Knowledge work automation

12 min read

—

Dec 15, 2025

A comprehensive guide to the best cap table management software for startups, VCs, and private equity. This is your complete guide to choosing the right platform, and implementing it in a way that actually works.

Imogen Jones

Content Writer

Many startups reach a familiar moment: someone asks for the cap table, usually an investor, auditor, or board member, and suddenly there’s a scramble. Spreadsheets appear from unexpected places. A legacy equity system no one quite remembers how to use is dusted off. Numbers don’t match. A vesting schedule from 2017 resurfaces and raises more questions than answers.

For more established companies, it’s often even worse: a labyrinth of legacy software stitched together with half-retired SFTP workflows and outdated permissions.

In this guide, we’ll define what cap table management actually is, take a clear look at the leading platforms designed to fix these problems (and prevent next-round panic attacks), and walk through a practical framework for implementing a system that works

In this article:

What is cap table management?

Deep dives into V7, Carta, Pulley, Ledgy, Cake Equity, and more

How AI agents are finally automating manual cap table management workflows

A guide to implementation

What is Cap Table Management?

Cap table management is the discipline of tracking who owns what in a company. That includes every share, option, warrant, SAFE, convertible note, and the rights that come with them.

At its simplest, it’s a ledger of ownership. In practice, it can be the backbone of everything from fundraising and valuations to hiring, governance, and investor reporting.

Managing it well means ensuring accuracy across legal agreements, financial statements, and stakeholder communications. Managing it poorly can mean costly mistakes, diluted founders, unhappy employees, and deals delayed because no one is quite sure which version of the spreadsheet is “the real one.”

A clean and accurate cap table ensures that investors have a clear understanding of the ownership structure, which builds trust and facilitates investment decisions.

The complexity comes from how quickly a straightforward ownership list becomes a network of interdependent rules (liquidation preferences, vesting schedules, option pools, conversion formulas, valuation caps, participation rights, pro-rata entitlements, anti-dilution triggers, and jurisdiction-specific tax rules, to name just a few). Every new funding round builds on the math and legal logic of the last.

Naturally, software solutions have emerged to help tackle this problem.

Cap Table Management Software Guide

Cap table management has grown up alongside the startup ecosystem. It started with founders and lawyers hacking everything together in Excel, then moved into early web tools and equity admin platforms like Solium/Shareworks and Capshare that tried to standardise option plans and reporting for more mature companies.

As venture-backed startups exploded in number and deal structures got more complex, newer players turned digitised certificates, 409A valuations, and board-ready reporting into a single platform.

Over time, all of these systems have had to do the same three things better and better:

Keep a legally accurate record of who owns what

Help companies model what happens under new funding or exit scenarios

Make investors, employees, and regulators comfortable that the numbers are right

Below, we explore some of the leading platforms for cap table management.

