AI implementation

11 min read

—

Nov 25, 2025

While others are still manually abstracting leases, early adopters are using AI to forecast trends and automate due diligence. Here is your roadmap to operationalizing AI across sourcing, underwriting, and management to stay ahead in 2025.

Imogen Jones

Content Writer

Ten years ago, spotting a critical discrepancy in a complex rent roll might require a weekend of manual review. Today, for forward-thinking CRE investors, there are AI platforms that could flag it in seconds.

Deloitte's 2024 Commercial Real Estate Outlook revealed that 76% of CRE firms are already exploring or implementing AI solutions. No wonder the global real estate AI market is projected to grow from $222.65 billion in 2024 to a whopping $988.59 billion by 2029.

Early adopters are using it to uncover undervalued properties, automate due diligence, and forecast market trends with far greater accuracy. Those who move first are already gaining a data advantage that compounds over time.

This guide explores how AI is reshaping commercial real estate investment and offers practical strategies for implementation and measuring impact. Readers interested in broader AI applications can find more information in our comprehensive guide to AI in real estate.

In this article:

How AI is changing commercial real estate investment

Core AI applications in CRE investment workflows

Leading AI platforms for CRE investment

Implementation strategy and measuring ROI

Future trends and strategic outlook

Knowledge work automation

AI for knowledge work

Get started today

Technology for Commercial Real Estate Investment

Traditional CRE investment analysis is labor-intensive and prone to human limitations. Analysts might spend weeks building pro forma models, combing through offering memoranda and leases, and compiling market comps, all under tight deadlines.

This manual process not only takes time, but also carries a higher risk of error. Human analysts are also limited in how much data they can process.

Important signals (like subtle market trends or early red flags in due diligence documents) might be overlooked due to sheer volume or cognitive bias. It’s not uncommon for investment teams to miss opportunities because they couldn’t review enough deals or to misjudge risk due to incomplete information.

AI for Commercial Real Estate Investment

AI fundamentally changes this equation. An AI system can ingest years of market data, thousands of property records, and real-time economic indicators to detect patterns that predict asset performance. It can comb through thousands of pages of documents in minutes, ensuring no material detail is missed during deal evaluation.

Across the industry, these advantages are driving widespread adoption of AI. Even historically tech-conservative CRE firms are realizing that those who harness AI’s capabilities can outpace those who don’t.

5 AI Applications for CRE Investors and Asset Managers

AI is being applied across the entire CRE investment lifecycle, from initial analysis to ongoing portfolio management. These applications are delivering measurable improvements in speed, accuracy, and profitability.

Due diligence is often where deals go to die, or where investment teams burn out. A single portfolio acquisition can involve thousands of pages: master service agreements, environmental reports (Phase I/II), estoppel certificates and more.

For example, a single property transaction might involve lease agreements referencing multiple amendments, each affecting different clauses within master service agreements, all of which impact the property's NOI calculations and ultimately its valuation.

Traditional document management systems fail here because they treat each document as a separate entity. AI document intelligence automates the extraction and analysis of this information. Platforms like V7 Go are leaders in CRE document intelligence, turning thousands of pages of dense legal and financial text into structured, actionable data. This is a core function of modern intelligent document processing.

Imagine a retail portfolio where a lease amendment references a clause in a document from three years ago. A human might miss the connection. An AI tool, however, builds a semantic network. It sees that a change in Document A triggers a compliance issue in Document B and immediately flags it for the asset manager.

A huge portion of real estate intelligence lies in unstructured text, like news articles, market research reports, earnings call transcripts, even social media and forums.

Natural Language Processing (NLP) enables AI to read and understand unstructured text data from news articles, market reports, social media, regulatory filings and more.

For example:

Systems can ingest news feeds and industry reports daily, automatically flagging relevant insights like a zoning change in a city, a major employer relocating, or a trend in consumer foot traffic.

NLP-based sentiment analysis can gauge market or community sentiment about a development project or a REIT’s reputation.

Instead of junior analysts skimming hundreds of articles, an AI assistant can summarize them and highlight those that matter most to the investor’s portfolio.

By processing the language of the market, no important qualitative factor slips through the cracks in investment decisions. AI tools can also scan public records, listing services, and news sources to identify potential on-market and off-market deals that match an investor's criteria.

So AI can help CRE investors find a great deal today, but what about looking to the future?

Traditional forecasting in CRE relies on expert opinion and lagging indicators, often low frequency, such as quarterly reports or historical comparables. AI changes that by integrating high-frequency, cross-domain data (everything from macroeconomic shifts to neighborhood-level mobility patterns) to model where markets are heading.

By finding patterns in how different factors correlate with past price changes, the AI can predict, for example, that “homes in this zip code are likely to appreciate 5% in the next six months” or flag that a certain condo market is overheating and due for a correction.

Of course, no model can foresee every “black swan” event, and AI forecasts are not replacements for expertise. They’re decision aids, helping investors quantify uncertainty and allocate attention more effectively. In practice, a lender might tighten credit criteria in a city where AI models flag declining absorption, or an investor might identify emerging submarkets before they appear in traditional reports.

Computer vision models analyze images and videos to assess property conditions, monitor construction progress, and even analyze foot traffic from satellite imagery. This technology provides automated, scalable property assessments, reducing the need for costly and time-consuming physical inspections.

For investors, this means quicker and more frequent property condition assessments, important for both acquisitions and managing existing assets. It can also act as a "sanity check" on third-party reports. If the OM says the roof was replaced in 2020, but the computer vision model detects significant weathering and pooling water, you know to dig deeper.

You can learn more about this use case in our blog, AI in Property Appraisal: Use Cases, Risks, and ROI.

After an asset is acquired, AI continues to add value by enhancing portfolio management. AI-driven dashboards provide real-time monitoring of asset performance, tracking everything from occupancy rates and rental income to operating expenses and market trends. These systems can run predictive analytics to forecast future performance and identify optimal times to buy, sell, or refinance.

For example, McKinsey highlights that real estate organizations using machine learning have successfully enhanced their Net Operating Income (NOI) by up to 10%. AI also helps with rebalancing strategies by simulating different market scenarios to determine the best portfolio adjustments.

AI Agents for CRE Investment Workflow Automation

Perhaps the most exciting emerging technology within AI for CRE investment is agentic AI. An AI Agent is an autonomous software entity capable of reasoning, planning, and executing multi-step workflows to achieve a high-level goal. They can proactively orchestrate the entire value chain of tasks that used to require a human to switch between three different screens and five different spreadsheets.

These AI agents act like diligent junior analysts, in need of supervision, but capable of intelligently undertaking complex work and using available tools.

For example, take this AI Real Estate Deal Sourcing Agent. Define your unique investment thesis (from asset class and geography to signs of distress or value-add potential) and let the agent continuously monitor the market to surface a pipeline of proprietary deal flow. The agent automatically scans listing platforms and public records daily, identifies new properties that fit your investment criteria, performs a preliminary underwriting on each, and then alerts your team with the top opportunities complete with a summary report.

Or an AI Real Estate Cash Flow Modeling Agent that hands the first pass of a tedious task to a specialized AI agent. It reads your rent rolls, leases, and operating statements, extracts all key inputs, and automatically builds a complete cash flow model in your firm's proprietary Argus or Excel template.

You can learn more about AI use cases in our blog, AI in Real Estate: Key Use Cases, Solutions, and Challenges.

