90% ROI increase

AI Loan Modification Analysis

Keep your loan servicing data accurate

V7 Go's agent automates the review of loan modification agreements, identifying exactly which terms were changed and providing structured data to update your servicing systems without error.

Ideal for

Loan Servicing Teams

Special Assets & Workout Groups

Shareholder agreement review

See Loan Modification Agreements in action

Play video

Shareholder agreement review

See Loan Modification Agreements in action

Play video

Shareholder agreement review

See Loan Modification Agreements in action

Play video

Shareholder agreement review

See Loan Modification Agreements in action

Play video

Challenge

Challenge

When a loan is modified servicers face a high-risk manual update process. An employee must read the agreement and manually key the new terms into the servicing system a process ripe for costly errors.

When a loan is modified servicers face a high-risk manual update process. An employee must read the agreement and manually key the new terms into the servicing system a process ripe for costly errors.

V7 Go's AI agent automates this critical task. It reads the modification agreement, compares it to the original loan, and extracts a clear summary of only the changed terms, ready to be fed into your servicing system automatically and without error.

V7 Go's AI agent automates this critical task. It reads the modification agreement, compares it to the original loan, and extracts a clear summary of only the changed terms, ready to be fed into your servicing system automatically and without error.

Time comparison

Time comparison

Traditional review time

1-2 hours

1-2 hours

With V7 Go

5 minutes

5 minutes

Average time saved

95%

95%

Why V7 Go

Why V7 Go

Change of Terms Extraction

The agent automatically identifies and extracts the specific terms that have been modified, such as interest rate, maturity date, and principal amount.

Change of Terms Extraction

The agent automatically identifies and extracts the specific terms that have been modified, such as interest rate, maturity date, and principal amount.

Change of Terms Extraction

The agent automatically identifies and extracts the specific terms that have been modified, such as interest rate, maturity date, and principal amount.

Change of Terms Extraction

The agent automatically identifies and extracts the specific terms that have been modified, such as interest rate, maturity date, and principal amount.

Original vs. Modified Comparison

Provides a clear side-by-side comparison of the original loan terms and the new, modified terms.

Original vs. Modified Comparison

Provides a clear side-by-side comparison of the original loan terms and the new, modified terms.

Original vs. Modified Comparison

Provides a clear side-by-side comparison of the original loan terms and the new, modified terms.

Original vs. Modified Comparison

Provides a clear side-by-side comparison of the original loan terms and the new, modified terms.

Fee & Forbearance Analysis

Accurately extracts any modification fees, capitalized interest, or principal forbearance amounts.

Fee & Forbearance Analysis

Accurately extracts any modification fees, capitalized interest, or principal forbearance amounts.

Fee & Forbearance Analysis

Accurately extracts any modification fees, capitalized interest, or principal forbearance amounts.

Fee & Forbearance Analysis

Accurately extracts any modification fees, capitalized interest, or principal forbearance amounts.

Covenant Update Identification

Detects any changes to financial or reporting covenants that result from the loan modification.

Covenant Update Identification

Detects any changes to financial or reporting covenants that result from the loan modification.

Covenant Update Identification

Detects any changes to financial or reporting covenants that result from the loan modification.

Covenant Update Identification

Detects any changes to financial or reporting covenants that result from the loan modification.

Elimination of Data Entry Errors

Dramatically reduces the risk of manual data entry errors that cause incorrect billing and servicing issues.

Elimination of Data Entry Errors

Dramatically reduces the risk of manual data entry errors that cause incorrect billing and servicing issues.

Elimination of Data Entry Errors

Dramatically reduces the risk of manual data entry errors that cause incorrect billing and servicing issues.

Elimination of Data Entry Errors

Dramatically reduces the risk of manual data entry errors that cause incorrect billing and servicing issues.

Automated System Updates

The structured data output can be used to automatically update the loan record in your servicing platform via API.

Automated System Updates

The structured data output can be used to automatically update the loan record in your servicing platform via API.

Automated System Updates

The structured data output can be used to automatically update the loan record in your servicing platform via API.