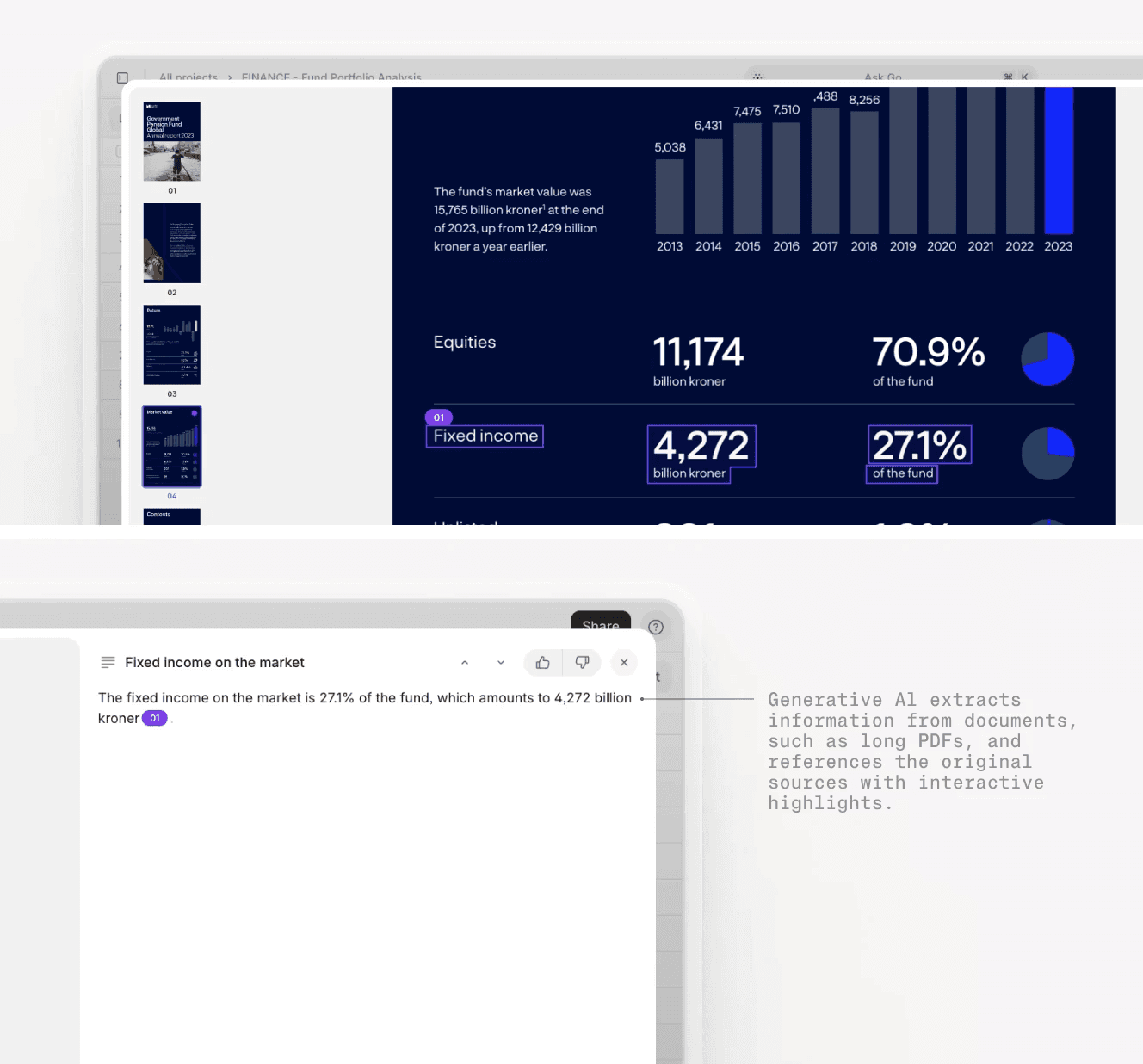

V7 Go

V7 Go is a flexible, powerful agentic AI platform designed for complex financial workflows. It can process dense spreadsheets and intricate legal documents to deliver accurate equity insights, scenario analysis, and compliance-grade reporting.

With multi-modal extraction and visual grounding,, every answer about your cap table is fully traceable, right back to the exact cell, clause, or source document it came from.

A Go agent can:

Pull ownership percentages, share classes, vesting schedules, option pools, liquidation prefs, and rights directly from cap tables and legal documents.

Run multi-round models, convertible conversions, option exercises, and participation waterfalls with precision.

Monitor equity changes over time and surfaces meaningful shifts in ownership structure.

Generate clean, defensible outputs for internal stakeholders, auditors, and regulators.

Support term sheets, option plans, note agreements, shareholder rights agreements, financial statements, and more, with agents that read them all in context.

See this in action here: AI Cap Table Analysis

Website: V7 Go

Tradeoffs:

Very early-stage startups with simple cap tables may not fully benefit from its advanced capabilities, unless they are also using the platform for other use cases.

Some users may prefer to use V7 as a powerful analytics and automation layer over other cap table management software, as there is not an employee portal.

