Document processing

32 min read

—

Jun 17, 2025

Unlock insights from complex funding prospectuses with AI. Learn how V7 Go streamlines analysis, enhances accuracy, and transforms due diligence for financial professionals.

Casimir Rajnerowicz

Content Creator

In the financial world, information is everything—but it often comes wrapped in hundreds of pages of dense prospectuses. Whether it's a mutual fund prospectus or an IPO offering document, analysts and investors face the daunting task of sifting through legal jargon, tables of fees, and exhaustive risk disclosures. The pain points are clear: manual prospectus review is notoriously time-consuming, error-prone, and frankly overwhelming.

Investment professionals often spend upwards of 12-15 hours per prospectus manually reviewing these lengthy, complex documents. This inefficiency is obviously a time sink. But, in consequence, it also limits the number of opportunities that can be thoroughly evaluated and creates inconsistency in analysis depth. Critical risks often buried in fine print and easily missed under pressure.

Fortunately, advances in Artificial Intelligence (AI) and AI platforms developed specifically for finance are now changing the game. By leveraging generative AI in finance and intelligent automation, firms can dramatically speed up document analysis without sacrificing accuracy. It’s a fundamental shift. For example, V7 Go's AI agents can reduce document review time from days to mere hours, while identifying approximately 30% more potential risk factors that might have been overlooked in a manual read-through. For a broader understanding of how AI is impacting related financial processes, exploring AI due diligence for M&A and beyond provides valuable context.

In this comprehensive guide, we'll explore how AI, particularly exemplified by V7 Go, can transform the prospectus analysis process. We will cover:

The essential nature of a funding prospectus: its purpose, key components, and diverse types.

The significant challenges and bottlenecks inherent in manual prospectus review.

How AI solutions, with a focus on V7 Go’s capabilities, augment and empower financial professionals.

Actionable best practices for successfully implementing AI in prospectus analysis workflows.

The future outlook for AI in financial document review and its impact on the industry.

By the end, you'll see how modern AI document automation turns prospectus review from a tedious chore into a strategic advantage. This translates into well-informed decision-making, enhanced compliance, and greater operational efficiency.

Understanding the Funding Prospectus: Purpose and Types

A funding prospectus, often referred to as an investment prospectus, is a formal legal document that companies and investment funds are required to produce. It meticulously discloses comprehensive details about an investment offering to potential investors. Mandated by regulatory bodies such as the Securities and Exchange Commission (SEC) in the U.S., this document forms an integral part of a company's broader registration statement.

The fundamental legal objective behind a prospectus is to ensure full transparency, providing all material information—facts, figures, and potential risks—necessary for investors to make well-informed decisions, thereby safeguarding their interests. Beyond its critical role in regulatory compliance, a prospectus also serves a strategic purpose as a marketing and sales instrument. Companies utilize it to articulate their history, operational model, performance track record, and the expertise of their management team, aiming to attract new capital.

Legal and financial due diligence can be accelerated and automated with AI solutions

For investors, the prospectus is an invaluable resource, offering profound insights into potential investments, clarifying the investment objectives and strategies, detailing the intended use of the raised capital, and meticulously outlining associated risk factors. These critical documents are readily accessible directly from the issuing company, through brokerage firms, or via the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) online portal, which hosts public company filings. The SEC's stringent requirement for prospectuses inadvertently fosters the creation of a standardized, legally robust marketing document, which can mitigate information asymmetry by aiming to equalize the informational playing field and promote fairer market pricing.

The Anatomy of a Prospectus: Key Components

A prospectus, by law, must contain specific, detailed sections, though their precise organization may vary. These mandated components ensure that investors receive a comprehensive overview necessary for informed decision-making. Understanding these sections is crucial for any analysis, whether manual or AI-assisted. Key sections typically include:

Section | Description | Significance for Investor |

|---|---|---|

Company Profile & Management | Provides an in-depth overview of the company or fund, its operational model, product/service offerings, historical trajectory, growth strategies, and core business objectives. It also includes critical information about the company's key officers, their professional biographies, and compensation details. | Crucial for assessing the business foundation, the quality and experience of its leadership, and its overall strategic direction and viability. |

Investment Objectives & Strategies | Delineates the financial aspirations of the investment (e.g., long-term capital growth, stable income, high total return) and outlines the precise methods, policies, and strategies the fund or company employs to manage and allocate its resources to achieve these objectives. This includes details on asset allocation, specific investment restrictions, and the potential use of derivatives or leverage. | Paramount for an investor to determine if the offering aligns with their personal financial goals, risk appetite, and investment timeline. |

Use of Capital/Proceeds | Explicitly details how the company or fund intends to deploy the funds raised from the sale of its securities. This could include R&D, market expansion, acquisitions, debt repayment, or general corporate purposes. | A key indicator of the company's financial health, its specific plans for future growth and investment, and the prudence of its capital allocation strategy. |