Automated System Updates

The structured data output can be used to automatically update the loan record in your servicing platform via API.

Get started

Get started

Review loan modification and forbearance agreements.

Extract new interest rates, maturity dates, and payment terms.

Get started

Import your files

Gmail

,

Google Drive

,

CoStar

Import your files from wherever they are currently stored

Import your files from wherever they are currently stored

Loan Modification Agreements

Loan Modification Agreements

Forbearance Agreements

Forbearance Agreements

Original Loan Agreements

Original Loan Agreements

Assumption Agreements

Assumption Agreements

Deferral Agreements

Deferral Agreements

Servicing Transfer Notices

Servicing Transfer Notices

All types of documents supported

All types of documents supported

New Interest Rate & Terms

New Interest Rate & Terms

New Maturity Date

New Maturity Date

Modified Payment Amount

Modified Payment Amount

Principal Forbearance/Deferral Amount

Principal Forbearance/Deferral Amount

Capitalized Interest & Fees

Capitalized Interest & Fees

Changes to Covenants

Changes to Covenants

Re-amortization Schedule

Re-amortization Schedule

Waiver of Past Defaults

Waiver of Past Defaults

Consent from Guarantors

Consent from Guarantors

Confirmation of New Principal Balance

Confirmation of New Principal Balance

Once imported our system extracts and organises the essentials

Once imported our system extracts and organises the essentials

The difference

The difference

AI-powered loan servicing

for banks and financial institutions

The difference

Finance teams work is about to make it's biggest shift in a century

Before

ChatGPT

V7 Go

Servicing staff manually read modification agreements and key the new terms into billing systems a high-risk process prone to costly data entry errors.

Use an AI agent to analyze loan modification agreements. Automatically extract changed interest rates, payment terms, and maturity dates for accurate loan servicing.

Finance teams work is about to make it's biggest shift in a century

Before

ChatGPT

V7 Go

Servicing staff manually read modification agreements and key the new terms into billing systems a high-risk process prone to costly data entry errors.

Use an AI agent to analyze loan modification agreements. Automatically extract changed interest rates, payment terms, and maturity dates for accurate loan servicing.

Finance teams work is about to make it's biggest shift in a century

Before

ChatGPT

V7 Go

Servicing staff manually read modification agreements and key the new terms into billing systems a high-risk process prone to costly data entry errors.

Use an AI agent to analyze loan modification agreements. Automatically extract changed interest rates, payment terms, and maturity dates for accurate loan servicing.

Multiple agents available to do the work

Are there any clauses in our vendor contracts that create exposure or conflict with our standard terms?

Select and tailor agents to perfectly align with the specifics of your Loan Modification Agreements

Multiple agents available to do the work

Are there any clauses in our vendor contracts that create exposure or conflict with our standard terms?

Select and tailor agents to perfectly align with the specifics of your Loan Modification Agreements

Multiple agents available to do the work

Are there any clauses in our vendor contracts that create exposure or conflict with our standard terms?

Select and tailor agents to perfectly align with the specifics of your Loan Modification Agreements

The difference

AI-powered loan servicing

for banks and financial institutions

The difference

Finance teams work is about to make it's biggest shift in a century

Before

ChatGPT

V7 Go

Analysts spend days manually reading 100+ page documents trying to spot subtle year-over-year changes in risk disclosures and MD&A.

Use an AI agent to analyze loan modification agreements. Automatically extract changed interest rates, payment terms, and maturity dates for accurate loan servicing.

Play video

Multiple agents available to do the work

Are there any clauses in our vendor contracts that create exposure or conflict with our standard terms?

Select and tailor agents to perfectly align with the specifics of your Loan Modification Agreements

Play video

Customer Voices

Customer Voices

Building trustworthy AI, trained on your data

Join the world's best teams and Fortune 500s

Healthcare

•

Finance

•

Legal

•

Insurance

•

Logistics

•

Biotechnology

•

Manufacturing

•

Real Estate

Healthcare

•

Finance

•

Legal

•

Insurance

•

Logistics

•

Biotechnology

•

Manufacturing

•

Real Estate

Healthcare

•

Finance

•

Legal

•

Insurance

•

Logistics

•

Biotechnology

•

Manufacturing

•

Real Estate

Customer Voices

Finance

The experience with V7 has been fantastic. Very customized level of support. You feel like they really care about your outcome and objectives.

Read the full story

Finance

The experience with V7 has been fantastic. Very customized level of support. You feel like they really care about your outcome and objectives.

Read the full story

Healthcare

The configurability and extensive API interface of V7 has enabled us to quickly create, customise, deploy and make changes to our labelling processes all through automated communications with our own backend tooling.

Read the full story

Healthcare

The configurability and extensive API interface of V7 has enabled us to quickly create, customise, deploy and make changes to our labelling processes all through automated communications with our own backend tooling.

Read the full story

Automotive

"We chose V7 because we wanted to build new types of workflows. We had our own system, but we wanted it to accomplish additional tasks, like create other annotation types, re-annotations, annotations on videos—activities that would be a lot of effort in development."

Read the full story

Automotive

"We chose V7 because we wanted to build new types of workflows. We had our own system, but we wanted it to accomplish additional tasks, like create other annotation types, re-annotations, annotations on videos—activities that would be a lot of effort in development."

Read the full story

Finance

The experience with V7 has been fantastic. Very customized level of support. You feel like they really care about your outcome and objectives.

Read the full story

Healthcare

The configurability and extensive API interface of V7 has enabled us to quickly create, customise, deploy and make changes to our labelling processes all through automated communications with our own backend tooling.

Read the full story

Automotive

"We chose V7 because we wanted to build new types of workflows. We had our own system, but we wanted it to accomplish additional tasks, like create other annotation types, re-annotations, annotations on videos—activities that would be a lot of effort in development."

Read the full story

Energy

"We label terabytes of data per platform across thousands of platforms. From the operations perspective—unless we did drastic developments, the scale of the projects requires a tool like V7 to succeed"

Read the full story

Agriculture

"V7 is really easy to use and has great customer support—bugs are fixed, email support is very fast, and feature requests are delivered as promised."

Read the full story

Features

Features

Results you can actually trust.

Reliable AI document processing toolkit.

Results you can trust.

Trustworthy AI document processing toolkit.

Supporting complex documents.

Up to 200 pages.

From handwritten notes to complex graphs, V7 Go reads and understands them all—even when layouts shift across documents. Process hundreds of documents and pages, transforming them into structured outputs with task-based workflows you can customize or build from scratch.

Input types

50+ languages

Handwritten

200 pages

Multi-modal

Document types

PDFs

URL

Tables

Graphs

Vendor_US.xlsx

3

Supply_2023.pptx

Review_Legal.pdf

Supporting complex documents.

Up to 200 pages.

From handwritten notes to complex graphs, V7 Go reads and understands them all—even when layouts shift across documents. Process hundreds of documents and pages, transforming them into structured outputs with task-based workflows you can customize or build from scratch.

Input types

50+ languages

Handwritten

200 pages

Multi-modal

Document types

PDFs

URL

Tables

Graphs

Vendor_US.xlsx

3

Supply_2023.pptx

Review_Legal.pdf

Supporting complex documents.

Up to 200 pages.

From handwritten notes to complex graphs, V7 Go reads and understands them all—even when layouts shift across documents. Process hundreds of documents and pages, transforming them into structured outputs with task-based workflows you can customize or build from scratch.

Input types

50+ languages

Handwritten

200 pages

Multi-modal

Document types

PDFs

URL

Tables

Graphs

Vendor_US.xlsx

3

Supply_2023.pptx

Review_Legal.pdf

Reach 99% accuracy rate through

GenAI reasoning.

Break down complex document processing into discrete steps. Choose from top GenAI models, OCR tools, custom Python code, or integrate your own model to achieve fast, accurate, and reliable results with outputs you can trust.

Model providers

Security note

V7 never trains models on your private data. We keep your data encrypted and allow you to deploy your own models.

Answer

Type

Text

Tool

o4 Mini

Reasoning effort

Off

Low

Mid

High

AI Citations

Inputs

Set a prompt (Press @ to mention an input)

Reach 99% accuracy rate through

GenAI reasoning.

Break down complex document processing into discrete steps. Choose from top GenAI models, OCR tools, custom Python code, or integrate your own model to achieve fast, accurate, and reliable results with outputs you can trust.

Model providers

Security note

V7 never trains models on your private data. We keep your data encrypted and allow you to deploy your own models.

Answer

Type

Text

Tool

o4 Mini

Reasoning effort

Off

Low

Mid

High

AI Citations

Inputs

Set a prompt (Press @ to mention an input)

Reach 99% accuracy rate through

GenAI reasoning.

Break down complex document processing into discrete steps. Choose from top GenAI models, OCR tools, custom Python code, or integrate your own model to achieve fast, accurate, and reliable results with outputs you can trust.

Model providers

Security note

V7 never trains models on your private data. We keep your data encrypted and allow you to deploy your own models.

Answer

Type

Text

Tool

o4 Mini

Reasoning effort

Off

Low

Mid

High

AI Citations

Inputs

Set a prompt (Press @ to mention an input)

Trustworthy results,

grounded in reality.

You can verify if AI-generated responses are true and which excerpts they were based on. AI models in V7 Go automatically highlight source areas in your documents. Human reviewers can focus their time on results with lower confidence scores and make corrections when needed.

Visual grounding in action

00:54

Deliberate Misrepresentation: During the trial, evidence was presented showing that John Doe deliberately misrepresented his income on multiple occasions over several years. This included falsifying documents, underreporting income, and inflating deductions to lower his tax liability. Such deliberate deception demonstrates intent to evade taxes.

Pattern of Behavior: The prosecution demonstrated a consistent pattern of behavior by John Doe, spanning several years, wherein he consistently failed to report substantial portions of his income. This pattern suggested a systematic attempt to evade taxes rather than mere oversight or misunderstanding.

Concealment of Assets: Forensic accounting revealed that John Doe had taken significant steps to conceal his assets offshore, including setting up shell companies and using complex financial structures to hide income from tax authorities. Such elaborate schemes indicate a deliberate effort to evade taxes and avoid detection.

Failure to Cooperate: Throughout the investigation and trial, John Doe displayed a lack of cooperation with tax authorities. He refused to provide requested documentation, obstructed the audit process, and failed to disclose relevant financial information. This obstructionism further supported the prosecution's argument of intentional tax evasion.

Prior Warning and Ignoring Compliance

02

01

01

02

Trustworthy results,

grounded in reality.

You can verify if AI-generated responses are true and which excerpts they were based on. AI models in V7 Go automatically highlight source areas in your documents. Human reviewers can focus their time on results with lower confidence scores and make corrections when needed.

Visual grounding in action

00:54

Deliberate Misrepresentation: During the trial, evidence was presented showing that John Doe deliberately misrepresented his income on multiple occasions over several years. This included falsifying documents, underreporting income, and inflating deductions to lower his tax liability. Such deliberate deception demonstrates intent to evade taxes.

Pattern of Behavior: The prosecution demonstrated a consistent pattern of behavior by John Doe, spanning several years, wherein he consistently failed to report substantial portions of his income. This pattern suggested a systematic attempt to evade taxes rather than mere oversight or misunderstanding.

Concealment of Assets: Forensic accounting revealed that John Doe had taken significant steps to conceal his assets offshore, including setting up shell companies and using complex financial structures to hide income from tax authorities. Such elaborate schemes indicate a deliberate effort to evade taxes and avoid detection.

Failure to Cooperate: Throughout the investigation and trial, John Doe displayed a lack of cooperation with tax authorities. He refused to provide requested documentation, obstructed the audit process, and failed to disclose relevant financial information. This obstructionism further supported the prosecution's argument of intentional tax evasion.

Prior Warning and Ignoring Compliance

02

01

01

02

Trustworthy results,

grounded in reality.

You can verify if AI-generated responses are true and which excerpts they were based on. AI models in V7 Go automatically highlight source areas in your documents. Human reviewers can focus their time on results with lower confidence scores and make corrections when needed.

Visual grounding in action

00:54

Deliberate Misrepresentation: During the trial, evidence was presented showing that John Doe deliberately misrepresented his income on multiple occasions over several years. This included falsifying documents, underreporting income, and inflating deductions to lower his tax liability. Such deliberate deception demonstrates intent to evade taxes.

Pattern of Behavior: The prosecution demonstrated a consistent pattern of behavior by John Doe, spanning several years, wherein he consistently failed to report substantial portions of his income. This pattern suggested a systematic attempt to evade taxes rather than mere oversight or misunderstanding.

Concealment of Assets: Forensic accounting revealed that John Doe had taken significant steps to conceal his assets offshore, including setting up shell companies and using complex financial structures to hide income from tax authorities. Such elaborate schemes indicate a deliberate effort to evade taxes and avoid detection.

Failure to Cooperate: Throughout the investigation and trial, John Doe displayed a lack of cooperation with tax authorities. He refused to provide requested documentation, obstructed the audit process, and failed to disclose relevant financial information. This obstructionism further supported the prosecution's argument of intentional tax evasion.

Prior Warning and Ignoring Compliance

02

01

01

02

Enterprise grade security

for high-stake industries.

Integrate V7 seamlessly with your existing tech stack. Our platform connects to your cloud infrastructure and ML frameworks while ensuring robust data security and compliance with rigorous standards.

Certifications

GDPR

SOC2

HIPAA

ISO

Safety

Custom storage

Data governance

Access-level permissions

Enterprise grade security

for high-stake industries.

Integrate V7 seamlessly with your existing tech stack. Our platform connects to your cloud infrastructure and ML frameworks while ensuring robust data security and compliance with rigorous standards.

Certifications

GDPR

SOC2

HIPAA

ISO

Safety

Custom storage

Data governance

Access-level permissions

Enterprise grade security

for high-stake industries.

Integrate V7 seamlessly with your existing tech stack. Our platform connects to your cloud infrastructure and ML frameworks while ensuring robust data security and compliance with rigorous standards.

Certifications

GPDR

SOC2

HIPAA

ISO

Safety

Custom storage

Data governance

Access-level permissions

Answers

Answers

What you need to know about our

Loan Modification Agreements

What is a Loan Modification Agreement?

It's a legal contract that permanently changes one or more of the original terms of a loan, such as the interest rate, loan term, or monthly payment amount.

+

What is a Loan Modification Agreement?

It's a legal contract that permanently changes one or more of the original terms of a loan, such as the interest rate, loan term, or monthly payment amount.

+

What is a Loan Modification Agreement?

It's a legal contract that permanently changes one or more of the original terms of a loan, such as the interest rate, loan term, or monthly payment amount.

+

How does the agent know what the original terms were?

The workflow allows you to provide both the original loan agreement and the modification agreement. The agent reads both and intelligently compares them to identify the changes.

+

How does the agent know what the original terms were?

The workflow allows you to provide both the original loan agreement and the modification agreement. The agent reads both and intelligently compares them to identify the changes.

+

How does the agent know what the original terms were?

The workflow allows you to provide both the original loan agreement and the modification agreement. The agent reads both and intelligently compares them to identify the changes.

+

Can this handle complex modifications like principal deferrals?

Yes, the agent is trained to understand complex modification structures, including interest rate step-ups, principal forbearance, and term extensions.

+

Can this handle complex modifications like principal deferrals?

Yes, the agent is trained to understand complex modification structures, including interest rate step-ups, principal forbearance, and term extensions.

+

Can this handle complex modifications like principal deferrals?

Yes, the agent is trained to understand complex modification structures, including interest rate step-ups, principal forbearance, and term extensions.

+

Is this for residential mortgages or commercial loans?

Both. The agent can be configured to process modifications for commercial real estate loans, corporate credit facilities, and standard residential mortgages.

+

Is this for residential mortgages or commercial loans?

Both. The agent can be configured to process modifications for commercial real estate loans, corporate credit facilities, and standard residential mortgages.

+

Is this for residential mortgages or commercial loans?

Both. The agent can be configured to process modifications for commercial real estate loans, corporate credit facilities, and standard residential mortgages.

+

How does this improve compliance?

By ensuring the servicing system is updated accurately with the legally agreed-upon terms, it prevents violations of servicing regulations and ensures correct reporting to borrowers.

+

How does this improve compliance?

By ensuring the servicing system is updated accurately with the legally agreed-upon terms, it prevents violations of servicing regulations and ensures correct reporting to borrowers.

+

How does this improve compliance?

By ensuring the servicing system is updated accurately with the legally agreed-upon terms, it prevents violations of servicing regulations and ensures correct reporting to borrowers.

+

What is the primary ROI?

The primary return is a reduction in operational risk by eliminating costly data entry errors, as well as significant efficiency gains in the loan servicing department.

+

What is the primary ROI?

The primary return is a reduction in operational risk by eliminating costly data entry errors, as well as significant efficiency gains in the loan servicing department.

+

What is the primary ROI?

The primary return is a reduction in operational risk by eliminating costly data entry errors, as well as significant efficiency gains in the loan servicing department.

+

Pilot

Pilot

Curious how we can realise 90% ROI increase for you?

Curious how we can realise 90% ROI increase for you?

Send us a few samples, and we’ll deliver a custom demo with results—within 48 hours.

Send us a few samples, and we’ll deliver a custom demo with results—within 48 hours.

Vendor_US.xlsx

3

Supply_2023.pptx

Review_Legal.pdf

More Documents

More Documents

Explore more agents to help you

boost productivity of your work

More agents

10-K Disclosure Analysis

Automate the analysis of SEC 10-K filings to find risks and compare year-over-year changes in minutes.

Insurance

•

Comparative Analysis

•

Risk Factor Extraction

•

MD&A Insight Extraction

Explore

10-K Disclosure Analysis

Automate the analysis of SEC 10-K filings to find risks and compare year-over-year changes in minutes.

Insurance

•

Comparative Analysis

•

Risk Factor Extraction

•

MD&A Insight Extraction

Explore

10-K Disclosure Analysis

Automate the analysis of SEC 10-K filings to find risks and compare year-over-year changes in minutes.

Insurance

•

Comparative Analysis

•

Risk Factor Extraction

•

MD&A Insight Extraction

Explore

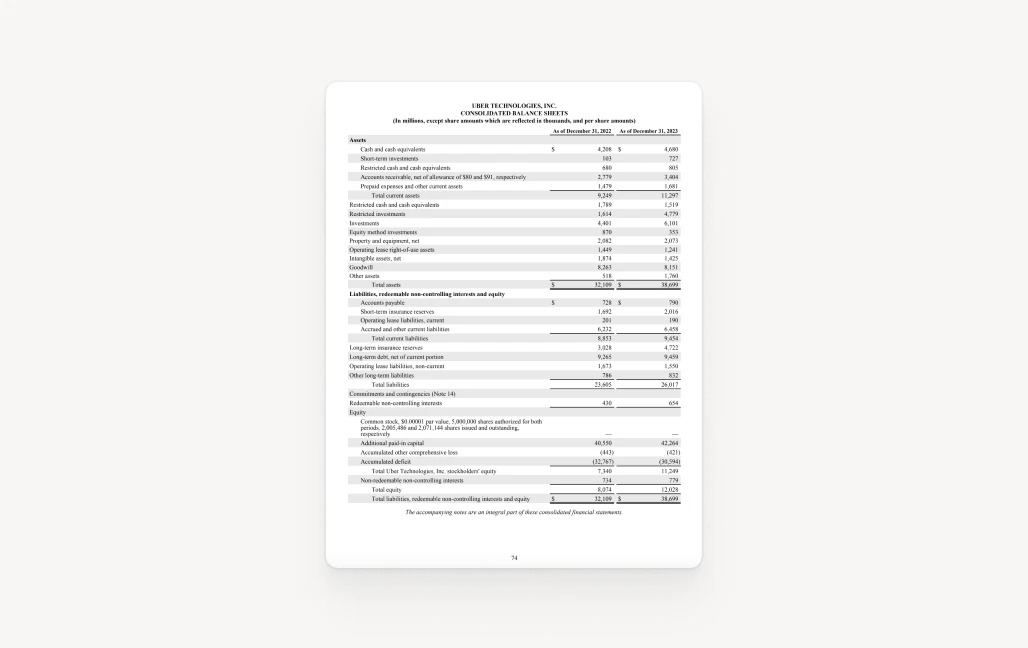

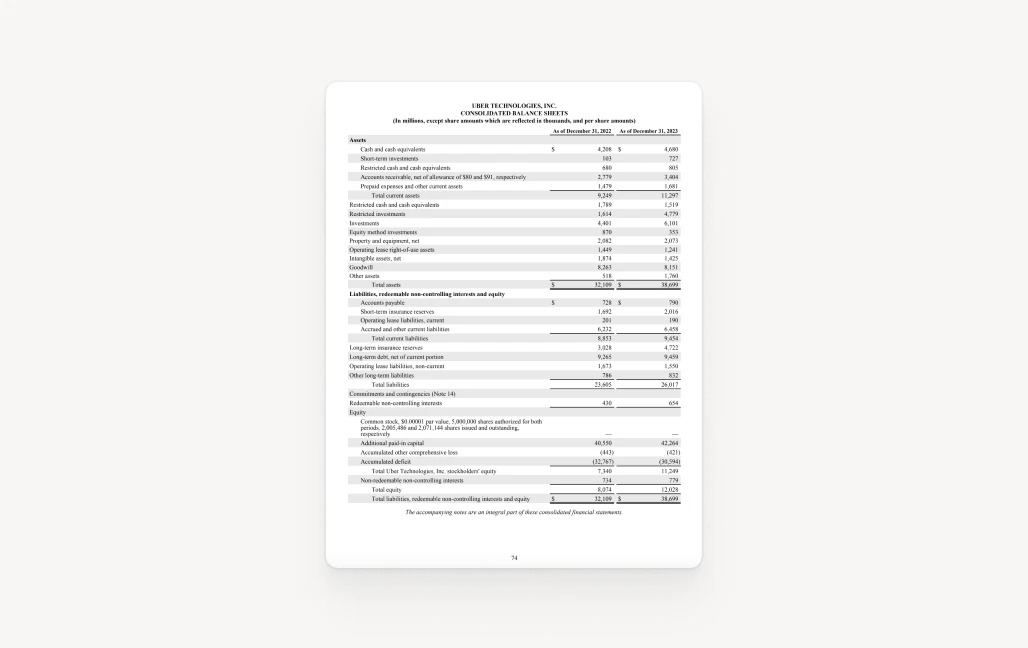

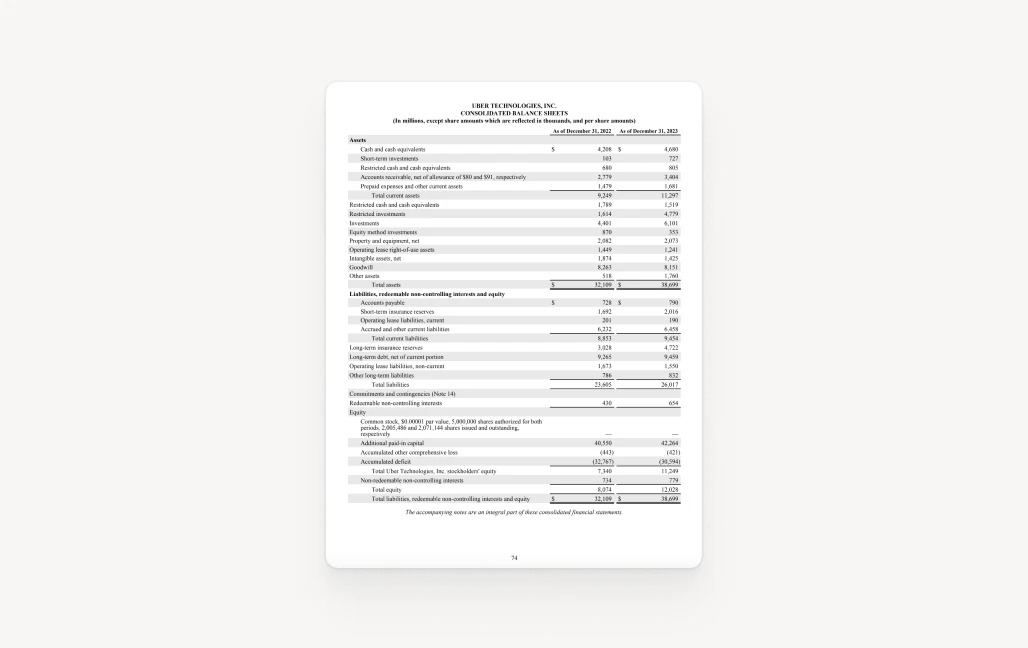

10Q Reports

AI-powered SEC 10-Q analysis: extracts key financial insights from quarterly filings efficiently.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

10Q Reports

AI-powered SEC 10-Q analysis: extracts key financial insights from quarterly filings efficiently.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

10Q Reports

AI-powered SEC 10-Q analysis: extracts key financial insights from quarterly filings efficiently.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Cap Tables

AI-powered Cap Table analysis: automate equity data extraction, ownership tracking, and report generation.

Insurance

•

Rapid Data Extraction

•

AI Citations

•

Table & Chart Analysis

Explore

Cap Tables

AI-powered Cap Table analysis: automate equity data extraction, ownership tracking, and report generation.

Insurance

•

Rapid Data Extraction

•

AI Citations

•

Table & Chart Analysis

Explore

Cap Tables

AI-powered Cap Table analysis: automate equity data extraction, ownership tracking, and report generation.

Insurance

•

Rapid Data Extraction

•

AI Citations

•

Table & Chart Analysis

Explore

Confidential Information Memorandum

AI analyzes Confidential Information Memoranda (CIMs): extract insights for faster due diligence.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Confidential Information Memorandum

AI analyzes Confidential Information Memoranda (CIMs): extract insights for faster due diligence.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Confidential Information Memorandum

AI analyzes Confidential Information Memoranda (CIMs): extract insights for faster due diligence.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Fund Performance Reports

AI analyzes Fund Performance Reports: extracts insights from complex financial data for better decisions.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Fund Performance Reports

AI analyzes Fund Performance Reports: extracts insights from complex financial data for better decisions.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Fund Performance Reports

AI analyzes Fund Performance Reports: extracts insights from complex financial data for better decisions.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Investment Memos

AI generates Investment Memos: extracts key metrics, analyzes financials, and assesses market potential.

Insurance

•

Rapid Data Extraction

•

AI Citations

•

Financial Analysis

Explore

Investment Memos

AI generates Investment Memos: extracts key metrics, analyzes financials, and assesses market potential.

Insurance

•

Rapid Data Extraction

•

AI Citations

•

Financial Analysis

Explore

Investment Memos

AI generates Investment Memos: extracts key metrics, analyzes financials, and assesses market potential.

Insurance

•

Rapid Data Extraction

•

AI Citations

•

Financial Analysis

Explore

Next Step

Next Step

Ensure loan modifications are recorded perfectly.

Ensure loan modifications are recorded perfectly.

Ensure loan modifications are recorded perfectly.

Delegate the review and data entry to an AI agent.

Delegate the review and data entry to an AI agent.

Delegate the review and data entry to an AI agent.

Uncover hidden liabilities

in

supplier contracts.

V7 Go transforms documents into strategic assets. 150+ enterprises are already on board:

Uncover hidden liabilities

in

supplier contracts.

V7 Go transforms documents into strategic assets. 150+ enterprises are already on board: