlock significant value. Organizations are beginning to deploy virtual AI agents along a spectrum of increasing complexity: from simple tools that augment existing activities to end-to-end workflow automation to entire “AI-first” agentic systems.

— McKinsey

For real estate investors, this means shaving hours off deal evaluation, eliminating manual re-entry into downstream systems, improving data accuracy, and enabling investment teams to scale without adding headcount.

Learn more about how AI could transform every aspect of your real estate investment workflows in our blog, AI in Real Estate: Key Use Cases, Solutions, and Challenges.

V7 Go

Rather than functioning as another point solution, V7 Go operates across the entire investment lifecycle, integrating with deal sourcing platforms, underwriting tools, CRMs, and property management systems.

V7 Go can reason through complex tasks using chain-of-thought analysis, breaking down multi-step investment workflows the same way an experienced analyst would. And because the platform supports multimodal ingestion, it can process and connect information from PDFs, spreadsheets, images, emails, maps, models, and structured data alike.

What sets the platform apart is its ability to not just extract data, but understand context and relationships. For example, when reviewing lease agreements, it can trace how amendments modify master terms, calculate financial impacts, and verify compliance requirements, all while providing clear citations back to source documents.

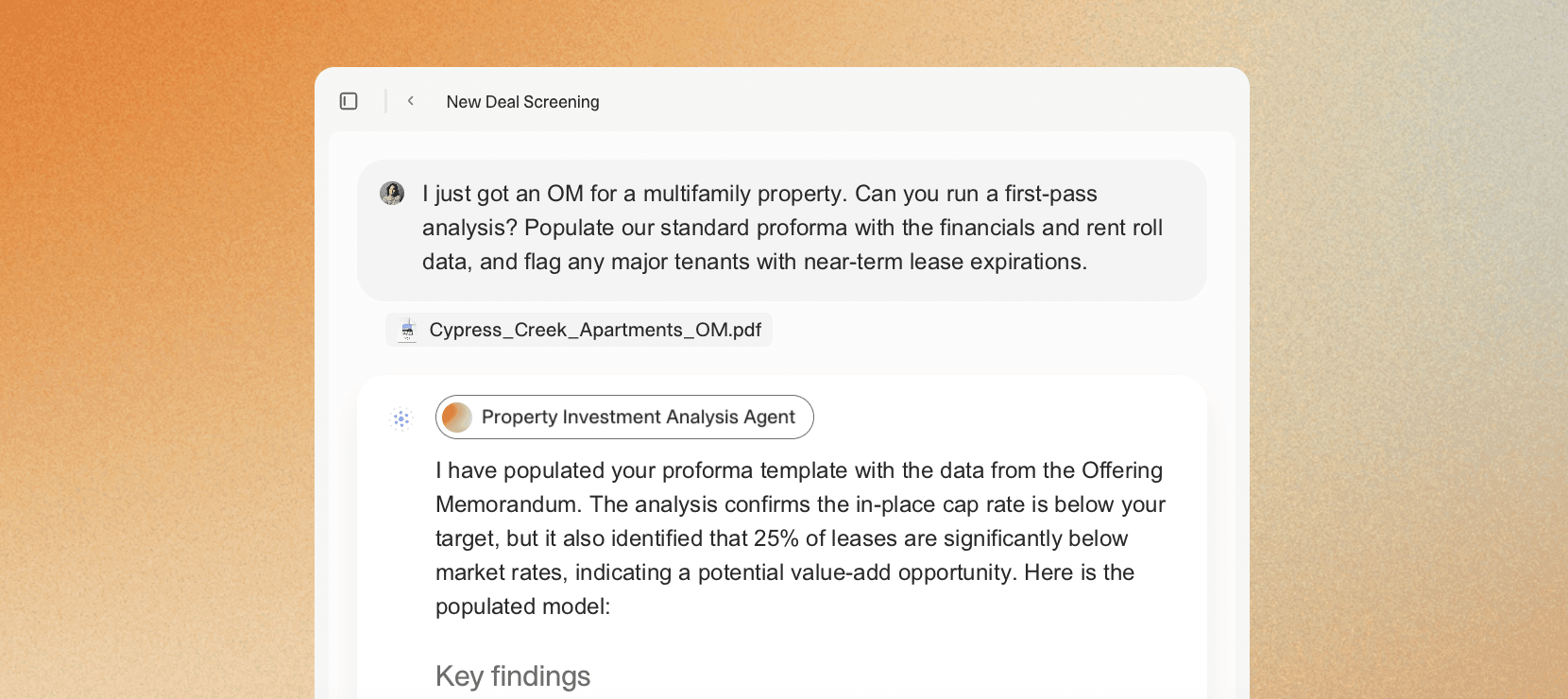

To see these capabilities in action, have a look at the V7 Property Investment Analysis Agent, which equips investors with:

• Automated OM data extraction that pulls key details, financials, and market information from any memorandum.

