90% ROI increase

Automate insurance document ingestion with AI

Reduce manual processing time by 90%

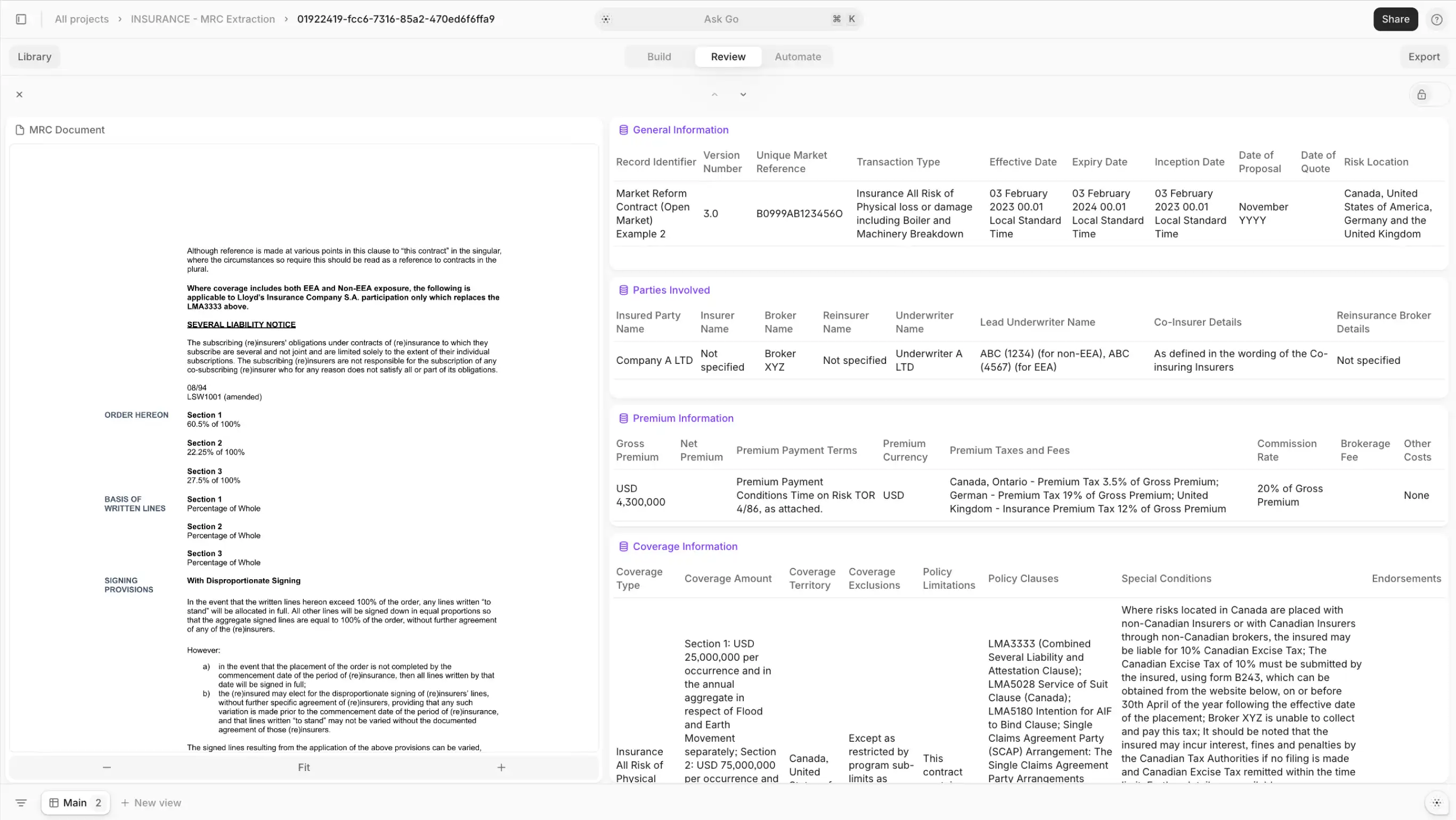

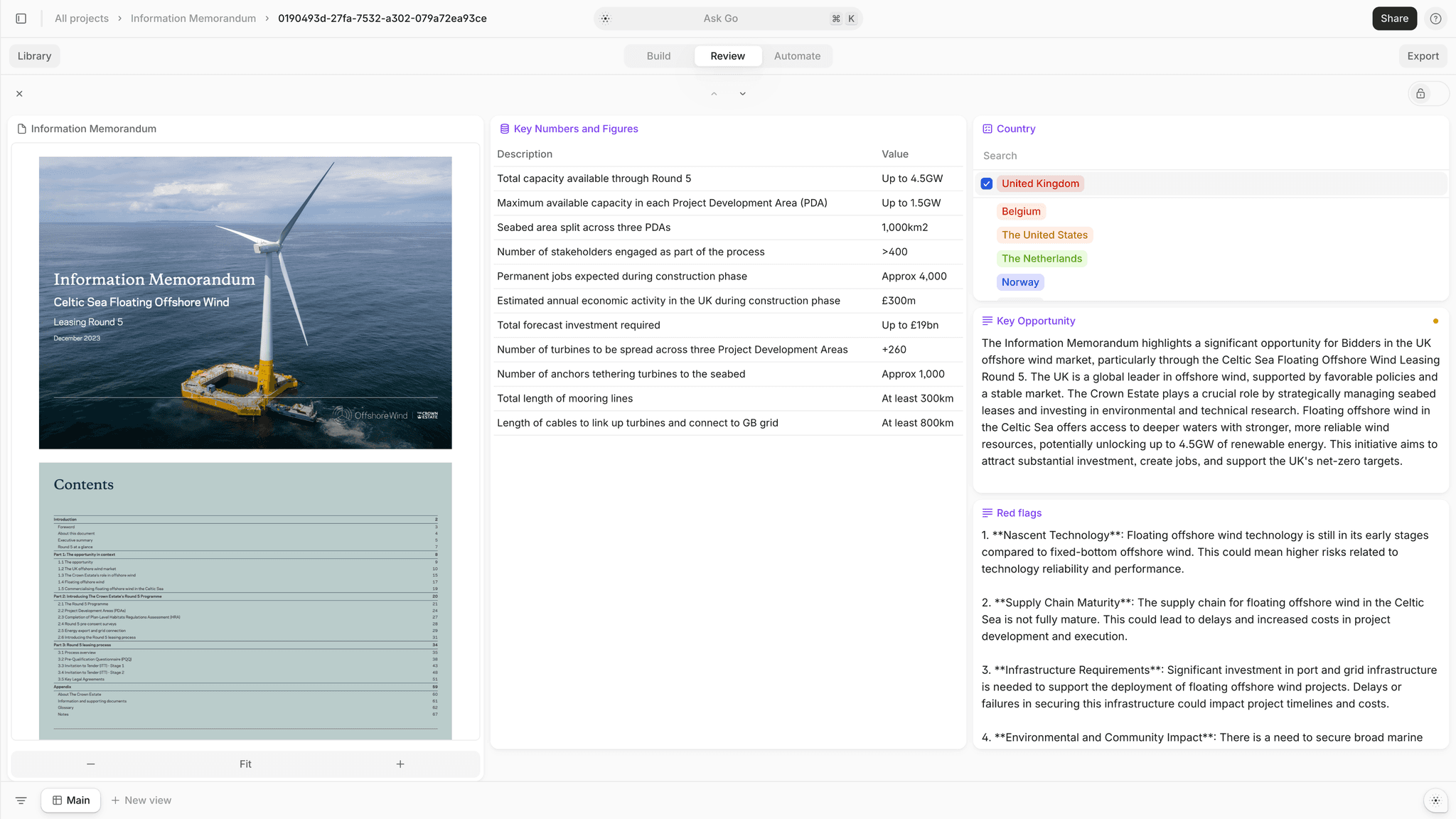

Extract information from insurance submissions, slips, and MRCs automatically. Process thousands of documents daily and reduce manual review time.