Risk Factors | Meticulously outlines potential elements that could adversely impact the investment. These can range from market-specific risks (e.g., interest rate changes, sector downturns), economic factors (recession, inflation), to company-specific risks (e.g., litigation, management issues, competitive threats, technological obsolescence). | Indispensable for investors to assess their personal risk tolerance against the disclosed vulnerabilities. This section helps in understanding the potential downsides and uncertainties of the investment. |

Financial Statements | Provides a transparent view into the company's financial health and historical performance through audited financial statements, typically including the balance sheet, cash flow statement, and income statement. This section presents key performance indicators (KPIs), revenue sources, profitability metrics, debt levels, and cash flow analysis, often spanning the past three to five years. | Allows investors to scrutinize the company's financial stability, profitability trends, liquidity, and overall financial management. |

Offering Details & Investment Costs | Conveys essential information about the securities being offered, including their type (e.g., common stock, bonds, fund units), the number of shares/units, how and where they will be traded, and their initial price or price range. It also details all associated fees, charges, and expenses (e.g., front-end/back-end loads, 12b-1 fees, management expense ratios for funds). | Helps investors understand the specifics of the investment terms, the nature of the security they are buying, and the full impact of costs on potential returns. |

Performance Data | Presents the historical performance of the fund or company, typically mandated for one, five, and ten-year periods, or for the life of the fund if its operational history is shorter. Includes a standard disclaimer that past performance is not indicative of future results. Portfolio turnover data is also disclosed, offering insights into potential expenses and tax implications. | Offers context on past returns and volatility, although with the crucial caveat that future results may differ. High turnover can indicate higher trading costs. |

The standardized, mandatory components of a prospectus collectively function as a de facto due diligence checklist. This inherent structure implicitly trains investors, analysts, and new market entrants on the critical areas to scrutinize when assessing any investment opportunity, effectively standardizing the process of inquiry.

Navigating the Landscape: Diverse Types of Prospectuses

The capital markets employ a variety of prospectus types, each meticulously designed to fulfill specific disclosure purposes and adhere to distinct regulatory requirements throughout the multifaceted fundraising process. These variations reflect a nuanced approach to balancing market efficiency with investor protection.

Type | Key Characteristics | Primary Use/Context |

|---|---|---|

Red Herring Prospectus (Preliminary Prospectus) | A preliminary document issued for offerings like IPOs. Contains most information but lacks final pricing or deal terms. Marked with a red disclaimer. | Used to gauge investor interest during roadshows and solicit feedback before definitive pricing is set. |

Final Prospectus (Statutory Prospectus / Offering Circular) | The complete and definitive offering document released after regulatory approval. Incorporates all final details, including offering price, number of shares/units, and subscription dates. | The primary legal document used during the public offering itself for investors to make their final investment decision. |

Shelf Prospectus | Allows established, publicly traded companies to make multiple issues of specified securities over a period (typically up to three years) without filing a new, full prospectus for each offering. A base prospectus is filed, with supplements for each takedown. | Provides flexibility and efficiency for established companies to quickly access capital markets when conditions are favorable. |

Abridged Prospectus | A condensed version of the full prospectus, presented in a prescribed, simplified format. Highlights key information. | Tailored for retail investors to facilitate easier comprehension of the offering details, making complex information more accessible. Often accompanies application forms. |

Statutory Mutual Fund Prospectus | The traditional, comprehensive, long-form document providing exhaustive details about a mutual fund or ETF, including objectives, strategies, risks, fees, and performance. | The primary disclosure document for mutual fund investors, updated regularly (often annually). |

Summary Mutual Fund Prospectus | A concise document, typically 2-4 pages, containing key information about a fund in a standardized format. Legally can satisfy prospectus delivery requirements if the full prospectus is readily available online. | Designed to make it easier for retail investors to digest key fund information and compare different mutual funds quickly. |

Private Placement Memorandum (PPM) / Offering Memorandum | Serves an analogous disclosure function for private offerings (e.g., hedge funds, private equity, Regulation D offerings). Not technically a “prospectus” but provides substantial detail on managers, strategy, terms, and risks. Typically 30-60 pages or more. | Used for offerings exempt from SEC registration, providing comprehensive disclosure to accredited or sophisticated investors. Essential for legal compliance and investor due diligence in private markets. |

The variety of prospectus types demonstrates a deliberate regulatory effort to balance market efficiency with robust investor protection. Even in less regulated segments like private placements, the provision of comprehensive PPMs indicates a market-driven demand for transparency and detailed disclosure, reflecting a broader financial principle beyond mere compliance.

The Regulatory Backbone: SEC Filings and Compliance

Companies offering public securities in the U.S. are legally obligated to file their prospectuses with the SEC, typically as part of a larger registration statement (e.g., Form S-1 for IPOs). The SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system is the primary platform for these submissions and serves as a vast, publicly accessible online portal. EDGAR provides historical data stretching back to 1994, making it an indispensable resource for financial intelligence and research.