• Proforma and ARGUS model population that fills your Excel or ARGUS templates with extracted data.

• Rent roll and lease analysis that shows in-place vs. market rents, expirations, and tenant mix.

• Value-add opportunity identification that flags below-market rents, inefficiencies, and improvement potential.

• Deal memo and IC summary generation that turns deal data into a clear investment summary.

• Automated deal screening that checks new deals against your criteria and highlights the best fits.

Tradeoffs: While V7 Go automates workflows, those workflows must first be mapped or imported. Teams without clear internal processes may need to spend time documenting their steps before automation can be maximized. Additionally, like any transformative platform, V7 Go shifts how teams work. Analysts accustomed to doing everything manually may need time to adjust to automation-first workflows.

Deal Analysis and Financial Modeling

Financial modeling engines for calculating Internal Rate of Return (IRR), Net Present Value (NPV), and cash-on-cash returns. These tools answer the question: "Should I buy this asset?"

They range from simple spreadsheet templates to complex, probabilistic modeling engines.

While simple spreadsheets work for single-family homes, complex commercial deals require specialized platforms that can handle multi-year cash flow projections and partnership structures.

BiggerPockets Calculators

For new investors, BiggerPockets offers accessible, web-based calculators. They are web-based, easy to use, and designed for quick screening of residential investments like BRRRRs, fix-and-flips, and rentals.

These calculators offer great strategy-specific templates with no model-building required.

Tradeoffs: The simplicity here is also the limitation. BiggerPockets can't model multi-tier partnership waterfalls, refinance events with multiple tranches of debt, or anything beyond basic rental economics. And because results live only in the app, nothing integrates with downstream systems, forcing data to be manually re-entered elsewhere.

RealData

RealData occupies the middle of the market, serving mid-tier developers, syndicators, and family offices that need serious modeling but want to stay inside Excel. Their templates include rich modules for construction budgets, JV waterfalls, sensitivity analysis, refinance modeling, and tax impacts.

Because RealData is Excel-based, analysts can start immediately without learning a proprietary system.

Tradeoffs: Familiarity comes with the same limitations as any spreadsheet: version control issues, manual data entry, zero automation, and models that break when cells move or formulas change. For firms evaluating dozens of deals a month, ingestion becomes the bottleneck.