Ideal for

Shareholder agreement review

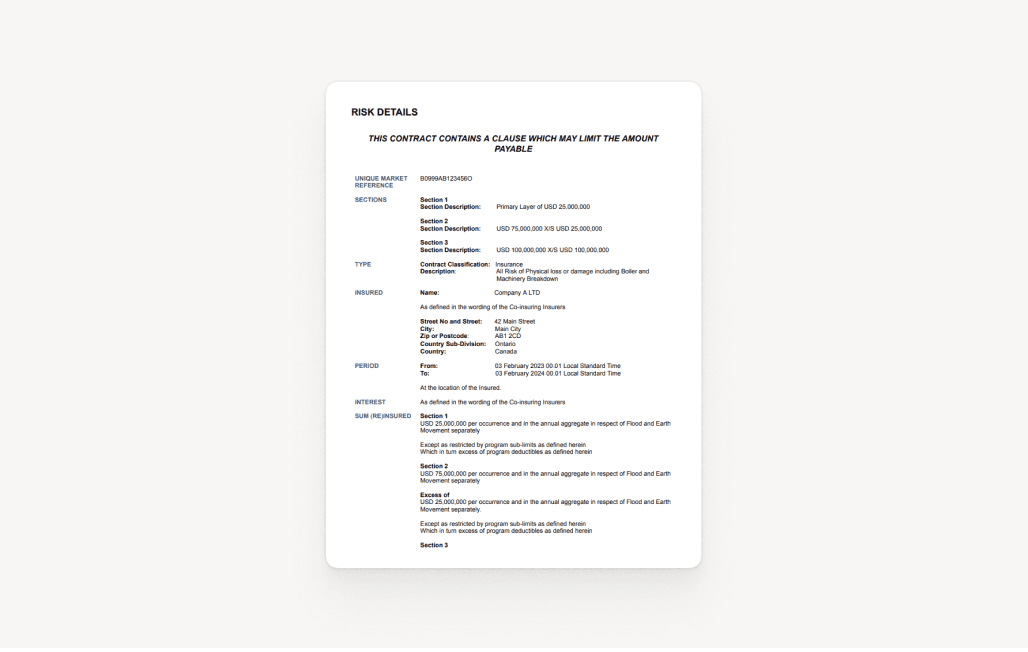

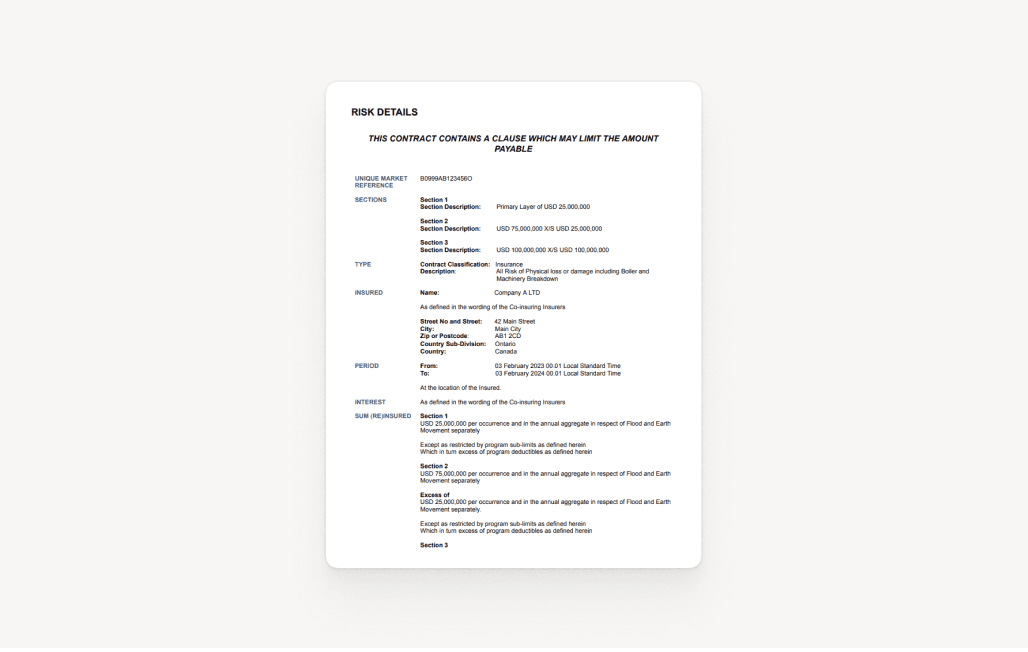

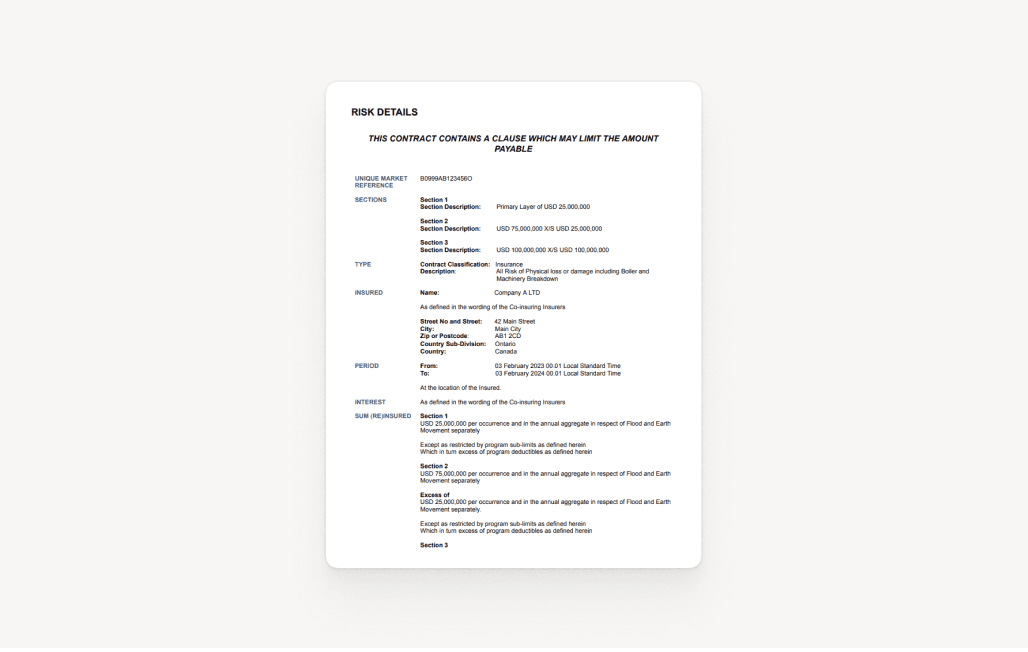

See Slips and MRCs in action

Play video

Shareholder agreement review

See Slips and MRCs in action

Play video

Shareholder agreement review

See Slips and MRCs in action

Play video

Shareholder agreement review

See Slips and MRCs in action

Play video

Challenge

Challenge

Insurance teams struggle with processing high volumes of submissions, slips, MRCs, and other documentation. Manual data entry creates bottlenecks, increases errors, and limits growth. On top of that, traditional IDP, OCR, and template-based solutions fail to handle varied document formats and complex data relationships.

Insurance teams struggle with processing high volumes of submissions, slips, MRCs, and other documentation. Manual data entry creates bottlenecks, increases errors, and limits growth. On top of that, traditional IDP, OCR, and template-based solutions fail to handle varied document formats and complex data relationships.

V7 Go solves these challenges with AI that understands insurance contexts, automatically classifies documents, and extracts structured data with the highest possible accuracy.

V7 Go solves these challenges with AI that understands insurance contexts, automatically classifies documents, and extracts structured data with the highest possible accuracy.