Mutual fund companies face a continuous obligation to update their prospectuses to reflect current information, at least every 13 months. This ensures that investors always have access to timely data. For summary prospectuses, funds must also post their current summary, the full statutory prospectus, Statement of Additional Information (SAI), and recent annual/semi-annual reports online. The SAI provides even more granular detail than the primary prospectus.

The stringent and frequent update requirements for prospectuses underscore the dynamic nature of financial markets and the ongoing obligation for issuers to provide current and relevant disclosures. Manually managing this continuous compliance process across numerous funds or offerings creates a significant operational burden, especially for larger institutions. This makes such recurrent, document-intensive tasks prime candidates for AI-powered automation, which can ensure timeliness and accuracy in regulatory filings.

The Bottlenecks of Traditional Prospectus Analysis

Despite their undeniable critical importance, traditional, manual methods for analyzing funding prospectuses are deeply inefficient and fraught with significant challenges. These bottlenecks inevitably lead to errors, delays, missed strategic opportunities, and increased operational costs.

One of the most significant hurdles is the Overwhelming Volume and Complexity of these documents. As noted earlier, prospectuses can easily exceed 100 pages, while Private Placement Memoranda (PPMs) often range from 30 to 60 pages, packed with complex financial data and legal jargon. This sheer length is compounded by dense legal and financial jargon, intricate accounting standards, evolving regulations, and the presence of sophisticated financial instruments. Manually navigating this textual maze is not just time-consuming; it's cognitively demanding, leading to analyst fatigue and a higher likelihood of oversight.

This manual approach directly contributes to Pervasive Data Errors and Inaccuracies. The process of manually extracting data from these documents and transcribing it into spreadsheets or internal systems is inherently prone to error. Studies have alarmingly revealed that nearly 88% of spreadsheets contain errors, ranging from simple typos to more significant formula mistakes. Human error in financial analysis can stem from various factors, including misinterpretations of complex accounting requirements, the pressure of tight deadlines, high staff turnover in accounting departments, or even cognitive biases influencing judgment. As a consequence, a prospectus review might take 12-15 hours, yet still miss subtle but critical risks or inconsistencies.

The immediate result is crippling Inefficiency and Time Consumption. Financial operations are inherently time-critical. Manual processing invariably leads to substantial delays that can impact deal timelines or compliance deadlines. The extraction of key data from documents like Confidential Information Memoranda (CIMs) and detailed financial statements is notoriously labor-intensive. This consumes an inordinate amount of time and valuable human resources, diverting highly skilled professionals from more complex, higher-value analytical and strategic tasks such as interpreting findings, assessing strategic fit, or engaging with management teams.

A further significant challenge arises from the Lack of Standardization and Comparability Issues. The absence of universal standardization in financial reporting, particularly with different accounting standards (e.g., IFRS versus US GAAP) employed across various countries and industries, can severely impede the ability to accurately compare financial statements from different companies. Even within the same jurisdiction, companies may present information in slightly different formats. This lack of uniformity makes apples-to-apples comparisons extremely difficult without extensive (and manual) normalization. Furthermore, the inherent complexity of financial reporting can create compliance barriers for smaller companies, potentially leading to a lack of transparency and accuracy in their disclosures. The absence of standardized documentation formats across various legal and financial documents further complicates cross-referencing and maintaining consistency in analysis portfolios.

Financial statements, by their very nature, possess an Elevated Inherent Risk of material misstatements. This “inherent risk” arises from factors such as the complexity of the business's transactions, the subjective judgment required in accounting estimates (e.g., asset valuations, loan loss provisions), and the unique characteristics of the business itself or the industry it operates in. A high volume and variety of transactions, or operations in volatile markets, further amplify this inherent risk. Auditors are specifically tasked with identifying these high-risk areas to allocate more attention during their review, but the initial identification often relies on the thoroughness of internal analysis.

Finally, the financial sector operates under a constantly evolving and increasingly complex web of accounting standards and regulations, creating Intricate Compliance Burdens. Navigating and ensuring compliance with these intricate rules manually demands a high level of specialized technical knowledge, continuous learning, and meticulous attention to detail. This makes compliance verification particularly challenging and susceptible to oversight, especially when regulations change frequently or differ across jurisdictions.

Beyond the readily apparent direct labor costs, manual prospectus analysis accrues substantial “hidden costs.” These include the financial impact of suboptimal investment decisions based on incomplete or inaccurate data, missed market opportunities due to slow analysis, increased exposure to regulatory penalties from compliance oversights, and even reputational damage. The concept of “inherent risk” further suggests that manual processes exacerbate the natural susceptibility of financial statements to misstatement, thereby increasing overall audit risk. Consequently, the true cost of manual analysis extends far beyond mere salaries; it encompasses a spectrum of operational inefficiencies and strategic limitations.