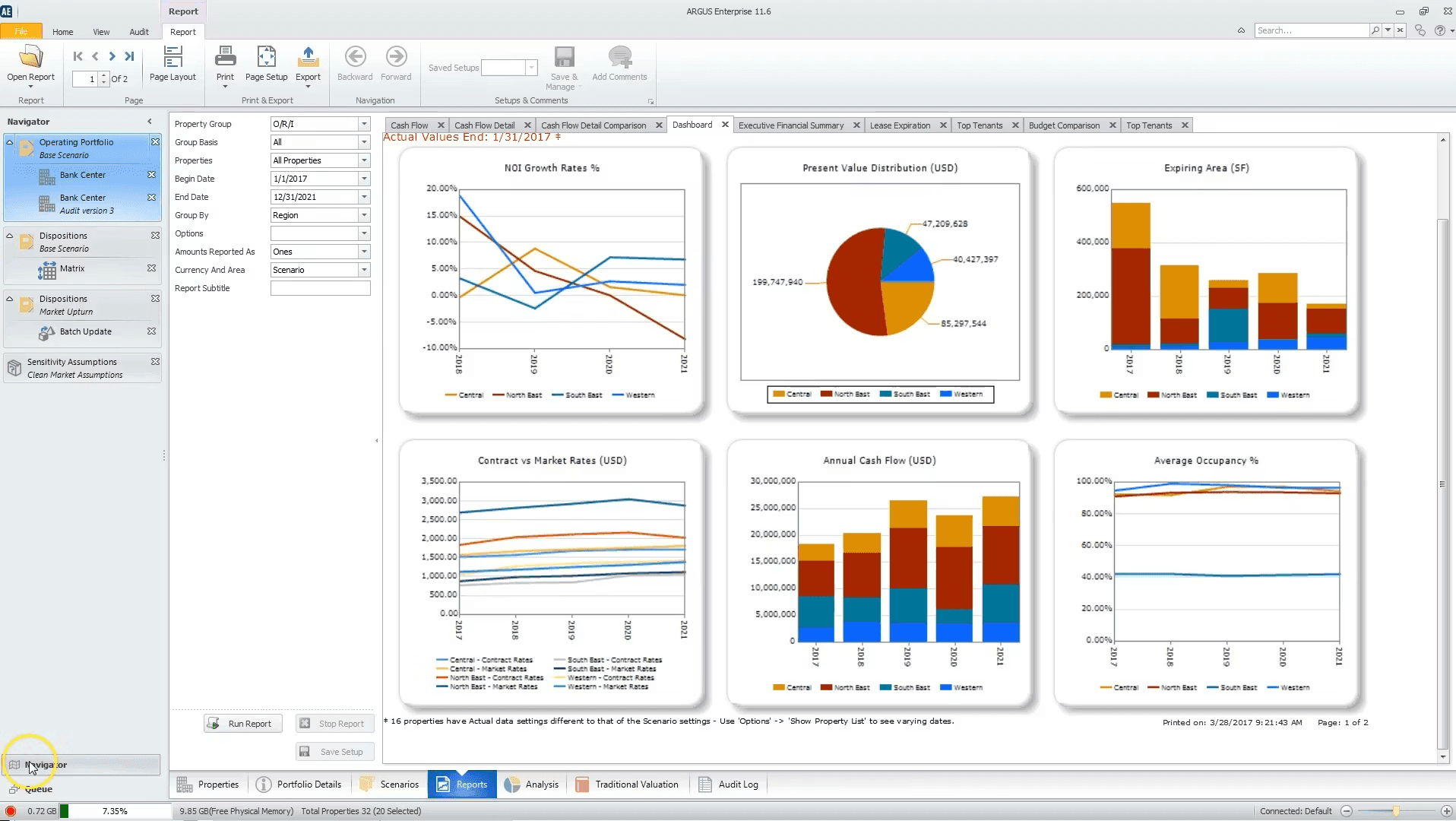

ARGUS Enterprise

For commercial real estate (office, industrial, retail) ARGUS is the industry’s lingua franca. It models lease structures in extraordinary detail: expense recoveries, operating expense reimbursements, mid-term CAM adjustments, market leasing assumptions, renewal probabilities, tenant improvement packages, free rent schedules, and more.

Its depth is unmatched, which is why lenders and institutional buyers often require ARGUS files in diligence.

Tradeoffs: This sophistication comes with considerable cost. Implementations can take 6–12 months and require expensive professional services. Many firms describe ARGUS as “the SAP of real estate”, which means powerful, rigid, and not particularly user-friendly.

Market Research and Sourcing

You can’t underwrite a deal you never saw. Market research and sourcing tools are the radar systems of real estate, helping investors identify opportunities before their competitors do. They answer two questions:

“What should I buy?”

“And at what price?”

These platforms vary greatly in scope depending on whether you're targeting residential, commercial, or off-market assets.