Time comparison

Time comparison

Traditional review time

With V7 Go

Average time saved

Why V7 Go

Why V7 Go

High volume support

Process hundreds of submissions simultaneously. Automatically classify insurance documents, extract key data, and validate information against expected ranges. Handle any format including PDFs, scans, and images.

High volume support

Process hundreds of submissions simultaneously. Automatically classify insurance documents, extract key data, and validate information against expected ranges. Handle any format including PDFs, scans, and images.

High volume support

Process hundreds of submissions simultaneously. Automatically classify insurance documents, extract key data, and validate information against expected ranges. Handle any format including PDFs, scans, and images.

High volume support

Process hundreds of submissions simultaneously. Automatically classify insurance documents, extract key data, and validate information against expected ranges. Handle any format including PDFs, scans, and images.

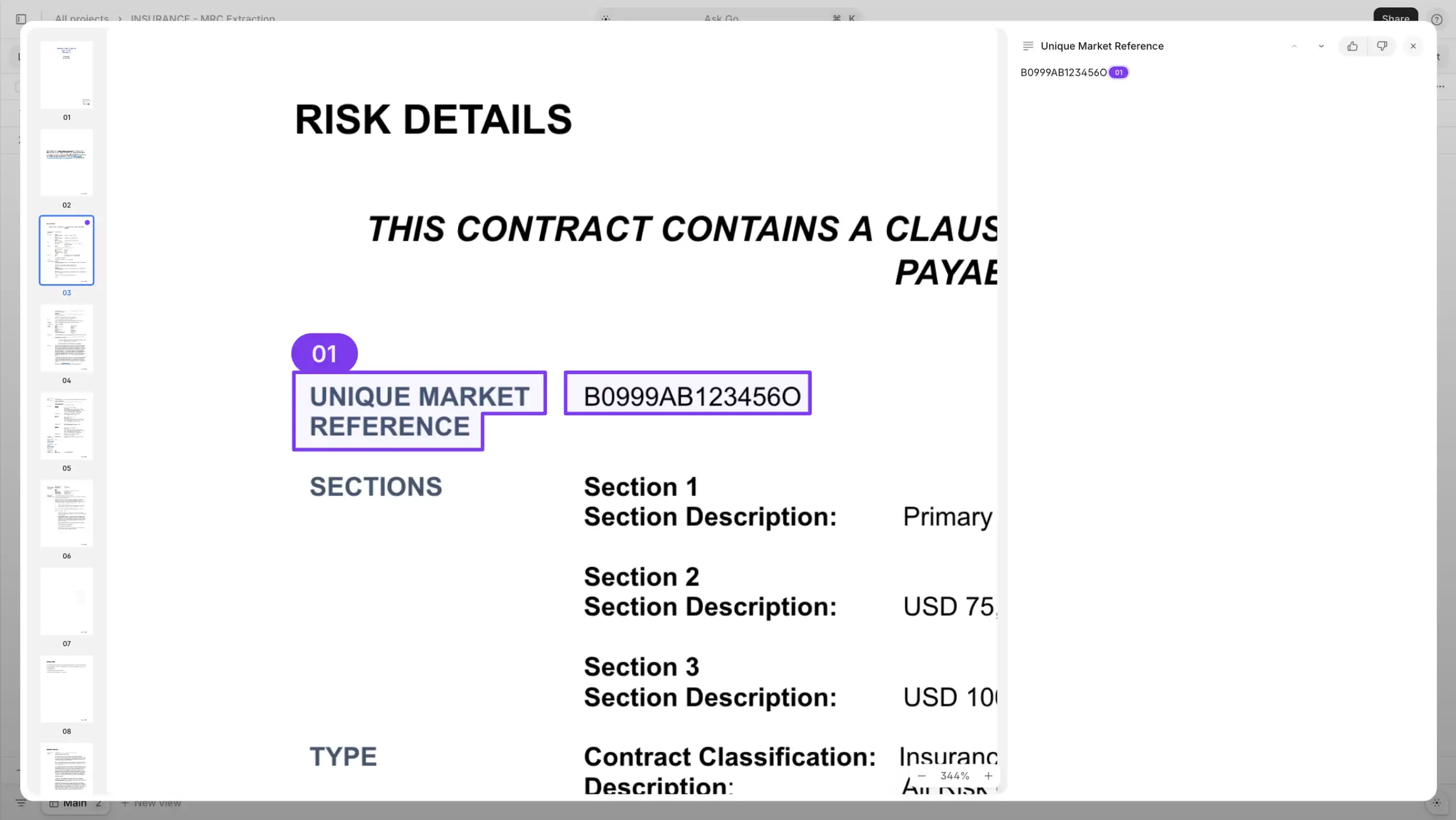

AI citations

Verify every extracted data point with highlighted source text. Validate values and flag exceptions for review. Maintain complete audit trails for compliance and quality assurance.