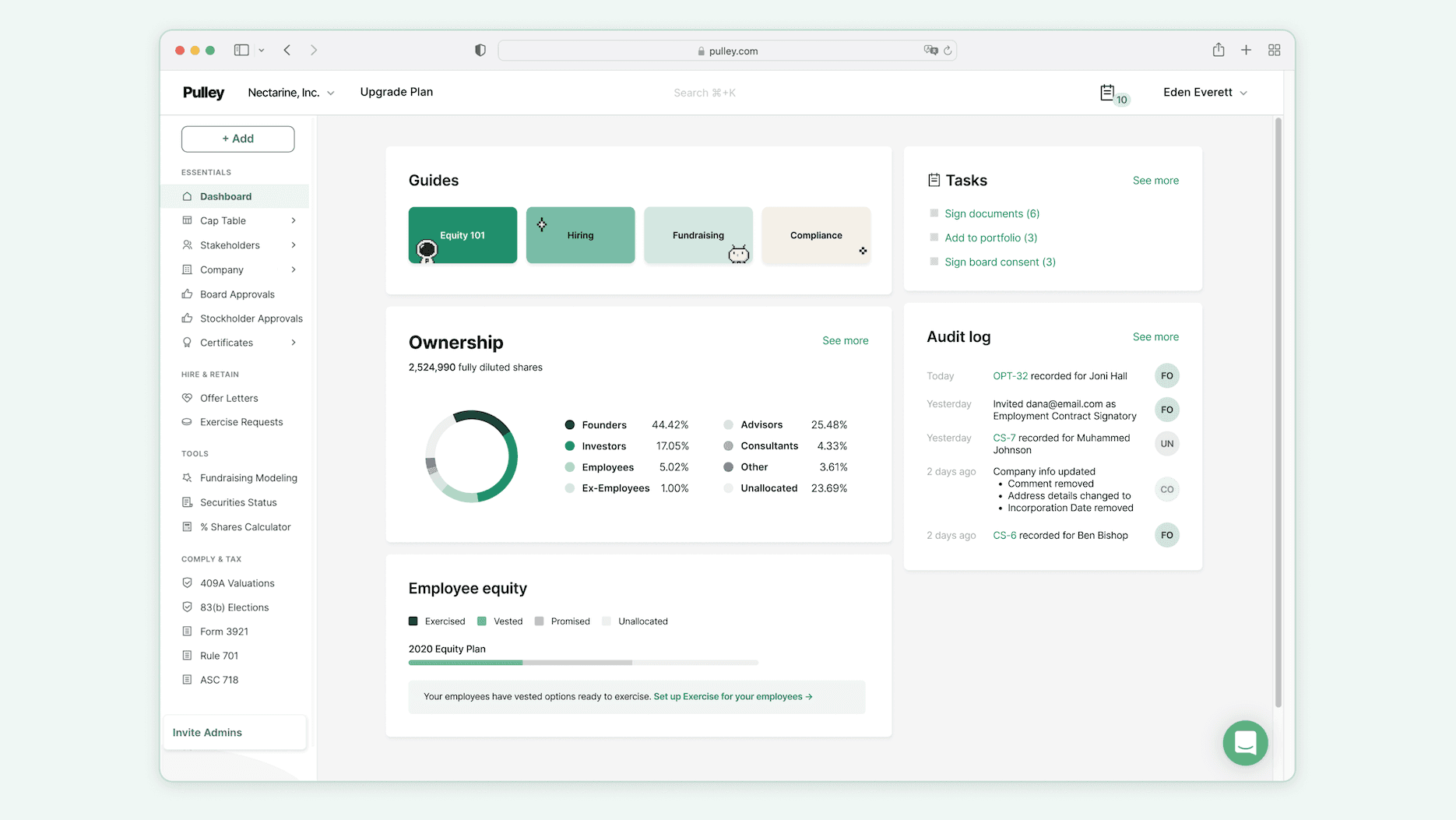

Pulley

Pulley has become a default choice for YC-style startups and high-growth early-stage teams. Founded by Yin Wu, it was built specifically to handle the "Series A fire drill", the moment when a startup realizes their Excel cap table is a liability.