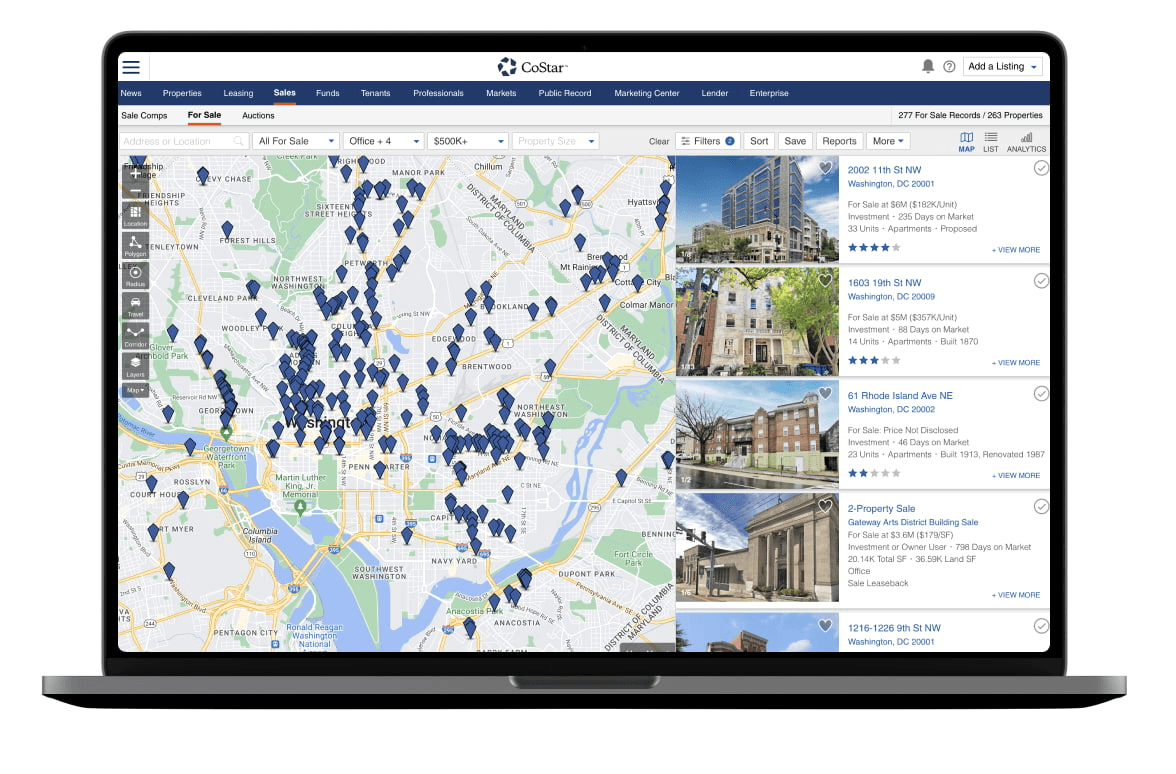

CoStar and LoopNet

CoStar is the dominant player in commercial real estate intelligence. It aggregates extensive datasets on leasing comps, sales comps, tenant rosters, loan histories, occupancy trends, and submarket analytics. Institutional investors rely on CoStar to benchmark underwriting assumptions and validate market rents or cap rates. LoopNet serves as the public listings marketplace for on-market deals.

Tradeoffs: These tools offer unmatched breadth, but they are expensive—prohibitively so for many small and mid-sized investors. Their interfaces can feel overwhelming, and negotiating contracts is notoriously painful. Still, for serious CRE players, CoStar often remains indispensable.

Reonomy

Reonomy tackles a different problem: figuring out who actually owns a property. Using entity resolution, it untangles layers of LLCs and holding companies to identify the decision-makers behind assets. This makes it essential for off-market deal sourcing, enabling investors to bypass crowded listing pipelines and go directly to owners.

Tradeoffs: While incredibly powerful, data quality can be inconsistent, and mastering its filters takes time. For firms pursuing cold outreach or direct-to-owner strategies, however, Reonomy is often one of the highest-ROI tool in the stack.

Privy

For residential fix-and-flip or BRRRR investors, Privy offers a unique angle: it tracks investor activity through MLS data. Instead of just telling you what properties are listed, it shows where investors are actually buying, and what they’re paying. This provides an edge in identifying undervalued neighborhoods before mainstream buyers catch on.

Tradeoffs: Privy is highly effective for residential strategies, but its utility stops at the commercial level. And because it relies on MLS coverage, availability varies by region.

Property Operations and Management

Once you own an asset, you need systems to manage it day-to-day. These platforms handle tenant relationships, maintenance, and rent collection.

Yardi

Yardi is the undisputed heavyweight of property management. Large multifamily operators, REITs, and institutional commercial owners rely on it as the operational backbone of their portfolio. It handles leasing workflows, maintenance ticketing, rent collection, budget tracking, AP/AR, accounting, and reporting—all in one ecosystem.

Tradeoffs: Yardi is best suited for large portfolios where the complexity justifies the implementation cost. Implementations can take months, integrations require specialized consultants, and the platform’s breadth means new teams face a steep learning curve.

AppFolio

AppFolio sits between accessibility and enterprise power. Built from the ground up as a cloud-native platform, it offers much of Yardi’s functionality with far less friction. Deployments happen weeks faster, updates are automatic, and the interface is intuitive enough for teams without formal training.