AI citations

Verify every extracted data point with highlighted source text. Validate values and flag exceptions for review. Maintain complete audit trails for compliance and quality assurance.

AI citations

Verify every extracted data point with highlighted source text. Validate values and flag exceptions for review. Maintain complete audit trails for compliance and quality assurance.

AI citations

Verify every extracted data point with highlighted source text. Validate values and flag exceptions for review. Maintain complete audit trails for compliance and quality assurance.

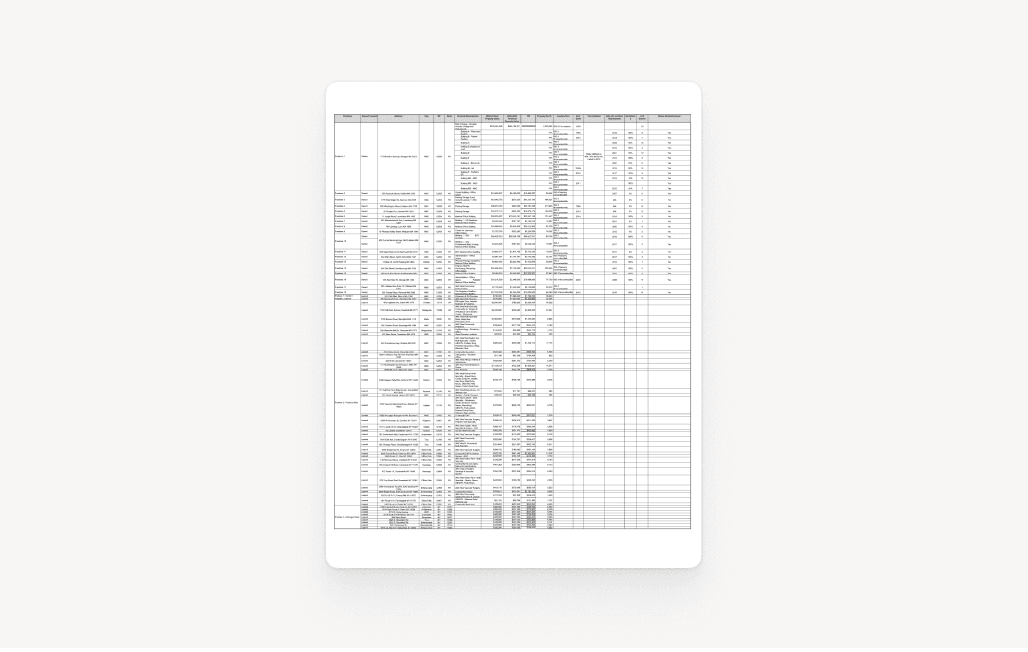

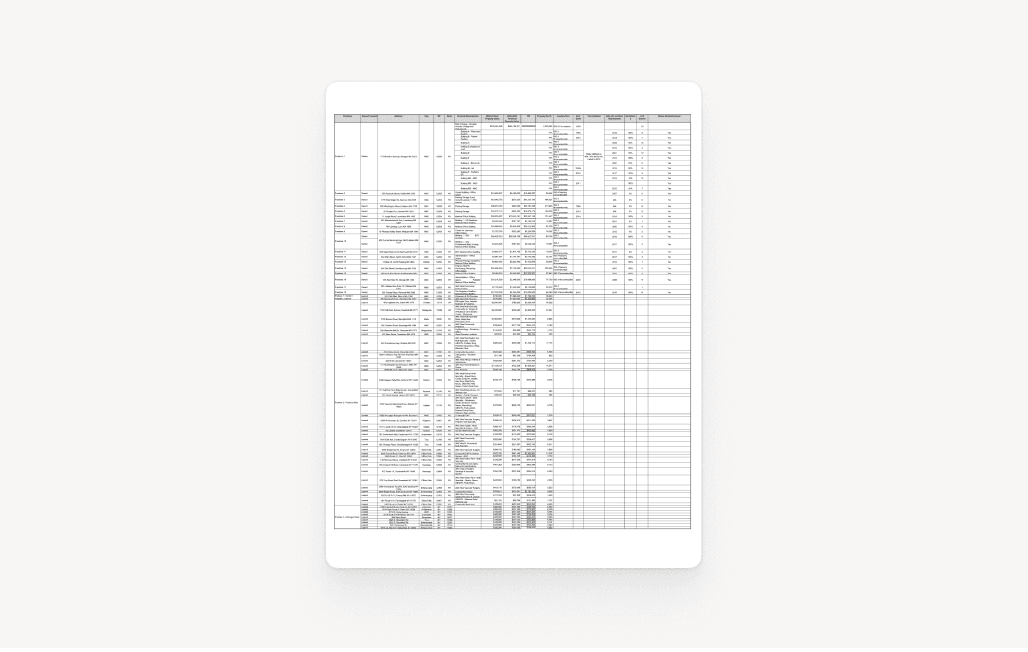

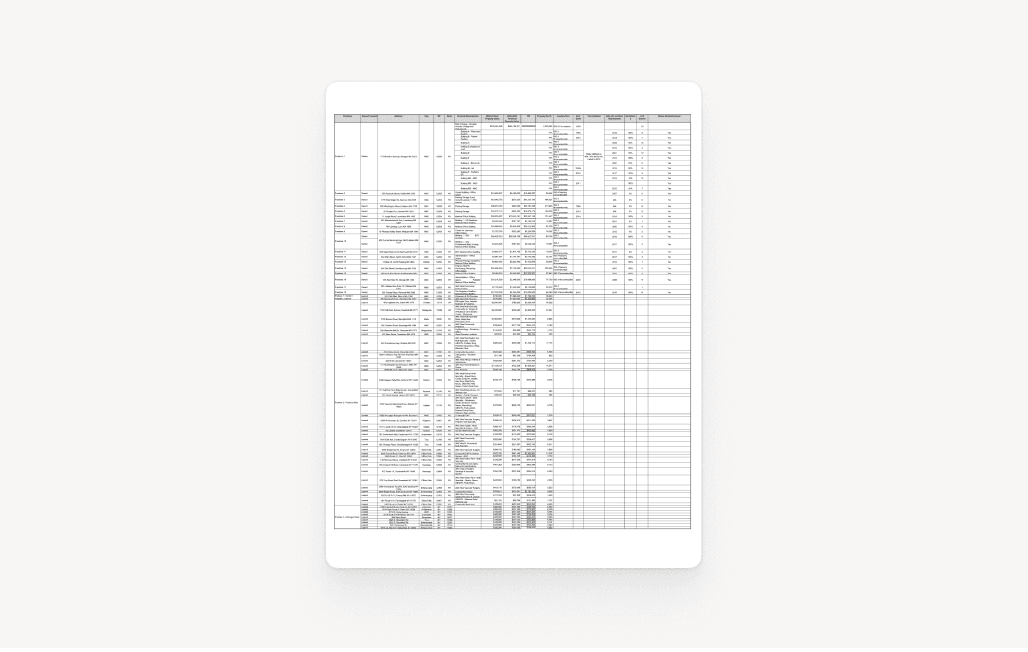

Table & graph analysis

Extract structured data from complex insurance tables automatically. Process coverage schedules, risk details, and security details while preserving document structure. Parse data to meet different template requirements and reporting formats.

Table & graph analysis

Extract structured data from complex insurance tables automatically. Process coverage schedules, risk details, and security details while preserving document structure. Parse data to meet different template requirements and reporting formats.

Table & graph analysis

Extract structured data from complex insurance tables automatically. Process coverage schedules, risk details, and security details while preserving document structure. Parse data to meet different template requirements and reporting formats.

Table & graph analysis

Extract structured data from complex insurance tables automatically. Process coverage schedules, risk details, and security details while preserving document structure. Parse data to meet different template requirements and reporting formats.

Security & compliance

Meet Lloyd's and London Market standards for data protection. Protect sensitive insurance data with enterprise-grade security features and maintain compliance with international insurance regulations.

Security & compliance

Meet Lloyd's and London Market standards for data protection. Protect sensitive insurance data with enterprise-grade security features and maintain compliance with international insurance regulations.

Security & compliance

Meet Lloyd's and London Market standards for data protection. Protect sensitive insurance data with enterprise-grade security features and maintain compliance with international insurance regulations.

Security & compliance

Meet Lloyd's and London Market standards for data protection. Protect sensitive insurance data with enterprise-grade security features and maintain compliance with international insurance regulations.

Permission levels

Control access across underwriting teams with customizable user roles. Manage complex insurance operations with configurable views. Set project-level permissions for different types of insurance documents.

Permission levels

Control access across underwriting teams with customizable user roles. Manage complex insurance operations with configurable views. Set project-level permissions for different types of insurance documents.

Permission levels

Control access across underwriting teams with customizable user roles. Manage complex insurance operations with configurable views. Set project-level permissions for different types of insurance documents.

Permission levels

Control access across underwriting teams with customizable user roles. Manage complex insurance operations with configurable views. Set project-level permissions for different types of insurance documents.

Easy integration

Connect V7 Go to your policy admin systems through API access. Implement in under a week with minimal configuration needed. Seamless workflow automation with existing insurance platforms.

Easy integration