V7 Go: AI for CRE Investment

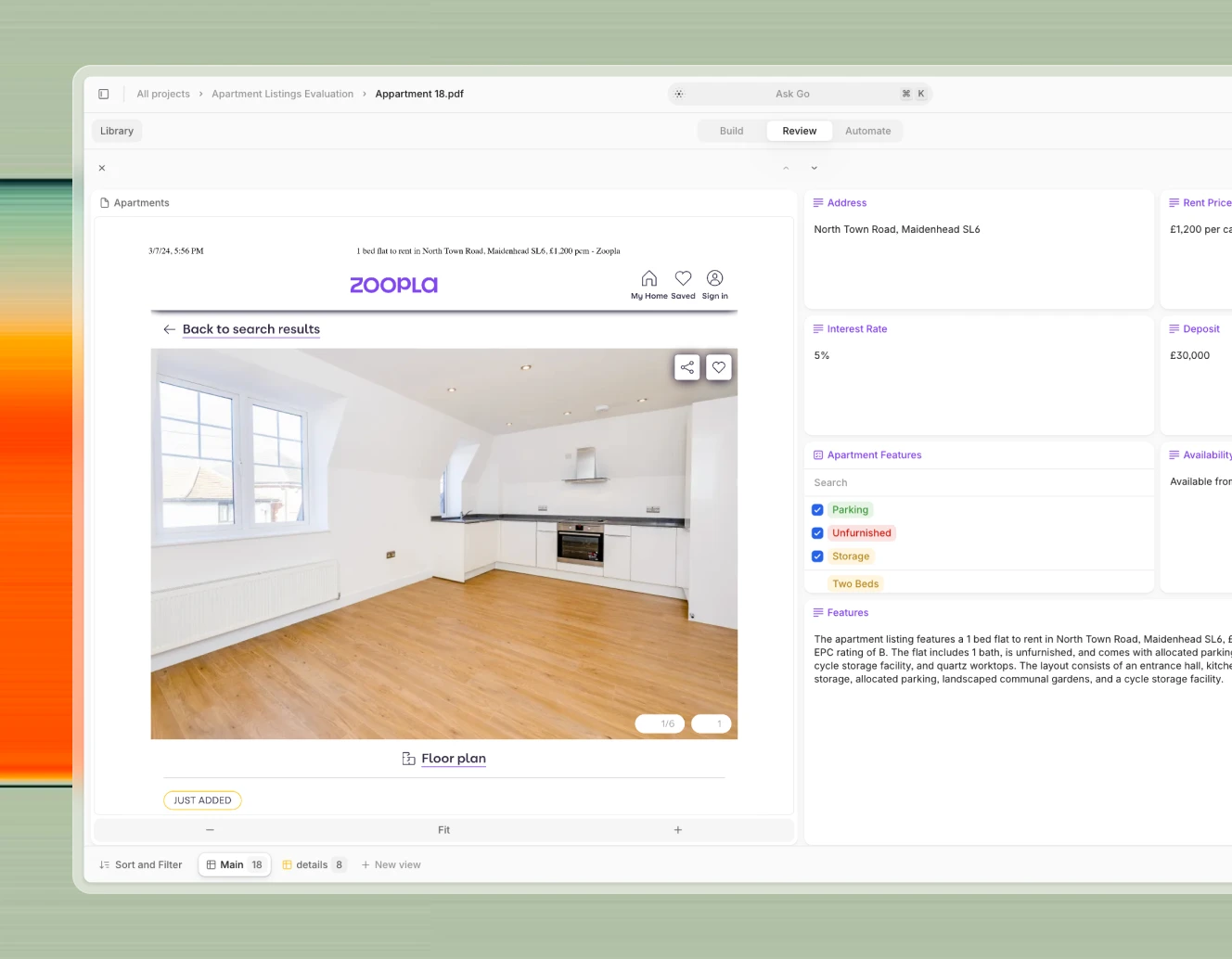

V7 Go is a premier solution for document-heavy workflows in CRE investment. It specializes in analyzing unstructured documents like leases, financial reports, and market research.

Crucially for investment, V7 Go solves the trust issue. Every extracted data point, whether it's a dimension from a floor plan or a clause in a tax record, includes a direct link back to the source file. This allows your team to move from raw files to automated property summaries or extracted data, with an audit trail that holds up to scrutiny.

By integrating directly with your existing models and CRMs, V7 Go transforms due diligence from a bottleneck into a competitive advantage, helping you get to a high-conviction "yes" (or a fast "no") while competitors are still manually abstracting leases.

With enterprise-grade security, it ensures all sensitive investment information remains protected.

5 Step Implementation Strategy for CRE Investment AI

Implementing AI requires a structured, strategic approach to ensure it delivers tangible value.

1. Audit the "Deal Funnel" & Define High-Friction Zones

Don't just "evaluate workflows." Specifically map the lifecycle of a deal to identify where high-paid analysts are doing low-value work.

In most firms, the bottleneck is the Data Ingestion Phase, the manual scrubbing of unstructured PDFs (OMs, T12s, Rent Rolls) into Excel or Argus models.

Begin with a pilot program focused on a high-impact, low-risk use case. Document processing for due diligence is an excellent starting point because it offers clear, measurable time savings and accuracy improvements. This allows you to demonstrate value quickly and build momentum for broader adoption.

Run a "Side-by-Side" test (Back-testing). Have the AI process a set of historical deals that your team has already underwritten. Compare the AI’s output against the human-verified data to establish an accuracy baseline.

The friction in adoption is often cultural. Address the human side of implementation. Emphasize that AI is a tool to enhance their expertise, freeing them from manual tasks to focus on strategy, negotiation, and relationship building (the factors that actually win competitive deals.)

However, without rigorous training, even the most powerful AI platform will become expensive "shelfware." CRE firms frequently sabotage their own implementation by falling into three specific traps:

Assuming software is simple enough to skip formal training. In complex workflows, nuance matters; if users don't understand the tool, they will revert to Excel.

They introduce tools too late in the process, when employees are already feeling frustrated. Similarly, training must happen proactively, not during a crunch period.

Believing tech will fix broken internal processes. AI accelerates your workflow, but it cannot fix a flawed one.

