Document processing

13 min read

—

Oct 7, 2025

Automating aspects of Private Placement Memorandum analysis can help loosen one of the most persistent bottlenecks in investment due diligence.

Imogen Jones

Content Writer

It's 9 PM on a Tuesday, and an analyst is on page 112 of a Private Placement Memorandum. Somewhere in the dense legalese and complex financial tables lies a potential multi-million dollar opportunity, or a hidden red flag.

This scene is all too familiar in private equity. The PPM is the gateway to every deal, but it's also a bottleneck that grinds deal flow to a halt. Promising opportunities sometimes wither on the vine due to nothing more than a lack of time.

These documents are hefty, often ranging from 50 to 100+ pages in length. It's no wonder a recent survey found private equity firms spent an average of 46 days on due diligence per deal, a significant portion of which is spent on document review and analysis.

Artificial intelligence offers a way out of this bind. By automating document analysis, investors can dramatically accelerate PPM review while enhancing accuracy.

In this article:

PPM fundamentals, and the key challenges

How AI document intelligence addresses those pain points

Platforms for AI PPM analysis

Emerging trends in AI for PPMs

Document processing

AI for document processing

Get started today

Private Placement Memorandums 101 (And Why They’re Challenging)

To understand why this process is such a time sink, we need to look under the hood of the PPM itself.

A Private Placement Memorandum is a comprehensive legal document that provides investors with a detailed disclosure of a private investment opportunity. Unlike public offerings, private placements are not registered with the U.S. Securities and Exchange Commission (SEC), so the PPM is the primary source of information for an investor's due diligence.

These documents are notoriously dense, but they do tend to follow a generally consistent structure. Thorough analysis requires a deep dive into several key sections:

Executive Summary: A high-level overview of the investment, the business, and the terms of the offering.

Business Overview: A detailed description of the company’s operations, market position, and competitive landscape.

Financial Projections: The company’s financial forecasts, including revenue models, growth assumptions, and key performance indicators.

Risk Factors: A critical section outlining all potential risks associated with the investment, from market and industry risks to operational and financial challenges.

Management Team: Biographies and track records of the key executives and principals leading the company.

Use of Proceeds: A clear explanation of how the capital raised will be utilized to grow the business or fund the project.

Legal Terms and Subscription Agreement: The detailed legal terms of the investment, including investor rights, governance, and the process for subscribing to the offering.

The goal for the investment professional is to extract a clear, actionable investment thesis from these disparate sections. This involves identifying key financial metrics, stress-testing growth assumptions, assessing competitive advantages, quantifying risks, and projecting potential returns.

The sheer length and complexity of PPMs, combined with intricate legal and financial terminology, make this a formidable task.

The Manual PPM Analysis Bottleneck

The traditional approach to PPM analysis is a manual, linear process that creates a significant bottleneck for investment firms.

The due diligence process for a single deal can range from three to twelve months, with a significant portion of that time dedicated to document review. Analysts can spend weeks manually reading a PPM, highlighting key sections, and transcribing data into financial models and summary reports. This intense time requirement directly limits the number of deals a firm can evaluate.

When different analysts review different PPMs, their focus and interpretation can vary. This leads to inconsistent analysis across the firm and increases the risk that critical information is overlooked. Without a standardized process, it is difficult to compare opportunities on a true "apples-to-apples" basis.

That ties in neatly to the next point; PPMs themselves are not standardized. You’ll see similar sections and information in each, but financial data, key terms, and risk disclosures are presented in a multitude of formats, often embedded in lengthy narrative paragraphs or complex tables. Projections might be embedded in PDF tables or mentioned in prose.

Multi-modal ingestion is key for accelerating PPM analysis automatically, because of the variety of formats used.

Manually extracting this unstructured data and standardizing it for analysis is tedious, and a breeding ground for copy-paste errors that can silently poison a financial model.

Ultimately, this manual process simply cannot scale. As a firm’s deal flow increases, it must either hire more analysts (costly and time-consuming) or pass on a growing number of potentially lucrative opportunities. This inability to scale prevents firms from capitalizing on broader market trends and limits their growth potential.

Surveys of private equity leaders show due diligence costs run about 1% of deal value on average, a figure that has remained stubbornly high, with much of that being personnel time.

How AI Transforms PPM Due Diligence

Should investors stay thorough and slow, or move fast and risk missing things? Would you like to rest on a rock or a hard place?