AppFolio excels for residential and light commercial portfolios. Workflows like renewals, maintenance coordination, marketing units, and tenant communication feel modern and lightweight.

Tradeoffs: It is less customizable than Yardi, which becomes apparent once portfolios grow complex or operational workflows deviate from the “AppFolio way.”

Portfolio Reporting and Analytics

Once operations are humming, the next question becomes: What story is the data telling?

This is where reporting and analytics platforms come in. Their purpose is to transform property-level data into portfolio-level intelligence: returns, risk, exposure, variance, and forward-looking insights.

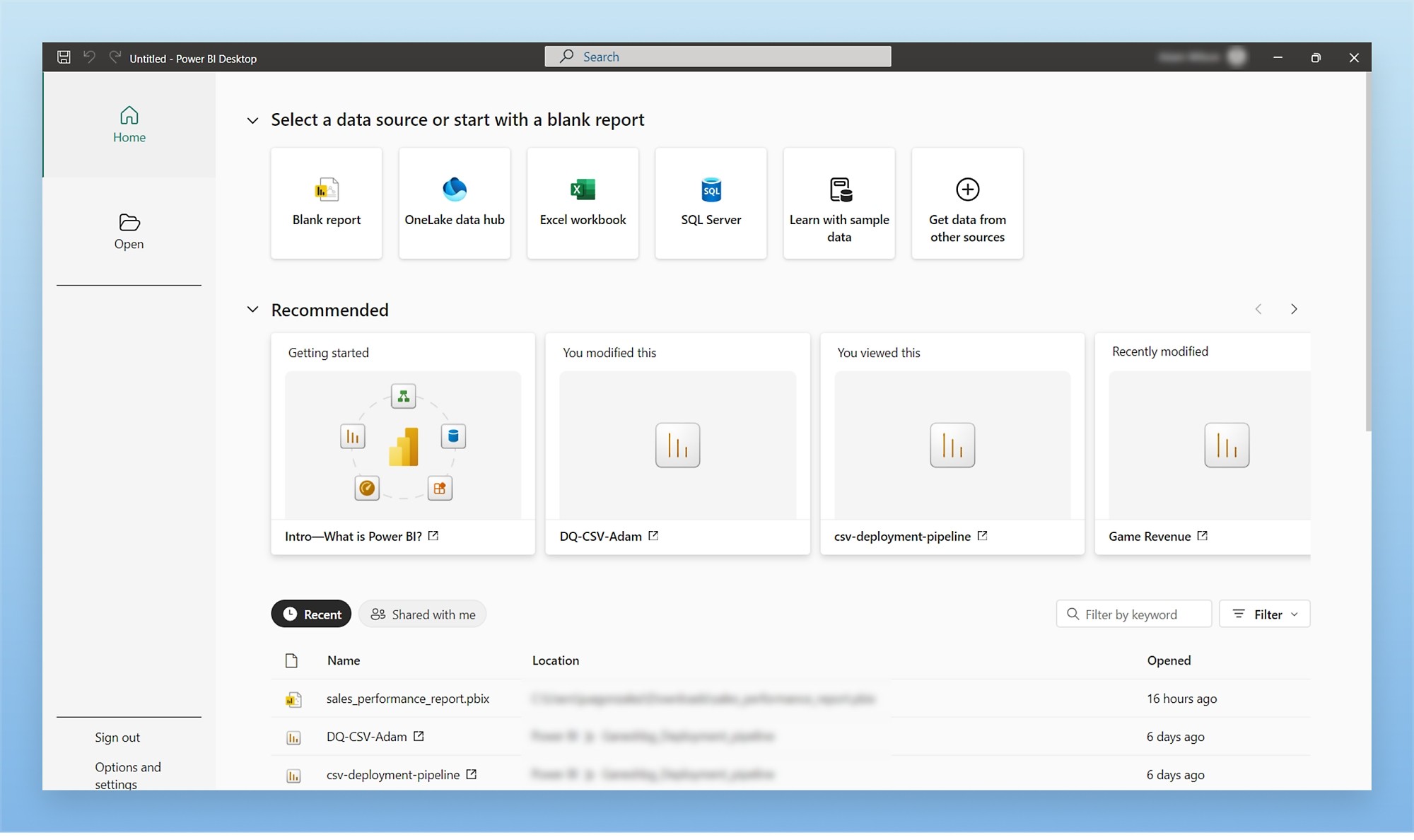

Tableau and PowerBI

Tableau and Power BI are the dominant choices for real estate analytics teams. They connect to nearly any data source, from your property management system to your underwriting models, and produce custom dashboards.

They can be transformative tools when paired with a strong ingestion layer, and nearly unusable without one. If your rent rolls are manually keyed, or if your operating statements arrive in unstandardized PDFs, the dashboards will reflect that inconsistency.

Buying Guide For Real Estate Investors: How to Evaluate Vendors

If you are in the market for new real estate software, the sales demo will always look perfect. The data will be clean, the dashboards will be green, and the reports will generate instantly. To assess the reality, you need to ask harder questions.

Don't just watch the vendor demo with their pre-loaded sample data. Most of the software in this industry can perform beautifully as long as the input is perfect. Bring the ugliest possible documents to your demo:

a scanned rent roll from a Class C property

a lease amendment with handwritten edits in the margins

a CAM reconciliation PDF with mixed formatting

an inspection report with photos embedded inside tables

If the system cannot understand documents it hasn’t seen before, or requires a human to map each new format, you will inherit that bottleneck. You want a system powered by AI agents that understand context, not rigid OCR templates that break the moment formatting changes.

Ask how the system integrates with the other tools in your stack. If you use ARGUS for modeling, can the system push data directly into ARGUS? If you use Yardi for property management, can it pull tenant data automatically? The best systems are designed to be part of an ecosystem, not a walled garden.

Selecting secure and reliable software is critical for real estate investors, who routinely handle sensitive financials, ownership records, tenant data, and investor communications. Beyond features, firms must ensure their tools meet modern standards for data protection, uptime, and operational resilience.

This means asking vendors clear questions about SLAs, including uptime guarantees, incident response times, and data recovery processes, and confirming that data handling complies with relevant privacy frameworks such as GDPR.

Certifications like ISO 27001, SOC 2, and other third-party audits offer strong signals that a provider follows rigorous security practices.

What to Buy Based on Portfolio Size

Choosing software is not just about features, it's about fit. A tool that’s perfect for a 200-unit owner is wildly inappropriate for a new investor with two duplexes. Here's what matters at each stage.

Small-Scale Investors (1-5 Properties)

New investors should focus on accessible, low-cost solutions that provide immediate value.

Look for tools that are intuitive and come with good customer support or educational resources. Many entry-level platforms offer guided setups and have vibrant user communities (like forums or help centers) to flatten the learning curve.

Typically, a beginner investor will benefit most from a solid deal analysis tool (to avoid bad purchases) and a simple property management solution (to efficiently handle tenants and rent). You might also use basic spreadsheets for a while, which is fine if you’re comfortable, but try to slowly migrate repetitive tasks to software to save time.

Mid-Size Investors (6-25 Properties)

Once you have a moderate portfolio, you’re likely experiencing the transition to a more sophisticated operation. What worked for a duplex might break down when you have 15 units across several locations. Here’s how to adapt your software stack as you scale:

You’ll want to move to software that can scale with your portfolio growth. This might mean upgrading from a free or basic plan to a tier with more features or users.

With more properties, keeping data in sync becomes a challenge. Integration between platforms becomes crucial. For instance, you might have one system for property management and another for accounting. Evaluate tools on how well they connect.

Established Investors (25+ Properties)

For large portfolios, enterprise-grade solutions are necessary. At this level, technology can be a competitive differentiator, so it’s worth ensuring you have best-in-class tools for each function.

With lots of data coming from your properties, you’ll want sophisticated reporting and optimization. This means software that can do portfolio-level analysis, risk modeling, and advanced performance metrics. Look for features like scenario planning (e.g., what happens to our portfolio value if interest rates rise 1% or if occupancy dips 5%?), benchmarking (comparing each property’s performance to market or to others in your portfolio), and perhaps predictive analytics (some platforms now offer AI insights, like predicting which tenants might be likely to move out or which capital improvements yield best ROI).

With a larger portfolio, you likely have a team. Ensure your software supports multiple users with roles and permissions, so people can collaborate without stepping on each other. A centralized communication tool (even something like Slack or Microsoft Teams, possibly integrated with your property software) can be useful to keep everyone aligned.

While others wait for analysts to finish typing data from PDFs, your team could be analyzing the trends that data reveals.

To see how you can automate the ingestion of your property data and your most painful manual workflows, book a demo with V7 Go.