Knowledge work automation

18 min read

—

Dec 19, 2025

Your practical guide to generative AI adoption in insurance. Discover use cases and guidance for claims processors, underwriters, actuaries, and brokers.

Imogen Jones

Content Writer

The insurance industry processes more documents per transaction than almost any other sector. A single commercial property submission can include 200+ pages: loss runs, inspection reports, policy wordings, SOVs, and engineering assessments. An underwriter at a mid-sized carrier might review 30-50 of these submissions per week. That is 6,000-10,000 pages of dense, unstructured text that must be read, cross-checked, and turned into a bind or decline decision.

For decades, the industry's answer has been the same: manual grind. Junior underwriters spend hours each day rekeying. Actuaries wait three days for a BPO team to compile claim statistics that should take three hours.

Generative AI removes this bottleneck. Not by replacing human judgment—insurance is too personal, too regulated, and too complex for that—but by eliminating the manual data entry and sluggish processes that have constrained the industry since the mainframe era.

In this article:

Why generative AI represents a different kind of shift.

AI Agents for Insurance: Automated workflows that execute multi-step processes.

AI use cases for Underwriters, Actuaries, Claims Processors and Brokers

Measuring success in a regulated, risk-averse industry.

Generative AI for Insurance

Core policy administration systems in the 1990s digitized records but preserved manual workflows. Rules engines and expert systems in the 2000s promised automation but proved brittle outside tightly defined scenarios. Predictive analytics and machine learning in the 2010s improved pricing, fraud detection, and segmentation, yet remained constrained to structured data and single-purpose models.

Then, in 2023, 'generative AI' was the buzzword on everyone's lips.

Generative AI differs fundamentally from the predictive models that came before. A fraud detection model looks at a claim and outputs a score: 0.73 probability of fraud. A generative AI model looks at a 50-page policy wording and outputs a summary, a list of exclusions, a comparison to your standard form, and answers to questions you did not anticipate when you built the system.

For insurance, this changes everything. Consider a commercial property submission. It contains:

A broker cover letter (unstructured narrative)

An ACORD application (semi-structured form, often handwritten)

Five years of loss runs (tables with inconsistent formatting)

An inspection report (mix of photos, diagrams, and text)

Prior policy wordings (dense legal language)

A Statement of Values with 47 locations (spreadsheet, possibly scanned)

A traditional OCR system can extract text from these documents. But it cannot understand that "sprinklered throughout" in the inspection report contradicts "partial sprinkler coverage" in the SOV. It can't recognize that the loss run shows three water damage claims in two years, which matters for a building described as "recently renovated."

A generative AI system can. Insurance sector spending on generative AI jumped from $70 million in 2023 to $320 million in 2024, a 357% increase. That is not pilot money. That is production deployment money.

Regardless of the insurer tendency for prudence and risk mitigation, the pressure is on to seize the opportunities. 77% of industry executives said they need to adopt gen AI quickly to keep up with rivals.

— IBM

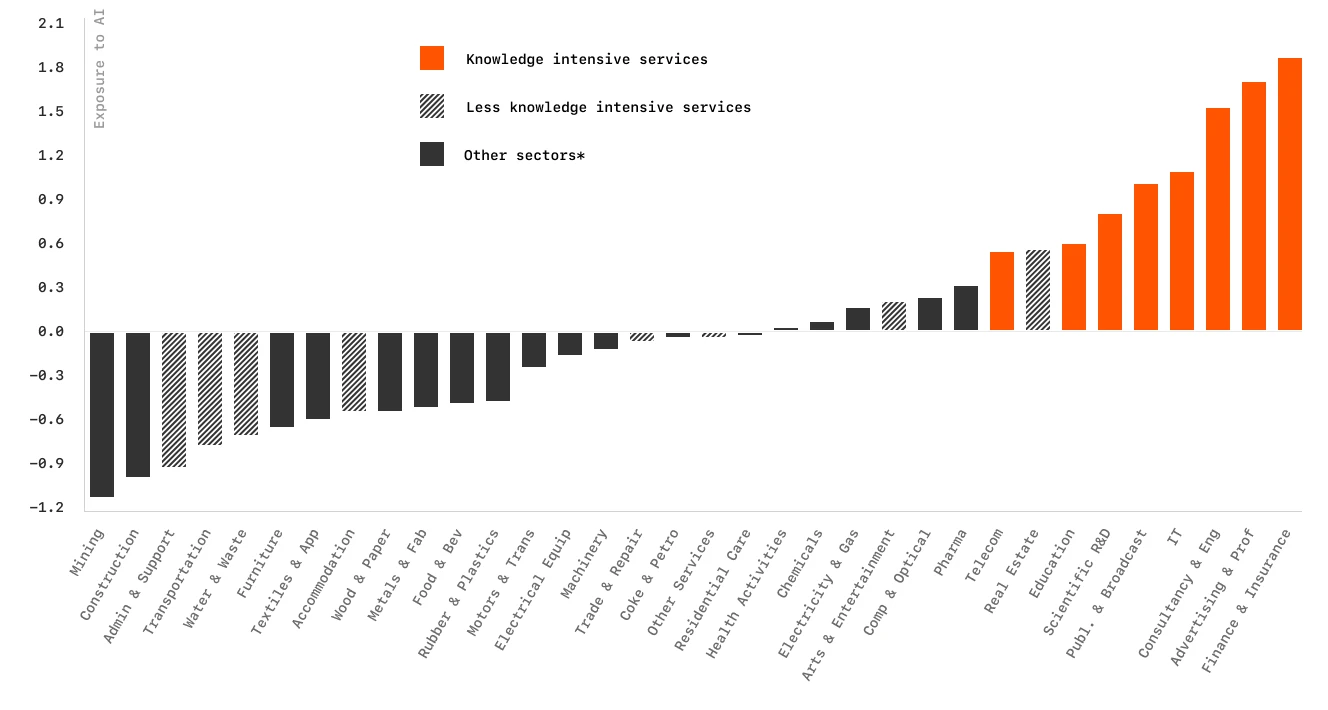

Insurance ranks among the top sectors for AI adoption, driven by document-intensive workflows and regulatory complexity.

Agentic AI for Insurance

Generative AI can read and write. Agentic AI can act. The distinction matters because insurance is not just about extracting data, it is about making decisions based on that data, often through multi-step workflows involving multiple systems and stakeholders.

An agent is an AI system that can:

Perceive its environment (read documents, query databases, check external sources)

Make decisions based on goals ("find all policies expiring in 60 days with premium over $50K")

Take actions (send renewal notices, update CRM records, flag exceptions for human review)

Learn from feedback (adjust thresholds based on underwriter overrides)

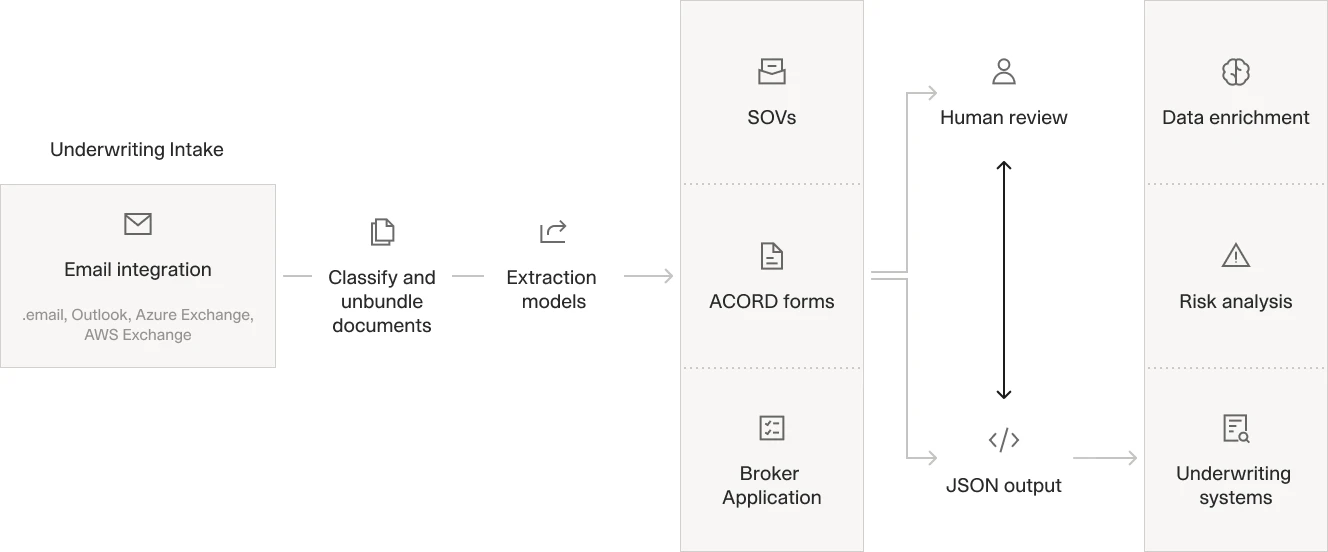

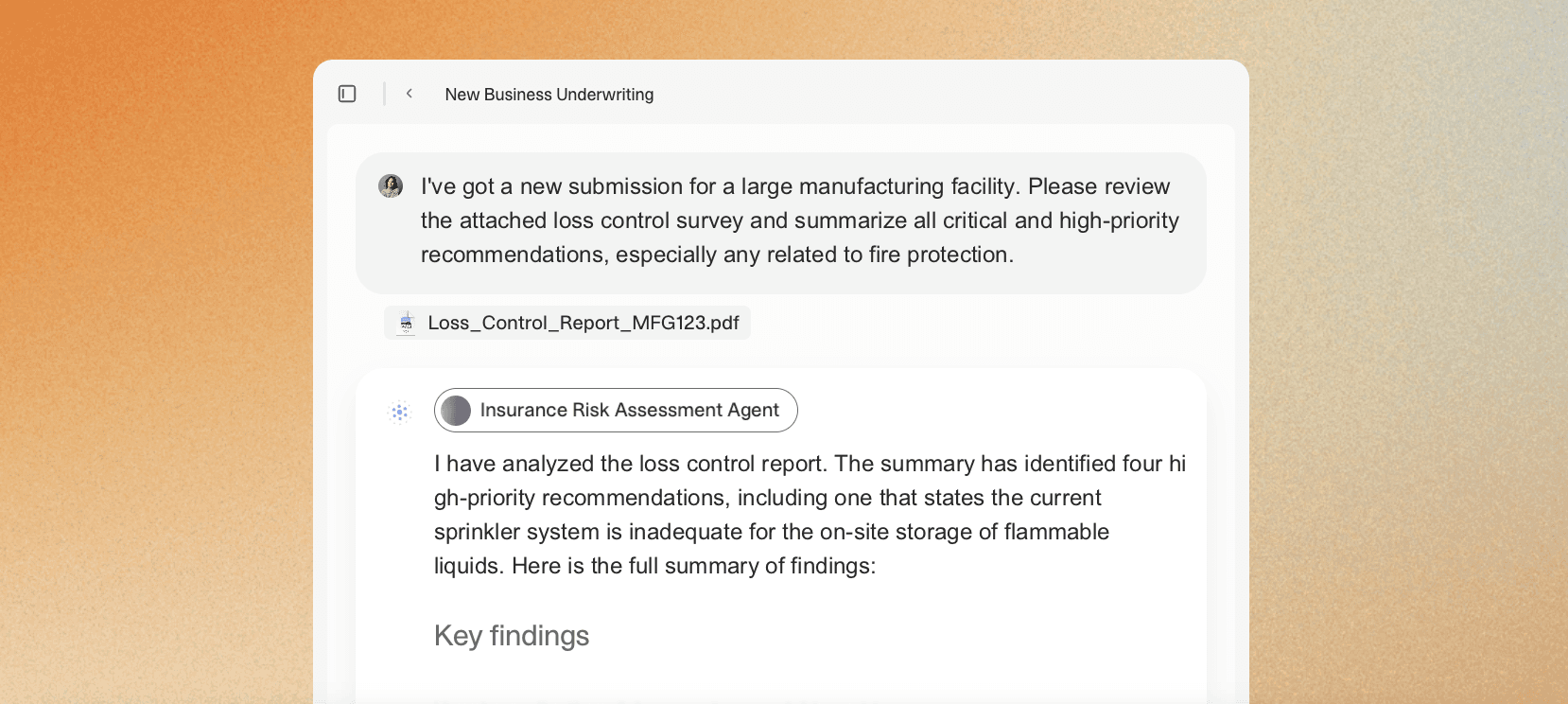

Automated underwriting workflow: from email submission to structured data extraction and decision support.

V7 Go implements this through its endlessly customizable agents, which you can browse in the agent library.

The Concierge feature means you describe what you need in natural language, and Go will automatically select and coordinate the appropriate specialist agents. For an underwriter, this means asking "analyze this property submission for wildfire risk" and receiving a complete risk assessment that pulls data from the submission documents, cross-references with CAT models, and highlights specific concerns from the inspection report.

Learn more about AI agents here: How to Create an AI Agent Without Code: A Practical Guide.

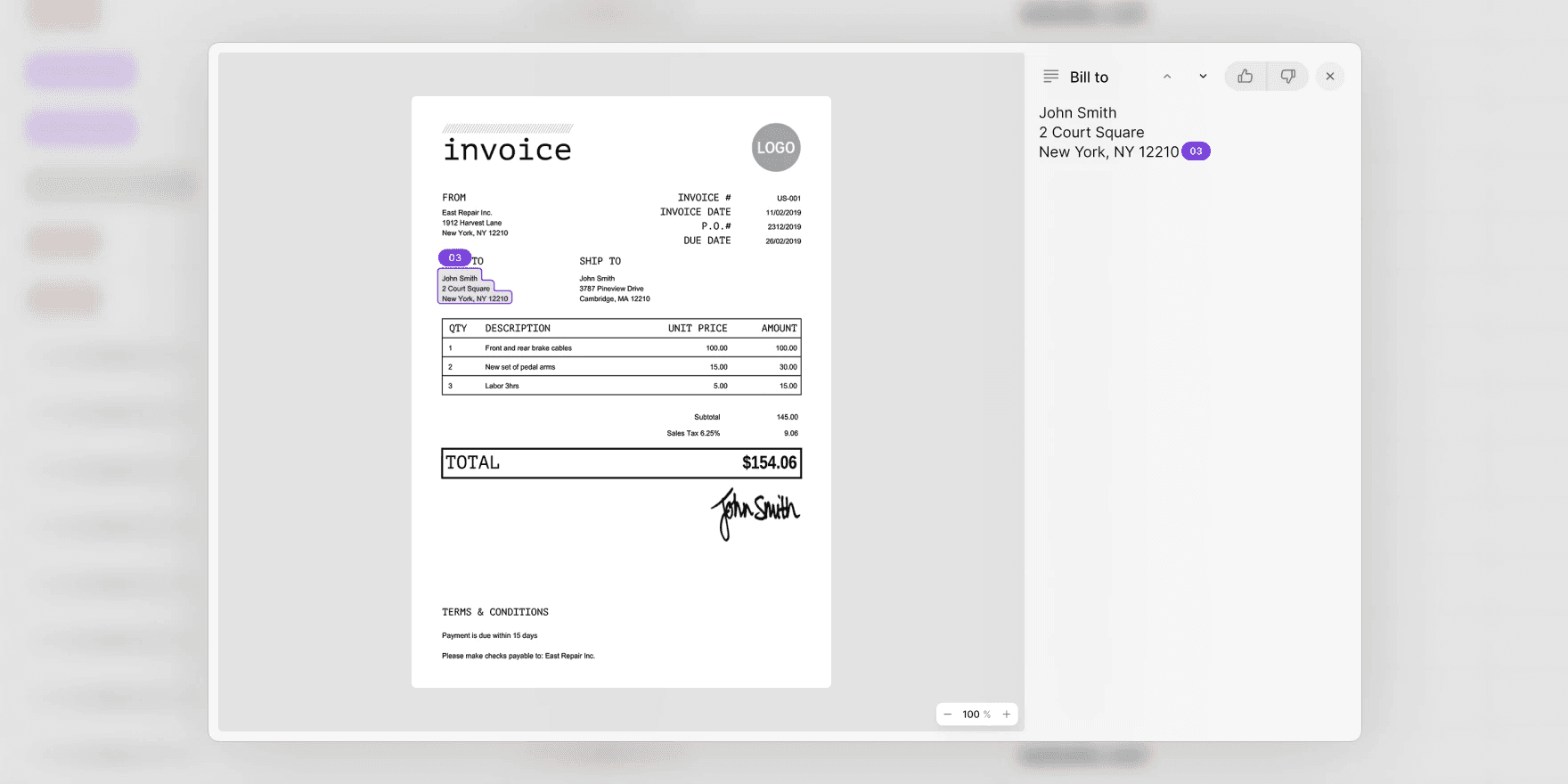

V7 Go's agent dashboard showing automated invoice processing and document analysis workflows.

AI for Underwriters

Underwriting generates the most immediate ROI from generative AI because the work is fundamentally about reading. Underwriters read submissions, loss runs, inspection reports, and policy wordings. They synthesize that information against underwriting guidelines, risk appetite, and market conditions. Then they make a decision: bind, decline, or quote with modifications.

The bottleneck has always been the reading part. A senior commercial lines underwriter might spend 60-70% of their day extracting information from documents. Only 30-40% goes to actual underwriting judgment—the part that requires expertise and experience.

Generative AI and AI Agents invert that ratio.

AI Use Cases for Underwriters

Here is how AI is reshaping specific underwriting tasks:

Submission Intake and Triage

An AI underwriting agent receives a submission and immediately extracts key data points: insured name, coverage requested, limits, deductibles, loss history, building characteristics.

It checks this against your appetite guidelines and flags immediate declinations ("three water damage claims in two years, building is 80+ years old, no sprinklers"). The underwriter sees only submissions that fall within acceptable parameters, with all relevant data pre-populated.

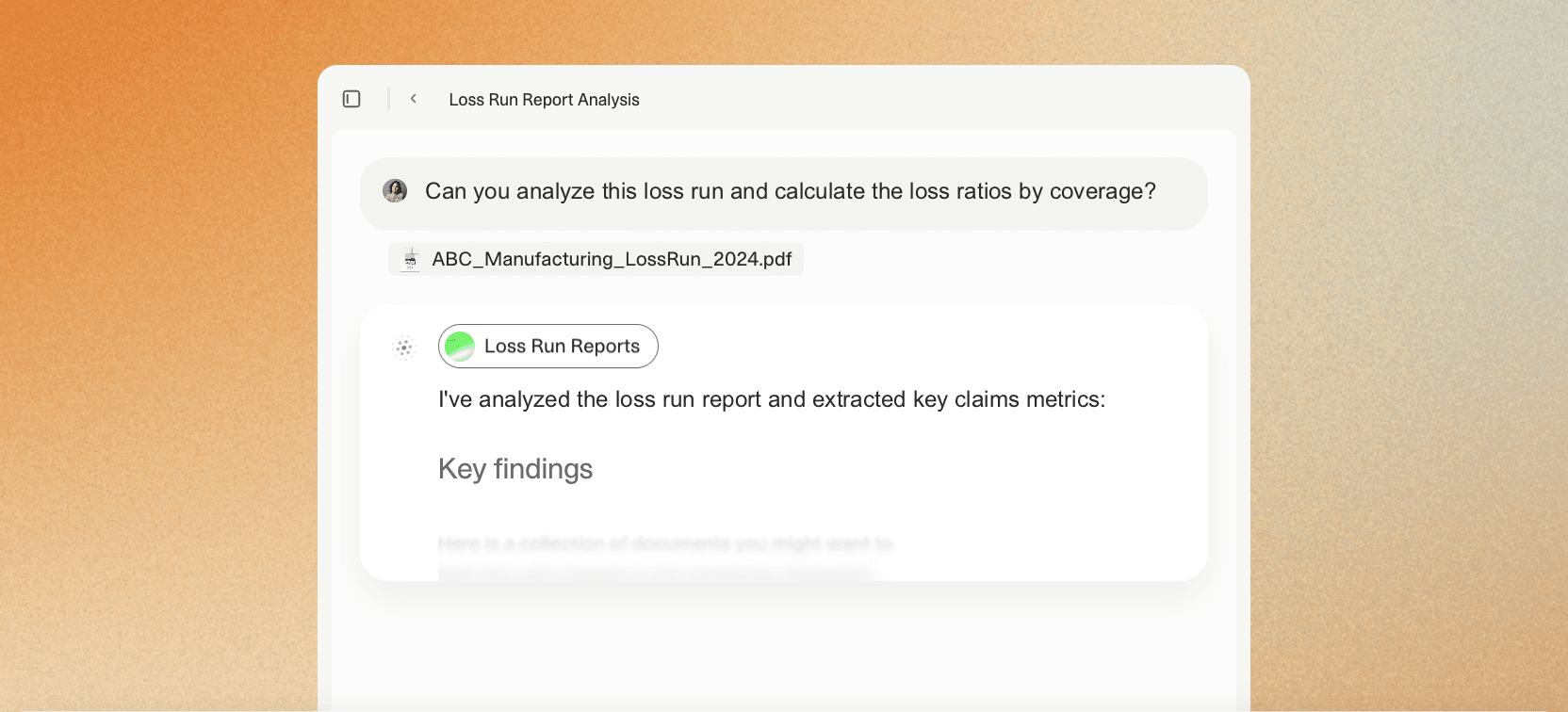

Loss Run Analysis

Reading five years of loss runs is tedious and error-prone. An agent processes them in seconds, calculating loss ratios, identifying frequency patterns, and flagging anomalies. It can spot that three "slip and fall" claims all occurred in the same location during winter months—a pattern that suggests inadequate snow removal procedures. A human might catch this. An agent catches it every time.

The loss run processing automation connects directly to underwriting workflows.

Policy Comparison and Gap Analysis

When a prospect provides their current policy, an agent compares it line-by-line against your standard form using policy analysis. It identifies coverage differences, highlights endorsements that might indicate adverse selection, and suggests pricing adjustments. This used to require an underwriter to read both policies side-by-side, taking 30-45 minutes. The agent does it in 90 seconds.

Inspection Report Processing

Engineering reports contain critical information buried in narrative text and photos. An agent can extract building characteristics (construction type, roof condition, fire protection), identify hazards (storage of flammables, housekeeping issues), and cross-reference recommendations against prior reports to verify completion. It can even analyze photos to confirm that "sprinklered throughout" actually means full coverage, not just a few heads in the warehouse.

A risk engineering agent can handle these workflows.

Renewal Processing

For renewals, an agent can pull the prior policy, current loss runs, and any mid-term changes. It generates a renewal summary highlighting what changed: new locations added, claims incurred, coverage modifications requested. The underwriter reviews the summary and makes a decision, rather than reconstructing the entire account history from scratch.

AI: The Impact on Underwriters

The fear is always that AI will replace underwriters. The reality is more nuanced. Underwriting error rates have dropped by roughly 28% among companies using AI decision support.

This shift is changing the career trajectory of the insurance professional. Here's what changes:

Junior underwriters spend less time on grunt work. The traditional career path (two years extracting data from submissions before you are trusted to quote) compresses. New underwriters can focus on learning risk assessment and market dynamics because the extraction is automated.

Senior underwriters handle more complex risks. When routine submissions are pre-analyzed, experienced underwriters can focus on the difficult cases: unusual exposures, large accounts, non-standard coverage requests. The work becomes more interesting and more valuable.

Underwriting guidelines become more sophisticated. When you can enforce complex rules consistently, you can write more nuanced guidelines. Instead of "decline all restaurants with more than two claims," you can specify "decline restaurants with more than two claims unless they have implemented recommended loss control measures and claims trend is improving." The agent evaluates that. A human underwriter, reading 30 submissions a day, will miss edge cases.

The role shifts toward relationship management and market intelligence. When you aren't buried in paperwork, you can spend more time talking to brokers, visiting risks, and understanding market trends. The best underwriters have always done this. AI makes it possible for more underwriters to work this way.

Learn more about AI and underwriting in our blog: Artificial Intelligence for Insurance Underwriting: Key Use Cases & Tools.

Generative AI for Actuaries

Actuarial work occupies a different position in the AI adoption curve than underwriting. Where underwriters read submissions and make binding decisions, actuaries aggregate historical data and build models that inform pricing, reserving, and capital allocation. The work is already quantitative, but the data preparation remains stubbornly manual.

Generative AI attacks the data gathering and cleaning bottleneck that consumes 60-80% of actuarial time on most projects.

AI Use Cases for Actuaries

Here is how AI is reshaping specific actuarial tasks:

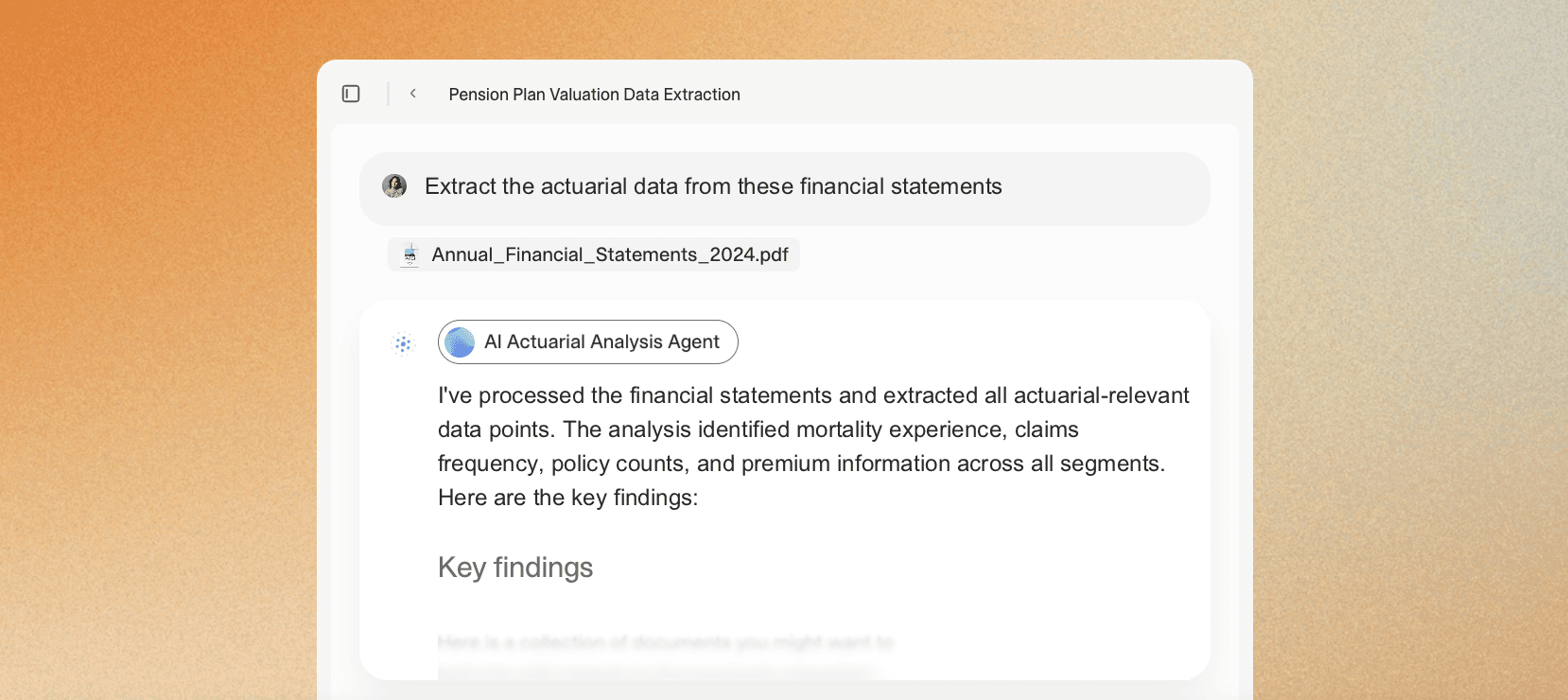

Data Extraction

Delegate the data extraction phase to a specialized AI actuarial agent. It reads financial statements, claims reports, policy documents, and regulatory filings to pull mortality rates, claims frequencies, policy counts, and other actuarial metrics. Your team gets clean, structured data ready for modeling—freeing actuaries to focus on assumptions and valuations.

Regulatory Reporting Automation

Statutory filings require data from multiple sources, formatted according to specific requirements that change annually. An agent can pull data from your policy and claims systems, apply the current year's reporting rules, generate the required schedules, and flag items that need actuarial review. What used to take a team three weeks now takes three days, with the actuaries spending their time on the exceptions rather than the routine calculations.

Experience Study Preparation

Pricing reviews require detailed experience studies—breaking down claims by coverage, geography, industry, policy size, and other dimensions. An agent can extract this data from your systems, calculate loss ratios and frequency/severity metrics, identify trends, and generate preliminary rate indications. The actuary reviews the results, adjusts for known issues (large losses, exposure changes), and finalizes the recommendations.

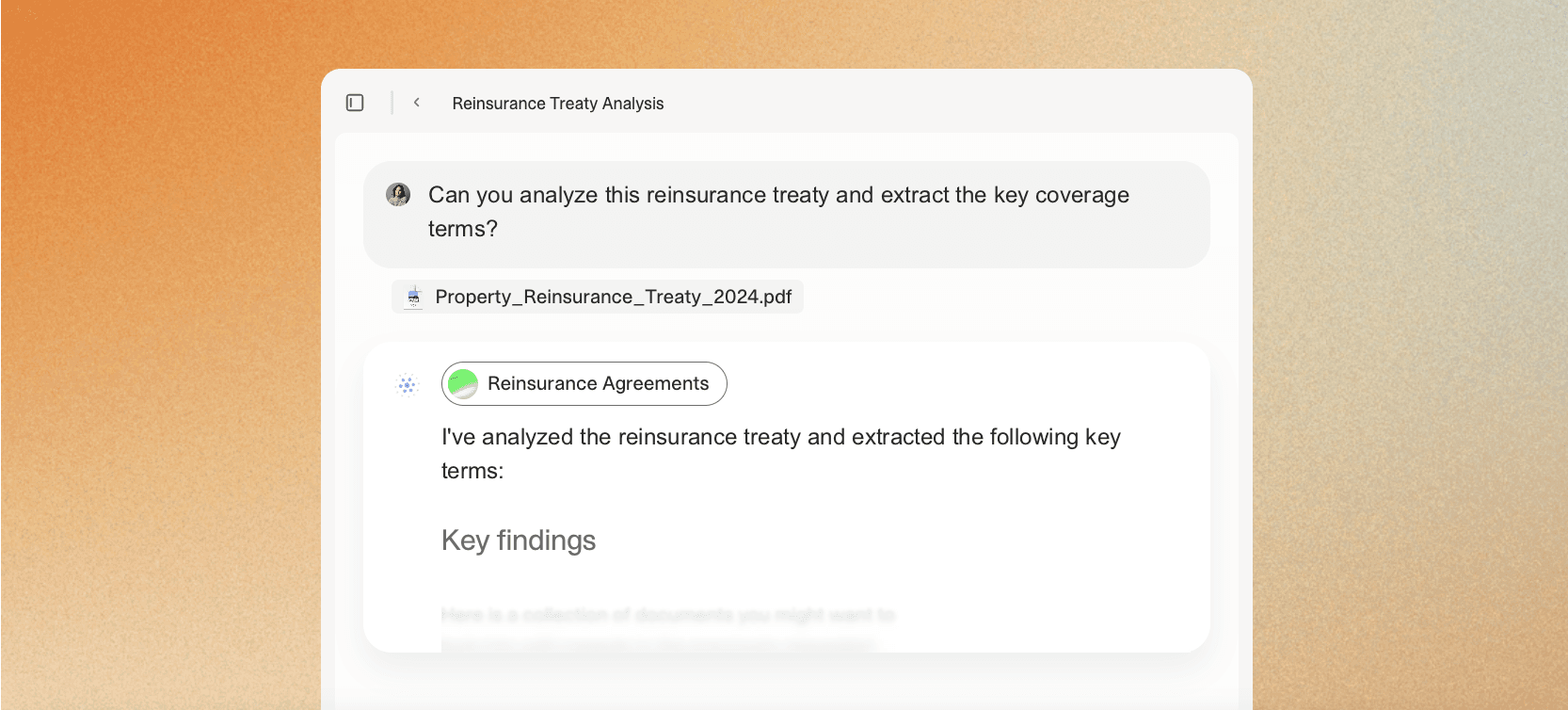

Reinsurance Treaty Analysis

Understanding your reinsurance program requires reading treaty wordings, tracking cessions, and modeling various loss scenarios. An agent can extract treaty terms from reinsurance agreements, identify coverage gaps or overlaps, and simulate how different loss patterns would impact your net retention. This is particularly valuable for complex programs with multiple layers and facultative placements.

Generative AI: The Impact on Actuaries

Actuarial work is already highly technical. The impact of AI is not about replacing actuaries, it is about letting them focus on the parts of the job that require actuarial judgment rather than data wrangling.

Less time in Excel, more time on model assumptions. When data aggregation is automated, actuaries can spend more time thinking about whether their assumptions are reasonable. Is the trend factor appropriate given recent market changes? Should we segment this class differently? Are we adequately capturing the impact of climate change?

Faster iteration cycles. When you can regenerate an analysis in hours instead of weeks, you can test more scenarios. What if we exclude the top 5% of claims? What if we adjust for exposure growth differently? What if we use a different development pattern? The ability to iterate quickly leads to better models.

More sophisticated analyses become feasible. Some analyses are theoretically valuable but practically impossible because they require too much manual work. With AI handling the data preparation, you can analyze claim development patterns by adjuster, compare reserve adequacy across different underwriting teams, or model the impact of specific policy language changes.

Junior actuaries learn faster. When you are not spending your first two years copying data between spreadsheets, you can focus on understanding the business. You can work on real pricing studies, reserve analyses, and capital modeling—the work that builds actuarial judgment.

AI for Claims Processors

Claims generates some of the highest ROI from generative AI because the work is fundamentally about interpreting evidence. Claims processors read FNOL reports, adjuster notes, police reports, medical documents, estimates, invoices, and policy wordings. They synthesize that information against coverage terms, regulatory requirements, and historical patterns. Then they make a decision: pay, deny, or negotiate.

95% of claims handlers are confident technology will significantly impact claims processing in the next five years. The report shows that contrary to common fears about artificial intelligence (AI) and automation displacing human workers, claims handlers see technology as an opportunity to improve processes, both for themselves and their customers.

AI Use Cases for Claims Processors

Here is how AI is reshaping specific claim processing workflows:

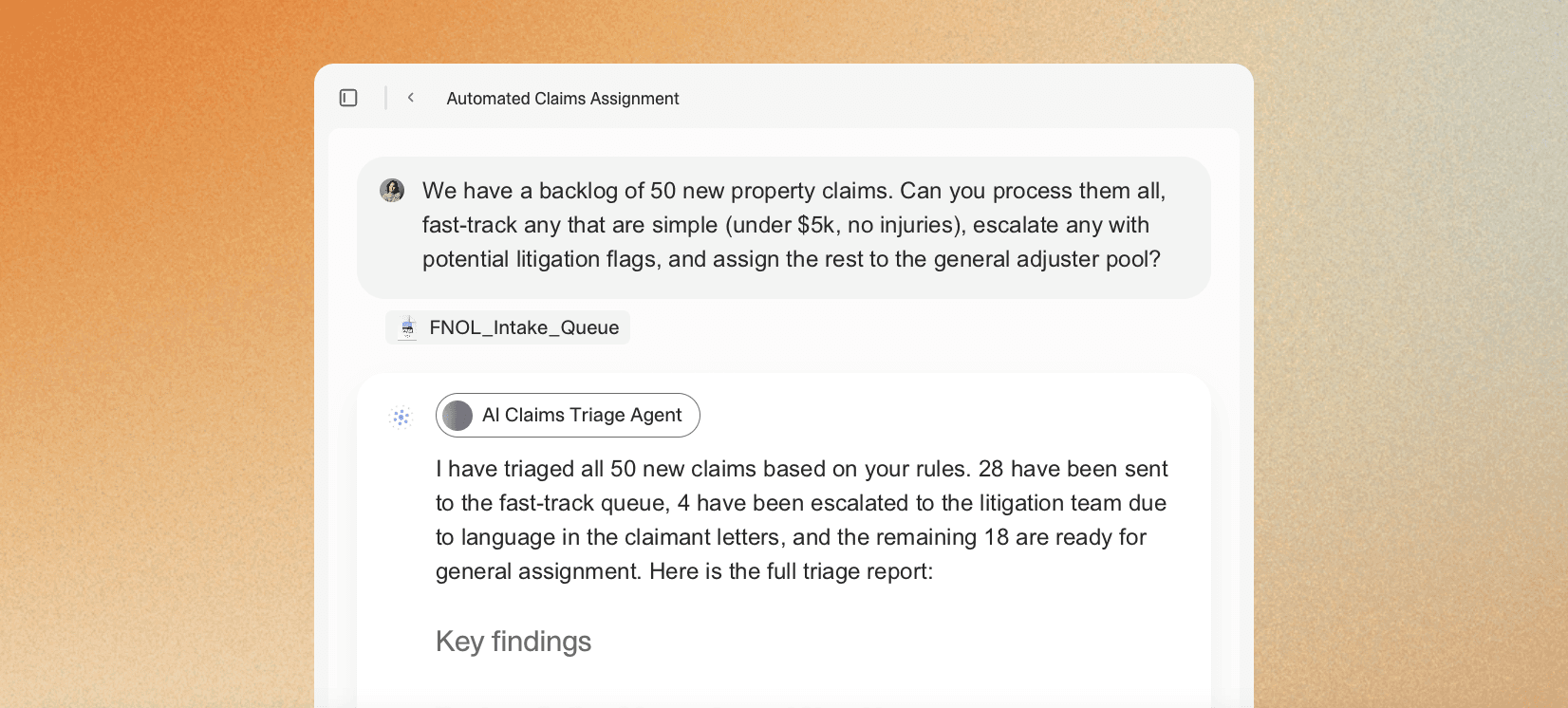

FNOL Intake and Triage

An AI Claims Triage Agent receives a First Notice of Loss and immediately extracts key data points: date of loss, cause of loss, parties involved, policy number, location, and preliminary severity indicators. It checks this against coverage triggers and regulatory reporting thresholds. The agent flags issues requiring immediate escalation—potential fraud indicators, bodily injury, statutory deadlines. Claims handlers see a clean, structured summary instead of raw, inconsistent intake data.

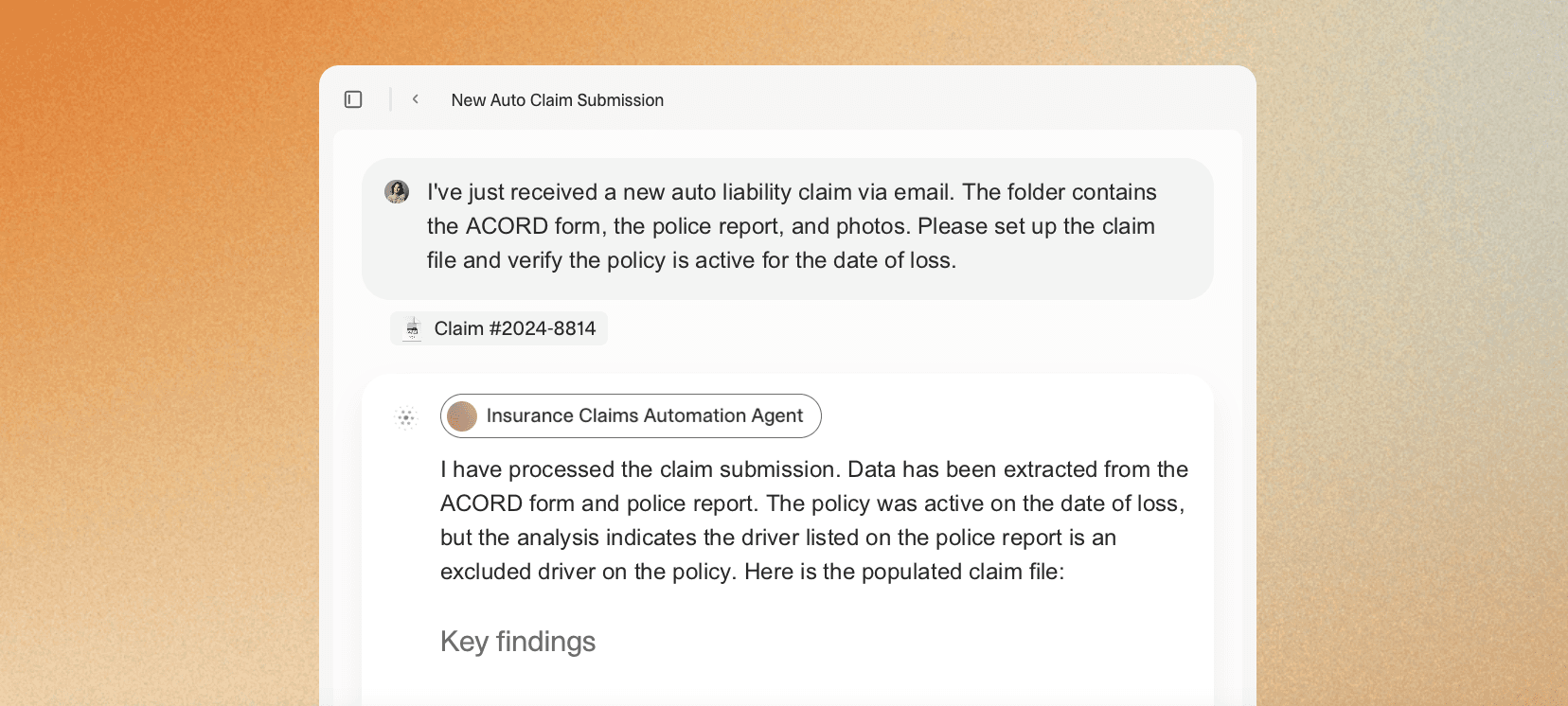

Document Review and Evidence Extraction

Policies, medical records, police reports, repair estimates, and invoices can run hundreds of pages. An Insurance Claims Automation Agent processes them in seconds. It can highlight inconsistencies—treatment codes that don’t match injury descriptions, repair invoices exceeding regional averages, or conflicting statements within the file.

Policy wording is also often complex, especially with endorsements and jurisdiction-specific requirements. An agent can compare the facts of the loss against the policy in force, identifying applicable coverage sections, exclusions that may apply, and ambiguity points requiring human review.

Damage Assessment and Repair Validation

Inspection photos and adjuster field notes often contain crucial details buried in images and free text. An AI agent can analyze photos to confirm damage type, compare against pre-loss images, and detect potential pre-existing conditions. It cross-references estimates with labor rates, parts databases, and historical claims to identify overbilling or unnecessary repairs.

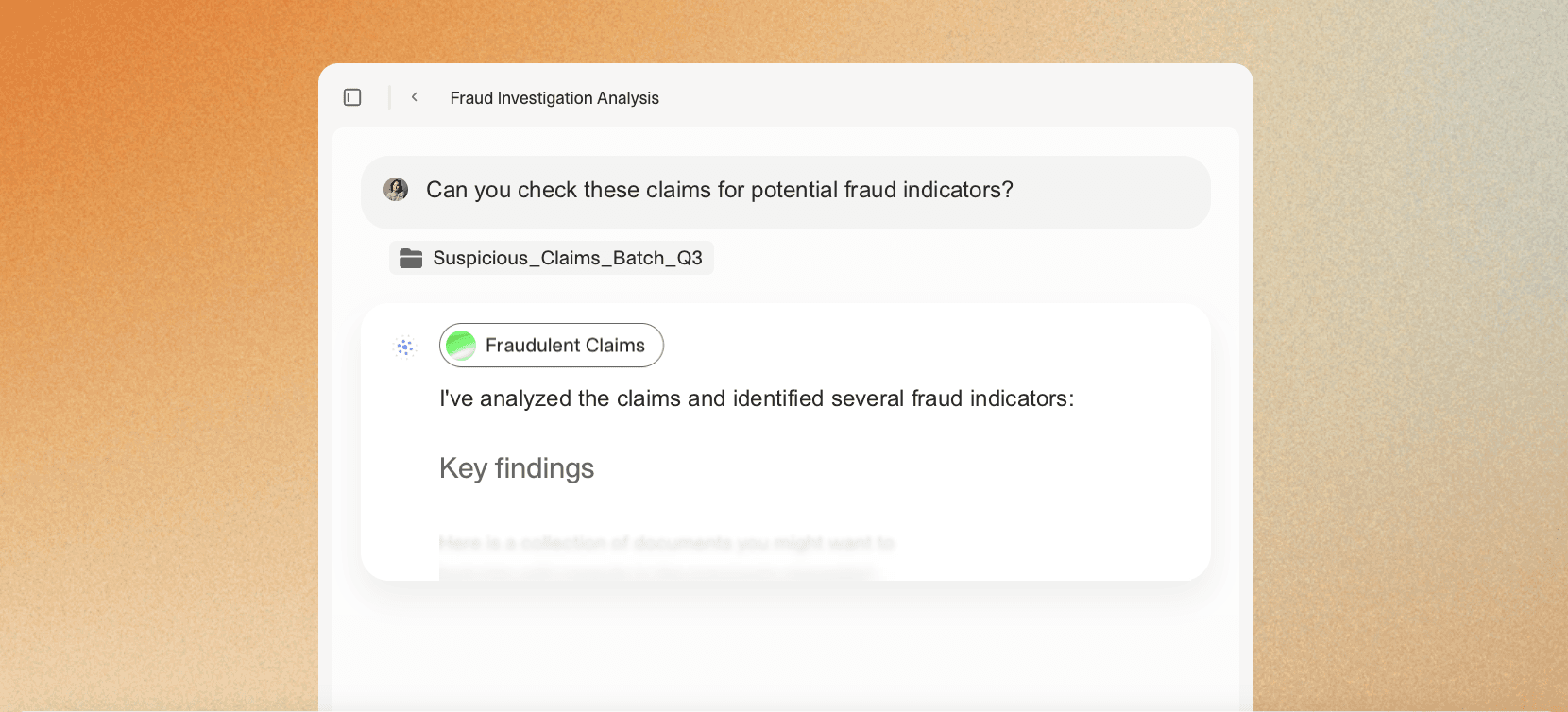

Fraud Pattern Detection

Fraud detection requires spotting subtle inconsistencies across documents, timelines, and claimant histories. An AI Fraud Detection agent can correlate narrative inconsistencies, unusual provider billing patterns, repeated vendors across unrelated claims, or suspicious timing sequences. Instead of a simple fraud score, it generates structured reasoning—“two prior losses with same repair shop, injury severity inconsistent with medical records”—and surfaces them for human review.

AI: The Impact on Claims Processors

For decades, claims processors have been forced to function as administrative routers, moving data between PDFs and legacy systems while trying to maintain the mental bandwidth to negotiate settlements. Generative AI fundamentally alters this dynamic

“We have six assessors. Before V7 Go, each would process around 15 claims a day, about 90 in total. With V7 Go, we’re expecting that to rise to around 20 claims per assessor, which adds up to an extra 30 claims a day. That’s the equivalent of two additional full-time assessors. Beyond the cost savings, there’s real reputational gains from fewer errors and faster turnaround times.”

From "Processors" to "Problem Solvers": When the FNOL is auto-populated and coverage is pre-verified, the adjuster picks up the phone already knowing the facts. They can focus on empathy, negotiation, and strategy—the human skills that drive Net Promoter Score (NPS) and fair settlement outcomes.

Higher capacity without burnout: The administrative burden of claims is a major driver of industry turnover. AI relieves this cognitive load.

Reduced leakage through precision: A human claims processor, under pressure to close files, might rubber-stamp a $500 supplement or miss a subtle pre-existing condition. An AI agent has infinite patience. It checks every line item against labor rates, parts databases, and historical photos. It stops the "death by a thousand cuts" of claims leakage that humans simply don't have the time to catch.

Junior adjusters upskill faster: The traditional path for a new claims processor involves years of data entry and simple file management. With AI handling the intake and basic liability checks, junior staff can be exposed to complex decision-making earlier. They spend less time learning how to use the claims system and more time learning how to assess liability and negotiate settlements.

Learn more about AI claims processing here: Automated Claims Processing: Implementation Guide for Insurance Operations

Generative AI for Brokers

Brokers are client-facing, relationship-driven, and constantly juggling multiple accounts at different stages of the insurance lifecycle. Their bottleneck is often handling high volumes of routine requests while still providing personalized service.

The efficient use of AI to streamline those processes which can be easily and appropriately automated can then enable brokers to find more time to focus on engaging with their customers and providing the tailored advice they require.

AI Use Cases for Brokers

Here is how AI is reshaping specific broker workflows:

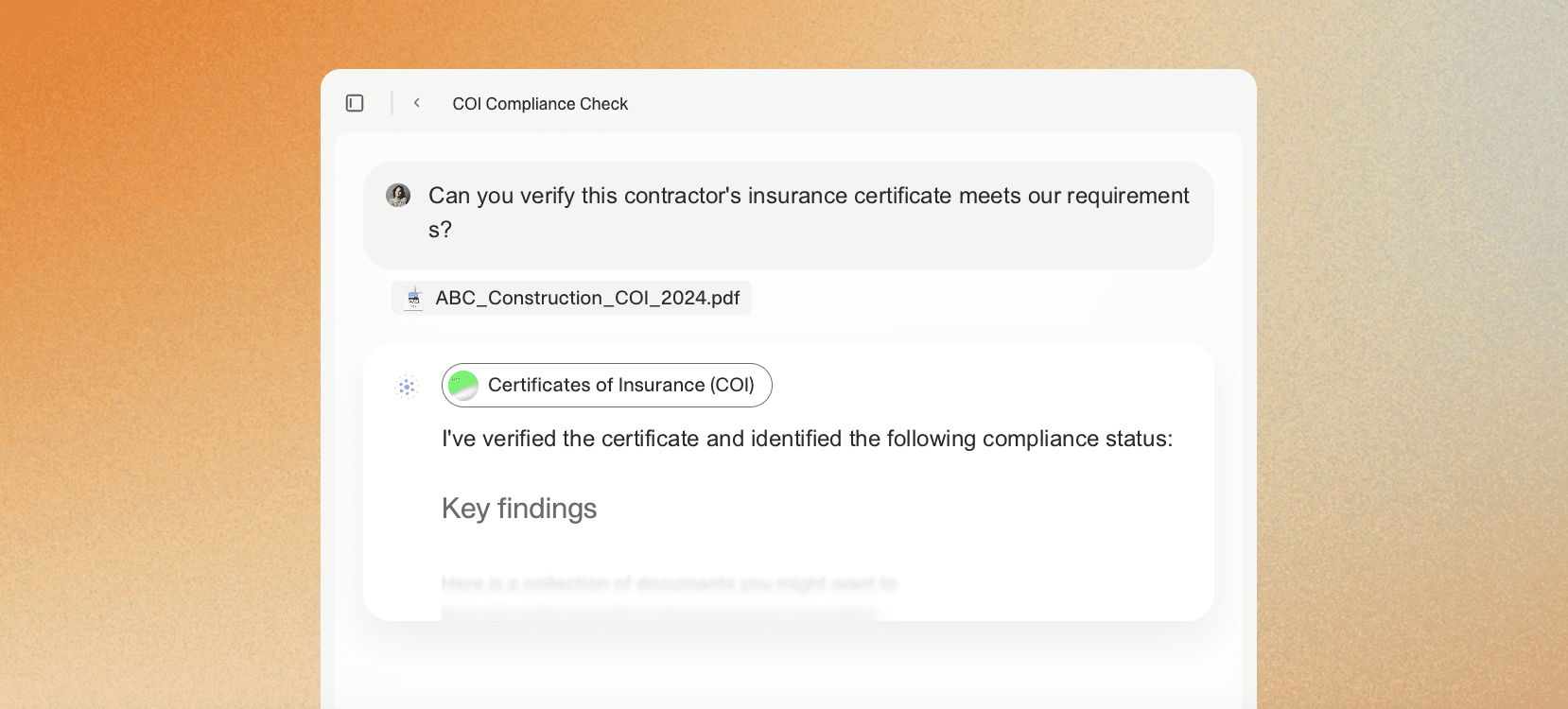

Certificate of Insurance (COI) Requests

This is a common pain point. A client needs a COI for a vendor, landlord, or contract requirement. The broker has to pull the policy, verify coverage, generate the certificate, and send it to the client. For a large account, this might happen 50-100 times per year. An AI COI automation workflow handles the entire process: receive the request via email, verify coverage against the policy, generate the certificate with correct language, and send it to the client—all without broker involvement unless there is an issue.

Policy and Quote Comparisons

When shopping coverage, clients want to understand the differences between proposals. An agent can analyze multiple quotes, extract coverage terms, identify differences in limits, deductibles, and exclusions, and generate a comparison summary. Instead of the broker spending an hour creating a spreadsheet, the client gets a clear comparison in minutes.

Renewal Preparation

Sixty days before renewal, an agent can pull the current policy, recent claims, any mid-term changes, and market conditions. It generates a renewal strategy memo: "Premium is likely to increase 8-12% due to two claims and market hardening. Recommend increasing deductible from $5K to $10K to offset. Also suggest adding cyber coverage given client's increased online sales." The broker reviews and refines, but the groundwork is accelerated.

Client Communication and Follow-Up

An agent can monitor email for client questions, draft responses based on policy terms and prior conversations, and flag items that need broker attention. Simple questions ("What is my deductible for water damage?") get immediate answers. Complex questions ("Will this cover our new manufacturing process?") get flagged for broker review with relevant policy language already pulled.

Common Pitfalls for Generative AI in Insurance

Most AI implementations fail not because the technology does not work, but because organizations misunderstand what they are buying or how to deploy it. Here are the patterns that lead to failure.

Pitfall 1: Treating AI as a Black Box

Insurance is a regulated industry, and you can't make decisions based on systems you do not understand. When an underwriter declines a risk, they need to explain why. When an actuary sets a rate, they need to justify it to regulators. "The AI said so" is not an acceptable answer.

The solution is explainability. Every AI decision should come with reasoning and evidence. V7 Go's visual grounding provides this—when it extracts a data point, it shows you the source.

Pitfall 2: Expecting Perfect Accuracy

No AI system is 100% accurate. LLMs hallucinate. OCR misreads text. Models make mistakes. If you deploy AI expecting perfection, you will be disappointed and your users will lose trust.

The solution is human-in-the-loop workflows. AI handles the bulk of the work, but humans review exceptions and edge cases. For example, an underwriting agent might auto-route submissions that clearly meet guidelines, flag borderline cases for review, and auto-decline obvious mismatches. The underwriter focuses on the middle category—the cases that require judgment.

Pitfall 3: Ignoring Data Quality

If your historical data is messy, inconsistent, or biased, your AI outputs will be too. Garbage in, garbage out.

Before deploying AI, audit your data. Are claim codes consistent? Are policy wordings standardized? Are underwriting decisions documented with clear reasoning? If not, you need to clean your data first. This is tedious work, but it is necessary.

The good news is that generative AI can help with data cleaning. An agent can identify inconsistencies, suggest corrections, and flag anomalies. But you still need human oversight to validate the corrections.

Pitfall 4: Underestimating Change Management

The technology is the easy part. The hard part is getting people to use it. Underwriters who have spent 20 years reading submissions manually will not trust an AI summary without proof that it works. Actuaries who have built their careers on Excel models will not switch to AI-generated analyses without validation.

Successful implementations start small. Pick one workflow, prove it works, and expand. For example, start with COI automation for brokers. It is low-risk, high-volume, and easy to measure. Once brokers see that it works, they will trust the system for more complex tasks.

Also, involve users in the design. Do not build an AI system in isolation and then force people to use it. Work with underwriters, actuaries, and brokers to understand their workflows and pain points. Build solutions that fit how they actually work.

Generative AI adoption follows the typical hype cycle, early enthusiasm, followed by disillusionment, then gradual productivity gains.

Pitfall 5: Focusing on Cost Savings Instead of Value Creation

The ROI pitch for AI is usually "we will reduce headcount by automating manual work." This is shortsighted. The real value of AI is not replacing people, it is enabling them to do higher-value work.

An underwriter who spends less time on data entry can write more business, handle more complex risks, and build stronger broker relationships. An actuary who spends less time on data preparation can build better models and provide more strategic insights. A broker who spends less time on COIs can focus on risk management consulting.

Measure AI success by business outcomes, not cost reduction. Are you writing more profitable business? Are you retaining more clients? Are you entering new markets? These are the metrics that matter.

One key difference from previous technological leaps is that gen AI is capable of levels of reasoning, judgment, creativity, and empathy that far exceed previous innovations’ capabilities—skill sets with particular salience to insurers. That’s why gen AI has the capacity to truly transform the insurance industry.

— McKinsey

If you're ready to unlock secure, reliable generative and agentic AI for your organization, book a chat with our expert team today.