The Impact of AI on Prospectus Analysis

Artificial Intelligence is fundamentally reconfiguring the landscape of financial analysis, enabling a shift from reactive, static data reviews to proactive identification of trends, accurate outcome prediction, and strategic decision-making with unparalleled speed and precision. This transformation is powered by a suite of advanced AI capabilities that directly address the shortcomings of manual prospectus review.

Core AI Capabilities involved include:

Optical Character Recognition (OCR) and Computer Vision: Convert diverse document types (printed, handwritten, scanned images, PDFs) into machine-readable data. Advanced computer vision interprets layouts, charts, and graphs.

Agentic Document Extraction: Preserves visual and spatial context, understanding complex layouts and accurately capturing structured elements like checkboxes, flowcharts, and financial tables.

Natural Language Processing (NLP): Empowers AI to analyze, interpret, and comprehend human language, extracting sentiment, intent, and key themes from unstructured text.

Large Language Models (LLMs): Go beyond simple text processing to understand context, discern relationships, and accurately identify relevant data points, even in unconventional formats. Platforms like V7 Go allow users to leverage LLMs for structured information extraction.

Retrieval Augmented Generation (RAG) and Vector Databases: Enable AI systems to query massive datasets and ground outputs directly in source data, ensuring rapid searches and high accuracy while reducing hallucinations.

Multimodal AI: Integrates text and image analysis to process diverse inputs, enhancing the scope and accuracy of data extraction.

AI Agents and Workflows: Orchestrate various AI technologies, breaking down complex tasks into manageable sub-tasks and applying the most appropriate technology to each step. For instance, V7 Go’s agents can be customized for specific prospectus review workflows.

These capabilities translate into several transformative applications in prospectus analysis:

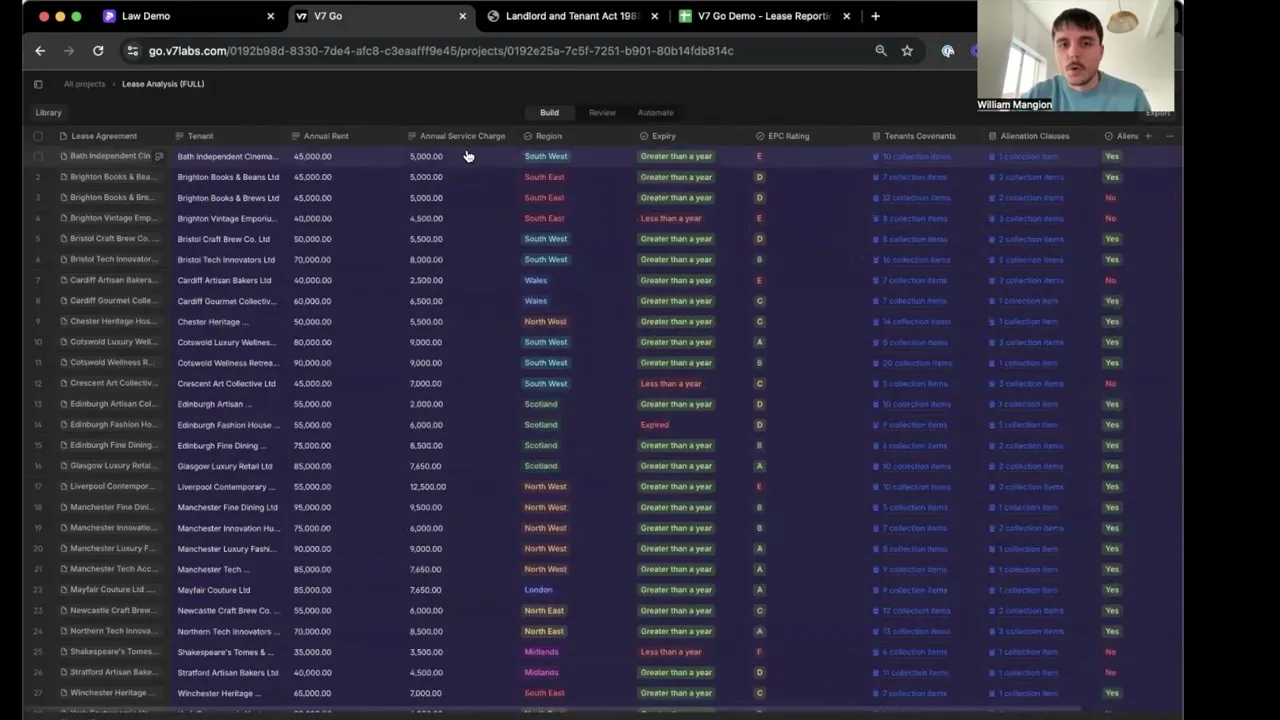

Automated Data Extraction: AI can automatically pull out crucial data points from a prospectus, regardless of their location or format. This includes extracting fee structures from mutual fund prospectuses (expense ratios, sales charges), use of proceeds and share offering details from IPO prospectuses, or key financial statements and metrics from an issuer. The AI understands context, distinguishing management fees from performance figures or risk factors from general information. By converting unstructured prospectus text into structured data (e.g., a CSV or JSON), AI makes analysis exponentially faster. An analyst using V7 Go can obtain a ready-to-analyze dataset instead of manually hunting through a PDF.