Comprehensive, early education reduces resistance to change and establishes groundwork for long-term operational success.

Eliminate data silos. Your AI platform must not function as an island; it needs to seamlessly connect with your existing ecosystem, such as your CRM, portfolio management software, or proprietary databases. Demand interoperability to ensure that valuable data extracted from documents flows directly into your systems of record without manual re-keying.

Simultaneously, treat data as a strategic asset. AI is only as capable as the information it processes, so prioritize data hygiene. Establish clear standards for how data is labeled, stored, and verified. By enforcing a "Single Source of Truth," you ensure that the insights generated by your AI are accurate, actionable, and trusted.

To justify AI investment, you must track specific performance metrics. Key KPIs include:

Processing Time Reduction: Measure the decrease in time spent on tasks like underwriting and due diligence. Reports show AI can reduce loan processing from weeks to hours.

Cost Savings: Track reductions in operational and labor costs. Automated underwriting can lead to cost savings of up to 20%.

Increased Deal Capacity: Measure the number of deals your team can evaluate. Some firms report handling 3-4 times more applications with the same staff.

Accuracy Improvement: Monitor the reduction in manual errors. Improved accuracy can lead to better investment decisions and lower default rates.

NOI Uplift: The ultimate benchmark is the impact on portfolio performance. Track improvements in Net Operating Income as a direct measure of AI's value.

Future Trends and Strategic Outlook for AI in CRE Investment

The evolution of AI in CRE investment is just beginning. We can expect to see more sophisticated predictive models, greater integration across platforms, and the rise of autonomous AI agents that can manage entire investment workflows. As AI becomes more widespread, the competitive landscape will shift. Firms that fail to adopt this technology will find themselves outmaneuvered by competitors who can analyze deals faster, more accurately, and at a lower cost.

The strategic imperative is clear: building long-term AI capabilities is not optional for maintaining competitiveness. Start now by investing in the right technology, training your team, and rethinking your workflows around an AI-first approach.

Ready to get started? Transform your CRE investment process with V7 Go.

How much can AI improve returns on commercial real estate investments?

AI can significantly improve returns by enhancing decision-making and operational efficiency. Firms adopting machine learning have reported boosting Net Operating Income (NOI) by up to 10%. Early adopters of broader AI solutions have seen an average ROI of 15-20% on their technology investments. These gains come from faster deal sourcing, more accurate underwriting, reduced operational costs, and optimized portfolio performance.

+

What are the initial costs and implementation timelines for CRE investment AI?

Initial costs vary widely based on the solution's complexity, from thousands of dollars for specialized software to much larger investments for enterprise-wide platforms. Implementation timelines also vary. A focused pilot program, such as automating document review with a platform like V7 Go, can often be up and running in a matter of weeks. A full-scale, integrated deployment across multiple departments could take several months to a year.

+

How do institutional investors use AI differently than smaller CRE investment firms?

Institutional investors often deploy AI at a larger scale, building proprietary datasets and custom algorithms for predictive market analysis and large-scale portfolio optimization. They may have dedicated data science teams to build and maintain these systems. Smaller firms typically leverage off-the-shelf AI platforms and tools to automate specific workflows like underwriting, due diligence, and deal sourcing. They focus on accessible, high-ROI applications to compete with the scale of larger institutions.

+

What types of CRE investment decisions benefit most from AI analysis?

Decisions that rely on large volumes of data and complex analysis benefit most. This includes initial investment screening and underwriting, where AI can analyze risk and forecast returns with greater speed and accuracy. Due diligence is another key area, as AI can review thousands of documents to identify risks. Finally, portfolio management decisions, such as when to buy, sell, or refinance assets, are significantly improved by AI's predictive capabilities.

+

How do I ensure data quality and accuracy when using AI for investment analysis?

Key considerations include data privacy, algorithmic bias, and transparency. Firms must ensure their AI systems comply with data protection regulations like GDPR. It is also crucial to monitor AI models for biases that could lead to unfair or discriminatory outcomes. Regulators are increasingly focused on the explainability of AI decisions, meaning firms must be able to document and justify how their AI models arrive at their conclusions, especially in areas like lending and valuation.

+

What are the regulatory and compliance considerations for AI in CRE investment?

Go is more accurate and robust than calling a model provider directly. By breaking down complex tasks into reasoning steps with Index Knowledge, Go enables LLMs to query your data more accurately than an out of the box API call. Combining this with conditional logic, which can route high sensitivity data to a human review, Go builds robustness into your AI powered workflows.

+