Connect V7 Go to your policy admin systems through API access. Implement in under a week with minimal configuration needed. Seamless workflow automation with existing insurance platforms.

Easy integration

Connect V7 Go to your policy admin systems through API access. Implement in under a week with minimal configuration needed. Seamless workflow automation with existing insurance platforms.

Easy integration

Connect V7 Go to your policy admin systems through API access. Implement in under a week with minimal configuration needed. Seamless workflow automation with existing insurance platforms.

Get started

Get started

Get started

Import your files

Gmail

,

Google Drive

,

CoStar

Import your files from wherever they are currently stored

Import your files from wherever they are currently stored

All types of documents supported

All types of documents supported

Once imported our system extracts and organises the essentials

Once imported our system extracts and organises the essentials

The difference

The difference

The difference

Insurance teams work is about to make it's biggest shift in a century

Before

ChatGPT

V7 Go

Speed up operations with AI document processing toolkit for insurance. Extract data from slips, submissions, MRCs, and policy documents with best accuracy.

Insurance teams work is about to make it's biggest shift in a century

Before

ChatGPT

V7 Go

Speed up operations with AI document processing toolkit for insurance. Extract data from slips, submissions, MRCs, and policy documents with best accuracy.

Insurance teams work is about to make it's biggest shift in a century

Before

ChatGPT

V7 Go

Speed up operations with AI document processing toolkit for insurance. Extract data from slips, submissions, MRCs, and policy documents with best accuracy.

Multiple agents available to do the work

Are there any clauses in our vendor contracts that create exposure or conflict with our standard terms?

Select and tailor agents to perfectly align with the specifics of your Slips and MRCs

Multiple agents available to do the work

Are there any clauses in our vendor contracts that create exposure or conflict with our standard terms?

Select and tailor agents to perfectly align with the specifics of your Slips and MRCs

Multiple agents available to do the work

Are there any clauses in our vendor contracts that create exposure or conflict with our standard terms?

Select and tailor agents to perfectly align with the specifics of your Slips and MRCs

The difference

The difference

Insurance teams work is about to make it's biggest shift in a century

Before

ChatGPT

V7 Go

Analysts spend days manually reading 100+ page documents trying to spot subtle year-over-year changes in risk disclosures and MD&A.

Speed up operations with AI document processing toolkit for insurance. Extract data from slips, submissions, MRCs, and policy documents with best accuracy.

Play video

Multiple agents available to do the work

Are there any clauses in our vendor contracts that create exposure or conflict with our standard terms?

Select and tailor agents to perfectly align with the specifics of your Slips and MRCs

Play video

Customer Voices

Customer Voices

Building trustworthy AI, trained on your data

Join the world's best teams and Fortune 500s

Healthcare

•

Finance

•

Legal

•

Insurance

•

Logistics

•

Biotechnology

•

Manufacturing

•

Real Estate

Healthcare

•

Finance

•

Legal

•

Insurance

•

Logistics

•

Biotechnology

•

Manufacturing

•

Real Estate

Healthcare

•

Finance

•

Legal

•

Insurance

•

Logistics

•

Biotechnology

•

Manufacturing

•

Real Estate

Customer Voices

Finance

The experience with V7 has been fantastic. Very customized level of support. You feel like they really care about your outcome and objectives.