V7 Go extracting key sections from a 10-Q form.

Summarization and Natural-Language Q&A: Modern generative AI can digest a 150-page prospectus and distill it into an executive summary or answer specific questions in seconds. For instance, an analyst could ask V7 Go, “What are the main liquidity risks mentioned in this fund?” or “Summarize the company's M&A strategy as described in the IPO prospectus.” The AI generates a concise, source-referenced answer. Complex legal language can be rephrased in plain English. This interactive capability, often through a chat interface, saves enormous time and improves comprehension.

Compliance Checks and Validation: AI acts as a tireless compliance assistant. It can automatically verify if prospectuses include mandated disclosures (e.g., “past performance” disclaimers, all required SEC sections like MD&A or Risk Factors). V7 Go can be configured with custom rules to flag deviations, anomalies (like an unusually short risk factor section), or inconsistencies (e.g., a financial figure in the text not matching the audited statements). This systematic cross-checking drastically reduces compliance oversight risks.

Visual Grounding of Data: Prospectuses contain vital information in charts, graphs, and tables (e.g., historical fund performance charts, fee breakpoint tables). AI systems like V7 Go perform multi-modal analysis, “seeing” and incorporating this visual data. If a prospectus states “refer to the chart below” for performance, V7 Go’s AI knows to look at that chart. This visual grounding, where AI links narrative text with visuals and can highlight the exact source of information on the document page, is crucial for trust and eliminates blind spots.

AI Citations in V7 Go allow users to click on an extracted data point and see the precise highlighted text in the source documents.

Interactive AI Chat + Spreadsheet UI: V7 Go blends conversational AI with structured output. A user might query via chat (“List all management fees and their percentages”) while the AI concurrently populates a spreadsheet with the extracted data. This dual interface caters to varied analytical needs—quick insights via chat and organized data for deeper analysis or reporting. This approach is user-friendly, mirroring how analysts often toggle between narrative understanding and quantitative work.

Multi-Document and Comparative Analysis: AI excels at reviewing multiple prospectuses simultaneously. An analyst comparing three mutual funds can have AI extract key metrics (fees, performance, manager tenure) from all three and generate a side-by-side comparison table. If tracking changes, AI can redline differences between an old and new prospectus version, instantly highlighting new risk factors or fee adjustments. This scalability allows firms to monitor a vast universe of filings (e.g., all new EDGAR submissions in a sector) for specific criteria and receive alerts.

Crucially, these AI-driven capabilities augment human expertise, not replace it. The AI handles the exhaustive groundwork, presenting findings for human analysts to interpret and apply strategic judgment. This augmentation is already yielding tangible results. Deloitte researchers note AI tools can slash due diligence timelines. V7's prospectus analysis agent, for example, can reduce review time from over 12 hours to just 1-2 hours, while identifying approximately 30% more potential risk factors.

The following table summarizes how AI addresses manual analysis challenges:

Manual Challenge | AI Solution | Key Benefit |

|---|---|---|

Inefficiency & Time Consumption (12-15 hrs/prospectus) | Automated Data Extraction & Summarization | Significant time savings (e.g., review time reduced to 1-2 hours). Enables analysis of more opportunities. |

Data Errors & Inaccuracies (human oversight, fatigue) | Enhanced Accuracy & Consistency with Visual Grounding | Dramatic accuracy improvement (error chances <1%); V7 Go identifies ~30% more risks. Verifiable outputs. |

Overwhelming Volume & Complexity (100+ pages of dense text) | Scalable & Deep Processing (NLP, LLMs) | Handles thousands of pages in seconds, comprehends complex jargon, extracts from tables/charts. |

Lack of Standardization & Comparability (IFRS vs. GAAP, varied formats) | Contextual Understanding & Data Normalization | Processes unstructured data into standardized, comparable formats; understands context for better cross-document analysis. |

Limited Information Generation (focus on extraction, less on synthesis) | Advanced Analytics, Q&A, & Multi-Document Comparison | Generates uniform summaries, enables interactive querying, facilitates side-by-side comparisons across multiple prospectuses. |

How to Successfully Implement AI for Prospectus Analysis

Adopting AI for prospectus analysis is a strategic initiative, not just a tech upgrade. Effective implementation maximizes benefits and integrates AI seamlessly into existing financial workflows. Here’s a more in-depth guide:

Identify Clear Use Cases and Specific Objectives: Before selecting any tool, clearly define what problems you aim to solve or what processes you want to improve. Are you looking to reduce initial screening time for IPOs? Do you need to extract all fee-related information from mutual fund prospectuses for a comparative database? Is the goal to automate compliance checks for specific regulatory disclosures? Quantifiable objectives are crucial. For example: “Reduce the manual effort for extracting Schedule of Investments from fund prospectuses by 90%,” or “Increase the number of IPO prospectuses reviewed per analyst per week by 50% while maintaining or improving risk identification accuracy.” V7 Go, for example, allows users to configure AI agents for very specific extraction and analysis tasks tailored to such objectives.