Let’s break down exactly how AI addresses the challenges we described.

Automated Data Extraction and Intelligent Document Processing (IDP)

No one got into investment for the love of rekeying data from a PDF into Excel. One of the most immediate wins from AI is automated data extraction. This is the ability to pull key financial metrics, investor terms, and risk factors directly from a PPM and convert them into structured, searchable data in seconds.

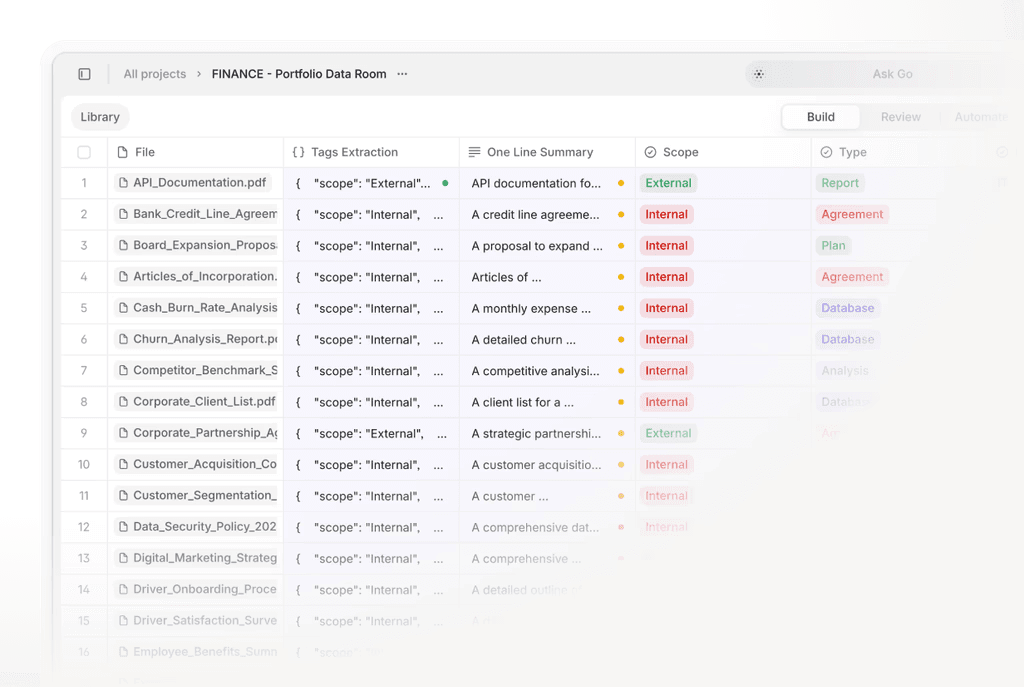

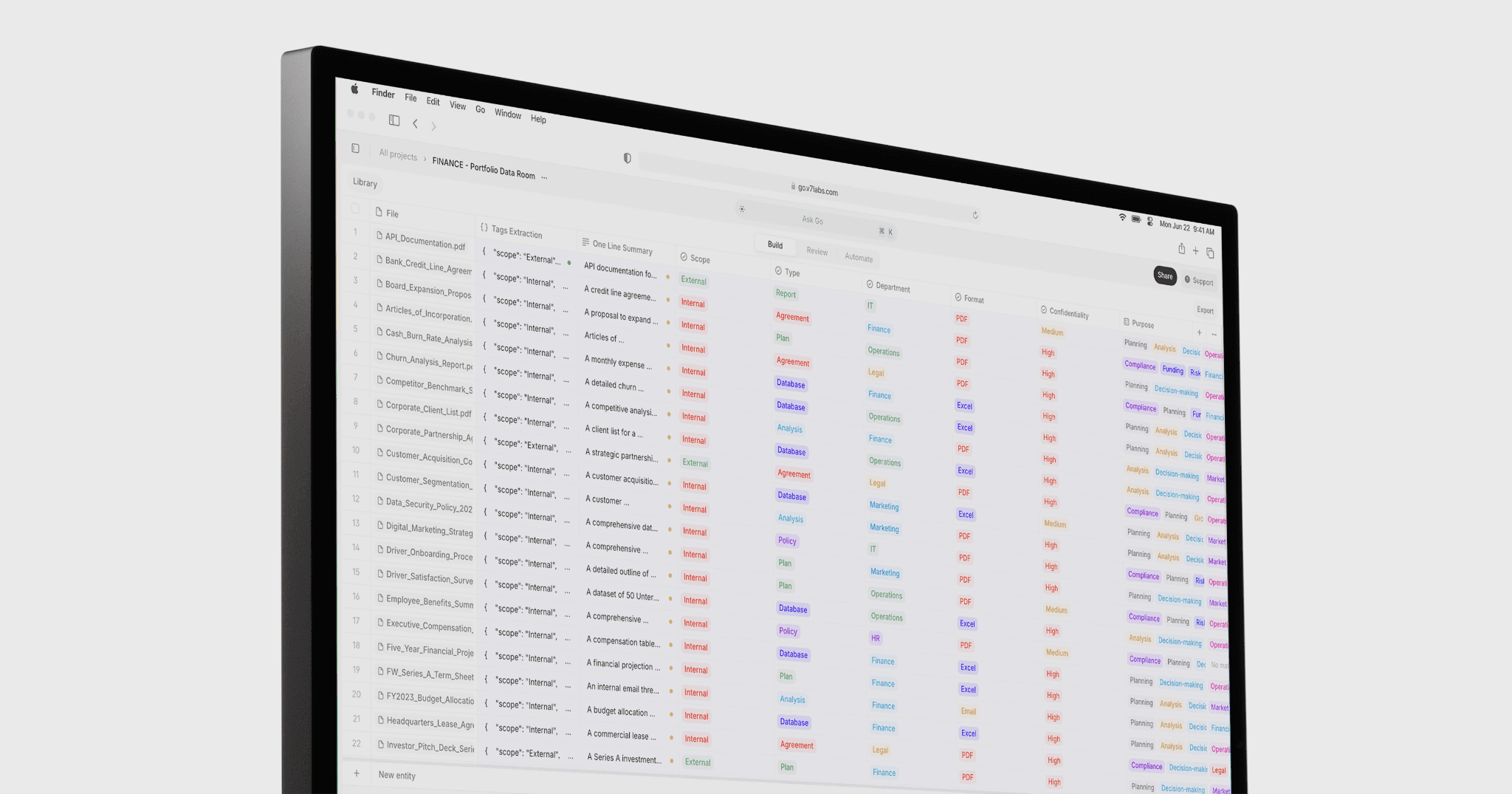

Modern AI document automation platforms like V7 Go go beyond simple text scraping. They can ingest a PPM and automatically identify the structure (sections, headings, tables and so on). For instance, even if the PPM doesn’t label a section “Risk Factors” in the contents, an AI model can recognize a page that lists numerous risk disclosures and tag it appropriately.

This is known as Intelligent Document Processing, and you can learn more about it in our blog, Intelligent Document Processing with GenAI: Key Use Cases.

This parsing is crucial; it means the AI knows where to find the executive summary or the financial data without explicit human guidance, regardless of formatting differences.

Because this data is now structured, documents can easily be compared and crunched in any number of ways. Analysts can used LLMs to query the system with natural language questions like “What are the top 5 risks mentioned in this PPM?” or “Does this document mention any pending litigation or regulatory issues?” without having to read line-by-line.

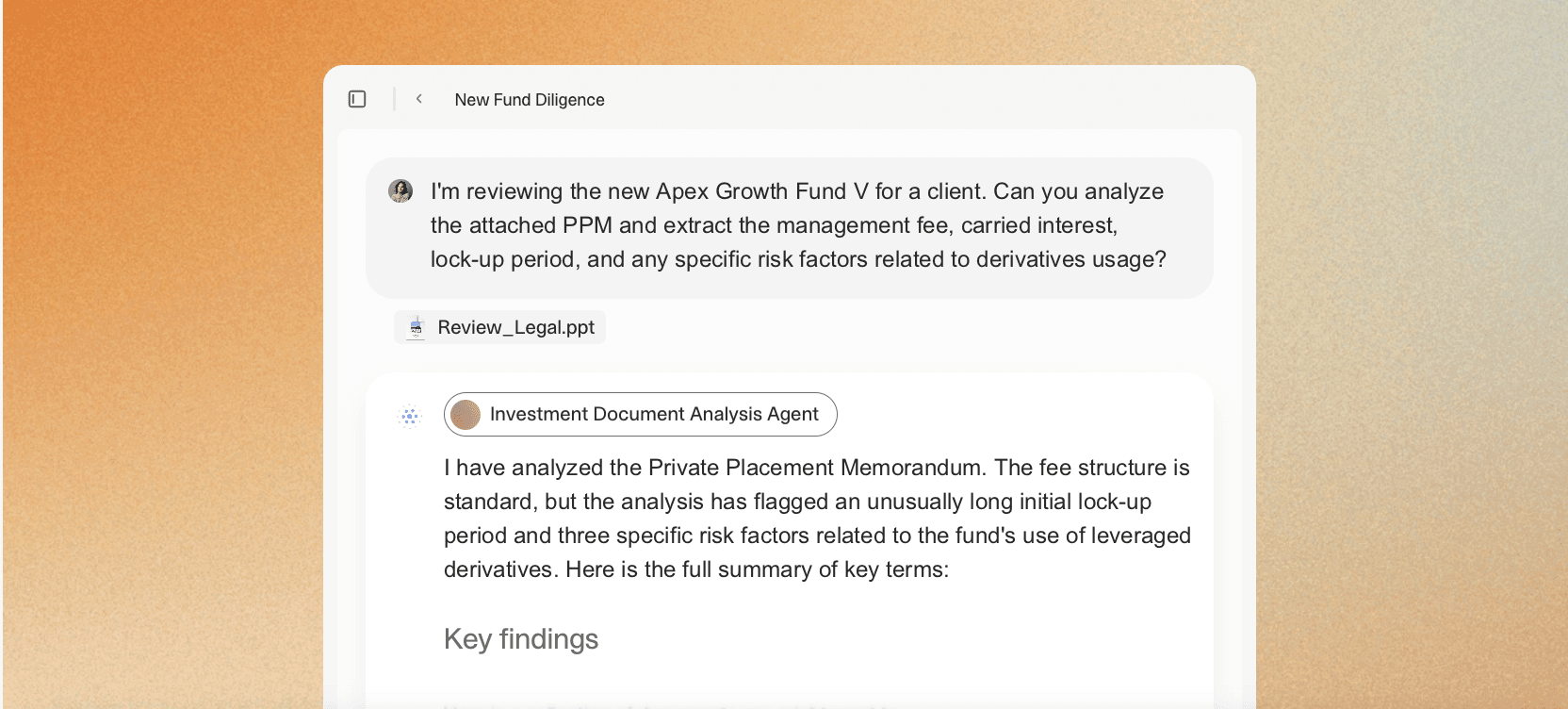

User in V7 Go asking Concierge to review an uploaded document

In short, AI doesn’t get lost in the document the way a human might when faced with hundreds of pages.

AI Agents for PPM Analysis

What happens when AI is used for more than just a first-touch processing and extraction tool? AI agents are intelligent software programs designed to perform tasks autonomously, adapting their actions to the environment to achieve specific goals. These agents can undertake specific reasoning steps, such as extracting key financial data, identifying competitive advantages, and evaluating market share.

For example, a V7 Go agent can be designed to review an PPM, extract crucial data points, and generate a standardized investment memo, thereby accelerating the due diligence process significantly.

AI can be used to flag potential risks, or highlight terms that deviate from market standards. For instance, if a fund’s PPM has an unusual fee structure or an atypical redemption term, a V7 Go Agent can catch that by comparing to other examples in its Knowledge Hub.

Think of it as a capable junior associate. It still requires oversight and approval, but it is able to make decisions, cross-reference other documents or datasets, and reason across multiple steps.

Check out our AI Hedge Fund PPM Analysis Agent, AI Offering Memorandum Analysis Agent, or browse our complete agent library here.

Scalability and Deal Flow

With AI handling the heavy lifting, firms can realistically examine more opportunities. Instead of reading one PPM at a time, investors can oversee AI analyses of multiple PPMs simultaneously, then spend their time on the strategic evaluation of the results.

Importantly, AI augments, rather than replaces, human expertise. You can learn more about the integration of AI and human expertise with human-in-the-loop solutions in our blog Will AI Replace Financial Analysts?

AI Platforms and Solutions for PPM Analysis

Not AI solutions for PPM analysis are created equal. The market spans from enterprise investment platforms to specialized document intelligence tools to custom-built solutions. Choosing the right one depends on your firm's size, existing infrastructure, compliance requirements, and the complexity of your due diligence process.

Enterprise Investment Management Platforms

These platforms are typically designed for large institutional investors and offer a comprehensive suite of tools for investment management, of which document analysis is one component.

A holistic investment management ecosystem that integrates portfolio construction, risk modeling, and trading execution. Aladdin's AI capabilities increasingly process financial documents to feed its analytics engines, helping institutional investors make data-driven decisions across their entire book.

Best for: Large asset managers who need PPM analysis as part of an end-to-end investment workflow.

The Bloomberg Terminal has long been the industry standard for financial data. Its AI features now help users search and analyze financial news, company filings, and reports—extracting key insights from unstructured documents and surfacing relevant data points.

Best for: Firms already embedded in the Bloomberg ecosystem who want AI-enhanced research capabilities.

A provider of portfolio management and accounting systems, SS&C Advent uses AI to automate data entry and document processing, managing information flow for large investment operations.

Best for: Firms prioritizing integration with existing portfolio management and accounting infrastructure.

2. Document AI Platforms: Built for Deep Analysis

This category includes platforms purpose-built for document processing and intelligence. They offer more targeted, and often more advanced, capabilities for tasks like PPM analysis.

V7 Go is an agentic AI platform designed specifically for complex document automation, including sophisticated PPM analysis. These are just a handful of the use cases existing V7 customers have in production.

Extract financial data from projections tables, even when formatting varies

Identify and categorize risk factors by type (market, operational, regulatory, etc.)

Analyze management team backgrounds, cross-referencing against public records

Flag discrepancies between financial claims and risk disclosures

Generate automated investment summaries with source citations

Compare PPMs across multiple deals to identify outliers

The AI Citations feature provides a complete audit trail, linking every extracted insight directly back to the specific section and page of the source document. This transparency is critical for due diligence meetings, compliance reviews, and defending investment decisions.

PPMs contain highly sensitive information; financial projections, competitive strategies, sometimes even investor identities. V7 Go is built with enterprise-grade security. No data is retained or used for model training, so your PPMs remain confidential.

Kensho is an AI platform focused on financial analysis and market intelligence. Its document processing capabilities extract information from financial reports and unstructured documents to power analytics and forecasting models.

Best for: Firms that want AI-driven market insights alongside document processing.

An investment research platform that uses AI to search and analyze a vast library of financial documents including company filings, earnings transcripts, research reports, and more. Its strength is powerful search and trend identification across large document sets.

Best for: Research-heavy firms that need to monitor thousands of documents for themes and signals.

These are foundational AI platforms that provide the tools to build custom solutions. They offer maximum flexibility but require significant development resources, in-house AI expertise, and ongoing maintenance.

OpenAI API Integration: Firms can build custom PPM analysis solutions using OpenAI's powerful language models, like GPT-4. This approach offers maximum flexibility but requires careful management of development, security, and compliance.

Microsoft Azure AI: Azure provides a suite of cognitive services, including document intelligence and natural language processing tools, that can be used to create custom workflows for financial document processing.

Google Cloud AI: Similar to Azure, Google Cloud offers robust Document AI and Natural Language API services that can be trained and adapted for financial use cases, including PPM analysis.

Regulatory and Compliance Considerations for AI in Investment Analysis

The question on every managing partner's mind is, 'How do we use this powerful new tool responsibly?'

As investment firms embrace AI for document analysis and due diligence, regulators have been vocal that responsible use is paramount. There aren’t AI-specific laws for PPM review yet, but U.S. regulators (SEC, FINRA) emphasize that existing rules fully apply to processes involving AI.

In other words, outsourcing your judgment to an algorithm doesn’t absolve a firm of its fiduciary duty or compliance obligations.

Here are key considerations.

SEC Guidance: The Securities and Exchange Commission has highlighted several risk areas. In its 2024 exam priorities, the SEC explicitly noted it will scrutinize firms that use AI (or “digital engagement practices”) in advisory services and recommendations. Examiners will check that firms have adequate policies and procedures to monitor and supervise AI use in functions like trading, portfolio management, record-keeping, fraud detection, and so on.

For example, if an investment adviser uses an AI tool to parse PPMs and make investment recommendations, the SEC expects the adviser to ensure the tool’s outputs are accurate and that any conflicts or biases are addressed. In fact, an SEC enforcement case hinted that failure to ensure the reliability of an algorithmic model or to implement policies around it could violate an adviser’s duty of care.Data Privacy and Security: PPMs contain sensitive financial and personal information (about companies, fund managers, sometimes even investors). If those are fed into an AI system, especially a cloud-based one, regulators expect firms to safeguard that data. The SEC’s Regulation S-P and other privacy rules require proper handling of non-public personal info. Any AI solution must have strong encryption, access controls, and must not expose confidential PPM data to unauthorized parties.

V7 Go complies with leading security guidelines and schemes.

Bias and Fair Dealing: There’s a nuanced point around AI bias. If an AI is used in deal evaluation, could it inadvertently bias the process? For instance, if the training data for an AI has gaps, it might systematically underweight certain risk factors.

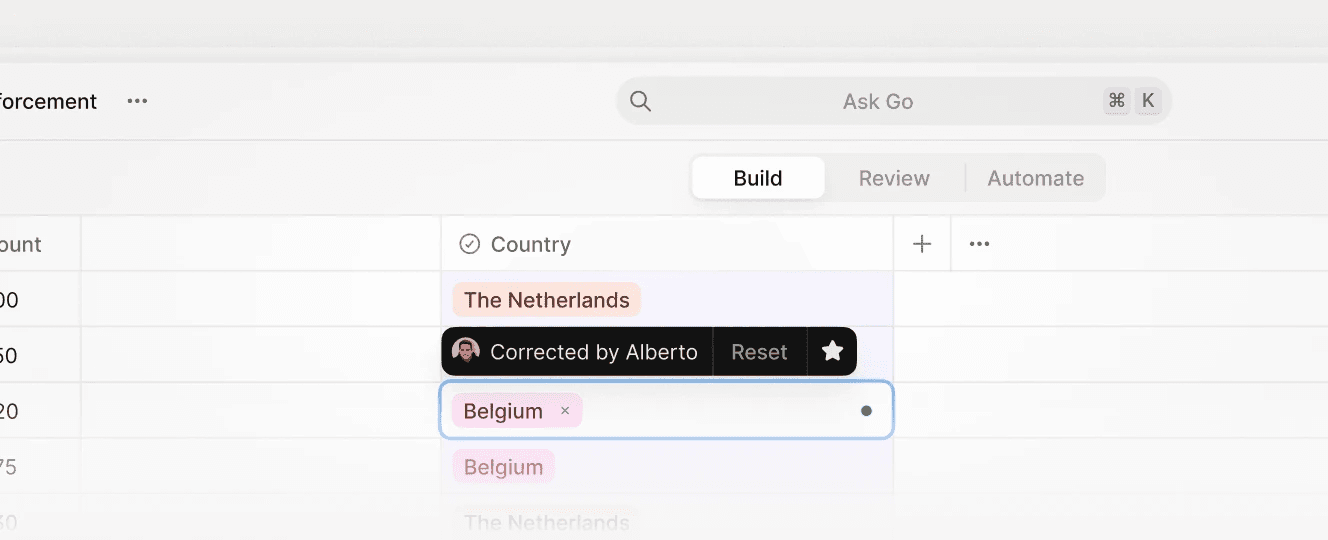

Regulators like the SEC have broader concerns that AI-driven recommendations might conflict with investor interests if, say, the AI is optimized for something other than the client’s best interest. In the context of PPM analysis, the main concern is ensuring the AI isn’t causing the firm to skew its due diligence in a harmful way. The firm should periodically test the AI’s outputs for quality and fairness, verifying that the AI accurately flags both positive and negative aspects of an investment and isn’t consistently missing a particular category of risk.Human Oversight: Regulators effectively expect a “human in the loop” for critical judgments. The SEC has talked about this in the context of robo-advisors and AI: you need knowledgeable people supervising them and ready to override if necessary. AI can draft an analysis, but an investment committee member should validate key findings.

This aligns with fiduciary duty. Ultimately, the firm owes its investors a duty of care, and that can’t be fully delegated to a machine.

Having clear internal procedures that analysts must review AI outputs, and spot-check the source document on critical items, is becoming a best practice.

A user making a manual correction in V7 Go

The bottom line is, investment firms implementing AI for PPM analysis should bake in compliance from day one. That means adopting AI tools that allow for recordkeeping (audit logs of what was analyzed), ensuring data security, having policies that describe how AI is used and reviewed, and training staff on these policies.

Done right, AI can actually enhance compliance by standardizing reviews and catching things humans might miss.

Emerging Trends: AI Adoption in Private Equity & Venture Capital

What started in 2023 as experimental use of ChatGPT-like tools by adventurous analysts has rapidly matured into firm-wide AI initiatives at many PE, VC, and institutional asset management firms.

Bain & Company’s 2025 Global PE Report found that by late 2024, the majority of PE portfolio companies were in some phase of generative AI testing, and nearly 20% had already operationalized AI use cases with concrete results. That’s remarkably quick adoption for a nascent tech. It aligns with anecdotal reports that many fund CEOs are tasking their teams to come up with an “AI strategy,” both for investments and for internal operations.

Here are some of the notable trends and developments we’re seeing across private equity and venture capital:

Widespread Adoption, But Shallow Usage

AI has entered the mainstream in dealmaking, but 58% of firms reported their AI use was only “minimal” so far.

In other words, many firms have dipped a toe in (perhaps using an AI tool on one workflow or letting a few team members experiment), but haven’t fully operationalized AI across the organization yet.

The barriers cited include regulatory/compliance concerns (27% of firms), data quality/integration issues (26%), and lack of skilled talent to implement AI (19%) were the top challenges to broader deployment.

We can expect the depth of AI integration to increase as these kinks are worked out.

AI Use Cases Expanding

Initially, the focus was on using AI to speed up existing tasks, like reading PPMs. Now, firms are exploring more advanced generative AI applications. No wonder an analysis noted that nearly 64% of surveyed M&A executives expect generative AI to revolutionize deal processes more than any other recent tech innovation.

For example, some are using AI to draft first versions of investment memos or to simulate Q&A sessions about a PPM. AI is being used to comb through external data for sourcing deals. VC firms use AI to scan news, patents, social media and so on to spot startups that match their thesis.

Private market investors are also using AI for market intelligence, like automatically reading industry reports, earnings transcripts of public comps, and regulatory filings to glean insights that inform their view on a private opportunity.

Refer to our articles 10 Key Use Cases of Generative AI in Finance of 5 Applications of AI in Venture Capital and Private Equity for more examples.

Cultural Shift and Acceptance

Initially, there was skepticism; concerns that AI might not “get” the nuances of an investment memo, or that it could hallucinate false information. Through practical trials, many of these concerns have been addressed by using AI in constrained, targeted ways, like using V7's Knowledge Hubs to ground analysis in a firm’s internal knowledge documents.

As success cases accumulate, the culture is very much shifting from “Why should we use AI?” to “How did we ever live without it?”. Senior dealmakers who closed AI-assisted investments are becoming evangelists. This mirrors the pattern seen in other industries: a cautious start, followed by rapid adoption once value is proven.

Move Faster Than The Market With Automated PPM Analysis

Reviewing private placement memorandums has historically been a tedious, time-intensive hurdle in the private investing world, a necessary drag on the agility and scale of deal-making. AI due diligence is enabling investment teams to break the old trade-off between thoroughness and speed.

Want to learn more about how V7 Go can accelerate your due diligence and PPM analysis? Reach out to our team for an in-depth conversation about your bespoke use case.

How can AI improve the efficiency of PPM due diligence?

AI can automatically extract, categorize, and summarize data from PPMs using techniques like Intelligent Document Processing (IDP). It identifies key sections, financial metrics, and risk disclosures, turning unstructured text into structured data for faster analysis. This reduces review time from weeks to days and allows analysts to focus on high-level judgment rather than manual data entry.

+

Is AI adoption in private equity limited to document analysis?

Not at all. While PPM automation is a leading use case, AI is now used for deal sourcing, portfolio monitoring, market intelligence, and drafting investment memos. Many firms use generative AI to simulate Q&A sessions about a deal or to identify potential investments through automated scanning of industry news and filings.

+

How do regulators view the use of AI in investment due diligence?

Regulators like the SEC have clarified that existing fiduciary and compliance rules apply to AI-assisted processes. Firms must maintain oversight, ensure accuracy, safeguard investor data, and document their procedures. Human validation of AI outputs is still required, especially for material investment decisions.

+

What should firms consider when selecting an AI platform for PPM analysis?

Key factors include data privacy, integration with existing systems, transparency (such as AI-generated citations linking insights to source text), and scalability. Tools like V7 Go stand out for enterprise-grade security, explainable AI outputs, and the ability to handle multi-format documents consistently—critical for regulated financial environments.

+