Pulley offers a rapid setup, so you can go from zero to a fully functional cap table in under an hour. It includes strong fundraising modeling tools that let you run "what-if" scenarios (e.g., "What happens to my ownership if we raise $10M at a $50M pre-money valuation?") without needing a spreadsheet.

Website: Pulley

Tradeoffs:

As companies scale past Series B, some users find the feature set shallow compared to Carta's enterprise capabilities.

Although Pulley has HRIS and tooling integrations, you’ll still need to clean and upload legacy legal docs, and bespoke legal workflows may require some configuration.

Cake Equity

Cake Equity focuses heavily on simplifying the employee experience. It is the "set and forget" solution for small teams that want a clean, modern interface without the complexity of enterprise-grade platforms.

Core features include dynamic cap table management, guided issuance of options (NSOs, RSUs, RSAs), and automated contract generation and e-signing. Their “MyCake” portals for shareholders and employees make it easy for people to log in, see vesting schedules, and understand the current and potential value of their equity.

Website: Cake Equity

Tradeoffs:

Lacks the depth for complex waterfall calculations or multi-currency scenarios.

Primarily designed for US and Australian companies; less robust for European tax laws.

Gust Equity Management

Gust Equity Management (GEM) is the budget-friendly option for very early-stage companies and first-time founders. It stands out by offering a free tier that’s actually usable, including a full cap table, basic round and exit modeling, and 409A valuations.

For founders coming off spreadsheets, the biggest benefit is simply avoiding formula errors while still getting audit-defensible valuations and ASC 718 support for stock-based compensation.

Website: Gust

Tradeoffs:

It’s intentionally simple, and you’ll quickly hit limits if you need complex waterfalls, multiple entities, or sophisticated scenario modeling across several rounds with exotic terms.

Fewer integrations with accounting and HR software compared to competitors.

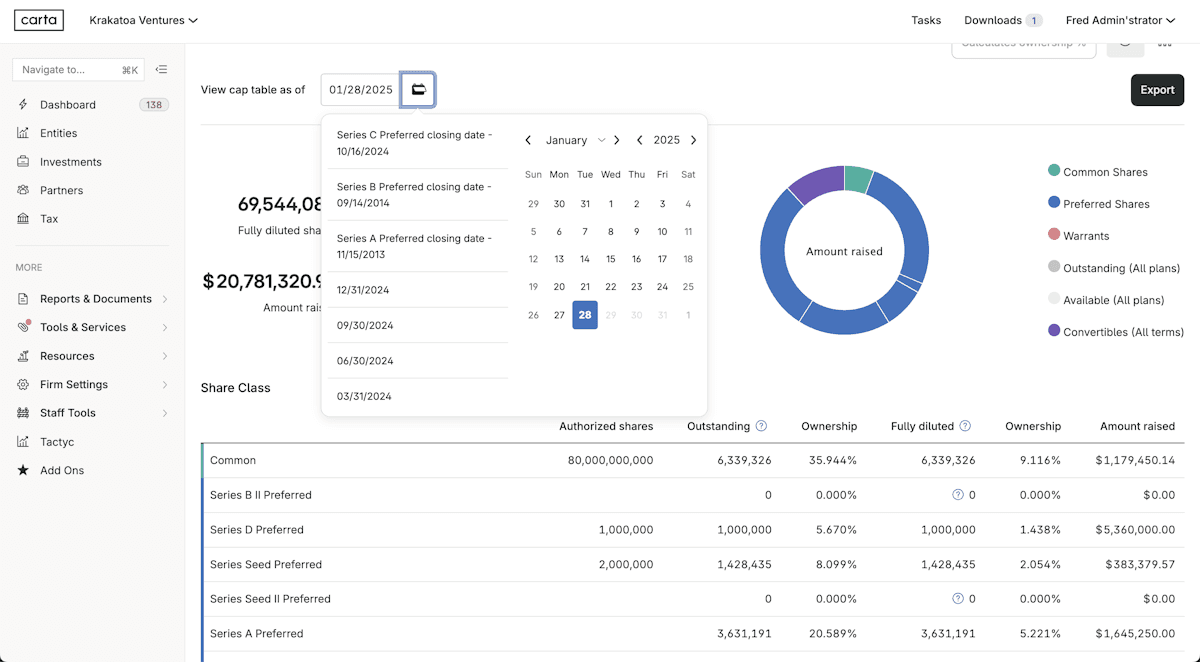

Carta

Carta is a market leader with a deep ecosystem of liquidity and valuation services. Built for complexity, it natively handles the most esoteric deal structures, including multiple share classes, liquidation preferences, participation rights, and cross-collateralized pools.

The platform includes CartaX, a private stock exchange that facilitates secondary transactions, allowing employees to sell shares before an IPO.

Carta sits at the center of a large ecosystem, including fund administration, SPV and fund-level tools for VCs, and integrations with HR, payroll, and accounting systems. For late-stage or soon-to-IPO companies, it’s often seen as the “default” choice.

Website: Carta

Tradeoffs:

Pricing is premium compared to most competitors and can feel heavy for early-stage or bootstrapped startups that don’t yet need the full enterprise stack.

User reviews often praise the breadth of features but mention slower customer support and a more rigid UX for edge-case structures, especially compared with newer, more founder-centric tools.

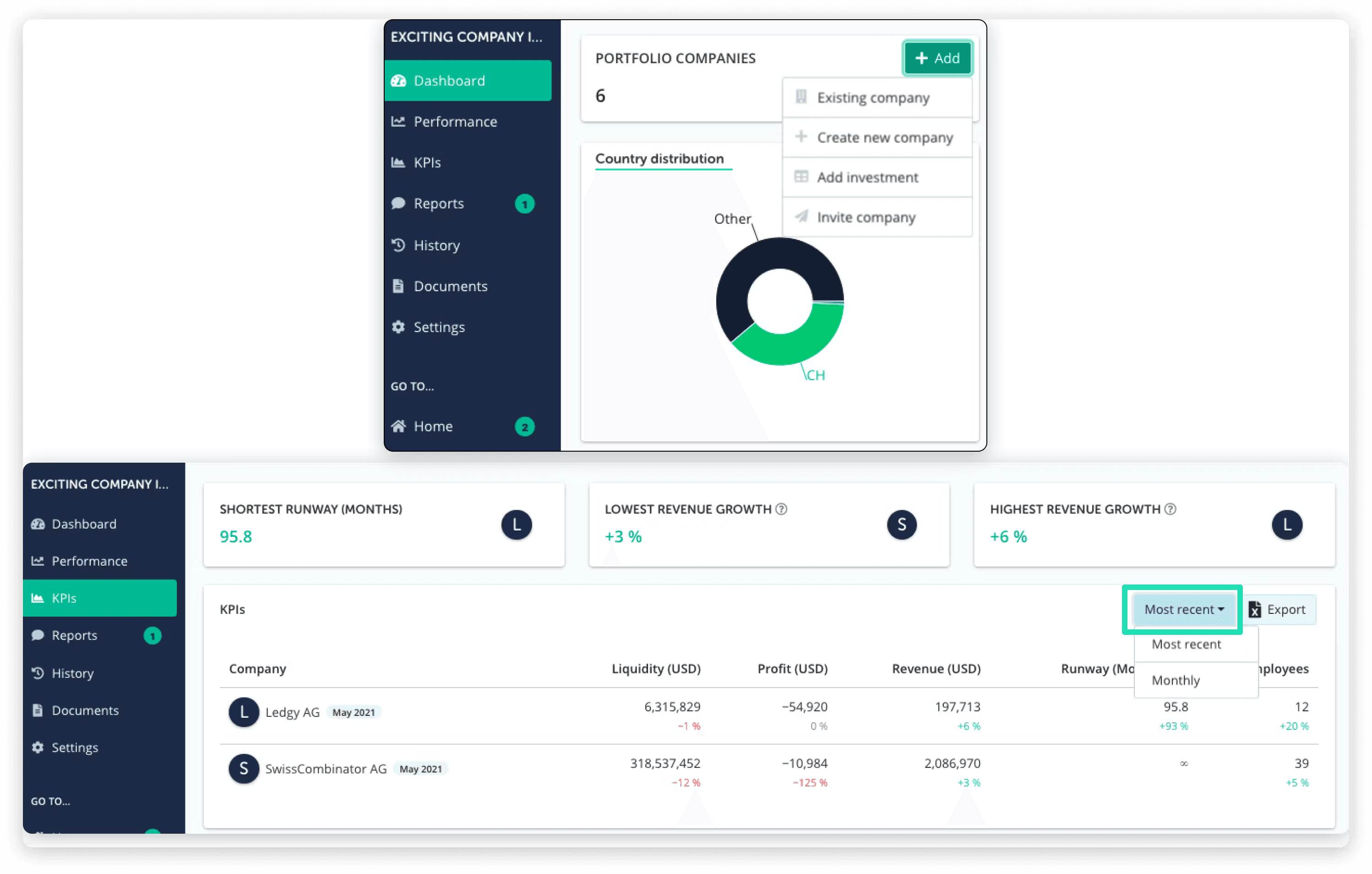

Ledgy

Ledgy is the European answer to Carta, built with a global-first mindset. Founded in Zurich, it focuses on making equity understandable and compliant for European startups and scale-ups dealing with multiple jurisdictions, currencies, and regulatory regimes.

Ledgy’s strengths are multi-entity and multi-jurisdiction support. It handles a wide range of ESOP structures and local tax schemes, plus automated expense and disclosure reporting under IFRS 2, US GAAP, ASC 718, and UK GAAP, critical for companies with cross-border teams.

The platform offers strong investor reporting and scenario modeling tools so founders and CFOs can track dilution, communicate ownership clearly, and simulate round and exit outcomes.

Website: Ledgy

Tradeoffs:

While Ledgy’s reporting is powerful, some power users find highly custom or bespoke reports harder to configure.

Onboarding can require more upfront configuration if you’re juggling many entities, jurisdictions, or legacy grants, especially for scale-ups migrating from spreadsheets.

Shareworks by Morgan Stanley

Shareworks (part of Morgan Stanley at Work) is the enterprise heavyweight. It’s designed for large private companies, unicorns, and public corporations with thousands of participants, complex global plans, and deep integration needs.

The platform covers the full lifecycle of equity compensation: global stock plans, ESPPs, RSUs, options, performance awards, and sophisticated tax and accounting workflows. It integrates tightly with ERP systems like SAP and Oracle and supports automated ASC 718 and IFRS 2 expense accounting, SEC and disclosure reporting, and detailed participant portals.

Website: Shareworks

Tradeoffs:

For startups and mid-size companies, Shareworks is usually overkill: the implementation timeline can stretch over many months, and the product is optimized for very large programs rather than nimble early-stage needs.

Pricing, implementation, and ongoing admin are geared toward enterprises with dedicated equity or compensation teams, not lean finance departments.

Advanced Use Cases: Beyond Basic Accounting

Modern cap table management software opens up high-value capabilities that go beyond simple accounting. Here is how finance teams are leveraging these tools:

Scenario Modeling & Waterfall Analysis

One of the most pressing demands from founders and investors is the ability to model "what-if" scenarios. If a company raises $10M at a $50M pre-money valuation, what happens to existing shareholders? How much dilution occurs? What is the new fully diluted ownership percentage?

In a traditional workflow, answering this requires building a complex Excel model with multiple tabs and formulas. With modern cap table software, this becomes a simple query. You input the new round parameters, and the system instantly calculates the dilution impact across all share classes. You can even use AI financial statement analysis tools to pull current data from your own reports to inform these models.

V7 makes it easy to interrogate different scenarios with natural language through the Concierge. All answers come with linked citations to the source document.

Employee Equity Portals

For many employees, their equity is the most valuable part of their compensation package. But most employees have no idea what their options are actually worth. They receive a grant letter with a number of shares and a strike price, but they don't know how to calculate the current value.

Many modern cap table platforms solve this by providing employee equity portals. Employees can log in to see the real-time value of their vesting options, based on the company's latest 409A valuation. This transparency is a powerful retention tool. Employees who understand the value of their equity are more likely to stay through the vesting period.

Automating 409A Valuations

For US companies, the IRS requires a 409A valuation to determine the fair market value of common stock for option grants. This valuation must be updated annually or after a material event (like a fundraising round).

Traditionally, companies hire an external valuation firm to perform this analysis, which can cost $5,000-$15,000 and take several weeks. Some modern cap table platforms offer integrated 409A valuation services, which can reduce the cost and turnaround time significantly.

Your 5 Step Guide to Choosing Cap Table Management Software

Selecting a cap table management platform directly shapes how smoothly you can raise capital, issue equity, stay compliant, and communicate with investors and employees. The right choice becomes a quiet but essential backbone of your company’s financial operations. The wrong one can lock you into clumsy workflows, unexpected costs, and painful migrations at the least convenient time.

With that in mind, here’s a clear guide to help you choose the platform that truly fits your needs today and supports where your business is heading.

1. Map Your Current and Future Complexity

Start with an honest assessment of your company’s structure today and where it’s heading.

How many shareholders do you have?

How many funding rounds are expected?

Do you issue options broadly or only to a few employees?

Will you need multi-entity or multi-jurisdiction support?

Early-stage teams with simple SAFEs need very different tools than later-stage companies managing multiple share classes and global equity plans. Matching complexity to capability prevents overpaying, or outgrowing a platform too soon.

2. Identify Your “Must-Have” Workflows

Cap table software varies more in workflow design than in features. Decide what you actually need the platform to do:

Equity issuance and electronic grants

Option plan management and employee portals

Modeling fundraising, dilution, or exit scenarios

409A/IFRS valuations and expense reporting

Investor reporting or board-ready outputs

If your priority is rapid modeling, choose a tool strong in scenario analysis. If you need help with global compliance, favor platforms with deep jurisdictional coverage. Clear priorities prevent feature fatigue.

3. Evaluate Integrations and Ecosystem Fit

Your cap table doesn't live alone; it interacts with HR, payroll, finance, legal, and sometimes investor systems. Look for integrations with HRIS, accounting and ERP compatibility, document automation and e-signature support, and API availability for future automation.

Poor integration often creates more manual work than the software replaces. A good ecosystem fit makes the cap table a single source of truth, not another silo to maintain.

4. Compare Total Cost, Not Just the Price Tag

Pricing models can be misleading. Some platforms bundle valuations; others charge for every shareholder, grant, or event. Consider:

Setup and migration effort

Annual maintenance fees

The cost of added compliance modules

Time saved by automation

A cheaper tool can become expensive if it slows fundraising or requires constant support from lawyers or analysts. Aim for value, not just a low quote.

5. Test Real Scenarios With Real Data

Before committing, run a true-to-life test. Import your actual cap table and issue a mock option grant. Model a prospective funding round, and generate an investor report or audit file.

You’ll quickly see whether the platform handles your structure gracefully, confuses your team, or forces workarounds. The right tool should feel intuitive, reliable, and fast from the first interaction.

More Flexible, Powerful Cap Management

Over the next five years, the standard for equity management will not just be a cloud database, but an intelligent system that can read, understand, and reason about equity documents. The firms that adopt these AI capabilities early will gain a significant speed advantage in fundraising and M&A.

If you are ready to automate your equity data workflows, book a demo with V7 Go.