Ensure Data Readiness and Accessibility: AI's effectiveness heavily depends on the quality and accessibility of the data it processes. Gather your prospectuses, typically PDFs from sources like EDGAR, issuer websites, or internal archives. For scanned or image-based documents, ensure robust OCR capabilities (often built into platforms like V7 Go). Organize documents logically (e.g., by issuer, date, type) to facilitate bulk ingestion and processing. Consider how the AI will access this data – will it be manual uploads, or an integration with a document management system or a direct feed from a data provider? Address data quality issues like missing pages, poor scan quality, or inconsistent naming conventions upfront.

Choose the Right AI Tools and Platform: The market offers a spectrum of options, from building custom solutions with LLM APIs (like OpenAI's GPT series) to adopting specialized platforms. Key evaluation criteria include: accuracy in extracting financial and legal text, ease of use for non-technical analysts, security protocols (especially for any non-public data), scalability for handling large volumes, and integration capabilities. For prospectus analysis, a platform like V7 Go is compelling because it comes with many pre-configured templates and AI workflows for financial documents, understands industry-specific language, and offers features like visual grounding and customizable workflows without requiring extensive coding. Carefully vet data privacy and security policies; for sensitive analyses, ensure the platform supports deployment in a private cloud or on-premise environment if required by your compliance standards.

Conduct a Pilot Program and Customize Iteratively: Start with a pilot project targeting a well-defined use case. Select a representative sample of prospectuses (e.g., 5-10 documents of varying types and complexities) and thoroughly test the AI's performance. Involve end-users—analysts, compliance officers, portfolio managers—from the outset. Gather their feedback: Did the AI extract the data accurately and completely? Were the summaries useful? Were there any critical omissions or misinterpretations? Use this feedback to customize and refine the AI. With V7 Go, customization might involve adjusting prompts for specific information, adding custom extraction fields for proprietary metrics, or fine-tuning the summarization length and style. This iterative process of testing, feedback, and refinement is key to aligning the AI's output with your organization's specific needs and building user trust.

Integrate AI into Existing Workflows: For AI to deliver sustained value, it must be embedded into your daily operations, not used as a standalone, isolated tool. Map out how AI-generated outputs will flow into subsequent steps. For instance, structured data extracted by V7 Go can be automatically exported to Excel for financial modeling, to a BI tool for dashboarding, or to a CRM for client reporting. Compliance flags raised by the AI could trigger alerts in a GRC (Governance, Risk, and Compliance) system. Leverage APIs and connectors (V7 Go, for instance, supports various integration methods) to ensure smooth data transfer. Define new roles and responsibilities if necessary, and clearly communicate how AI changes existing processes. The goal is a synergistic workflow where AI handles the data-intensive tasks, and humans leverage those outputs for strategic decision-making.

Maintain a Robust Human-in-the-Loop (HITL) Strategy: While AI achieves high accuracy, human oversight remains indispensable, especially in high-stakes financial analysis. Implement a HITL strategy where analysts review and validate AI-generated outputs, particularly for critical data points or ambiguous interpretations. Platforms like V7 Go facilitate this by providing source-linked citations—users can click on any piece of AI-extracted information and be taken directly to the relevant section in the source prospectus for verification. This traceability builds trust and allows for quick corrections. The HITL process also serves as a continuous feedback mechanism to improve the AI's performance over time. The level of human oversight can be adjusted as confidence in the AI system grows, moving from comprehensive reviews to exception-based spot-checks.

Measure Impact, Iterate, and Stay Updated: Continuously monitor the AI's performance against the objectives defined in Step 1. Track key metrics: time saved per prospectus, number of documents processed, error rates (AI vs. manual), and qualitative feedback from users. Are analysts able to cover more ground? Has the quality of initial reviews improved? Use these insights to further refine the AI configuration, prompts, or workflows. The field of AI is evolving rapidly; stay informed about new features and model updates from your chosen platform provider. V7 regularly enhances its AI agents and capabilities, offering opportunities to further optimize your prospectus analysis process.

Ensure Comprehensive Compliance and Data Governance: Financial data is highly sensitive and regulated. Ensure your AI implementation adheres to all relevant data privacy laws (GDPR, CCPA, etc.) and industry-specific regulations. Document how the AI system processes data and makes determinations, particularly if these outputs inform investment decisions or regulatory filings. This includes maintaining audit trails of AI operations. Select platforms that meet high security standards (e.g., SOC 2 Type II, ISO 27001). If dealing with non-public information, confirm that the AI provider's data handling practices align with your firm's policies, potentially opting for private cloud or on-premise solutions for maximum control. An internal review by your legal, compliance, and IT security teams is essential before full-scale deployment.

By following these best practices, financial firms can successfully integrate AI into their prospectus analysis workflows, transforming a traditionally burdensome task into a source of efficiency and deeper insight.

Best AI Tools for Prospectus Analysis

The marketplace for AI document analysis tools is rapidly expanding. For prospectus analysis, solutions range from general-purpose LLMs to highly specialized platforms. Here’s an overview:

V7 Go Prospectus Analysis Agent: This is a leading choice for end-to-end prospectus review. V7 Go's solution is purpose-built for analyzing investment documents, including IPO prospectuses, mutual fund reports, and offering memoranda. It integrates OCR, advanced NLP, and configurable multi-step AI workflows. Key strengths include automated extraction of all crucial financial fields (financials, fee structures, risk disclosures, management details), AI-generated summaries, and an interactive chat interface for querying documents. Its spreadsheet-like UI for viewing extracted data, robust QA checks, and exceptional accuracy with nuanced financial language make it highly effective. A core differentiator is its verifiable outputs: V7 Go's AI Citations allow users to trace every AI-derived insight directly back to the source text in the prospectus, which is paramount for trust and auditability in a regulated financial environment. It is designed for financial analysts and compliance teams who need reliable, quick, and actionable insights without extensive custom development.

Large Language Model APIs and Chatbots (e.g., OpenAI's GPT-4, Google's Gemini, Anthropic's Claude): These foundational models possess powerful text comprehension and generation capabilities. They can be used to summarize sections of a prospectus or answer specific questions if provided with relevant text chunks. However, applying them directly to lengthy prospectuses requires significant engineering effort. This typically involves document parsing, text chunking (due to context window limitations), vectorization for RAG, and sophisticated prompt engineering. While offering flexibility for custom solutions, this approach also carries concerns regarding data privacy (when using third-party APIs with sensitive information) and the potential for hallucinations if not carefully managed with grounding techniques.

Domain-Specific Financial LLMs: Some major financial data providers are developing LLMs trained specifically on vast corpora of financial text (e.g., BloombergGPT). These models, by virtue of their specialized training, can exhibit superior understanding of financial jargon, market context, and regulatory nuances. While highly promising for tasks like prospectus analysis, these models are often proprietary and integrated into the provider's existing platforms (e.g., enhancing financial terminals) rather than being available as standalone tools for direct deployment by most firms. Their existence, however, underscores the trend towards more specialized AI in finance.

Intelligent Document Processing (IDP) and RPA Solutions: Traditional IDP tools (e.g., ABBYY FlexiCapture, Kofax) and RPA platforms have long been used for automating structured data extraction. While effective for forms or tables within prospectuses, they historically struggled with the large volumes of unstructured, narrative text. Newer IDP solutions are increasingly incorporating AI and LLM capabilities (e.g., Microsoft Azure AI Document Intelligence, Google Document AI) to handle more varied content. These can be useful components in a larger AI pipeline for prospectus analysis—for instance, using an IDP tool for initial OCR and table extraction, then passing the textual content to an LLM for deeper comprehension and Q&A. This approach generally requires more technical expertise to integrate and manage multiple components.

Financial Knowledge Search Platforms (e.g., AlphaSense, Sentieo): These platforms leverage AI and NLP to provide powerful search capabilities across vast repositories of financial documents, including SEC filings. They are excellent for finding specific information, mentions of certain keywords or themes (e.g., “ESG risks” or “supply chain disruptions”) across thousands of prospectuses or other filings. While they don't typically offer in-depth analysis of a single prospectus in the way V7 Go does, they are highly valuable for comparative analysis, trend spotting, and broad market research. They complement document-specific AI tools by providing breadth across a corpus.

Open-Source Frameworks and Custom Solutions: For organizations with significant in-house ML and engineering talent, building a custom prospectus analyzer using open-source tools (e.g., LangChain, Haystack for RAG orchestration; Llama-family models for the LLM component) is an option. This path offers maximum control and customization, allowing the system to be perfectly tailored to proprietary analysis methodologies and integrated deeply with internal systems. However, it's a substantial undertaking, requiring expertise in model fine-tuning, infrastructure management, and ongoing maintenance to keep the system current with new document types and evolving AI techniques.

When evaluating these tools, financial firms should prioritize accuracy, verifiability (source citations are key), security, ease of integration, and the ability to handle the specific complexities of financial and legal language found in prospectuses. A pilot project, testing a few shortlisted tools on a set of representative documents, is often the best way to determine the optimal solution for a firm's unique needs and workflow.

V7 Go offers powerful AI agents like the prospectus analysis agent, designed to dissect complex financial documents efficiently and accurately.

The Future of Prospectus Analysis and the Financial Professional

Looking ahead, it's clear that AI will be an integral, indispensable part of the financial professional's toolkit, especially when it comes to dissecting complex documents like prospectuses. The future is not one of human obsolescence but of profound augmentation. AI will increasingly handle the laborious tasks of data extraction, initial review, and compliance checking, empowering analysts, portfolio managers, and compliance officers to dedicate their expertise to higher-level strategic analysis, critical thinking, and nuanced decision-making.

We are already witnessing the emergence of what can be termed “hybrid professionals” in finance. These are experts who skillfully leverage AI tools to amplify their impact and efficiency. Instead of spending days meticulously reading documents line-by-line, they will spend minutes receiving AI-generated insights, and then dedicate hours to the truly valuable work: interpreting those insights within broader market contexts, conducting deeper due diligence on AI-flagged issues, engaging in complex problem-solving, and communicating sophisticated conclusions to stakeholders. In essence, the role is shifting from being a primary data retriever and processor to becoming a highly skilled data interpreter, strategist, and critical evaluator of AI-generated information.

Risk assessment and decision quality are poised for significant improvement. AI's ability to systematically scan and cross-reference vast amounts of information can surface subtle warnings, inconsistencies, or patterns that a human reviewer, no matter how diligent, might miss due to fatigue, time constraints, or cognitive biases. For example, if an AI highlights that a prospectus's risk factor section heavily emphasizes cybersecurity risks compared to industry peers, or uses unusually cautious language in its forward-looking statements, an analyst can take that as a cue for deeper investigation. The professional's job becomes more about asking insightful “why” and “so what” questions, rather than being bogged down in the “what.” This deeper level of analysis, spurred by AI, can lead to more robust investment decisions and more effective risk management. The ability to identify 25-35% more material risks, as seen with tools like V7 Go, is a testament to this potential.

On the compliance front, the landscape is also set for transformation. Regulators themselves are likely to increasingly adopt AI tools to scan filings for irregularities, completeness, and adherence to disclosure standards. The SEC's existing use of analytics for market surveillance could readily extend to AI-powered review of prospectuses to spot misleading statements or missing information. This implies that firms utilizing AI for internal compliance checks will essentially be self-auditing with a similar level of rigor, enabling them to proactively identify and rectify issues before filings are made or before regulatory scrutiny. The future compliance officer might spend less time on manual checklist-style reviews and more on investigating complex issues flagged by AI, ensuring a higher overall standard of transparency and accountability industry-wide.

The format and delivery of prospectus information might also evolve. As AI-driven analysis becomes commonplace, issuers and regulators may move towards more structured, machine-readable disclosure formats. This would further enhance AI's ability to perform instant comparisons and checks across filings. The trend towards summary prospectuses for mutual funds could be accelerated and enhanced by AI-generated plain-language summaries (potentially verified by AI for consistency with the full document). This could make complex financial information more accessible to a broader range of investors.

For the financial professional, embracing AI is rapidly becoming a necessity. Those who upskill to work effectively alongside AI—understanding how to frame queries, interpret AI outputs critically, and integrate AI insights into their decision-making frameworks—will find their ability to cover more ground, derive insights faster, and add strategic value significantly enhanced. Those who resist may find themselves struggling to keep pace with the sheer volume and velocity of information. Crucially, uniquely human skills—critical thinking, ethical judgment, complex problem-solving, client relationship management, and strategic foresight—will become even more differentiating. If AI levels the playing field in terms of information access and initial processing, the competitive edge will come from the wisdom and creativity applied to that AI-generated intelligence.

The question of AI replacing jobs in finance is a recurring concern. However, current evidence and expert consensus (including from major financial institutions and consulting firms) suggest a transformation of roles rather than outright replacement. AI is primarily seen as a tool to increase productivity and enhance human decision-making. AI systems, particularly in their current state, cannot take ultimate responsibility for financial decisions, nor can they fully replicate human understanding of complex market dynamics, strategic nuances, or ethical considerations. Therefore, the future points towards a collaborative or partnership model, where AI handles the analytical heavy lifting and humans provide oversight, validation, and strategic direction.

In practical terms, roles like “AI-enabled investment analyst” or “AI compliance specialist” will likely become common. These professionals will be adept at using AI platforms like V7 Go to achieve in minutes what previously took days, and then using that reclaimed time to explore deeper, more complex insights or to engage in more client-facing and strategic activities. Career progression will increasingly depend on this blend of financial acumen and AI literacy.

In summary, the future of prospectus analysis—and indeed much of financial analysis—is one of powerful synergy between human intellect and artificial intelligence. This collaboration promises not only greater efficiency but also deeper insights, more robust risk management, and ultimately, better-informed financial decisions across the board. Professionals will not be reading less. Instead, they'll be reading smarter, guided by AI to focus on what truly matters.

If you want to learn more and find out how to improve your document review workflows, book a demo and tell us more about your specific use case.