Read the full story

Finance

The experience with V7 has been fantastic. Very customized level of support. You feel like they really care about your outcome and objectives.

Read the full story

Healthcare

The configurability and extensive API interface of V7 has enabled us to quickly create, customise, deploy and make changes to our labelling processes all through automated communications with our own backend tooling.

Read the full story

Healthcare

The configurability and extensive API interface of V7 has enabled us to quickly create, customise, deploy and make changes to our labelling processes all through automated communications with our own backend tooling.

Read the full story

Automotive

"We chose V7 because we wanted to build new types of workflows. We had our own system, but we wanted it to accomplish additional tasks, like create other annotation types, re-annotations, annotations on videos—activities that would be a lot of effort in development."

Read the full story

Automotive

"We chose V7 because we wanted to build new types of workflows. We had our own system, but we wanted it to accomplish additional tasks, like create other annotation types, re-annotations, annotations on videos—activities that would be a lot of effort in development."

Read the full story

Finance

The experience with V7 has been fantastic. Very customized level of support. You feel like they really care about your outcome and objectives.

Read the full story

Healthcare

The configurability and extensive API interface of V7 has enabled us to quickly create, customise, deploy and make changes to our labelling processes all through automated communications with our own backend tooling.

Read the full story

Automotive

"We chose V7 because we wanted to build new types of workflows. We had our own system, but we wanted it to accomplish additional tasks, like create other annotation types, re-annotations, annotations on videos—activities that would be a lot of effort in development."

Read the full story

Energy

"We label terabytes of data per platform across thousands of platforms. From the operations perspective—unless we did drastic developments, the scale of the projects requires a tool like V7 to succeed"

Read the full story

Agriculture

"V7 is really easy to use and has great customer support—bugs are fixed, email support is very fast, and feature requests are delivered as promised."

Read the full story

Features

Features

Results you can actually trust.

Reliable AI document processing toolkit.

Results you can trust.

Trustworthy AI document processing toolkit.

Supporting complex documents.

Up to 200 pages.

From handwritten notes to complex graphs, V7 Go reads and understands them all—even when layouts shift across documents. Process hundreds of documents and pages, transforming them into structured outputs with task-based workflows you can customize or build from scratch.

Input types

50+ languages

Handwritten

200 pages

Multi-modal

Document types

PDFs

URL

Tables

Graphs

Vendor_US.xlsx

3

Supply_2023.pptx

Review_Legal.pdf

Supporting complex documents.

Up to 200 pages.

From handwritten notes to complex graphs, V7 Go reads and understands them all—even when layouts shift across documents. Process hundreds of documents and pages, transforming them into structured outputs with task-based workflows you can customize or build from scratch.

Input types

50+ languages

Handwritten

200 pages

Multi-modal

Document types

PDFs

URL

Tables

Graphs

Vendor_US.xlsx

3

Supply_2023.pptx

Review_Legal.pdf

Supporting complex documents.

Up to 200 pages.

From handwritten notes to complex graphs, V7 Go reads and understands them all—even when layouts shift across documents. Process hundreds of documents and pages, transforming them into structured outputs with task-based workflows you can customize or build from scratch.

Input types

50+ languages

Handwritten

200 pages

Multi-modal

Document types

PDFs

URL

Tables

Graphs

Vendor_US.xlsx

3

Supply_2023.pptx

Review_Legal.pdf

Reach 99% accuracy rate through

GenAI reasoning.

Break down complex document processing into discrete steps. Choose from top GenAI models, OCR tools, custom Python code, or integrate your own model to achieve fast, accurate, and reliable results with outputs you can trust.

Model providers

Security note

V7 never trains models on your private data. We keep your data encrypted and allow you to deploy your own models.

Answer

Type

Text

Tool

o4 Mini

Reasoning effort

Off

Low

Mid

High

AI Citations

Inputs

Set a prompt (Press @ to mention an input)

Reach 99% accuracy rate through

GenAI reasoning.

Break down complex document processing into discrete steps. Choose from top GenAI models, OCR tools, custom Python code, or integrate your own model to achieve fast, accurate, and reliable results with outputs you can trust.

Model providers

Security note

V7 never trains models on your private data. We keep your data encrypted and allow you to deploy your own models.

Answer

Type

Text

Tool

o4 Mini

Reasoning effort

Off

Low

Mid

High

AI Citations

Inputs

Set a prompt (Press @ to mention an input)

Reach 99% accuracy rate through

GenAI reasoning.

Break down complex document processing into discrete steps. Choose from top GenAI models, OCR tools, custom Python code, or integrate your own model to achieve fast, accurate, and reliable results with outputs you can trust.

Model providers

Security note

V7 never trains models on your private data. We keep your data encrypted and allow you to deploy your own models.

Answer

Type

Text

Tool

o4 Mini

Reasoning effort

Off

Low

Mid

High

AI Citations

Inputs

Set a prompt (Press @ to mention an input)

Trustworthy results,

grounded in reality.

You can verify if AI-generated responses are true and which excerpts they were based on. AI models in V7 Go automatically highlight source areas in your documents. Human reviewers can focus their time on results with lower confidence scores and make corrections when needed.

Visual grounding in action

00:54

Deliberate Misrepresentation: During the trial, evidence was presented showing that John Doe deliberately misrepresented his income on multiple occasions over several years. This included falsifying documents, underreporting income, and inflating deductions to lower his tax liability. Such deliberate deception demonstrates intent to evade taxes.

Pattern of Behavior: The prosecution demonstrated a consistent pattern of behavior by John Doe, spanning several years, wherein he consistently failed to report substantial portions of his income. This pattern suggested a systematic attempt to evade taxes rather than mere oversight or misunderstanding.

Concealment of Assets: Forensic accounting revealed that John Doe had taken significant steps to conceal his assets offshore, including setting up shell companies and using complex financial structures to hide income from tax authorities. Such elaborate schemes indicate a deliberate effort to evade taxes and avoid detection.

Failure to Cooperate: Throughout the investigation and trial, John Doe displayed a lack of cooperation with tax authorities. He refused to provide requested documentation, obstructed the audit process, and failed to disclose relevant financial information. This obstructionism further supported the prosecution's argument of intentional tax evasion.

Prior Warning and Ignoring Compliance

02

01

01

02

Trustworthy results,

grounded in reality.

You can verify if AI-generated responses are true and which excerpts they were based on. AI models in V7 Go automatically highlight source areas in your documents. Human reviewers can focus their time on results with lower confidence scores and make corrections when needed.

Visual grounding in action

00:54

Deliberate Misrepresentation: During the trial, evidence was presented showing that John Doe deliberately misrepresented his income on multiple occasions over several years. This included falsifying documents, underreporting income, and inflating deductions to lower his tax liability. Such deliberate deception demonstrates intent to evade taxes.

Pattern of Behavior: The prosecution demonstrated a consistent pattern of behavior by John Doe, spanning several years, wherein he consistently failed to report substantial portions of his income. This pattern suggested a systematic attempt to evade taxes rather than mere oversight or misunderstanding.

Concealment of Assets: Forensic accounting revealed that John Doe had taken significant steps to conceal his assets offshore, including setting up shell companies and using complex financial structures to hide income from tax authorities. Such elaborate schemes indicate a deliberate effort to evade taxes and avoid detection.

Failure to Cooperate: Throughout the investigation and trial, John Doe displayed a lack of cooperation with tax authorities. He refused to provide requested documentation, obstructed the audit process, and failed to disclose relevant financial information. This obstructionism further supported the prosecution's argument of intentional tax evasion.

Prior Warning and Ignoring Compliance

02

01

01

02

Trustworthy results,

grounded in reality.

You can verify if AI-generated responses are true and which excerpts they were based on. AI models in V7 Go automatically highlight source areas in your documents. Human reviewers can focus their time on results with lower confidence scores and make corrections when needed.

Visual grounding in action

00:54

Deliberate Misrepresentation: During the trial, evidence was presented showing that John Doe deliberately misrepresented his income on multiple occasions over several years. This included falsifying documents, underreporting income, and inflating deductions to lower his tax liability. Such deliberate deception demonstrates intent to evade taxes.

Pattern of Behavior: The prosecution demonstrated a consistent pattern of behavior by John Doe, spanning several years, wherein he consistently failed to report substantial portions of his income. This pattern suggested a systematic attempt to evade taxes rather than mere oversight or misunderstanding.

Concealment of Assets: Forensic accounting revealed that John Doe had taken significant steps to conceal his assets offshore, including setting up shell companies and using complex financial structures to hide income from tax authorities. Such elaborate schemes indicate a deliberate effort to evade taxes and avoid detection.

Failure to Cooperate: Throughout the investigation and trial, John Doe displayed a lack of cooperation with tax authorities. He refused to provide requested documentation, obstructed the audit process, and failed to disclose relevant financial information. This obstructionism further supported the prosecution's argument of intentional tax evasion.

Prior Warning and Ignoring Compliance

02

01

01

02

Enterprise grade security

for high-stake industries.

Integrate V7 seamlessly with your existing tech stack. Our platform connects to your cloud infrastructure and ML frameworks while ensuring robust data security and compliance with rigorous standards.

Certifications

GDPR

SOC2

HIPAA

ISO

Safety

Custom storage

Data governance

Access-level permissions

Enterprise grade security

for high-stake industries.

Integrate V7 seamlessly with your existing tech stack. Our platform connects to your cloud infrastructure and ML frameworks while ensuring robust data security and compliance with rigorous standards.

Certifications

GDPR

SOC2

HIPAA

ISO

Safety

Custom storage

Data governance

Access-level permissions

Enterprise grade security

for high-stake industries.

Integrate V7 seamlessly with your existing tech stack. Our platform connects to your cloud infrastructure and ML frameworks while ensuring robust data security and compliance with rigorous standards.

Certifications

GPDR

SOC2

HIPAA

ISO

Safety

Custom storage

Data governance

Access-level permissions

Answers

Answers

What you need to know about our

Slips and MRCs

Can V7 Go handle both London Market MRCs and international slips?

Yes, V7 Go processes both standardized London Market MRCs and varied slip formats from any market. The AI adapts to different document structures while maintaining consistent data extraction and normalization standards. You can also customize it to meet your unique requirements for any unusual document format or data type.

+

Can V7 Go handle both London Market MRCs and international slips?

Yes, V7 Go processes both standardized London Market MRCs and varied slip formats from any market. The AI adapts to different document structures while maintaining consistent data extraction and normalization standards. You can also customize it to meet your unique requirements for any unusual document format or data type.

+

Can V7 Go handle both London Market MRCs and international slips?

Yes, V7 Go processes both standardized London Market MRCs and varied slip formats from any market. The AI adapts to different document structures while maintaining consistent data extraction and normalization standards. You can also customize it to meet your unique requirements for any unusual document format or data type.

+

What types of insurance documents can V7 Go ingest?

V7 Go ingests all insurance documentation, including new business submissions, renewal submissions, broker slips, Market Reform Contracts (MRCs), policies and endorsements, and claims documentation. The AI adapts to any document structure while maintaining consistent data extraction quality.

+

What types of insurance documents can V7 Go ingest?

V7 Go ingests all insurance documentation, including new business submissions, renewal submissions, broker slips, Market Reform Contracts (MRCs), policies and endorsements, and claims documentation. The AI adapts to any document structure while maintaining consistent data extraction quality.

+

What types of insurance documents can V7 Go ingest?

V7 Go ingests all insurance documentation, including new business submissions, renewal submissions, broker slips, Market Reform Contracts (MRCs), policies and endorsements, and claims documentation. The AI adapts to any document structure while maintaining consistent data extraction quality.

+

What data can V7 Go extract automatically?

V7 Go extracts all critical insurance information, including risk details and exposures, coverage terms and conditions, premium and rating information, claims history and loss runs, regulatory compliance data, and participant and broker details. You can also specify what information should be extracted by tweaking AI prompts.

+

What data can V7 Go extract automatically?

V7 Go extracts all critical insurance information, including risk details and exposures, coverage terms and conditions, premium and rating information, claims history and loss runs, regulatory compliance data, and participant and broker details. You can also specify what information should be extracted by tweaking AI prompts.

+

What data can V7 Go extract automatically?

V7 Go extracts all critical insurance information, including risk details and exposures, coverage terms and conditions, premium and rating information, claims history and loss runs, regulatory compliance data, and participant and broker details. You can also specify what information should be extracted by tweaking AI prompts.

+

How does V7 Go integrate with existing systems?

V7 Go offers flexible integration options, including REST API access, webhook support, or Zapier. It also integrates seamlessly with cloud platforms such as AWS, where it’s available directly on the AWS Marketplace.

+

How does V7 Go integrate with existing systems?

V7 Go offers flexible integration options, including REST API access, webhook support, or Zapier. It also integrates seamlessly with cloud platforms such as AWS, where it’s available directly on the AWS Marketplace.

+

How does V7 Go integrate with existing systems?

V7 Go offers flexible integration options, including REST API access, webhook support, or Zapier. It also integrates seamlessly with cloud platforms such as AWS, where it’s available directly on the AWS Marketplace.

+

What technologies does V7 Go use?

V7 Go uses several key technologies to pull data from documents accurately. At its core is RAG technology, which helps it understand context, along with specialized language models trained on insurance terms. The system can process text, images and tables at the same time, making sure it catches all important information. V7 Go also uses some custom-built tools to keep data accurate and handle different types of insurance paperwork.

+

What technologies does V7 Go use?

V7 Go uses several key technologies to pull data from documents accurately. At its core is RAG technology, which helps it understand context, along with specialized language models trained on insurance terms. The system can process text, images and tables at the same time, making sure it catches all important information. V7 Go also uses some custom-built tools to keep data accurate and handle different types of insurance paperwork.

+

What technologies does V7 Go use?

V7 Go uses several key technologies to pull data from documents accurately. At its core is RAG technology, which helps it understand context, along with specialized language models trained on insurance terms. The system can process text, images and tables at the same time, making sure it catches all important information. V7 Go also uses some custom-built tools to keep data accurate and handle different types of insurance paperwork.

+

How quickly can insurance teams implement V7 Go?

Teams can start processing MRCs and slips with V7 Go in less than a week. The platform includes pre-built insurance workflow templates that are ready to use instantly. While these templates may require additional customization, adjustments can easily be made through an intuitive graphical interface.

+

How quickly can insurance teams implement V7 Go?

Teams can start processing MRCs and slips with V7 Go in less than a week. The platform includes pre-built insurance workflow templates that are ready to use instantly. While these templates may require additional customization, adjustments can easily be made through an intuitive graphical interface.

+

How quickly can insurance teams implement V7 Go?

Teams can start processing MRCs and slips with V7 Go in less than a week. The platform includes pre-built insurance workflow templates that are ready to use instantly. While these templates may require additional customization, adjustments can easily be made through an intuitive graphical interface.

+

Pilot

Pilot

Curious how we can realise 90% ROI increase for you?

Curious how we can realise 90% ROI increase for you?

Send us a few samples, and we’ll deliver a custom demo with results—within 48 hours.

Send us a few samples, and we’ll deliver a custom demo with results—within 48 hours.

Vendor_US.xlsx

3

Supply_2023.pptx

Review_Legal.pdf

ROI

50% faster insurance document processing

Leading insurers and brokers accelerate their operations with V7 Go. By automating MRC and slip analysis across lines of business, teams can process more submissions and maintain accurate risk assessment.

More Documents

More Documents

Explore more agents to help you

boost productivity of your work

More agents

Slips and MRCs

AI automates Slips and MRCs ingestion: extracts key data from insurance submissions accurately and fast.

Insurance

•

High volume support

•

AI citations

•

Table & graph analysis

Explore

Slips and MRCs

AI automates Slips and MRCs ingestion: extracts key data from insurance submissions accurately and fast.

Insurance

•

High volume support

•

AI citations

•

Table & graph analysis

Explore

Slips and MRCs

AI automates Slips and MRCs ingestion: extracts key data from insurance submissions accurately and fast.

Insurance

•

High volume support

•

AI citations

•

Table & graph analysis

Explore

Insurance Market Reform Contracts (MRC)

AI processes Insurance Market Reform Contracts (MRCs): extract key data, ensure accuracy, speed up assessments.

Insurance

•

High volume support

•

AI citations

•

Table & graph analysis

Explore

Insurance Market Reform Contracts (MRC)

AI processes Insurance Market Reform Contracts (MRCs): extract key data, ensure accuracy, speed up assessments.

Insurance

•

High volume support

•

AI citations

•

Table & graph analysis

Explore

Insurance Market Reform Contracts (MRC)

AI processes Insurance Market Reform Contracts (MRCs): extract key data, ensure accuracy, speed up assessments.

Insurance

•

High volume support

•

AI citations

•

Table & graph analysis

Explore

Risk Engineering Reports

AI analyzes Risk Engineering Reports: extracts key risk factors and standardizes assessments for insurers.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis support

Explore

Risk Engineering Reports

AI analyzes Risk Engineering Reports: extracts key risk factors and standardizes assessments for insurers.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis support

Explore

Risk Engineering Reports

AI analyzes Risk Engineering Reports: extracts key risk factors and standardizes assessments for insurers.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis support

Explore

Statement of Value (SOV)

AI processes Statements of Value (SOVs): extract property values & risk factors for underwriting.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Statement of Value (SOV)

AI processes Statements of Value (SOVs): extract property values & risk factors for underwriting.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Statement of Value (SOV)

AI processes Statements of Value (SOVs): extract property values & risk factors for underwriting.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis

Explore

Policy Renewals

AI automates Policy Renewals: extracts and validates policy data, cutting processing time and improving accuracy.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis support

Explore

Policy Renewals

AI automates Policy Renewals: extracts and validates policy data, cutting processing time and improving accuracy.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis support

Explore

Policy Renewals

AI automates Policy Renewals: extracts and validates policy data, cutting processing time and improving accuracy.

Insurance

•

Long document support

•

AI citations

•

Table & graph analysis support

Explore

Explanation of Benefits (EOBs)

Automate the processing of Explanation of Benefits (EOBs) to accelerate healthcare revenue cycle management.

Insurance

•

Automated Data Capture

•

Line-Item Level Detail

•

Payer Format Agnostic

Explore

Explanation of Benefits (EOBs)

Automate the processing of Explanation of Benefits (EOBs) to accelerate healthcare revenue cycle management.

Insurance

•

Automated Data Capture

•

Line-Item Level Detail

•

Payer Format Agnostic

Explore

Explanation of Benefits (EOBs)

Automate the processing of Explanation of Benefits (EOBs) to accelerate healthcare revenue cycle management.

Insurance

•

Automated Data Capture

•

Line-Item Level Detail

•

Payer Format Agnostic

Explore

Next Step

Next Step

Standardize your insurance workflows with AI.

Standardize your insurance workflows with AI.

Standardize your insurance workflows with AI.

Stop manual data entry. Start processing insurance documents at scale.

Stop manual data entry. Start processing insurance documents at scale.

Stop manual data entry. Start processing insurance documents at scale.

Uncover hidden liabilities

in

supplier contracts.

V7 Go transforms documents into strategic assets. 150+ enterprises are already on board:

Uncover hidden liabilities

in

supplier contracts.

V7 Go transforms documents into strategic assets. 150+ enterprises are already on board: